This report demonstrates that investing in WELL Health Technologies (WELL.TO) is not a dream come true but a nightmare. We value Well at $1.00 to $1.50 per share. We believe that there is an 80% – 90% downside to the stock.

Download this Report

“ This is why, aspirationally speaking, we like to refer to ourselves as the Berkshire Hathaway of tech-enabled healthcare.” Q4-2020

“ …capital allocation decisions are centralized and thoughtfully planned to ensure that the company is always making the most compelling and accretive investment decisions.” Q3-2020

“ It should also be noted that WELL is increasingly seeking investments and situations where its business unit leaders assist with WELL’s capital allocation goals.” Q4-2020

Hamed Shahbazi, Founder, Chairman and CEO

____________________________________________________________________________________________________________________

The old idiomatic expression “ If wishes were horses, men would fly” aptly describes the predicament of Well Health Technologies Corp. (“Well,” or the “Company”). How does it get off the acquisition treadmill without decimating its stock price and soaring expectations of investors in the marketplace? While Well wrestles with self-inflicted wounds and its philosophical conundrum, we strongly urge all investors to decamp and not wait for the inevitable demise of its lofty valuation and stock price.

There is no proprietary or path-breaking technology at Well. We believe that Well is masquerading as a healthcare company to delude Canadian institutional investors into buying its stock, given that Canada has few investable homegrown healthcare companies. That top management of Well is confused is evident from the change in tone highlighted in the quotes from Q3-2020 and Q4-2020.

Evidently the CEO is abdicating all responsibility given multiple sub-optimal, high-priced, and value-destroying M&A transactions consummated under his watch. CRH Medical Corporation (“CRH”), the most recent and the largest, described as “monumental” in a recent press release, is also the worst of the lot. We agree that it is a “monumental” fiasco.

We believe Well’s misunderstood position as a virtual care entity, backed by a rising stock price based on COVID-19 telehealth frenzy, is enriching insiders at the expense of outsiders. Top management of Well is using an inflated stock as currency to lull investors into believing in its growth prospects. While all future write-downs at the Company will be non-cash in nature, the imminently significant decline in wealth for those that came late to the Well party, including those purchasing the CRH subscription receipts, is likely to render them in critical care.

We also believe that valuations accorded to two key transactions, Insig and Circle Medical, are borderline duplicity and that investors should be circumspect of the Company’s disclosures.

Most importantly, CRH is a value-destructive transaction that raises multiple red flags regarding management’s ability to allocate capital judiciously. After reviewing the CRH transaction, we do not believe that the current management team is fit to lead Well. Well needs a new board and new management team in place ASAP.

“Fly Me to The Moon[9]” was merely rhetorical! Investors in Well appear to have taken it literally.

For those interested in a quick sound-bite suffice it to say that at Well: EBITDA is NOT EBITDA, Free Cash Flow is NOT Free cash Flow, Digital Technology is mundane, and management is flaky and business prospects are shaky.

Others with patience should follow our chain of thought to agree or disagree.

Past is Prologue

Once upon a time, circa 2007, there was a publicly-traded electronic medical record business (“EHR” or “EMR”) called BCE Emergis (“Emergis”). Telus Communications Inc. (“Telus”) acquired Emergis for $763M in November 2007[1]. We estimate Telus paid a revenue multiple of 4.1x and an EBITDA multiple of 18.5x, which included a 19% premium over Emergis’ stock price of the previous day[2]. Since then, Telus has emerged as Canada’s leading EMR business, serving “approximately 23,000 physicians followed by Loblaws at 15,000”[3]. The current darling of growth investors in Canada is a distant third with 10,700 physicians[4] on its rolls.

Well’s proforma estimated fully diluted enterprise value, including CRH Medial Corporation (“CRH”) ( as of April 23, 2021) of approximately $1.5B implies a valuation of 5.3x 2021E proforma revenue of $284M and 27.8x 2021E proforma, EBITDA including CRH of $53.8M[5]. [All amounts in C$. M for million, B for Billion, Acquisitions after Q1-21 excluded]

The Company was trading at an approximate EV/EBITDA multiple of 180x 2021E EBITDA of $7M[6], before the CRH acquisition, on February 5, 2021. Perplexing indeed! A sign of the times or waterfall ahead?

