News headlines, President Trump’s tweets, rhetoric from China’s bureaucracy, and jittery investors have contributed to NXP Semiconductors NV (NXPI US) trading at a 20% discount to the price proposed by Qualcomm to acquire the company. We believe investors should ignore the noise and take the plunge. There is a very high degree of probability that NXPI will provide sufficient risk-adjusted return in short order for the few brave souls who stick around till the end. With the U.S. lawmakers removing anti-ZTE measures from the defense bill, one of the last hurdles in the way of a successful culmination of the deal is out of the way.

ANTYA’s previous opinion on NXP Semiconductors NV–An Intriguing Investment proved prescient from the vantage point of an opinion piece, but less than useful for investors looking to make a bet on a positive outcome, since May 13, 2018, the day we published our opinion was a Sunday, and in the Monday morning trade NXP Semiconductors NV (NXPI US) opened up more than 10%. Perhaps this time would be different! The overnight change in sentiment and the leap in NXPI’s stock price was driven by a tweet from President Trump highlighting his excellent working relationship with President Xi of China and the grant of a lifeline to ZTE Corp H (763 HK). President Trump’s message is reproduced in Figure 1.

Figure 1: President Trump’s ZTE tweet

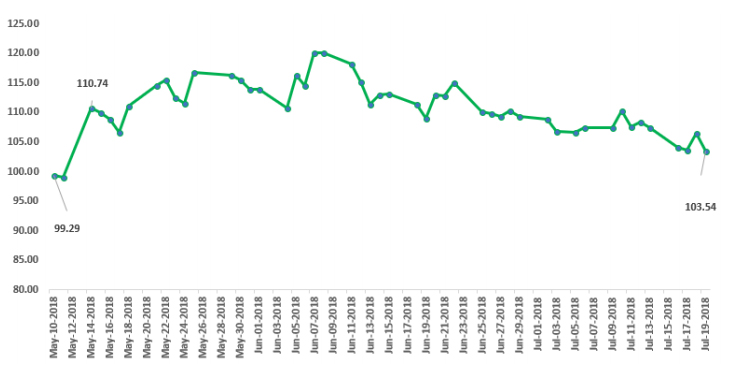

Investors took that as a sign of a positive outcome for Qualcomm Inc’s (QCOM US) proposal to acquire NXPI and accordingly bid up NXPI’s stock price. Figure 2 highlights the subsequent trajectory of NXPI.

Figure 2 – NXPI Declines Once Again

Source: Capital IQ and ANTYA

At the time of publication of our report, NXPI was below $100. Within weeks positive sentiment gave way to negative headlines with both the U.S. and China, implementing tariffs on goods, with neither side backing down. Larry Kudlow’s comments on CNBC added fuel to the fire as highlighted in the story ‘Shocking’ and ‘bogus’: China’s foreign ministry rebukes Kudlow for trade remarks. The end result is that NXPI stock is back to square one.

While trading algorithms and traders are buying and selling on the news, in the current topsy-turvy environment, what are rational investors expected to do? In ANTYA’s view, the answer to this conundrum lies in the geopolitics driving President Trump and President Xi’s agenda. The co-dependent nature of this relationship which involves North Korea, Taiwan, Russia, Japan and the EU to a lesser extent, suggests that business will proceed as usual with some hiccups.

In our assessment, one more extension might be sought before MOFCOM gives the green light to the deal, although Qualcomm has said that July 25, 2018, is the deadline.

Qualcomm’s View on The Deal

Let’s first hone in on what the CEO of Qualcomm, Steve Mollenkopf (“Mollenkopf”) said to the New York Times on July 19, 2018, and we quote:

Mr. Mollenkopf said Qualcomm had done all it could to persuade Beijing to approve the $44 billion transaction, which the companies have said will be terminated next Wednesday [July 25, 2018] without regulatory consent.

More details are available in Trump Tried to Protect Qualcomm. Now His Trade War May Be Hurting It.

