Tencent Music Entertainment (TME US) (“TM” or the “Company”) filed a Registration Statement with the Securities and Exchange Commission on October 2, 2018, for a proposed American Depository Receipt (“ADS”) offering of $1 billion or more. The anticipated filing was much awaited given that Spotify Technology Sa (SPOT US) (“Spotify”) – the world’s largest music streaming company – which trades on the NYSE holds a 9.1% equity stake in TM. Similarly, TM holds an approximately equivalent stake in Spotify as well.

While some others are bullish on the prospects for TM, we remain on the sidelines. ANTYA is disappointed in the disclosures outlined by TM, and it evident that TM is not a subscription-based streaming company. Clearly, comparisons to monthly subscription-based business models such as Netflix, Spotify, and Roku, will enable justifying a higher valuation multiple to prospective investors. Instead, we believe that TM is primarily a seller of virtual goods where other competently placed sellers can and will provide vigorous competition to TM.

Moreover, Tencent Holdings (700 HK) (“Tencent”) as the purveyor of the much-ballyhooed QQ messenger and the We chat platform, has fully milked those properties, and the most recent IPO’s completed in the U.S. or in Hong Kong, have touted their respective business relationships with Tencent and

links to its various chat platforms. Meituan Dianping (3690 HK) (“MD”), Qutoutiao Inc (QTT US)(“QTT”), Pinduoduo (PDD US) (“PD”) are some that readily come to mind. TM is the next in line to peddle its Tencent pedigree. But perhaps that is too much of a good thing.

TM outlines that it generates revenues from subscriptions, content sub-licensing, and advertising. Given that there are 61 mobile apps in China with more than 100 million monthly active users (as per iResearch China), China’s media multiples related to advertising have to correct. For it does not require a massive leap of faith that food-related advertising and promotions will migrate to MD, surplus goods for sale, or time of use related products and services will move to PD, while general consumer goods will compete for eyeballs in QTT, TM and others. With advertising revenues at Amazon, Inc. expected to cannibalize search and display advertising revenues on the PC and mobile, and Alibaba moving in a similar direction in China, investors will have to make astute bets in Chinese media stocks.

In our view, TM is a bet that is best avoided, until there is additional clarity on unfolding developments.

TM Subscription Based Revenues are Disappointing

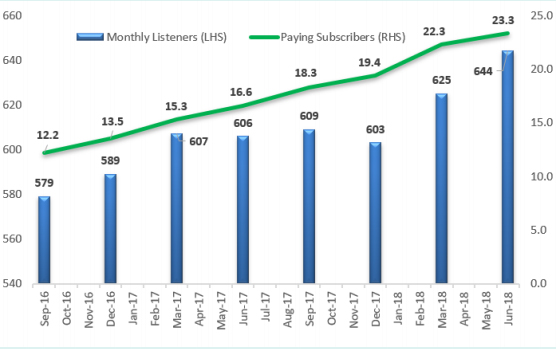

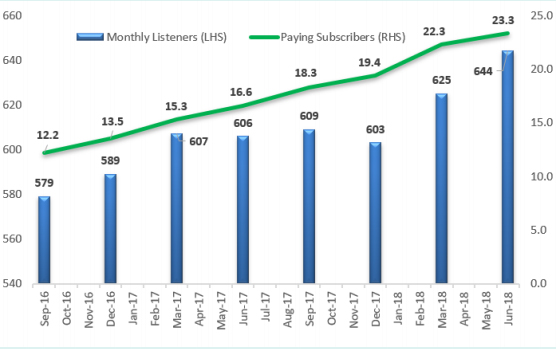

Premium multiples accrue to premium business models that deliver substantial impregnable growth. In the case of TM, we find it hard to believe that anything that it currently offers is defensible from a business standpoint. Starting from subscriptions as outlined in Figure 1, TM is struggling to grow its paying consumer base, as well as, the average monthly revenue associated with that customer base.

