f NIO is for the Braveheart and Tesla is for the Warrior in You, then Niu Technologies is for the investor that is looking for growth investing but only wants to put money to work with those that have already delivered. Niu Technologies (NIU US) is making and delivering e-scooters from its own manufacturing facility. Financials for 2016, 2017 and YTD 2018 are respectable and highlight progress with each passing quarter. We are optimistic given the secular backdrop, China’s emphasis on improving its environment and given Niu’s stature as a pure-play. Yes, there will be competition, but it appears that for the next few years Niu will deliver volume growth and improving margins.

Niu Technologies (“Niu” or the « Company”), an all-electric scooter maker from China, has filed a registration statement with the SEC to sell equity securities in the form of American Depository Receipts. Niu is coming to the market at an interesting time given the recent IPO of NIO Inc (NIO US), a maker of battery-operated vehicles, also from China, had a volatile debut. We discussed the prospects for NIO in our insight NIO Inc. – NIO for the Braveheart and Tesla for the Warrior in You.

There has also been a flurry of announcements recently from car majors in Europe on their e-vehicle plans; the so-called Tesla killers including those from Audi discussed in ‘Tesla Killer’ narrative comes back as German automakers launch EV offensive. Saudi Arabia has also been on the attack investing both in Tesla Inc. (“Tesla”) (a 5% stake acquired in the public markets) and investing a billion dollars in Lucid Motors (“Lucid”) of California for an undisclosed stake. We discussed Saudi interest in Lucid in our insight NIO Inc. – Rumoured Saudi Interest in Lucid Motors – What Does It Tell Us About NIO and Tesla?

Therefore, Niu is coming to the market at an opportune time when investors are becoming comfortable with the notion that battery-operated electric vehicles are becoming mainstream and will be more than 50% of the cars sold in the developed world by 2025. An important point of differentiation for Niu, compared to the rest of the players in the automotive and vehicle space is that like Tesla:

- It is a pure-play on the electrification of mobility

- It has production, sales, and distribution infrastructure; and

- It has approximately 390,000 vehicles on the roads of China, which have already logged in 1.2 billion kilometers.

Therefore, investors buying into the IPO of Niu are buying more than hope, and they are investing in more than an expectation that the management team can deliver. The management team has already built the Company to a stage where growth capital is required to stabilize the business and to continue to invest in R&D, and production facilities to grow the business.

First, a few essential facts as gleaned from the prospectus are:

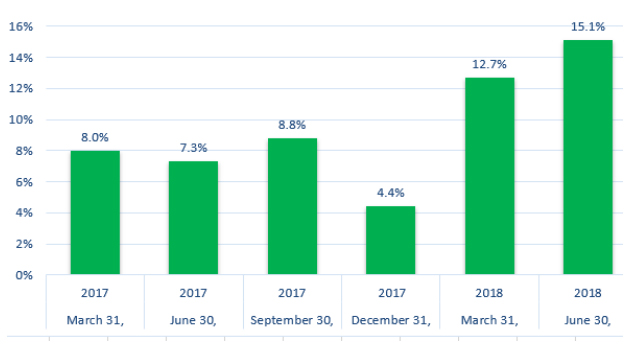

Niu is covering its cost of sales and is profitable at the gross margin level. In our view that is important because investors recall that all the hoopla surrounding Tesla has been that the car will never reach a gross margin level of 25%-30% and that in Q1-18, and Q2-18 the gross margins were highly negative. Well at least in the case of the Company, gross margins are positive and have been consistently trending upwards as shown in Figure 1.

Growing Gross Margins are a Good Sign

Source: ANTYA and Niu Technologies Prospectus

As illustrated in Figure 1, Niu has been able to leverage its growing volumes, and growing brand recognition to push through price increases enabling the Company to deliver rising gross margins. The Company may also be benefiting from a depreciating RMB given that sales growth outside China has been meaningful in 2017 and in the first half of 2018. In the words of the management;

We raised the retail price for certain e-scooter models in January 2018, with the volume-weighted average retail price increasing by 9.3%, which also contributed to the increase in net revenues from e-scooter sales. The net revenues per e-scooter increased from RMB4,177 for the six months ended June 30, 2017, to RMB4,456 for the six months ended June 30, 2018.

This is heartening indeed given that pricing power is the key to maintaining and sustaining profitability in competitive industries, and Niu’s ability to raise prices in a growing business is an important indicator of its success in the nascent marketplace that it competes in. The Company also reported a marginal decline in the cost of revenue of 1%, YoY, helping margins overall.

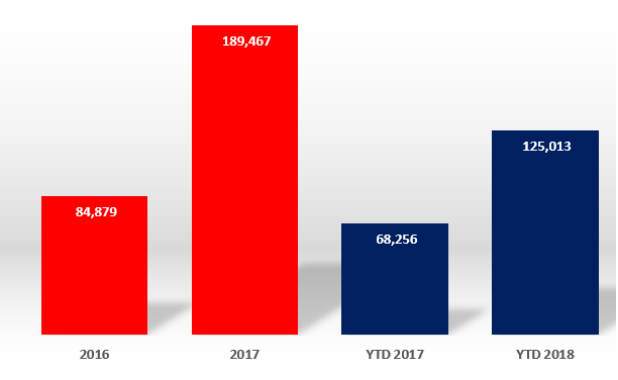

As highlighted in Figure 2, sales volumes grew 123% in 2017, followed by an 83% increase in the first six months of 2018.

