The last seventeen days have been tumultuous for Musk, for Tesla Inc. and its employees, for those that are short Tesla, and for the shareholders of Tesla. Monday could be another highly volatile day for the stock as short-term arbitrageurs re-balance portfolios, now that “No Deal” is the official word. Musk stays put in his position with the unwavering support of the board, and we can all go back to discussing Model 3 production ramp in October. News media and bloggers will no doubt pat themselves on the back for having the foresight to suggest that Musk’s plan was a non-starter anyway. More importantly, with Musk and Grimes un-following each other on Instagram, and Musk ruminating about love on Twitter, it seems to us that after the imminent raucousness in Tesla stock on Monday, saner days are in store for shareholders. We Bank on it.

Elon Musk, CEO of Tesla Motors (TSLA US) (“Tesla” or the “Company”) admitted failure in his haphazard attempt at taking Tesla private. In a blog post on the Company’s website, Musk outlined three key reasons for staying a public corporation, all of which were evident to many commentators and a skeptical investor base. For clarity we quote Musk;

Based on all the discussions that have taken place over the last couple of weeks and a thorough consideration of what is best for the company, a few things are clear to me:

Given the feedback I’ve received, it’s apparent that most of Tesla’s existing shareholders believe we are better off as a public company. Additionally, a number of institutional shareholders have explained that they have internal compliance issues that limit how much they can invest in a private company. There is also no proven path for most retail investors to own shares if we were private. Although the majority of shareholders I spoke to said they would remain with Tesla if we went private, the sentiment, in a nutshell, was “please don’t do this.”

I knew the process of going private would be challenging, but it’s clear that it would be even more time-consuming and distracting than initially anticipated. This is a problem because we absolutely must stay focused on ramping Model 3 and becoming profitable. We will not achieve our mission of advancing sustainable energy unless we are also financially sustainable.

That said, my belief that there is more than enough funding to take Tesla private was reinforced during this process.

After considering all of these factors, I met with Tesla’s Board of Directors yesterday and let them know that I believe the better path is for Tesla to remain public. The Board indicated that they agree.

Thus, Musk outlined something he probably knew already but went ahead with his banter on Twitter anyway. Importantly, Musk is trying to reinforce his view that there is enough funding to take Tesla private. We concur with that thought, although the hurdle to access that capital is pretty high, as demonstrated by a quick reversal of the plan.

What’s next for Tesla Shareholders?

In ANTYA’s view, this too shall pass.

We hope a chastised Musk will pay undivided attention to running operations, instead of indulging in a public tête-à-tête with those with a negative view of Tesla’s prospects. The stock could have heightened volatility in the short-term as investors come to terms with capital and financing requirements and a little bit of halo surrounding Musk evaporates. Rightly so! Needless to say, all eyes are on the Company’s valuation, and in the eyes of many conventional thinkers, the stock is set for a steep fall. That may well be true, especially given the current episode, but on a fundamental basis (not current financials but the evolutionary path ahead) Tesla is unlike any other large-capitalization company with global growth prospects and the ability to dominate its markets.

What are some of the Benchmarks to Evaluate Tesla?

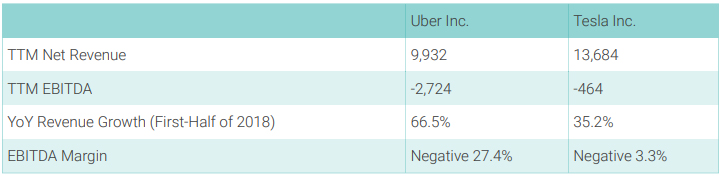

The nuance surrounding Tesla is multi-faceted, and hence we try to limit ourselves to the bigger picture with real-world examples of the valuation accorded to other companies. Let’s first talk about Uber Technologies Inc. Figure 1 compares Uber to Tesla.

Investors have valued Uber at around $70 billion, making it the highest-valued private technology company in the world.

Currently, at 325/share or thereabouts, Tesla’s equity is valued at US$55 billion, and the Company’s Enterprise Value is US$67.6 billion. In ANTYA’s view, Tesla is worth much more than UBER because:

- Tesla has yet to gain scale in its service operations where the Company is making rapid progress. That will help alleviate margin pressure and improve customer satisfaction.

- Tesla is still ramping up Model 3 production and in Q3-18 and Q4-18 will likely best Uber in revenue growth and will also deliver positive EBITDA, adding to its cash balances.

- Uber’s business model is asset-light with a software as a service (“SAAS”) paradigm assisting passengers and drivers find each other. Many industry participants are exiting autonomous driving and there is pressure on others, including Uber to do the same. Waymo of Alphabet fame, Baidu in China, Tesla and GM in the U.S., and some German automakers recently entering the autonomous driving fray, it appears to us that Tesla, Waymo, and Baidu (given the backing of the state in China) could dominate the next wave of transport innovation.

Media stories touting the value of autonomous vehicle units are beginning to pop up. Please see This Valuation Says Google’s Waymo Unit Is Worth More Than Tesla. Whether or not that is correct, it is pertinent that investors are beginning to place equity valuations of tens of billions of dollars on autonomous driving units. We discussed that in GM & Vision Fund JV Highlights Tesla Inc. Is Significantly Undervalued; Stock Is Headed Higher.

Waymo has just entered China surreptitiously as outlined in the following Bloomberg story Waymo’s Shanghai Subsidiary Gives Alphabet Another Route Back to China. We already know that Tesla is building a factory in Shanghai, and outlined Tesla’s China opportunity in Tesla Inc. – NIO Inc. Registration Statement Highlights Tesla’s Opportunity in China

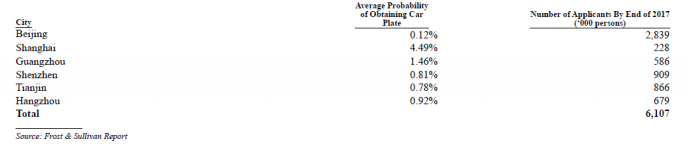

A treasured piece of information in NIO Inc.’s IPO prospectus filed with the SEC resides on page 115 and is reproduced below both for China watchers and Musk haters.

Figure 2 should provide fodder for EV bulls in China. Due to severe traffic congestion and air pollution, seven of China’s major cities, as outlined limit the number of car plates issued to internal combustion engine vehicles each year through a lottery or an auction process. As such good luck to anyone looking to replace a car or get a new one, unless it happens to be an EV, where there are either no quotas or a much higher probability of getting one. For Tesla, and to a lesser extent for NIO, it implies pricing power and a ready market.

We remain bullish on Tesla. Tesla will raise equity at its current or higher valuation, and it will not default on its debt. If nothing else, Tesla stock ownership is getting concentrated in the hands of long-term shareholders including Musk, Saudi Sovereign Fund, Tencent, Baillie Gifford & Co., T. Rowe Price Group Inc. and others.

We have said earlier that many growth-oriented funds are on the sidelines and are currently not invested in Tesla. That implies that many growth investors are underweight or notionally short Tesla. Once Q3-18 production numbers are disclosed, and Tesla can exhibit a sustained production rate of 5,000/week or 4,500/week, many will jump on the bandwagon. The best window of opportunity for shorts to cover their position is the week beginning Monday, August 27, 2018.

Stay Tuned.