Jd.Com Inc (Adr) (JD US) with Walmart, Alibaba Group Holding (BABA US) with Softbank Group (9984 JP), Meituan Dianping (MEITUAN CH) with Tencent Holdings (700 HK), and many others are all vying for the holy grail of delivery services in China. In our view, success is less about making money on delivery riders, and more about ensuring adoption of rival payment platforms by merchants and customers. In that scenario, it is not clear who will blink first, but as a standalone player Meituan Dianping needs to tread with caution.

Alibaba Group (“Baba”) reported its Q2-18 results before U.S. markets opened for trade in August 23, 2018. At this juncture, we refrain from commenting on Baba’s results and its outlook. Instead, we gleaned additional information on the logistics business and plans for the segment going forward, and its likely impact on Meituan Dianping’s (“MD” or the “Company”) proposed IPO in Hong Kong. We previously highlighted increasing competitive intensity in China’s online delivery marketplace earlier in Meituan Dianping – Market Domination & Share Gains to What End?

What did Baba disclose today?

Baba reaffirmed the following facts about its China delivery and logistics business.

- Baba is creating a local service holding company that will hold Ele. me – the food delivery program – and Koubei which is a local services platform focussed on in-store consumption in China.

- The logistics business will be separately capitalized with investments from Baba, Ant Financial, and third-party investors. US$ 3 billion has been committed to the logistics platform in the form of new investments including capital from Baba and Softbank. More money is expected to follow.

- Baba will start consolidating Koubei, which will contribute to a significant revaluation gain when the transaction closes.

- Baba is serious about continued investment in the newly created platform and believes that “I and Koubei will work together to provide a comprehensive local service offering that is core to our strategy. Together with our commerce and [indiscernible], this local service flagship subsidiary will offer complimentary consumer insights, category expansion, and on-demand logistic network infrastructure to strengthen our value proposition to our merchants and brand customers.”

- Baba says that “[it] plans to aggressively invest in these businesses to gain market share and execute deep integration into the ecosystem of Alibaba’s service offerings such as incorporating local service users into our new 88 VIP membership. Local investments to gain food delivery market share in China and the consolidation of Koubei after completing the reorganization may result in slower overall group profit growth near term. But these businesses will have substantial operating leverage once the economy turns positive.

If there was ever any doubt about Baba’s commitment then the following statement from the CFO, Wei Wu should put that to rest.

It is a must-win and must-have for us.

Given that stance, it should be no surprise that Baba is willing to compromise EBITDA growth in the short to medium-term, while it delivers on its promise of building an integrated offline-online delivery network to serve its customers across platforms and channels.

How much did Baba Invest in Ele? me in Q2018?

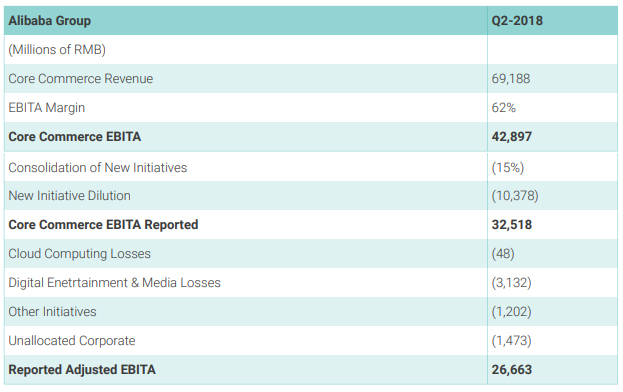

Responding to an analyst question regarding the level of investment in its food delivery business, the CFO said Ele. I represented 20% of the investment in new ventures in the quarter. Figure 1 walks through the numbers to assess Baba’s investment in food delivery in Q2-18.

Figure 1: Segmented Information

Source: ANTYA Investments Inc. and Alibaba Group

As highlighted in Figure 1, Baba continues to invest in high-growth areas and expects to reap the benefits in due course. Baba’s cloud business is already approaching an annualized revenue run rate of US$ 3 billion and growing at over 90% YoY. Nonetheless, reverting back to investments in new initiatives, as highlighted in Figure 1, Baba’s investments in new initiatives approached RMB 10.37 billion.

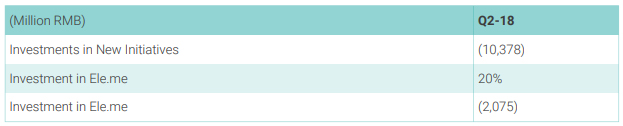

Given that the CFO said 20% of the Q2-18 investments went to Eli. me, Figure 2 highlights that Baba invested RMB 2.07 billion in its food delivery initiative.

Figure 2: Outshining Meituan Dianping in Incentives

Source: ANTYA Investments Inc.

Baba’s investments are in the form of incentives and promotions for merchants and customers to use their platform versus that of the competitor or introduce the usefulness of the platform via promotions to new customers. Although given a paucity of disclosure the numbers may not be comparable, Baba’s RMB 2 billion investment in Q2-18 compares to RMB 2.2 billion by MD for all of 2017.

Most importantly, is delivery more than Coffee?

That is an important question that investors need to wrestle with. A useful perspective has been provided in the following Starbucks Faces a Bigger Challenge in China than Luckin.

To sum up, investors in MD need to weigh their options carefully.