We have previously discussed our view of Xiaomi Corporation’s valuation on a sum of the parts basis using appropriate global benchmarks in Xiaomi Corporation – U.S.$100B, $80B, $50B — Stop Dreaming. We Believe Even $20 Billion Is Too Much. We also highlighted the private market equity value of the Company based on various disclosures in Xiaomi Corporation — Value Is in the

Eye of the Beholder – $100 Billion or $20 Billion – A Wide Gulf. This report highlights the internal valuation used by Xiaomi to compensate executives and accordingly forms the strong third leg of our estimate.

Given that the CDR offering is off the table, it is our view that absent Chinese retail investor demand, Xiaomi will accept a much lower equity valuation than speculated currently in the media.

We have been pleasantly surprised by the significant interest shown by users in our equity value estimate of Xiaomi Corp (1810 HK) (“Xiaomi” or the “Company”). Our realistic assessment of the Company’s valuation appears to be at odds with media stories, sell-side bankers, China optimists, and others. Recently, skepticism expressed by China Securities Regulatory Commission (“CSRC”) in Xiaomi’s prospects has raised a few doubts amongst cheerleaders. The following story from Reuters China’s Xiaomi cuts valuation to $55 billion-$70 billion: sources highlight some of the details. A Bloomberg story suggests that China CDR is also off the table, although a premium valuation is still in the offing. Details are described in Xiaomi Says It Doesn’t Have Timeframe to Revisit China Listing.

As Xiaomi heads to New York for a road-show, we decided to revisit some of the numbers disclosed by the company as part of its revised and updated prospectus filed with HKEX in June 21.2018.

According to the Company;

On June 77, 2018, pursuant to the shareholder’s resolution, each existing issued and unissued share of ……. were subdivided into 10 shares …, following which … The number of outstanding Class A ordinary shares and Class B ordinary shares became 6,695,187,720 and 3,741,581,500 respectively, the latter of which included the additional shares issued to Lei Jun on April 2, 2018, as detailed below.

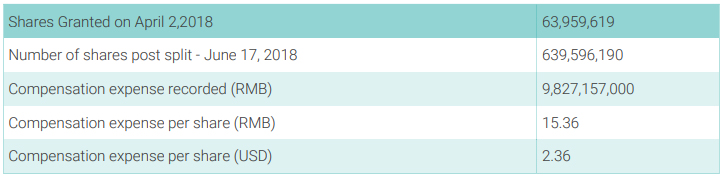

Readers of our previous reports on the Company would recall that in Xiaomi Corporation — Value Is in the Eye of the Beholder – $100 Billion or $20 Billion -A Wide Gulf we discussed the 63,959,619 Class B shares issued to Lei Jun on April 2, 2018, including the opinion that;

Just to be clear, we have no right to complain as yet because the enterprise is private. We are just highlighting the caveats that come with investing alongside charismatic founders and public relations driven story-lines.

The bill for that largesse has come due, with the Company recognizing 9,827,157,000 RMB as compensation expense related to Lei Jun’s stock grant for Q2-18 on April 2, 2018. Since the updated prospectus has disclosures up to March 31, 2018, the impact on the income statement and the balance sheet will be visible to investors whenever Xiaomi reports Q2-18 results. Nonetheless,

there have been multiple media stories discussing the modalities of such stock grants, including by the WSJ in CEO’s Stock Award from Chinese Smartphone Maker Xiaomi is One of the Largest Ever.

For our purposes, i.e. for those looking to invest in Xiaomi, this is a critical development.

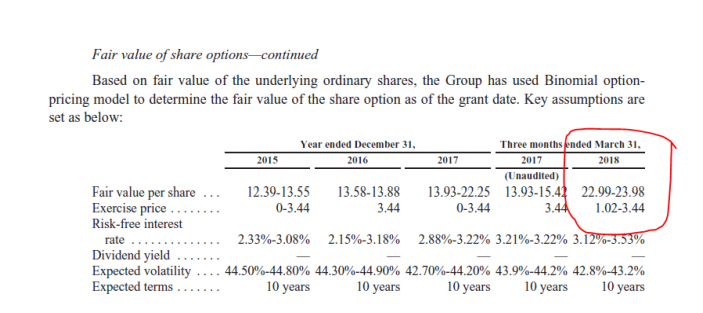

From an accounting policy standpoint, the Company has to fair value the stock grant for taxation purposes and to shield future income. Accordingly, the accounting policy notes that;

The Group has used the discounted cash flow method to determine the underlying equity fair value of the Company and adopted equity allocation mode! to determine the fair value of the underlying ordinary share. Key assumptions, such as discount rate and projections of future performance, are required to be determined by the Group with best estimate. The fair value of each RSU at the grant dates were determined by reference to the fair value of the ordinary shares of the Company that issued to its shareholders.

This provides prospective investors with both a recent internal valuation yardstick and an objective benchmark to ascribe an equity value to the Company since it has to meet the test of tax-authorities in multiple jurisdictions. Whatever the optics related to the stock grant, prospective investors can account for it in their fair value estimate of the Company, since they are buying in after the stock has been granted. We would be remiss by omitting to say that RSU’s have a vesting period, whereas the stock grant to Lei Jun has no preconditions.

