NIO Inc (NIO US) (“Nio” or the “Company”) filed a Form F-1 registration statement with the SEC for a proposed public offering of US$ 1.8 billion on August 13, 2018. Nio is an upcoming electric vehicle manufacturer from China, with the aim of creating premium battery-operated electric vehicles (“BEV”) to serve the growth opportunities in the SUV segment. NIO’s first two BEV’s are called ES8 and ES6 respectively. The Company started making deliveries of ES8 – a 7-seater BEV – on June 28, 2018. As of July 31, 2018, NIO had delivered 481 ES8 vehicles, with unfulfilled reservation deposits for 17,000. Tesla is on the other hand is at a current weekly production run-rate of 7,000 vehicles, with expectations of scaling that up to 8,000 / week by the end of August 2018.

ES6 which is still in development – a 5-seater high-performance BEV – will likely be available for sale in the first half of 2019. It will have a lower price point than ES8 and will be targeting a broader audience. NIO’s BEVs are manufactured by a 3rd party under contract from the Company. The

Company’s intellectual property including design and software has been developed in collaboration with European and U.S. partners, service providers, employees and others.

China BEV Market

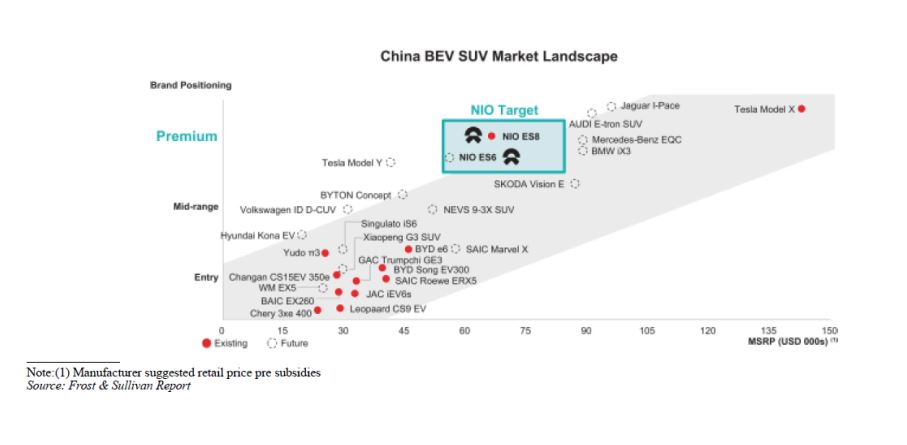

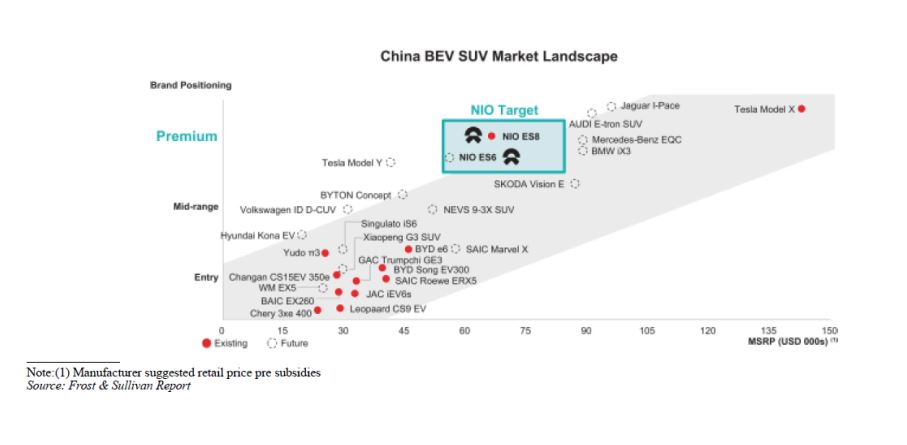

The more interesting piece of information to emerge from the Company’s disclosures is the rapid growth in the mainland for BEV. Sourcing data from Frost & Sullivan, NIO outlines 40% annualised growth in China’s BEV segment. Chinese electric vehicle market including hybrid vehicles is estimated to grow to 3.6 million units in 2022. As highlighted in Figure 1, Tesla Motors (TSLA US) is the leader in China with its Model X.

Figure 1: Is Tesla Model Y a Mid-Range SUV?

