Geo-political risks are elevated across the globe. We are increasing our allocation to Canadian assets. We see the C$ gaining strength and interest rates in Canada staying lower for longer.

Every now and then, investors get an opportunity to earn outsized returns in capital markets. Is Britain’s recent vote to exit from Europe one such opportunity? At the heart of this conundrum is a fundamental question – will Brexit ultimately result in an unravelling of the European Union (“EU”)?

Brexit undoubtedly threatens European stability. Firstly, the region will probably see a break-up of United Kingdom, as Scotland looking to stay within the EU, bolts out the door. Post Brexit, Nicola Sturgeon, the leader of Scottish National Party, said that Scottish independence is “highly likely” to secure Scotland’s place in the EU. European Commission President Jean-Claude Juncker, has said that Scotland should be able to set out its position to remain in the EU.

Nonetheless, Scotland’s splintering from the UK is the least of EU’s problems. EU has herculean task of convincing its populace, currently reeling under Germany’s painful policy of austerity, to stay united, while the far-right across the region is drumming up support for an exit.

France

First up on the agenda of investors in Europe is France, where general elections are due in 2017. Francois Hollande, President of France, already called crisis meetings last month with former President Nicolas Sarkozy’s conservative opposition party, the Greens, parties on the far left and centre, after Marine Le Pen, the leader of the far-right National Front party, called for a referendum on France’s EU membership.

Back in December 2015, Le Pen’s anti-immigration party – a French counterpart of Britain’s UK Independence Party that played a key role in making Brexit a reality – recorded its best local-elections result since its founding in 1972. Unfortunately for Hollande, he will be seeking re-election at a time when economic growth in France has been near-zero for many years. According to Rabobank , the French economy faces many structural challenges, including a relatively weak competitive position, high unemployment, and weaker public finances compared with other European countries.

Germany

Germany’s national elections, due 2017, will queer the pitch for Chancellor Angela Merkel, who will have to perform a delicate balancing act. Merkel has to maintain equilibrium between Germany’s economic relationship with the UK, and its firmness in negotiating a fair Brexit. Any softness in Merkel’s stance would infuriate the likes of Matteo Renzi, the Italian prime minister, who has been at loggerheads with the European Union over relentless pressure to abide by economic targets such as a 3 percent budget deficit – that’s been a challenge for many countries such Italy, Spain and Portugal where the economies have suffered immeasurably following the global financial crisis.

In fact, back in January this year, tensions between Rome and Brussels intensified after Rome blocked an EU plan to provide Turkey with €3 billion in aid, claiming that the amount earmarked for the country — approximately €300 million — should be exempted from its budget deficit. This came only a month after Renzi slammed Merkel over EU’s policies on energy, banking and migration. These altercations are symptoms of Italians having a very different vision of Europe, and it’s not the same as that of Merkel or even the German finance minister Wolfgang Schauble.

Italy

Italy is hurting even more now, as in the aftermath of Brexit, the country’s banks are under enormous pressure. But, this time around EU President Juncker was much more forthcoming. He said the banking sector in Italy and elsewhere in Europe will be protected and that the EU will do everything to prevent a bank run. He is concerned that Italian banks, which are saddled with €360 billion of bad loans, a third of the euro zone’s total, risk attacks by hedge funds betting that Brexit turmoil could tip them into full-blown crisis.

The palpable disenchantment with Europe is evident from Italian economy minister Padoan’s defence of the nation’s banking sector. He was quoted as saying in Ansa the EU has a “distorted perception” of its banks in terms of ‘numbers, non-performing loans and what needs capitalising,” noting Brexit has affected the entire European banking system, not just Italy.

Europe is therefore at crossroads, as its constituents suffer economically, and there is no clear-cut solution in sight to end their pain quickly. It remains to be seen how long will the German electorate foot the bills as economies of France, Italy, Spain, Portugal and Greece continue to struggle.

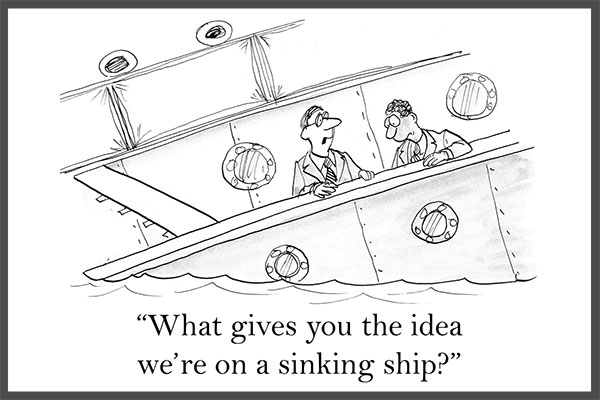

It’s during this bout of economic weakness and political vulnerability the far-right is showing people the exit door as a panacea for their problems. In the UK, the anti-immigration sentiment was so strong that it beat the economic rationale for staying within Europe. Could the same happen in France? It’s the chorus that Europe with its obviously flawed one-size-fits-all monetary policy is a failed experiment, and it is probably time to jump off the bandwagon, is growing?

That’s the risk investors in European equities face, as they ponder whether the supremely-depressed Italian bank valuations represent a generational buying opportunity, or the biggest value trap of this decade?

Our Takeaway

Looking at the unfolding geo-political chaos, ANTYA is increasing its benchmark weight to Canadian large capitalization equities from 20% to a range of 25%-30%. Canadian dollar will benefit from weakness in the British Pound and in the Euro, as the situation in Europe in 2017 becomes tense. A stronger dollar and a politically stable Canada is likely to attract significant capital into Canadian financial and physical assets. We have also increased our allocation to bonds, Reits and preferred equity given expectation of rates staying lower for longer.

As always, elevated Canadian real estate prices, remain a question mark on continued financial stability. However, with approximately $8 trillion of global sovereign debt yielding below zero, flows into Canadian real estate in Toronto and Vancouver could accelerate even further.

Therefore, to stay strong, stay diversified.

Call ANTYA Today, and we can create a customised plan to suit your needs.

About the Author

Ashutosh Kumar, based in London U.K., is a highly accomplished and experienced commentator on investing. He has written extensively for Bloomberg and the Financial Times Group, as well as, worked in analytical roles with Morningstar Inc. and Standard & Poors. Ashutosh is a contributing columnist for ANTYA.

All rights reserved.