Our updated sum-of-the-parts equity valuation, based on 22.4 billion post-IPO shares outstanding, including the approximate proceeds to the Company of US$3.56 billion (excluding the green-shoe option, assuming the stock prices at HK$ 19.5 at midpoint), implies an equity value of less than $US 1.00 /share of Xiaomi Inc. Our equity value estimate implies an EV/TTM EBITDA multiple of

20 x. That is rich!

Xiaomi Corp’s (1810 HK) (“Xiaomi” or the “Company’) current stock offering of 1.434 billion shares from the treasury and 745.14 million shares from the existing shareholders and an over-allotment option of 326.94 million shares has the market on edge. More details about the offering are available in Xiaomi IPO Review – Amazing Products, Honest Pricing. Just Not the IPO.

We are compelled to lower our valuation per share of the Stock, given the new disclosures outlined in the global offering document published June 25, 2018, by the HKEX. The reason for the revision is the significant discrepancy in share counts described in the draft prospectus of May 21, 2018, or thereabouts, the final prospectus of June 21, 2018, or thereabouts, and the global offering

a document published today.

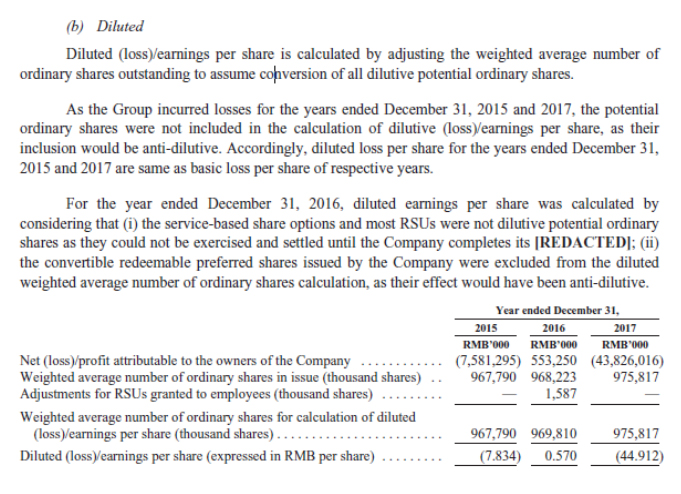

First, we quote from the Draft version of Xiaomi Inc.’s prospectus and reproduce the diluted earnings and share count table.

As illustrated in Figure 1, the Company is informing investors that there are 975.8 million diluted ordinary shares outstanding. Xiaomi also says that;

diluted (loss)/earnings per share is calculated by ….. to assume conversion of all dilutive potential ordinary shares.

The assumption of all dilutive securities being included is important because that provides a clue to prospective investors about the number of shares outstanding. More importantly, the Company also says that;

…the convertible redeemable preferred shares issued by the Company were excluded from the diluted weighted average number of ordinary shares calculation, as their effect would have been anti-dilutive.

This is important once again, because an ordinary outsider like us, would assume that from the proceeds of the IPO some of the preferred stock sold to private equity or venture capital investors would be redeemed, and the portion that is not redeemed but converted to common is already reflected in the disclosed weighted ordinary share numbers. But then, one would be wrong.

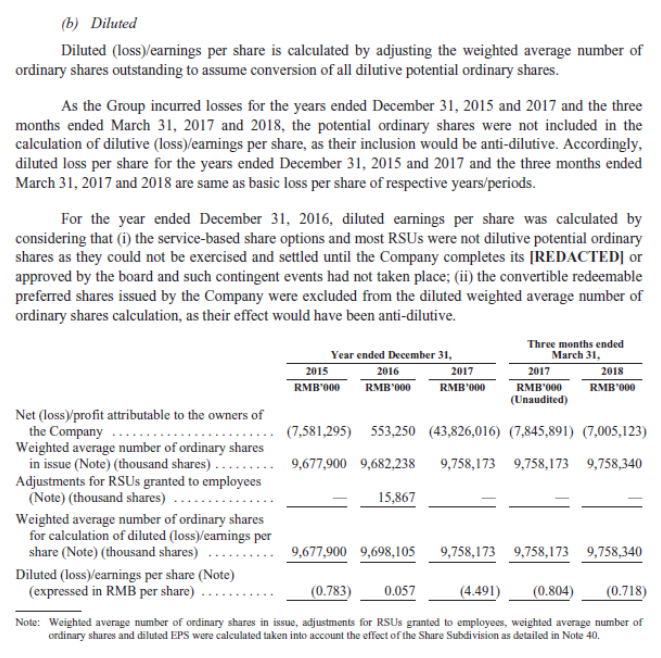

Subsequently, on June 21, Xiaomi filed the final prospectus and repeated its boilerplate language, albeit with a higher number of shares outstanding due to a ten-for-one stock split. Figure 2 highlights that disclosure.