As illustrated in the graphic, Tesla is at the top of the food chain in China, with every aspirant and existing manufacturer lower in price and in perception. Point being that if Tesla is finding it hard to be profitable at the prices highlighted in Figure 1, what is the rest of the industry up to? The current travails of Tata Motors Ltd Spon Adr (TTM US) and other global auto manufacturers are evident in ever declining stock price. Investors are catching on to the fact that the incumbents are in a classic catch-22 situation. The premium segment, which is the most profitable aspect of the automobile industry, is seeing both Tesla and other new aspirational entrants take away customers. While Tesla migrates downwards in the value chain, increasing efficiencies and gaining operational leverage, the incumbents are hollowing out existing infrastructure to replace it with new facilities, concomitantly serving the existing base with its attendant labour, organisation and capital expenditures cash outlays.

Therefore, although Tesla needs billions of dollars to grow its operations, incumbents require equally copious amounts of capital to maintain existing services and reinvest to grow new operations and catch-up in new technologies.

What is the Valuation of Nio Inc.?

As recently as in December 2017, NIO issued 211,156,415 Series D convertible preferred shares for US$ 5.353 per share. According to company disclosures;

As of the date of this prospectus, 44,631,528 ordinary shares and 821,378,518 preferred shares are issued and outstanding. All of our issued and outstanding ordinary and preferred shares are fully paid.”

Therefore, based on the total number of shares outstanding, assuming no growth in equity value, NIO’s private market equity value is a total of US$4.6 billion as the date of the prospectus. To fair value stock grants, the independent valuer used a discount rate of 23% as recently as in the quarter ended June 30,2018.

We do not know how the underwriters of NIO will sell the company’s prowess and opportunity to prospective investors in the U.S. The proposed US$ 1.8 billion could be for 20% of the Company or for 30% of the Company. Assuming, a mid-point of 25%, that would value NIO at $7.2 billion or $6.25/ share. If that is correct, how does it impact Tesla?

Tesla is already a Champion in China and the Rest of the World

If NIO’s China opportunity is worth $7.2 billion, then what is Tesla’s China opportunity worth?

NIO is likely to have 2 mid-range SUV’s – if all goes well and the caveats to that are more than the fingers on both our hands – by the end of 2019. Tesla, on the other hand, will have a fully functional captive automotive manufacturing operation in Shanghai China by 2020/2021, producing 250,000 or more cars. Tesla has a line up of Model 3, Model S, Model X, and as per NIO’s prospectus a Model Y, which will be a mid-range SUV. Thus, Tesla will cover the entire gamut of middle and high range cars and SUVs. While Tesla will not manufacture all its various SKUs in China, it will sell all of them.

Therefore, in ANTYA’s view, Tesla’s market opportunity and equity value should be 4X that of NIO, or $30 billion in China.

If Meituan Dianping (MEITUAN CH) – burning cash, EBITDA negative, and going up against equally well funded and motivated competitors – and Pinduoduo (PDD US) are both valued by equity investors at US$20 billion to US$ 30 billion, then Tesla’s China opportunity is not worth any less than that. Tesla could and should IPO its China unit to crystallize the prospects for its subsidiary.

We also discussed Tesla autonomous driving opportunity in our previous report GM & Vision Fund JV Highlights Tesla Inc. Is Significantly Undervalued; Stock Is Headed Higher and suggested that Tesla autonomy should be valued at approximately $19 billion. If China opportunity is worth $25 billion, then the two together account for $44 billion of equity value.

At the current stock price, Tesla’s Enterprise Value is approximately $70 billion (Capital IQ). Adjusting for the solar city acquisition, China and autonomy, the Enterprise Value for the car unit is roughly US$20 Billion, or 3.7x 2020 consensus EBITDA of US$5.33 billion. That is low.

Therefore, while Musk may have contacted “foot in mouth” disease, there is substance behind his madness.

More importantly, if short interest in Tesla is a leading indicator, we are interested in making friends with those brave souls that would be willing to bet on NIO? What happens If NIO cannot raise capital in the U.S.?

To our chagrin, if Musk’s “secured funding” tweet proves to be a “fib”, Tesla stock will suffer a dramatic battering. Musk could be forced to resign, and if that happens, none of this will really matter, because a crisis of confidence could engulf Tesla, engendering a self-fulfilling prophecy. Rhetorical we are NOT!