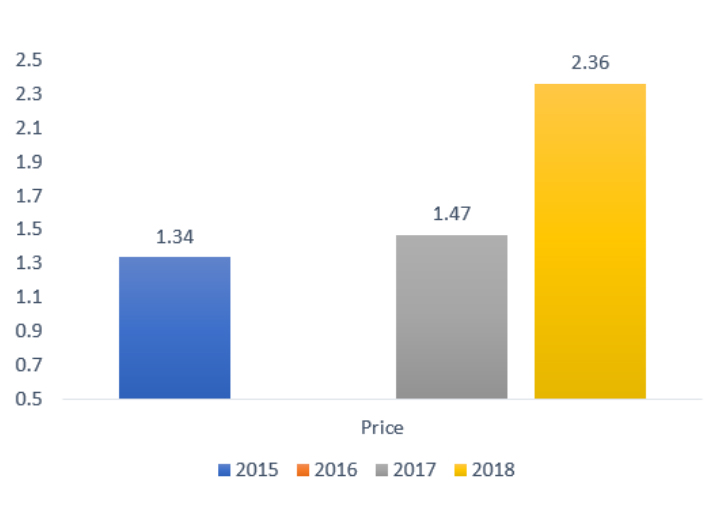

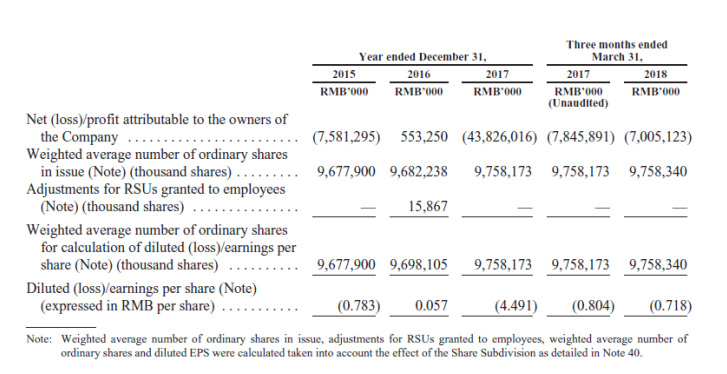

Figure 2 highlights the movement in fair value of stock granted by Xiaomi to executives, adjusted for the stock split announced by the Company in various years.

As highlighted the grant to Lei Jun, was valued at $2.36/share in 2018, compared to $1.47 to others in 2017. Adjusted for the ten for one stock split, the fair value of approximately $23.60/share, also matches up with the assumptions used by the Company to fair value option grants to its employees in Q1-18 as highlighted in Figure 3.

The critical question that arises is the justification for the significant increase in fair value year-on-year assumed by the Company. We know that on August 24, 2017, the Company issued shares to Nokia Growth Partners II, L.P. for a post-split price of $2.1068/share, or $21.06/share on a pre-split basis. Although the investment was a mere $9.99 million, it would have contributed to showcasing

an improving valuation for all other general partners involved with Xiaomi before the Nokia deal as well as Xiaomi itself.

Moreover, the company has also shown increasing momentum recently with sales growth year on year, as well as, displacing Samsung from the position of the number one handset vendor in India. The Company also booked a significant gain on its investment in iQIYI Inc (IQ US) and now holds equity worth approximately $1.8 billion in IQ. Similarly, Xiaomi holds some equity in Ant Financial of Alibaba Group Holding Ltd (BABA US) fame as well.

How does it all add up?

Having established fair value for the shares, we now turn to total shares outstanding as highlighted in Figure 4.

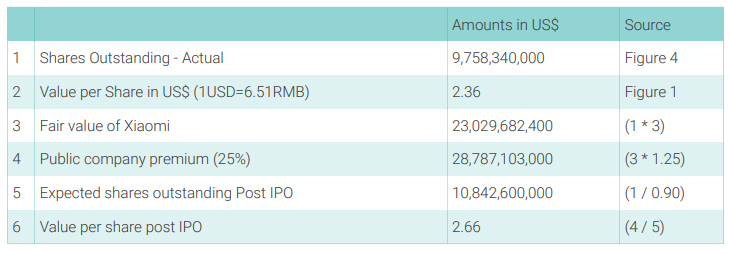

As highlighted in Figure 4, as of March 31, 2018, Xiaomi has 9.758 billion shares outstanding. Using that share count, we calculate the fair value of the Company in Figure 5.

The current fair value of Xiaomi as a private company is $23 billion. Undoubtedly as a public company, purely from a liquidity profile, the stock should be worth more, although it is also possible that after the initial euphoria or a lack thereof, investors re-price the stock lower. Nevertheless, we add a premium of 25% to the Company’s private market value to arrive at $28.7

billion in public equity value.

Based on various media reports we surmise that the company expects to issue 10% new shares and that existing shareholders are not looking to sell immediately. Therefore, we gross up the current shares outstanding to arrive at a total of 10.84 billion shares after successful placement of the IPO. With $28.78 billion in equity value and 10.84 billion shares outstanding, we estimate that the stock is worth $2.66 per share in a best-case scenario. This excludes the IPO proceeds that would come in as cash to the company. On a per-share basis IPO cash is expected to be $0.25/ share.