Once again as illustrated the Company said that;

the convertible redeemable ….., as their effect would have been anti-dilutive.”

We once again believed that the Company has accounted for the shares issuable after the IPO too early investors in Xiaomi, in the share count disclosed in Figure2.

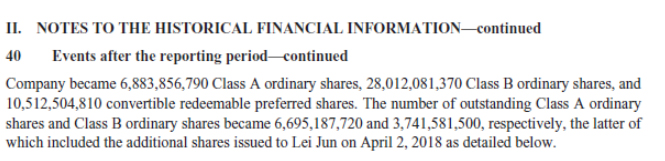

Nonetheless, as highlighted in Figure 3, Xiaomi tried to forewarn investors of the impending dilution, but it appears that investor attention, including ours, was focussed more on Lei Jun’s compensation than clarity in disclosures.

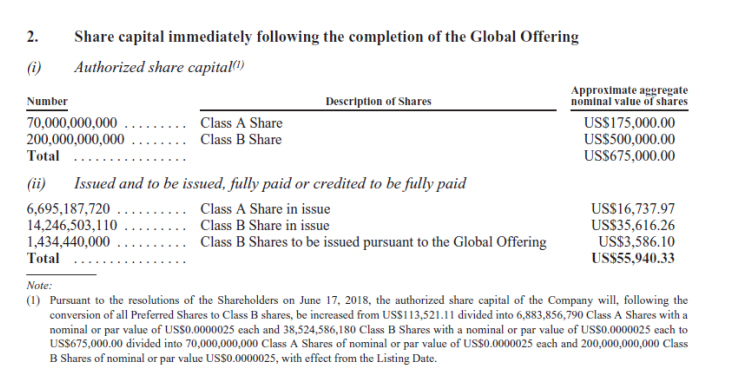

We homed in on the 6.69 billion Class A and 3.74 billion Class B shares, while blissfully ignoring the 10.512 billion convertible redeemable preferred shares, based on the premise that those are anti-dilutive and a relic of the various funding rounds at Xiaomi. Clearly, we were mistaken, because when Xiaomi threw the following Googly (an unplayable ball in the sport of cricket) at us, we were left scratching our head. The googly is highlighted in Figure 4.

Evidently, there are 22.37 billion shares outstanding and not 9.758 billion shares that have been highlighted ad-infinitum in the prospectus by the Company.

Why are the shares anti-dilutive?

In our view, the reason the company called these shares anti-dilutive — we can’t come up with another explanation — is that with higher shares the outstanding, the reported loss per share would be lower and hence the anti-dilutive effect. To put it another way, if the Company was making a profit the shares would be dilutive and therefore would be included in reported numbers. If you are shaking your head like we are, we should all stop before being declared bobble-heads.

The lesson from all of this is that the fair value of RSU’s and options granted to employees, as recently as March 2018, does not present a proper benchmark for valuing the Company anymore. Lei Jun’s stock grant, which the Company valued at US$2.36/share is also questionable because to us methodologies aren’t transparent anymore.

Revisiting The Valuation

That takes us to our independent valuation estimate discussed in Xiaomi Corporation – U.S.$100B, $80B, $50B —- Stop Dreaming. We Believe Even $20 Billion Is Too Much

Our updated sum-of-the-parts equity valuation, based on 22.4 billion post-IPO shares outstanding, including the approximate proceeds to the Company of US$3.56 billion (excluding the green-shoe option), implies an equity value of less than 1US$/share of Xiaomi Inc.

That implies an enterprise value to EBITDA multiple of 20 x, based on TTM EBITDA of US$ 951 million. As per the accountant’s report, the Company’s net cash and borrowings are almost equal as of March 31, 2018. Xiaomi also has short-term and long-term investments with a fair value of approximately $3.46 billion, which we deducted from our estimate of market capitalization to arrive at EV. {(( 22.4x 1 ) – 3.46)/ 0.951= 19.9 x}

In our view, an EV/EBITDA multiple of 20 x is a rich multiple for a business that has yet to prove itself, although the travails of Zte Corp H (763 HK) could provide short-term upside to estimates. We have also learned another important lesson in disclosure and governance. Trust but verify even if it involves reading 697 pages of the same document in various versions 3 times each. Just because it says something, it may not mean it.