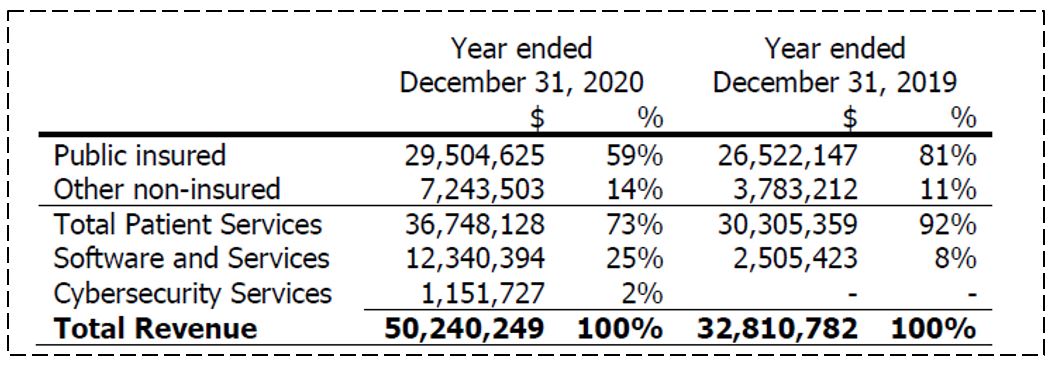

For 2020[7], Well reported $50.24M in revenue, of which clinical services, a.k.a. regulated revenues comprise $29.5M (59% of total), a hodgepodge of digital services contributed $13.4M ( 27%), and others the rest. Not surprisingly, Clinical services, digital services and cybersecurity services are barely profitable. The entire operation, ex-CRH, has been stitched via acquisitions costing an estimated $72.3M in cash and an estimated $111M in stock[8]. Including deferred acquisition costs, Well paid $7.08M in 2018, $10.3M in 2019, and $38.4M in 2020 and approximately $16.5M as of March 07,2021.

So why is the Company valued stratospherically at around $1.5B by investors?

To dWell or NOT?

In our view, with COVID-19 in the rear-view mirror, fervour enveloping telehealth will evaporate. Moreover, Hamed Shahbazi (“Shahbazi,” “Well’s CEO”) is not content merely with “the Berkshire sound-bite” in his back pocket. He needs Superman too.

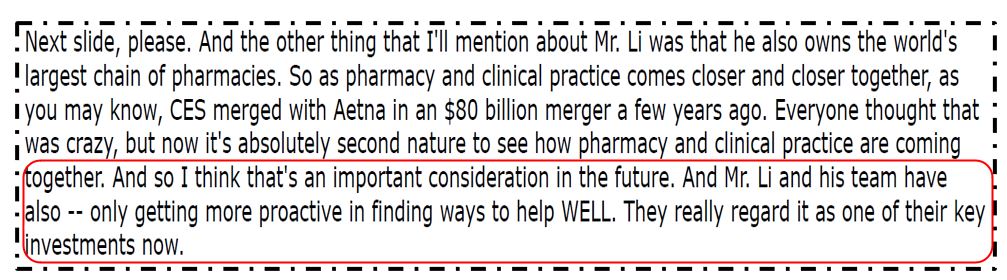

Shahbazi’s hyperbole knows no end. His characterization that Sir Li Ka-Shing (“Shing”), the Superman of Hong Kong, is taking a “personal interest in WELL” adds fuel to the fire of myths surrounding Well. Shing sold orange networks to Mannesmann AG for a profit of US$31B in today’s dollars in 1999[10] and sold Hutchison Max India to Vodafone for a gain of US$14.5B in today’s dollar in 2007. Apparently, now Shing is on a new quest – Well is the apple of his eye – and is “leading a group of strategic investors,” who have collectively invested less than $10M in WELL[11]?

