Sentiment on China and the news on Tesla are a definite no-no when it comes to subscribing to NIO’s IPO. Financial statements are unlikely to be of benefit when considering an investment in NIO because not only are they backwards-looking, but also bereft of optimistic forecasts. NIO is a venture investment, just as Tesla was in 2010, with one crucial caveat. China is growing gangbusters, adopting leading-edge technology like there is no tomorrow, its denizens are willing to support homegrown technology and the environment challenge in China is a clear and present danger. That makes NIO and intriguing investment for Bravehearts.

NIO Inc. (“NIO”, or the “Company”) intends to raise US$1.8 billion from prospective investors in the United States to execute on its vision of becoming a meaningful player in the Chinese Battery Electric Vehicle (“BEV”) marketplace. NIO’s plan is to focus on the all-electric mid-range SUV segment, 5-seater, and 7-seater, where it will be positioned as the only Chinese Company that domestically manufactures the SUV. NIO believes domestic production will provide it with unique cost advantages relative to others, such as Tesla Inc. (“Tesla”) that currently import vehicles into the country. Imports must contend with a customs duty of 15%, and recently imposed punitive tariffs of 25%, on auto imports from America.

Whatever be the merits of NIO’s business plan, let’s first provide some context to NIO’s status as an enterprise compared to Tesla that went public in early 2010.

- Prior to filing its registration statement, Tesla sold 937 Tesla Roadsters to customers in 18 countries, with more than 3.0 million miles under the Roadsters belt. As per NIO, it has sold 481 ES8 BEV in China. No details on miles driven were provided by NIO.

- Included in the 937 Roadsters sold, were second-generation units called Roadster 2 as well. i.e. prior to its IPO, Tesla had already upgraded its product once. No such details are available from NIO.

- Tesla was working on Model S at the time of its IPO. Model S was a generational leap in technology, sophistication, and customer acceptance and went head-to-head with global automotive icons like Daimler-Benz, BMW, VW, Lexus, etc., and emerged a winner. NIO has plans of introducing a smaller variant of ES8 called ES6, sometimes in 2019. Tesla was behind schedule with its Roadster, and Model S. NIO’s is still a developing stage enterprise and it could also be late.

- Tesla had 10 corporate stores in the United States and Europe prior to its IPO, with plans for 20 stores by the end of 2010 after the IPO. NIO has not provided a figure for its store count.

- NIO employs 6,231 personnel in China, California, Munich, and United Kingdom. 87% of the employees are in China with only 600 in software design. Rest are sales, marketing, manufacturing, etc. The majority of high-value employees in design, research, software for autonomy, and other essential areas are based offshore. Tesla employed 514 individuals at the time of its IPO.

- The Tesla Roadster used over 2,000 purchased parts, sourced from over 150 suppliers. The supply base was global with about 30% of suppliers in North America, 40% in Europe, and 30% in Asia. The ES8 uses over 1,700 purchased parts which are sourced from over 160 suppliers. Both Tesla and NIO were dependent on components that were/are single-source. NIO expects it to be similar for the ES6.

- Two years prior to the IPO, auditors identified a weakness in internal controls that was rectified by Tesla in 2008. Auditors at NIO have identified “a material weakness in internal control over financial reporting”. Currently, NIO is undertaking steps to rectify this weakness and the weakness could persist for another year.

- Both Tesla and NIO benefit from government subsidies for green vehicles, although in Tesla’s instance once it reaches a cumulative unit sale of 250,000 cars, those subsidies will begin to decline or be eliminated sometimes in 2018.

- Tesla outlined a positive gross margin for the nine-month period ended September 30, 2009, of $7.75 million based on revenue recognition of 706 Tesla Roadsters in its IPO filing. In its registration statement, NIO described a loss at the gross margin level of $23.5 million based on recognizing revenue from the sale of 481 ES8 vehicles.

- As of June 30, 2010, the first quarter ended after the IPO, Tesla had an enterprise value of approximately US$2 billion comprising $1.7 billion in common equity, and the rest in preferred stock (Capital IQ). Based on the most recent equity capital raise, NIO enterprise value is approximately US$ 4.6 billion.

What is in Favour of NIO compared to Tesla at its IPO?

- NIO has access to a network of approximately 214 thousand publicly available charging piles as of December 31, 2017, 59.6% of which are supercharges. Tesla did not have a charging infrastructure, public or private, and had to spend significant sums of capital for building the Tesla charging and supercharging network. That is now Tesla’s unique advantage given that it is proprietary. Access to a charging grid is a big plus for NIO.

- NIO has 17,000 unfulfilled ES8 reservations with deposits. Tesla had 2,000 reservations for a non-existent Model S at the time and reservations for only 220 Roadsters.

