An audacious President-elect has done what the collective might of central bankers from G-7 couldn’t do. ANTYA highlights eight things to watch out for in 2017. Our view is that the S&P/TSX Composite will struggle in 2017.

Download this Report

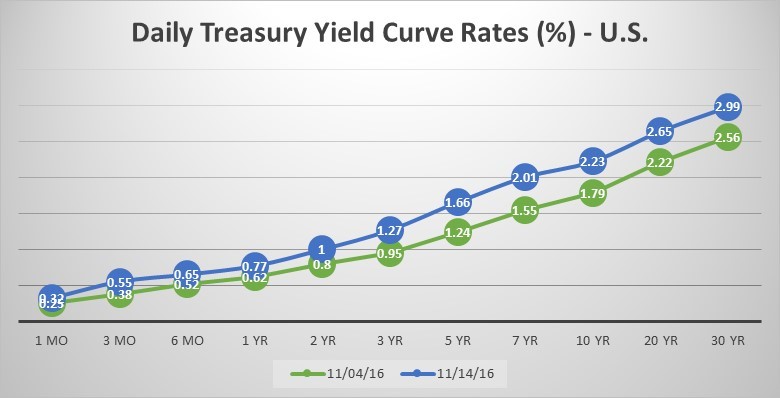

Within 5 days of being elected, Donald Trump has managed to do what the entire cohort of central bankers across the world couldn’t. Trump’s ascendance to the oval office, has steepened the U.S. yield curve forcing a global rise in bond yields, strengthened the U.S. dollar, and battered emerging market stocks & bonds. Commodities like copper have skyrocketed while Gold has cratered. The much-beleaguered financials have attained a life of their own with banks, asset managers and insurers of all ilk, rising. Technology darlings of yore including the so-called FANG (Facebook Inc, Apple Inc., Netflix Inc. and Google Inc.) have taken it on the chin. More likely than not, oil is headed lower later in November when the inability of OPEC to come to a decision dawns on the market.

These development do not bode well for the S&P/TSX Composite Index in 2017.

Figure 1: President-Elect Roils the Bond Market – The 10 Day Shift

Source: U.S. Department of Treasury

We believe, the specter of yields continuing to rise is very real indeed, especially given rising inflation expectations in U.S. We find the following from the U.S. Department of labor CPI release of September 2016 quite concerning: “The all items index rose 1.5 percent for the 12 months ending September, its largest 12-month increase since October 2014. The index for all items less food and energy rose 2.2 percent for the 12 months ending September.”

In ANTYA’s view, the operative word is “largest”, and more importantly, the less volatile component of the index excluding food and energy, is now consistently running above 2%. Furthermore, the current unemployment rate of 4.9% is where the economy was prior to the financial crises of 2008, suggesting full employment in the U.S. has been attained.

To us, it appears that the Federal Reserve has achieved its twin objective of full employment and stable inflation approaching the 2% range. Combine that with President-elect Trump’s fiscal stimulus plan and an emphasis on infrastructure investments, – just like PM Trudeau’s agenda in Canada – and one quickly arrives at the conclusion that the yield curve will steepen further.

Therefore, we believe investors should be cognizant of the fact that the great stock-market rotation out of yield into growth has begun in earnest. We recommend raising cash levels by selling yield-oriented assets.

Outlook for 2017

- Declining emerging market bond spreads will cause a sell-off. Therefore, we recommend selling before the herd arrives, and retrenching to N. America. Emerging market “high yield” could turn out to be a “much higher and still going higher yield” through 2017.

- Emerging market currencies will weaken causing higher domestic inflation, constraining domestic demand, and pressuring domestic companies operationally and financially. Therefore, sell emerging markets equities and retrench to N. America. Except for China, emerging market equities will likely be “submerging equities” in 2017.

- Higher rates are inevitably a negative for oil prices. Continually weak oil prices in 2017 and 2018, at or around current levels, will negatively affect global consumption and investment demand, as well as, reduce current account surpluses available for recycling into U.S. treasuries. Companies with exposure to Western Canada, and in the commodities patch, will continue to face challenges. Hard times for pipelines, oil & gas players and oil-services companies should continue in 2017.

- Higher rates are generally good for all financial stocks. Online brokers, insurance companies, banks, asset managers and investment banks could benefit from a multi-year cycle of improving ROE (return on equity) and NIM (net interest margins). Nonetheless, the S&P/TSX Composite (“TSX”) is already overexposed to financials.

- In ANTYA’s view, higher rates will be negative for Gold in 2017, and hence expect the bear market in Gold to continue or intensify. To deal with either additional political risk emanating from Europe, or higher inflation, TIPS are a better bet than Gold for 2017.

- Dividend yielding utilities and telecom stocks, which have been the darling of income investors, will have a rough 2017. Dividend growth ability which comes either via pricing power or via cash flow growth will trade at a premium, compared to those providing yield based on a high payout. For instance, BCE Inc. which has a high payout ratio compared to its discretionary free cash flow and its reported EPS could see its valuation compressed in 2017, while Cogeco Cable Inc., which has room to both grow the dividend and de-lever its balance sheet, should be a relatively better performer in 2017. Regulated utilities with little to nil pricing power, like Fortis Inc. should underperform significantly in 2017.

- A growing U.S. economy accompanied by lower gasoline prices should do wonders for airlines, cruise operators, and travel stocks, while continuing to hold up consumer spending. Air Canada, Carnival Cruise Lines & Delta Airlines are some of the names that could find an increased following in 2017.

- Finally, rates in Canada are going to follow U.S. yield curve, whether Stephen S. Poloz, the Governor of the Bank of Canada likes it or not. ANTYA expects that the yield curve will continue to steepen in 2017.

Going back to VITARKA of August 2016, we had said that Canadian real estate has peaked and that it was time to reallocate funds to the TSX. Since then everywhere in Canada, except in Toronto, real estate volumes and prices have been declining. We believe that Toronto will catch up to the rest of the country in 2017. Moreover, with various initiatives undertaken by Finance Canada and the mortgage insurers to lower risk in the mortgage market, flat to declining property prices are likely to dampen consumer spending and economic growth in Canada.

Conclusion

Approximately 34% of the TSX comprises financials, which gain (higher Net Interest Margins and a higher yield on cash balances) and lose (lower mortgage volumes and declining loan to value ratios) with rising rates. The exposure to materials, gold, energy, and real estate is roughly 34% too. These sectors lose with higher rates. Therefore, we think 2017 will winess a tug of war within the TSX as opposing forces come to play.

To sum up, In ANTYA’s view, prospects for the TSX are far less compelling in 2017 and 2018, than the prospects for S&P 500, NASDAQ or the Dow. We advocate diversifying outside of Canada.

Download this Report