China is a land of many opportunities. Softbank Group Corp (ADR) and Altaba Inc (AABA US) hit a home run with Alibaba Group Holding Ltd (BABA US). Naspers Ltd (NPN SJ) can thank Tencent for its riches. In our opinion, Xiaomi is not in that league.

Xiaomi Corp (XIAOMZ CH) (“Xiaomi” or the “Company”) is coming to the market with a much-anticipated IPO. Given China’s eminent stature in the Internet start-up world, and the stupendous success of Baidu, Tencent, Alibaba and JD.com, it appears that investors expect another home run from the proposed IPO of Xiaomi. In our humble opinion, those hopes are likely misplaced, b the Company is no Apple Inc., and nor does it claim to be. Like its brethren from the ancient kingdom, the Company’s fingers are in more pies than one could count, with subsidiaries, associates, equity investees, long-term and short-term investments. Seemingly, China is the place where alchemy

works because fair-value gains on investments can arise before Usain Bolt can finish the 100-meter dash (For the record it took Bolt 9.69 seconds to set a world record in Beijing Olympics in 2008).

Xiaomi says, and we quote;

No statutory financials statements have been prepared for the Company since its date of incorporation’.

We say WoW!”

For those that are keeping score, the company was incorporated on January 5,2010, with an authorised share capital of US$50,000. Within seven years, in 2017, the Company booked a fair valuation gain on its investments through the P&L of approximately US$1 Billion. Reported Revenue of RMB 114.6 B amounts to US$18 billion or thereabouts. For a young company like Xiaomi, these amounts are phenomenal. As for the integrity of its financial statements, that is a topic for another day!ecause

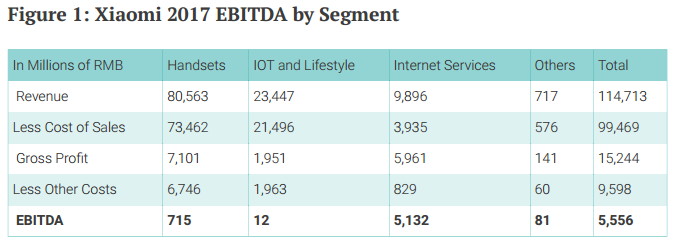

We will not delve into the intricacies of accounting and disclosure today, but take numbers as disclosed in the prospectus at face value, make a few adjustments to highlight our thinking, and let the readers judge if logic is in the air. Figure 1 highlights Xiaomi’s consolidated EBITDA by segment for 2017.

Cost of sales is sourced from the prospectus. Other costs comprise S&M, R&D and administration costs which ANTYA has allocated to segments based on proportional revenue share for 2017. Depreciation & amortisation has been allocated entirely to the handset segment because most of that expenditure is manufacturing and IP based.

There are many ways to look at a number and decide if it makes sense. Wepresent a few ways to help prospective investors think through the process.

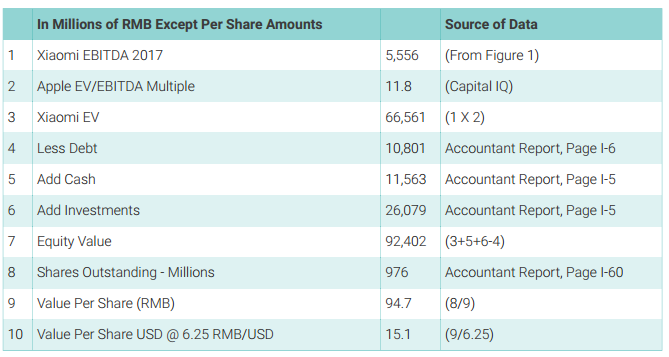

First, we take the optimistic track and apply the trailing twelve months EV/EBITDA multiple that Apple Inc (AAPL US) currently enjoys in the marketplace. We take the multiple as calculated by S&P, make no adjustments to it and apply it to Xiaomi for 2017.

Therefore, by benchmarking to Apple Inc., we arrive at an equity value per share of US$15.10 in an optimistic scenario. The legitimate question is that why is our Apple multiple outlandish?

The simple answer is that Apple Inc. has the dominant, self-developed smartphone eco-system in the world. Apple has the software, the app-store, the services business, hardware margins of 37%-38% or thereabouts, limited but premium SKU’s, an enviable position in the developed world, a lock on the high value customer segments in the world, a business spanning enterprise and consumer, a fortress balance sheet, in-house chip design and manufacturing etc. etc. We could go on and on, but at this juncture, the readers get the message.