Figure 1: Subscription Base Paltry Compared to Listener Cohort (In Millions)

Source: ANTYA Investments Inc. and IPO Prospectus

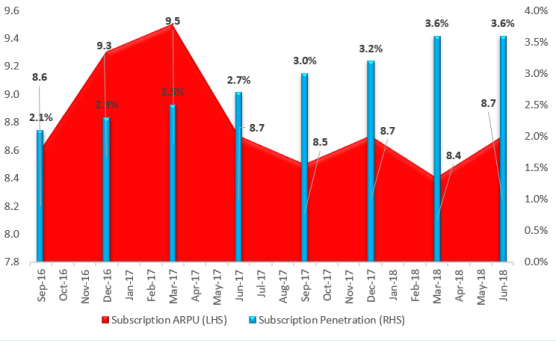

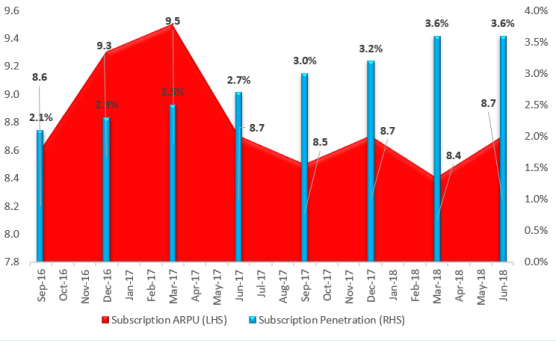

From March 2017 to June 2018, MAUs grew 37 million, whereas paying customers increased by 8 million. From an incremental perspective, although it appears that TM managed to garner a significantly higher number of paying consumers over that period – 24% of the additional users became payers -, system-wide the data leaves much to be desired. As highlighted in Figure 2, paying users are stagnant at 3.6% of the user base and so is the monthly subscription revenue, which has declined 8% from a peak of RMB9.5 to RMB8.7.

Figure 2: TM – These Metrics Do Not A Growth Stock Make

Source: ANTYA Investments Inc. and IPO Prospectus

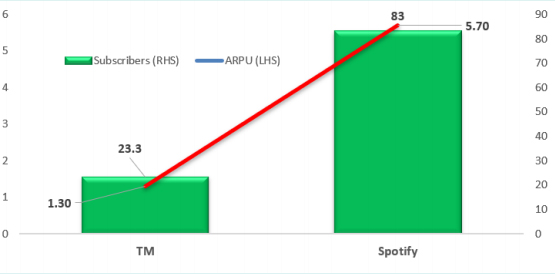

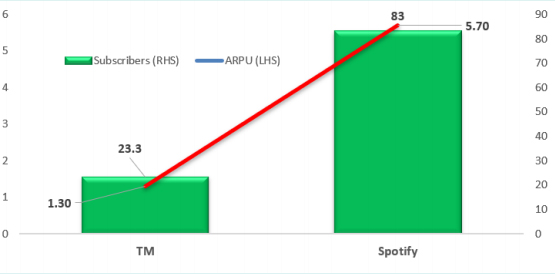

From our vantage point, stagnating penetration accompanied by flat-lining ARPU cannot be good for the growth prospects of TM. Comparing TM’s numbers to those reported by Spotify presents a not too compelling picture for bulls on TM. Figure 3 highlights some useful facts for investors to chew on.

Figure 3: The Gulf Between Spotify and TM is Wide–June 2018 Disclosures –

(Subscribers in Millions, ARPU in equivalent USD)

Source: ANTYA Investments Inc. and IPO Prospectus

The paying subscriber base of Spotify with 83 million global subs is 3.6 x times that of TM, and those subscribers are much more valuable paying 4.4 x as much to enjoy their music compared to Chinese audiences. Although Apple Music and Amazon Prime are building global platforms to rival that of Spotify, none comes close, and nor will TM. TM is a one-country play, that is transaction focussed and where regulatory challenges and or other issues can arise at any moment.

In our opinion, TM IPO will be flat-footed and NOT fleet-footed that many are hoping for. Expect the low-end of the valuation range and to go lower after.