Tesla Inc. survived a rough Q2-18, and it now appears that much better days are in store for shareholders. Musk reaffirmed that Tesla does not require new equity, will repay and refinance its debts from internally generated cash flows, will reach 15% gross margin for Model 3 in Q3-18,and 20% in Q4-18, will build a factory to produce 250,000 cars in Shanghai in 2019 in a highly capital efficient manner, and will manufacture between 50,000-55,000 Model 3’s in Q3-18.

The question is What’s Not to Like? In our view, Tesla is headed much higher. Short covering is yet to begin.

Tesla Motors (TSLA US) (“Tesla” or the “Company”) once again defied skeptics by reporting acceptable financial results that appear to have been unanticipated by disbelieving investors. While the aftermarket surge is not necessarily an indicator of what’s to come next week or next month, reported financial disclosures and management commentary leave little room for cynics surrounding the Company’s operational prowess.

As acknowledged by Musk and Tesla at various points in time, most recently in “The Last Bet-the-Company Situation’: Q&A With Elon Musk, there is still time before Tesla emerges from its “production hell”. Nonetheless, those with a background in software development would understand the concept of “agile development” and “iterative production” to arrive at optimal solutions quickly.

That is the approach followed by Tesla in developing its production platform, and an explanation for the lack of auto executives at the top, which has been a familiar refrain of many commentators including an opinion expressed by Henry Kwon

Let’s highlight all the good news for Tesla enthusiasts from the conference call and the MD&A today.

1. Model 3 gross margins turned positive in Q2 and are expected to be 15% in Q3. That apparently means that Tesla will start to accumulate cash, or at least, turn cash flow neutral by Q4-18. All the noise surrounding Tesla’s debt obligations is just that; NOISE. Musk and the CFO reconfirmed our expectation that Tesla will be cash-flow positive in Q3, Q4, and beyond.

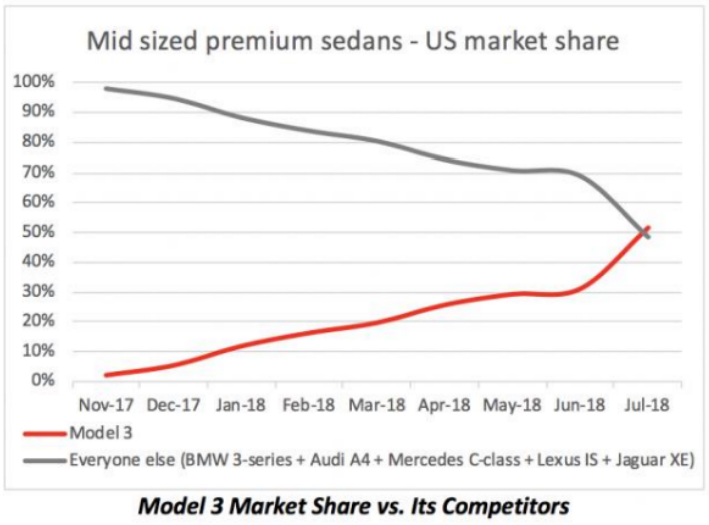

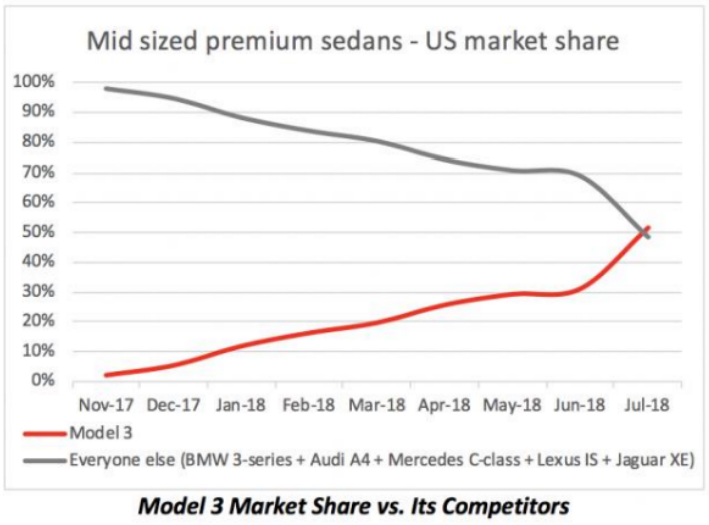

2. Model 3 outsold all mid-sized premium sedans combined in the U.S., with a market share of 52% of the segment overall. Figure 1 sourced from the company’s quarterly disclosure highlights the trend as it has evolved over the last few months.

Figure 1: The Trend is Irreversible

3. Tesla expects to hit 10,000 Model 3 cars/week sometime next year. Most likely that means in the second half of 2019. The current year’s goal is to reach 6,000 Model 3 cars/ week by the end of August and then stabilize operations. These are achievable goals that should make the stock less volatile.

4. All the “negative talk of producing cars under a tent” is a distraction because Model 3 quality is already at par with that of Model S and Model X. Please don’t take our word for it but that of experts.

The Wall Street Journal called it a “thrilling, modern marvel” and a vehicle that is “magnificent, a spaceship, so obviously representative of the next step in the history of automobiles. The Model 3 is more than futuristic. It’s optimistic. This is what ordinary cars should be, which Is to say, better than they are. Motor Trend said: “In maybe 120 wheel revolutions, a high-performance hierarchy has been rattled. The European marques perennially atop the sport sedan podium are about to have trapdoors release beneath them…[T]he dual motor and all-wheel drive give the compact Tesla a tensed, hair-trigger potency for leaping ahead or around whatever’s in the way. It’s pure jungle cat.”

The WSJ review is available at First Test Drive of the Tesla Model 3 Performance: A Thrilling, Modern Marvel.

Motor Trend review is available at 2018 TESLA MODEL 3 DUAL MOTOR PERFORMANCE REVIEW: FIRST TASTE

5.Tesla has redesigned the autonomous driving computer from the ground-up and has its own in-house capability for autonomous driving compared to the modular systems-based approach being implemented by others. Tesla’s system has the ability to analyze 2,000 frames/second compared to the current capability provided by Nvidia and its GPU- based integrated chips of around 200 frames per second. While we have discussed Tesla’s unconventional approach previously, perhaps more knowledgeable individuals such as William Keating can opine more on this latest development.

6. Tesla expects the Gigafactory in China to be producing cars by the end of 2021. Current capacity planning is for 250,000 cars per year with an eventual increase to 500,000. While preliminary, Musk is of the view that the factory in China will cost somewhere between $2-2.5 billion. China is meant to feed the local market and will not affect U.S. manufacturing operations. Tesla expects much of its China investment “to be funded through local debt”. In the words of the CFO, “the operating plan expects to self-fund itself and debts are expected to be refinanced or repaid with a healthy cash balance from internally generated cash flow” [paraphrased].

7. Model 3 gross margins are expected to ramp to 15% in Q3-18 and 20% in Q4- 18. Musk believes that in Q2-19 Tesla will hit its targeted gross margin of 25% for Model 3. We surmise that Model 3 hits a production run rate of 10,000/week sometimes then.

8.The top five cars traded in for Model 3 by U.S. customers were Toyota Prius, BMW 3 series, Honda Accord, Honda Civic, and Nissan Leaf. This is important because except for BMW, these are low-priced mid-range cars and the expectation would be that customers driving those would not be able to afford the $60,000 + car. Clearly, Model 3 is resonating with multiple strata of customers, and with

the dual-motor Tesla Model 3 already burning rubber, the market opportunity appears bigger than anticipated.

Stay tuned for additional analysis after the 10-Q is filed.