We estimate that Bank Of Baroda (BOB IN) (“BOB”), which is being recapitalised by the government of India via a preferential allotment of equity shares of INR 53.75B (US$ 825M approximately), could take a hit of approaching INR 462M (U$70M) on its exposure to Bank of Baroda South Africa. BOB will also bear the burden of other exit, legal and business wind-down costs. In our estimate, without additional capital infusion or support from the parent, Bank of Baroda South Africa could become insolvent. Thus, SARB is being taciturn to maintain calm at a time of heightened political anxiety in South Africa.

The South African Reserve Bank (“SARB”) issued a media advisory on February 12, 2018, informing South African citizens that the Bank of Baroda South Africa (“BoBSA” or “bank”) was shuttering its operations. The bank issued a curt statement outlining its intent to rationalise international operations, thereby justifying the decision to exit South Africa. By presiding over the economic decline of South Africa and getting embroiled in State Capture, Zuma’s presidency tarnished the ANC. It also undermined the pursuit of equal economic opportunity spearheaded by Nelson Mandela.

In knowingly aiding State Capture, the bank:

- Forgot that Mahatma Gandhi fought for a corruption free and egalitarian South Africa and is revered as the Father of the Nation in the country of its parent entity; hence its link to South Africa is sacrosanct.

- Overlooked suspicious transactions which fell afoul of South Africa’s Financial Intelligence Centre Act suggesting a breakdown of compliance and control systems.

- Submitted documents for audit purposes that were inconsistent thereby raising regulatory and supervisory suspicion implying a lackadaisical management style.

- Practiced unsophisticated and haphazard risk management practices that fail to meet prudence guidelines under any standard of governance anywhere in the world.

- Most importantly for investors, the auditors raised doubts on provisions related to receivables and advances by calling existing balances “a key audit matter”.

While Organisation Undoing Tax Abuse (“OUTA’”) focussed on State Capture by Zuma and his cronies, it appears to us that BoBSA was a willing and naive accomplice. The net results of institutional indolence of BoBSA is not only an exit from South Africa but also a reputational hit for the parent, soon to be followed with financial penalties in the form of losses and perhaps additional fines on the parent.

Parent’s Capital and Reputation Under Threat

We estimate that Bank Of Baroda (BOB IN), which is being recapitalised by the government of India via a preferential allotment of equity shares of INR 53.75B (US$ 825M approximately), could take a hit of approaching INR 462M (U$70M) on its exposure to BoBSA. BOB will also bear the burden of other exit, legal and business wind-down costs. In our estimate, without additional capital infusion or support from the parent, BoBSA is staring at insolvency. Thus, SARB is being taciturn to maintain calm at a time of heightened political anxiety in South Africa.

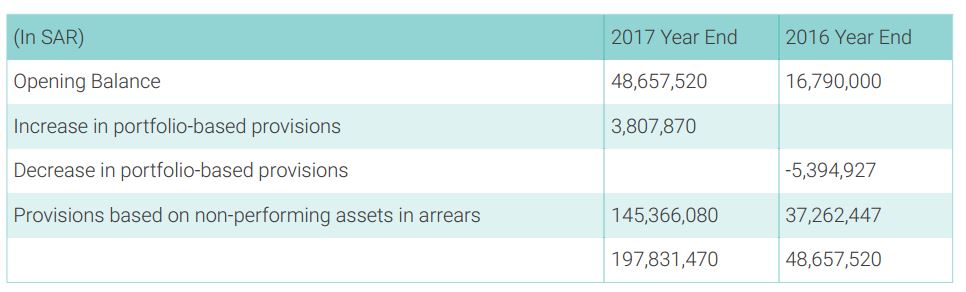

Compared to the parent, BoBSA has a small balance sheet, with equity capital of SAR 179M (US$15.4M) and advances of SAR 1,721M (US$148.5M). For year ended March 31, 2017, the bank reported a pre-tax loss of SAR 86.4M ($7.4M), compared to a profit of SAR 17.6M (US$ 1.51M) for F-16. The significant year on year decline in profitability was credited by the bank to “The increase in provisions for non-performing assets is attributable to two debtors which were unable to meet the required repayment obligations, thus being classified as non-performing assets”. Figure 1 highlights the provisions.

Figure 1: Provisions Increased as State Capture Investigations Gained Momentum in South Africa

Incidentally, provisions rose simultaneously with the State Capture scandal gaining increasing media attention and momentum in South Africa.

Complete Failure of Risk Management and Transparency

That brings us to risk-management at the bank, and its various disclosures touting sophistication and avant-garde policies and procedures. Figure 2 is a partial reproduction from the annual report.

Figure 2: We Preach but Do Not Practice – An Extract From the Risk Management Section

The bank has been following a conservative risk philosophy, which has steered the bank through difficult times. However the bank has an open policy regarding new and unexplored areas and new opportunities are not lost sight of. The important aspects of this philosophy are embodied in the internal circulars and are periodically codified in the form of manual instructions.

The business objectives and the strategy of the bank is decided taking into account the profit considerations, the level of various risks faced, level of capital, market scenario and competition. The bank is always conscious of its asset quality and earnings and hence judiciously matches profit maximisation with risk control.

Source: ANTYA & BoBSA Annual Report — Note 22 on Risk Management

“Please forgive the long letter; I didn’t have time to write a short one”, said Blaise Pascal.

Similarly, the framework surrounding risk management policies, procedures and tables runs into six pages or 16% of the 2017 annual report. Perhaps those are just tongue in cheek disclosures. The bank and its parent would vehemently deny our take on their disclosure, but just like an inconsistent audit trail found by the supervisors and the audit team, we highlight the following contradiction.