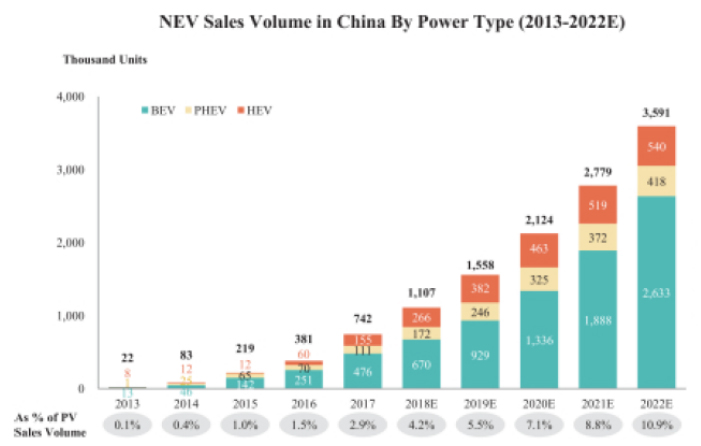

- When Tesla launched its Roadster, BEVs were a novelty. Now BEVs are a part of day-to-day life especially in China as illustrated in Figure 1.

Source: NIO Prospectus and ANTYA

With estimated sales of 1.1 million units in 2018, 1.56 million units in 2019 growing to 3.6 million units in 2022, the runway is long and growth exponential. Multiple others see a future in it as well, and as highlighted in Figure 2, existing Chinese auto manufacturers are already growing their BEV sales.

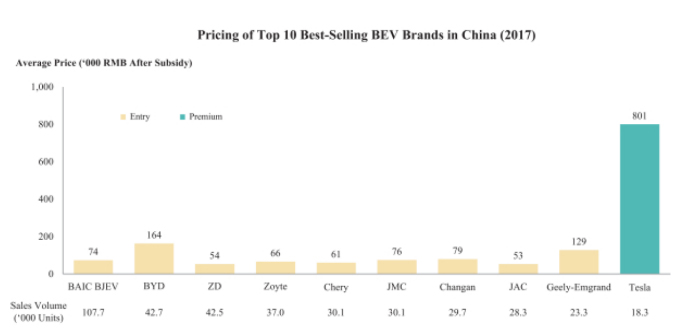

Figure 2: BEV sales and Pricing

Source: NIO Prospectus and ANTYA

A few critical highlights from Figure 2 should provide an interesting perspective to investors. The volume-weighted average price for non-Tesla vehicles is 82,600 RMB. Tesla vehicles averaged 801,000 RMB (All pricing shown is after subsidies). Therefore, there is a significant gap in price and brand positioning between Tesla and all others in China. NIO intends to fill this gap by pricing its vehicles in a range of 450,000 RMB – 550,000 RMB. Therefore, NIO plans to occupy a definite niche in mid-range leaving majors such as Audi, Mercedes, BMW, and Tesla to slug it out for the top, while mainstream Chinese counterparts focus on the mass segment.

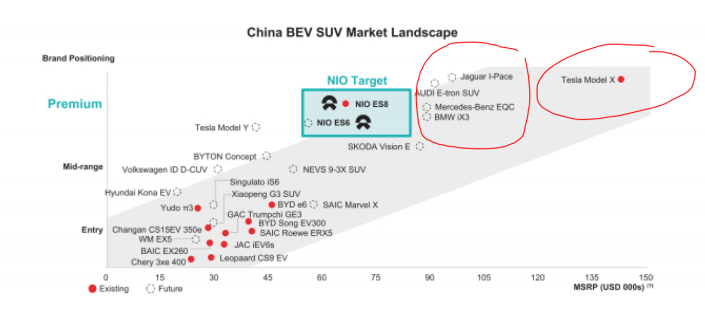

Therefore, we believe NIO is positioning itself well in the market as highlighted in Figure 3.

Figure 3: NIO Offers More for Less

Source: NIO Prospectus and ANTYA

Figure 3 illustrates that NIO is offering more for less, and therefore, it will appeal to a customer segment that aspires to affordable luxury. That customer segment desires the bells and whistles provided by a foreign luxury brand. However, due to affordability issues, it is willing to pay less and get access to that comfort from a home-grown brand. In emerging markets and low-income countries such as China, it can be a winning strategy. Therefore,

NIO’s positioning and product offering are tantalizing. We are not making a call on product quality and its acceptance by the marketplace. That remains to be seen, and it will become evident in due course.

Conclusion

Sentiment on China and the news on Tesla are a definite no-no when it comes to subscribing to NIO’s IPO. Financial statements are unlikely to be of benefit when considering an investment in NIO because not only are they backward-looking, but also bereft of optimistic forecasts. NIO is a venture investment, just as Tesla was in 2010, with one crucial caveat. China is growing gangbusters, adopting leading-edge technology like there is no tomorrow and its denizens are willing to support homegrown technology. President Trump’s America First agenda can only serve to strengthen the resolve of Chinese bureaucracy and decision-makers to propel the next wave of technological innovation forward in China.

Most importantly, with 17 Chinese cities expected to restrict access to internal combustion engine cars – to deal with congestion and pollution – the outlook for both Tesla and NIO in China is bright.

NIO will be volatile and could end up being a dud. It could also be a ten-bagger in 2-3 years.

We advocate owning both Tesla ( surprise surprise!) and NIO.

NIO is for the Braveheart in you, and Tesla is for the contrarian investor who is a warrior.