That paraphrased statement involves multiple layers of insinuations and deductions. Firstly, this implies that Chinese regulatory agencies have sought and received concessions from Qualcomm, suggesting there isn’t much left to give. An example of that was discussed and presented in our report on NXP Semiconductors NV–An Intriguing Investment. We emphasized that Qualcomm renegotiated some of its multi-product patent licensing agreements with Xiaomi Corp (1810 HK) in April 2018, within six months of signing the initial deal with Xiaomi in November 2017. Then Qualcomm chose to become a cornerstone investor in the IPO of Xiaomi, along with other state-owned investors, as discussed in Xiaomi Post-IPO Review – As Good as It Gets; Don’t Count on Stabilization.

China Played Its Part in North Korea Meeting

In our mind, there is no doubt that China was instrumental in pressuring North Korea to come to a summit meeting with President Trump in Singapore and was helpful in initiating a dialogue on the denuclearization of the Korean peninsula. Given President Trump’s attempts to undermine the Iran nuclear deal, from a political standpoint, it was important for President Trump to show progress with North Korea, and hence his repeated references to President Xi as “a good friend”, who did make it happen.

It was also after the Singapore summit that President Trump blindsided allies on the eve of G7 by asking for Russia to be invited to the meeting, and announced the proposed meeting with President Putin. Given that North Korea is sandwiched between two nuclear powers it appears to us that a security and political stability arrangement with North Korea is being worked out to ensure continuity within North Korea, once and if de-nuclearization takes place. The United States wants minimal Russian interference in North Korea, China does not want a refugee crisis at its door and the incumbents want to stay in power in North Korea.

Therefore, in our view, beyond the sensational headlines and apparent chaos, a face-saving deal is brewing for all parties involved in the matter. To us it appears, President Trump’s bluster on trade is a negotiating ploy to nudge China in assisting with the intractable problem of North Korea.

Why will China Allow the Deal?

By allowing Qualcomm to proceed, the Chinese government will accomplish two things:

- It will indicate its intention to be accommodative towards President Trump’s political needs, without suggesting cowardice.

- It will showcase to the world that politics does not drive China’s business and economic decisions.

More importantly, China will have the upper hand once the deal closes because it can always tighten the screws post-closure, including the divestiture of some parts of the business at advantageous terms to a local corporation at a future date. Therefore, in our view, China does not need to kill the deal right now.

Qualcomm is helpful with “Make in China”

Coming to China, there is no shortage of news stories discussing “Made in China 2025” which involves both a home-grown semiconductor industry and leading-edge investment in networks. More details available in Made in China 2025. Qualcomm is the only company that can assist China in establishing an edge in deploying and delivering 5G services to mainland businesses and consumers. China Mobile, China Telecom, and home-grown behemoths of online commerce and services could become world leaders with the early adoption of 5G. It is the rapid adoption of the 5G threat from China that recently kick-started U.S. efforts in that direction as well.

China is undoubtedly investing in A.I., robotics, and electric vehicles. Baidu recently showcased a bus with autonomous driving technology. More details on Baidu’s efforts in this direction are discussed in Baidu starts mass production of autonomous buses. Both Qualcomm and NXPI are involved in providing automotive manufacturers with technology to improve and enhance products. Mollenkopf was quoted by NY Times as saying that “… [Qualcomm’s] backlog of chip orders from the auto industry is $4 billion.”

Although purchasing NXPI will be a reduction of competition in the auto-chip segment, given Qualcomm’s ownership of leading technologies and a rich trove of IP, preventing the deal will not make it any easier for Chinese auto manufacturers to gain access to those chips from Qualcomm.

Moreover, in the absence of an approval to buy NXPI, given the mercurial nature of President Trump, he could bar Qualcomm from selling any automotive chips to China, or delay the roll-out of 5G in China. He has done that with ZTE recently and the Chinese decision-makers will no doubt be thinking of that as well. Qualcomm opened itself up to such political intervention by going the CFIUS route to defend against an unwanted advance from Broadcom Limited (AVGO US) Limited. All of these scenarios seem far-fetched and unlikely; but so did the rise of Trump’s presidency and the subsequent upending of the well-established global order.

We maintain the view that there is a 66% probability that the transaction as proposed by Qualcomm will close. On a probability adjusted basis – assuming 10% short-term downside on the failure of the proposed transaction – at current levels, NXP provides approximately 11% upside.

Even at 50:50 odds, the payoff is a positive 6%.