Figure 2: Unit Sales Growth Thrives YoY

Source: ANTYA and Niu Prospectus

Growing unit sales and higher prices per unit enable Niu to deliver 117% revenue growth to RMB 769 million in 2017, and 95% revenue growth to RMB 557 million YTD. All of this growth is backed by secular trends that are bound to gain momentum with each passing year as highlighted in Figure 3.

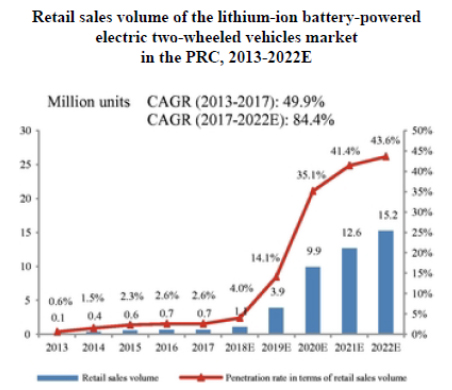

Figure 3: Tremendous Runway for Growth Ahead

Source: ANTYA and Niu Technologies Prospectus

Figure 3 shows that we are still in the early days of the adoption of battery-based two-wheelers in China and the rest of the world. Staying true to China, two-wheeler volumes are expected to grow from an estimated 1.1 million units in 2018 to an estimated 15.2 million units in 2022. Niu is at the leading edge of this S-Curve growth and is well-positioned to capitalize on the growth of the Chinese two-wheeler industry.

The prospectus filed by the Company says the following about China’s two-wheeler marketplace.

As of December 31, 2017, there were approximately 700 million two-wheeled vehicles in China, and on average, one out of every two persons owns one two-wheeled vehicle. One important trend in urban mobility solutions is that electric two-wheeled vehicles are gradually replacing traditional two wheeled vehicles. Electric two-wheeled vehicles are affordable and convenient and can navigate congested traffic better than automobiles. According to CIC, China is the largest market for electric two-wheeled vehicles, where sales volume and retail sales value of electric two-wheeled vehicles reached 27.0 million units and US$8.0 billion in 2017, respectively. Sales volume and retail sales value of electric two-wheeled vehicles in China are expected to reach 34.9 million units and US$13.0 billion by 2022, respectively.

Therefore, in our view, Niu is well-positioned on many fronts.

First Mover Advantage Should Hold for a While

According to data cited in the prospectus from a China-based consultancy, the Company leads in China’s lithium-ion battery-powered electric two-wheeled vehicles market with a unit market share of 26.0%, compared to

6.7% for the number two player. This is interesting indeed, because if the first two players have 32.7% of the market two questions arise:

- How many other players are there?

- How much of the market does each have?

At first glance, this seems to suggest that there should be no pricing power, but we know from experience Niu has raised prices. Perhaps in the updated version of its prospectus, the Company can shed some additional light on the competition. Nevertheless, Niu has a well-established distribution network covering 150 cities and 571 franchised stores in China. Outside of China, the Company has 18 distributors covering 23 countries.

Unlike NIO Limited Niu Technologies Owns Manufacturing

The Company’s production facility is located in Changzhou, Jiangsu Province and currently occupies an area of 12,000 square meters, with a production volume of approximately 380,000 units per year. With unit sales of 125,000 in the first half of 2018, by the end of 2018, Niu would be approaching full utilization of its production facility. A part of the IPO proceeds would are earmarked to increase production volume by 700,000 & 1,000,000 units by 2019 and 2020, respectively.

In addition, Niu intends to upgrade the production facility, with the automation of assembly and testing, automatic-guided vehicles to streamline internal logistics, the transition from gas shielded welding to pressure-controlled resistance welding, and the transition from paint spraying to plastic coloring powder. The Company currently produces all its e-scooters in the Changzhou facility and plans to partner with motorcycle manufacturers to produce the N-Series in the future.

Scooters are Selling Well in Europe Too

Niu has tapped into the growing green movement in Europe and from a standing start in 2016 the Company reported revenues of RMB 69.2 million in the first half of 2018, representing 12.4% of its consolidated revenue for the first half, and exhibiting growth of 91% YoY. This notable success was achieved on top of substantial growth in 2017 as well.

The Valuation is Still Undecided – We estimate the Upper End at 6.5x EV/2018 Sales

Thus far we are positive about Niu and its prospects. From a valuation standpoint, we highlight that NIO with no track record is trading at an EV/ Sales multiple of 6.77x 2019 estimated sales of $1.7 billion as per capital IQ. The last funding round of March 26, 2018, where the Company issued 5,137,859 Series B redeemable convertible preferred shares at the price of US$4.96 per share aggregating total proceeds of $25,500,000, valued the total equity of the Company, pre-IPO with 134.67 million shares outstanding at $667.96 million.

On that basis, post-money using June 30, 2018, consolidated balance sheet, we estimate the EV of Niu at 728.1 million or RMB 4.95 billion. At its current run rate, Niu will likely have revenue of RMB1.2 billion for 2018. Therefore, that assumes a current EV/Sales of 4.1x. Assuming the Company’s IPO’s at a multiple of 6.5x 2018 EV/Sales, we are looking at an equity value of RMB 7.8 billion or US$1.13 billion.

We will provide more updates as additional information becomes available and in due course.