ANTYA has always been wary of media reports highlighting or even forecasting Xiaomi Corporation’s (“Xiaomi” or the “Company) valuation prior to the IPO as if it were gospel. The media stories seemed to be leading investors to a pre-determined outcome. If the CDR had succeeded perhaps all that advertising and PR would have paid dividends. Nonetheless, the Company’s IPO price of HK$17/ share described in various media stories, including Reuters in China’s Xiaomi raises $4.72 billion after pricing HK IPO at the bottom of range: sources confirm our long-held belief that Xiaomi is more hype than substance; at least in its current form. We are also of the view that based on the IPO price, investors that hold Xiaomi shares need significant support from underwriters to protect the investment before a tsunami of shares for sale from insiders hits the deck.

It is indeed notable that some of the largest and most sophisticated institutional investors, including Capital Group Cos. and George Soros took the bait at the current valuation of Xiaomi, which in our view is stratospheric, to say the least. Additional details are available from the WSJ in the story Xiaomi Prices Hong Kong IPO at Bottom of Target Range. That Qualcomm Inc (QCOM US) is a subscriber is not a surprise to us because Qualcomm has supported Xiaomi since its inception and it has a vested interest in promoting the Company. Other cornerstone investors from the mainland such as China Mobile Ltd Spon ADR (CHL US) are there to lend support to a Chinese-controlled enterprise with vision 2025 looming in the background.

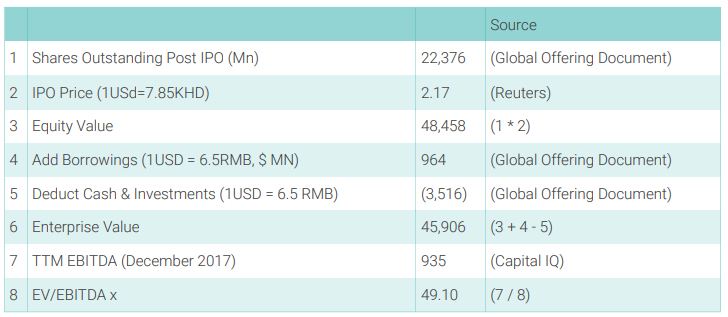

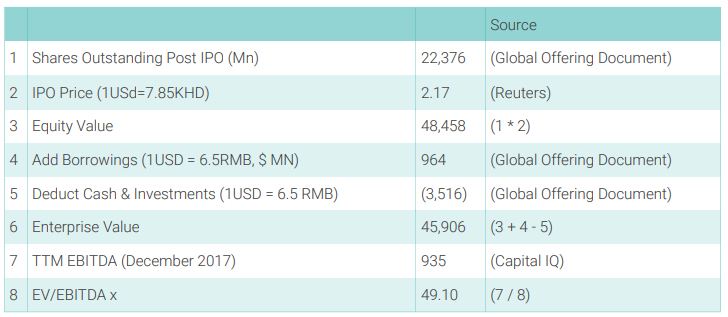

Figure 1 highlights Xiaomi Inc.’s valuation assuming no green-shoe option is exercised by the underwriters and excludes $3.56 billion of cash inflow post the IPO of $0.16/share.

Whether it was obfuscation as discussed in our report Xiaomi Inc. — Where Is the Transparency? Updated Equity Value Estimate of US$1/Share or it is a genuine love for the Company, we cannot say, since we have never been privy to

any conversation related to IPO placement or its valuation. Nonetheless, we make a heroic assumption about the Company’s EBITDA growth and then highlight where the Company stands with respect to some of its peers globally.

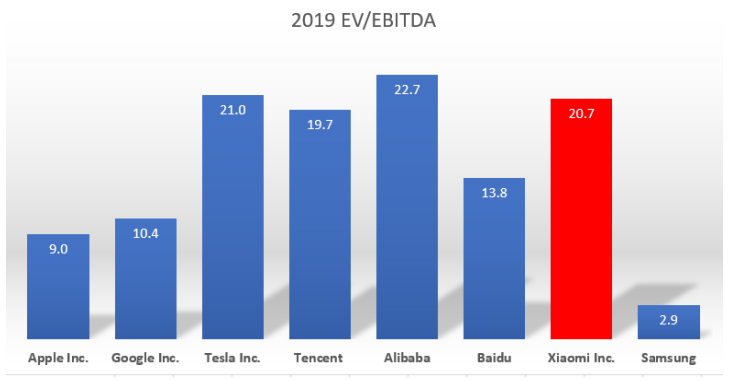

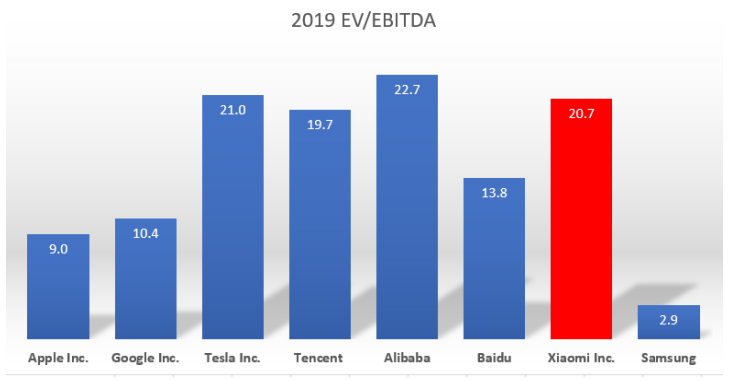

Figure 2 highlights that investors have accorded Xiaomi a valuation in line with its peers on the mainland.

In order to give Xiaomi the benefit of the doubt, we grew the Company’s reported 2017 EBITDA by 50% both in 2018 and in 2019 to arrive at an estimated EBITDA of $2.2 billion for 2019. The enterprise value for all companies is as of June 29, 2018.

Where to From Here?

In our view, Xiaomi is primarily a sales and distribution company that aggregates services provided by others on its hardware platform. That platform has little intellectual property of its own and is dependent on free core software, 3 party contract manufacturing, IP support from Qualcomm, chips from Samsung Electronics Co Ltd (005930 KS), and others, etc. Moreover, the Company’s strategy appears to be to piggyback on the next fad that emerges from mainland China, such as its foray into online lending. The Company has launched micro-credit services in India as well, perhaps emboldened by the success of India’s public-sector banks in recovering their dues from well-meaning borrowers.

For more on India and the shenanigans underway there, please see The Indian Economy and Public-Sector Banks —- On the Edge of A Precipice and Zuma Sacked, PNB Hacked, and Bank of Baroda South Africa Axed.

Apple Inc (AAPL US), Alphabet Inc Cl C (GOOG US) which are among the leading software platforms globally in maps, in operating system software, in cloud-based services for enterprise and individuals in addition to many other credible and profitable products, trade at a discount to the Company. Tesla Motors Inc (TSLA US) has upended global auto manufacturing, sales, service, and the combustion engine — all simultaneously — and depending on the day could trade at a discount to the Company. For more on Tesla see GM & Vision Fund JV Highlights Tesla Inc. Is Significantly Undervalued; Stock Is Headed

Higher.

We do not deny that Samsung has corporate governance issues, but those don’t seem to be any more than what we have witnessed at Xiaomi so far. Alibaba Group Holding Ltd (BABA US) has Ant Financial, Baidu Inc (ADR) (BIDU US) owns iQIYI Inc (IQ US) and AI software, Tencent Holdings Ltd (700 HK) has a lock on China, and all that Xiaomi has are re-seller agreements with IQ and with Ant Financial.

We are not believers; at least not yet! To those that believe, we send our best.