Xiaomi Corp (XIAOMZ HK) has gained global credibility by gatecrashing the smartphone market via value-based pricing and some luck. With Zte Corp H(763 HK) under the gun currently, the Company could benefit if the Departmentof Justice, President Trump and the Senate cannot come to an amicablesolution. However, any benefit is likely to be short-lived, and cannot sustain a valuation of more than $20 billion in equity value. Therefore, investors need to get a price below USD 15/share to have any reasonable chance of earning a defensible return.

We saw significant interest on the platform in our equity value estimate of Xiaomi Corporation (“Xiaomi” or the “Company”) as discussed in Xiaomi Corporation – U.S.$100B, $80B, $50B — Stop Dreaming. We Believe Even $20 Billion Is Too Much. Evident to investment management professionals, valuation is as much of an art as it is a science. Objectively a DCF model captures multiple inputs which a diligent analyst accumulates from a variety of data sources. Subsequently, using the capital asset pricing model or other methodologies, the model provides an estimate of enterprise value today or in the future. Practitioners can accept the output as gospel or overlay a probability distribution on the outcomes. The entire model could also be simulated using the Monte Carlo approach very quickly in an off the shelf statistical software. The DCF can also be benchmarked to comparable transactions or comparable multiples in the market. A DCF based valuation could approach any number you want, including the rumored $100 billion.

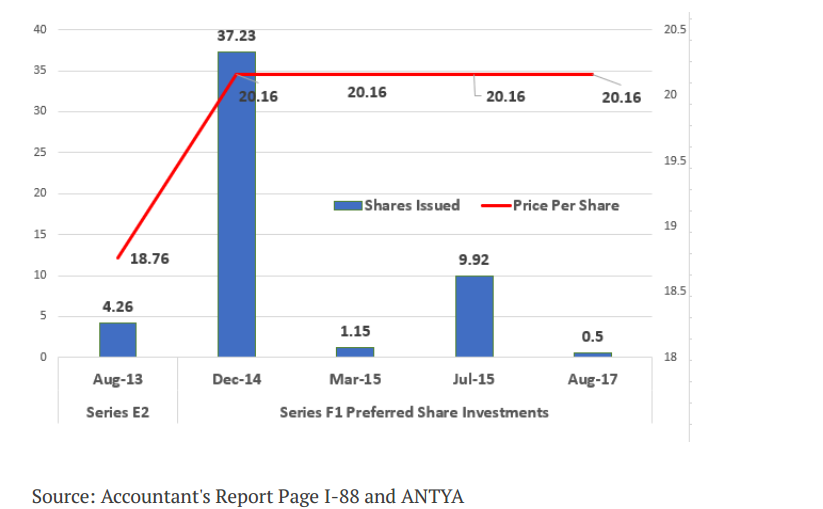

We used the benchmarking approach to provide our estimate of equity fair value of USD 15 – USD 16.60, which happens to be lower than the price that Nokia Growth Partners II, L.P. (“Nokia”) paid on August 24, 2017, for subscribing to 495,830 Series F-1 Preferred Shares. The aggregate purchase price of USD 9,999,998.61, paid by Nokia, implies a per share price of USD 20.1682. (Page I-88, Accountant’s Report)

The Company reports that on December 31, 2017, there were 669,518,772 Class A and 308,698,531 class B ordinary shares for a total of 978,217,303 shares outstanding. On that basis, one can safely presume that barely eight months ago, Nokia fair valued the equity of the Company at USD 19.72 billion. More importantly, Nokia invested merely USD10 million for a five basis-point stake. So how much faith can be placed in an immaterial stake in a massive enterprise? We would argue that Nokia was a price taker because the price paid was the same as the price paid by other stakeholders in previous rounds. It is also apparent that Xiaomi could not compel Nokia to pay more, and a lower

valuation from Nokia would have gone against a story chronicling the rise of of a world-beating enterprise.

Figure 1 illustrates various capital raising rounds undertaken by Xiaomi since 2013.

Between December 2014 and August 2017, Xiaomi has issued a total of 48.8 million shares representing approximately 5% of shares outstanding and raised USD 984 million in total from outside investors. From the standpoint of the prospective IPO subscribers, there has been no appreciation in the price of the company’s stock in the private market for approximately 3.5 years. Over a period of 4 years ended August 2017, the company’s stock appreciated by a cumulative 7.5%, implying a holding period return of 1.8%, courtesy of the $18.76/share E2 series placement in August 2013.

Investors Should be Thankful for the Opportunity to Invest

The top management of the Company wants to ensure that consumers have access to high-quality products at very reasonable prices. The plan as disclosed and visible to prospective investors is to parlay hardware sales into a recurring services revenue stream via subscription-based services. Playing into that theme of customer-friendly positioning are the headlines suggest a “Holier than Thou” approach to management and stakeholder relations.

An example would be the following story from South China Morning Post, Xiaomi CEO Lei Jun’s rather counter-intuitive success formula: don’t be greedy.

In our view, reconciling that story with the following from the Company’s prospectus runs counter to the narrative in the media and the company’s various stakeholder initiatives. We quote;

On April 02, 2018 we issued 63,959,619 class B Shares (orlredacted] class B Shares following the Share Subdivision) at par value to Smart Mobile Holdings Limited, an entity controlled by Lei Jun, for his contributions to our Company.”

To ensure we got that right, we found another reference on page 59 saying the same with the added caveat and we quote;

Such issuance will result in significant share-based compensation expenses in the second quarter of 2018 and for the fiscal year 2078. ….. ,and dilute existing shareholder’ shareholding.”

Is Governance Important in a Private Company?

What should prospective shareholders make of governance at the Company? The weighted average grant date fair value for Restricted Stock Units issued to employees was $14.73 during 2017. Xiaomi stock was issued to Nokia at $20.16 in August 2017. However, in April 2018, the founder was granted stock at Par. After this grant, the Company has approximately 1.042 billion shares outstanding, i.e. 6% or thereabouts of additional capital has been given to top management as compensation. In a nutshell, the Company issued more stock at par value of $0.000025 to the founder as appreciation for services rendered, than was issued cumulatively to outside investors that injected approximately USD 1.06 billion into the Company since August 2013.

We, therefore, conclude that investors should thank their stars for getting the opportunity to invest alongside current management. As always, the value is in the eyes of the beholder.

Just to be clear we have no right to complain as yet, because the enterprise is private. We are just highlighting the caveats that come with investing alongside charismatic founders and public relations driven story-lines.

Good luck to all those considering an investment in the Company. We advise keeping the faith. Otherwise, equity and bond markets are full of opportunities to make and lose money.