In its audited disclosures, the bank said that “The company’s [BoBSA] ten most significant customers comprise 78% of the advances and other recievables amount at 315¢ March 2017 (2016:45%)”.

Need we say more? With 78% of outstanding advances to only ten customers, and even those are most likely to be a part of the same family, to us it appears we are analysing the Bank of Guptas. Moreover, year-on-year exposure to top ten customers increased in F-17, and rose 23% from the prior year. Reserve Bank of India (“RBI”) should take note of this, and risk management practices

of BOB in India as well.

When 2 of those customers failed to pay up in 2017, the bank went from a small profit in 2016 to a big loss in 2017. That is the reason the auditors raised a red flag by calling the bank’s receivables and its provisions a “key audit matter’.

Perhaps it Should be Rechristened The Bank of Guptas

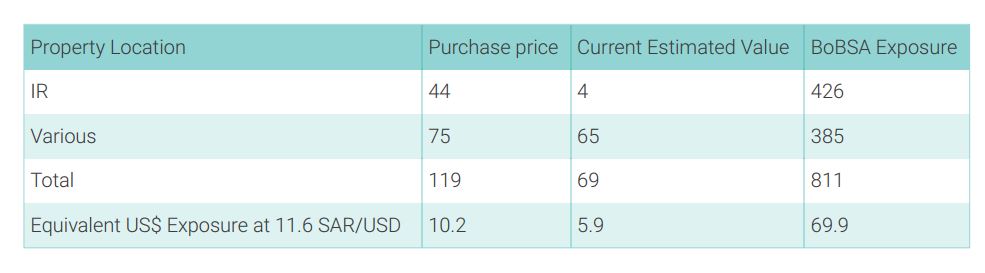

On July 13.2017, OUTA wrote a letter to SARB and the Financial Intelligence Center asking for an investigation into BoBSA. The regulator replied on July 25,2017, acknowledging the receipt. Attached to the letter was a list of properties -dated July 13.2017 – highlighting various properties owned by the Gupta family and against which BoBSA had loans outstanding. State Bank Of India (SBININ) also made the list, but we keep our discussion confined to BoBSA. Figure 3 highlights the details.

Figure 3: BoBSA Exposure to Gupta Properties (In Millions of SAR, July 13.2017)

Figure 3 is property scam 101 practiced in many parts of the world to either fool the banks, or in connivance with the bank. The modus operandi is to buy a piece of land cheaply, inflate the purchase price in collaboration with the seller, and overvalue it significantly to provide collateral to the bank to secure funding. Something similar seems to have taken place in South Africa, confounding even

skeptics like us where the lending is almost 10x the collateral. Perhaps cultural ties between the lender and the borrower helped in smoothing this process. Alternatively, maybe RBI’s strictures limiting real estate lending in India forced managers to look elsewhere.

RBI Directives and Basel III of no Avail

Since the letter from OUTA is dated July 13, 2017, and audited financials are dated July 31.2017, one can easily deduce that BoBSA is teetering under bad debts. The bank reported total advances of SAR 1,585M as of the balance sheet date. Unless something changed significantly in favour of BoBSA between March 31.2017 and July 13, 2017:

- The bank is sitting on a mark to market loss of US$64M on its advances to Guptas.

- 51% of the advances are backed by illiquid real estate, a majority of which appears to be unproductive farmland.

- A mark-to-market loss before exiting South Africa will impair capital position at the parent in India.

- The conclusion; Talk of sophisticated risk-management is just that; drivel.

In ANTYA’s view, these matters are very serious and need better disclosure. Currently, BoBSA is taking or could be taking the position that advances were based on guarantees provided by Optimum Mine Rehabilitation Trust (Assets of SAR 1,470M) and Koornfontein Rehabilitation Trust (Assets of SAR 288M). OUTA filed a lawsuit to freeze the trust funds on September 21,2017. In our view, that position is untenable on two counts:

- The bank knowingly created a security over assets it knew were less than the value of debt backing those assets. That cannot be kosher. It is likely that the bank did not adopt this tactic.

- Cross-subsidisation of loan guarantees based on Trust funds cannot be kosher either. With compromised individuals at the helm, this is possible. These are remedial trust funds set up for post-closure cleaning of minesafter shut down. The aim is to attempt to bring the environment back to itsoriginal state before mining began.

Nevertheless, a South African court has frozen both accounts https://www.bloomberg.com/news/articles/2017-09-26/s-atrica-court-order-treezes-gupta-mine-rehab-funds-group-says with the final hearing set tor Mayb2018, which will determine the fate of the trust funds. Given governance and legal challenges at various Gupta companies in South Africa, ANTYA does not believe that the legal system will allow management any freedom in using the monies in the trust for any other purpose but the stated intent. Any guarantees given by the trusts would become null and void. If money from the trusts has already been used to settle some obligations then it could become a long-drawn legal and reputational risk.

It is unlikely BoBSA will be able to make an argument in its favour because it is the job of the banker to be aware of the laws, restrictions and for implementing a proper KYC and KYP.

Thus to the extent, BoBSA is under the impression that its debts are secure, the writing is on the wall. Perhaps the bank already knows that its follies have caught up with it. Hence it is shuttering its operations.

Conclusion

Do shareholders of Bank of Baroda in India know that more write-downs related to South Africa could be coming? Do the Government of India and the Ministry of Finance know that incompetent management teams at India’s public-sector banks are squandering tax-payer funds? How long can investors keep investing in these securities under the pretext that this too shall pass?