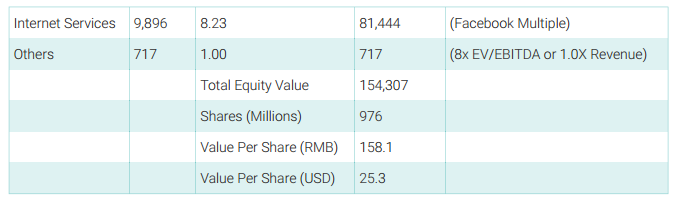

A Sum-Of-The-Parts Optimistic Valuation

As we peel away the layers of the Company, we can also undertake a sum-of-the-parts valuation of Xiaomi. Let’s begin with the handset division and the promise made by Lei Jun, and we quote:

We pledge that our overall hardware net profit margin will never exceed 5%.”

Handsets are Worth 0.75x Revenue at Best

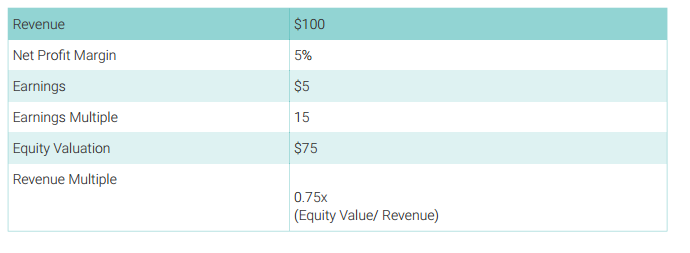

Without getting into the moral predicament of that statement —- Lei Jun slams Hank Rearden — simple math suggests that Xiaomi handset business cannot be worth more than 1x revenue and more likely 0.6x-0.75x revenues. Figure 3 walks the talk.

IOT and Lifestyle

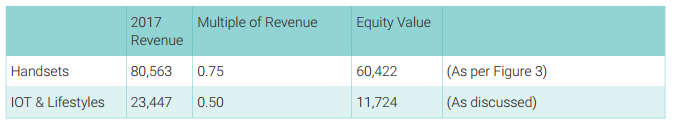

The IOT and other hardware segment generated 11 million RMB in EBITDA, as illustrated in Figure 1. Some might argue with our allocation of excessive costs to the IOT segment. Most of the hardware is sourced from 3’@ party manufacturers, and distribution & administration costs associated with consumer electronics of all kinds tend to be substantial. One cannot forget advertising costs accompanying branding either. The IOT business, just like the handset business will struggle to generate net profit margins higher than 5%. Therefore, in our view, an optimistic valuation greater than 0.5x revenue is not feasible.

Internet Services

This is an exciting segment given that it has the highest gross margin and EBITDA margin for the company. As calculated by us in Figure 1, EBITDA margin in the division is approximately 52% while gross margin is 60.2%. In the company’s own words;

We currently generate internet services revenues primarily from advertisingband internet value-added services, which mainly include games.”

Although many business models can be compared to that of the Company’s, we discuss bench-marking to two premium businesses which can provide a positive stance on the valuation

The first is Tencent Holdings Ltd (700 HK) in China. With its WeChat application, it covers more than 60% of China’s population and offers gaming, advertising and value-added services. WeChat is platform agnostic and has its reach into the Chinese diaspora as well. Tencent trades at a trailing EV/EBITDA multiple of 22.7x. We do not believe the Company deserves that multiple.

The other premier provider of advertising and chat services globally, primarily on mobile is Facebook Inc A (FB US) . The trailing-twelve-month EV/EBITDA multiple for Facebook is 13.5x, or 8.3x revenue. Facebook has a lock on global mobile consumer-facing advertising, owns WhatsApp and Instagram and is entering value-added services via its messaging platform as well.

Therefore, in our opinion, Xiaomi’s internet services segment cannot be worth more than FaceBook.

Others Including Online Lending

Online lending is a fad in China that is bound to meet a fate like that of Indian microfinance lenders. If evidence is required, plenty is available in the form of lacklustre stock market performance of Chinese online lender IPOs post listing on NASDAQ such as Qudian Inc (QD US). The fate of companies like Lendingclub Corp (LC US) and Lendingtree Inc (TREE US) also come to mind.

As illustrated, the handset EV embedded within Figure 4, implies an EV/EBITDA multiple of 84.5x the handset EBITDA of 715 million RMB for 2017. While the 5% net profit margin is an aspirational goal highlighted by top management, given that EBITDA margin is 1% currently, it is a tall ask. In our opinion at best the handset business deserves a 10.0x EBITDA multiple implying a haircut of 53.2 billion RMB to our valuation in Figure 4, which means a deduction of US$ 8.73/share from the equity valuation highlighted in Figure 4.

The net result is an equity value per share of $16.57/share. We believe Xiaomi IPO is no slam dunk, and it would be best to steer clear of it. I think our price range should satisfy Toh Zhen Zhou who published Xiaomi Pre-IPO Review – Hoping for an Honestly Priced IPO.

More valuation related work with a different viewpoint has been done in Xiaomi The Money!

Conclusion

ANTYA estimates an equity value per share range of US$16.60 – US$15.10 for the Company. That compares to Series F1 preferred shares most recently at sold at $20.16 in August 2017.

Investors should leave the alchemy to the alchemists.