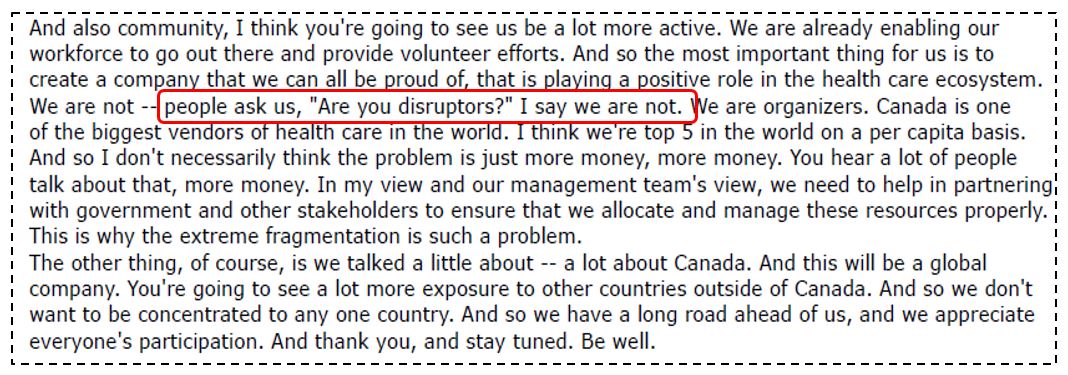

We bet 1,000 Well shares that while Shing will recall that he sold Husky Energy to Cenovus for $3.8B in 2020, he would be hard-pressed to evoke Well, which is one of two hundred thirty-four investments that Horizons Ventures has made over the years[12]. Moreover, Shing backs Horizons Ventures but is not directly involved in its day-to-day activities. Shahbazi is exaggerating his association with Shing. During the September 30, 2020, shareholder call, the CEO outlines that Shing is directly interested in Well. The following comments by the CEO, sourced from that call should suffice to highlight the management team’s promotional characteristics.

Figure 1: Li Ka-Shing Helping Well

Source: Shareholder Call, September 30, 2020

Wouldn’t you love to be a fly on the wall to overhear that conversation, where Shing is calling favours for Well? Moreover, it is impressive indeed that a man with an officially known fortune exceeding US$30B, at the age of 92 years, is taking a personal interest in Well while waving goodbye to everything else in his life. It seems Shahbazi missed global news wires announcing Li Ka-Shing’s retirement on March 16, 2018[13]. Shahbazi also missed that Superman said, “ I’ve been working for a long time, too long.”

Notably, Horizons Ventures, backed by Superman, presents Li Ka-Shing’s involvement with that organization merely as making a “special appearance[14].” Rightly so.

TIO Networks was no Home Run

Indeed, it is true that Investors love a track record of prior success, and therefore, could it be that the sale of TIO Networks (“TIO”) to PayPal for $302M in July 2017 lends credence to Shahbazi? This fact is displayed prominently in the CEO’s profile on the Company page. Nevertheless, subsequently, PayPal dissolved TIO, given susceptibilities and shortcomings in TIO’s technology? SEC also raised questions about TIO to PayPal and its intangible assets as part of its purchase price allocation of the TIO deal. We quote the SEC in Figure 2.

Figure 2: August 24, 2018, SEC Comment Letter[15]

We also note your disclosures about the intangible assets and net assets recognized in July 2017 upon acquisition of this business and the $30 million impairment of customer related intangible assets recognized during the fourth quarter of 2017 upon the suspension of TIO’s operations. In light of your decision to wind down TIO’s operations, please tell us how you considered whether any of the remaining tangible and intangible assets of this business may be impaired. We may have further comment after reviewing your response.

Source: https://blog.auditanalytics.com/paypal-sec-requests-clarification-about-tio-intangibles

We agree that PayPal’s due diligence was deficient. Either the sale of TIO was lucky by chance, or it was uncharitable! Our readers should make that decision. Nonetheless, the sellers foisted imminent failure on unsuspecting silicon valley mavens.

That Shahbazi is coy about discussing TIO publicly, which is one of his biggest professional success stories, is evident in the following BNN interview (at 4:20 on the tape) https://www.bnnbloomberg.ca/investing/video/Well-health-technologies-looks-to-modernize-health-care~1873218.

In the same interview, Jon Erlichman, the anchor, prods the CEO by asking what you are tackling in healthcare and questioning the key issues that need to be solved?

While references to capital allocation, growth by acquisition, the importance of scale, bringing medical clinics from the dark age into the light, and other lofty ideas/ideals were a part of the mix, the core questions went unanswered. A man selling astute capital allocation learnt from masters of the domain such as Buffett and Shing could not put two coherent sentences together regarding his revolutionary business plan.

The question arises once more, why investors are going gaga over mundane ideas when turgidity is all that is evident. History and experience show that it all begins with accounting and morphs into something more sinister later.

Accounting Choices Project Strength and Hide Weakness

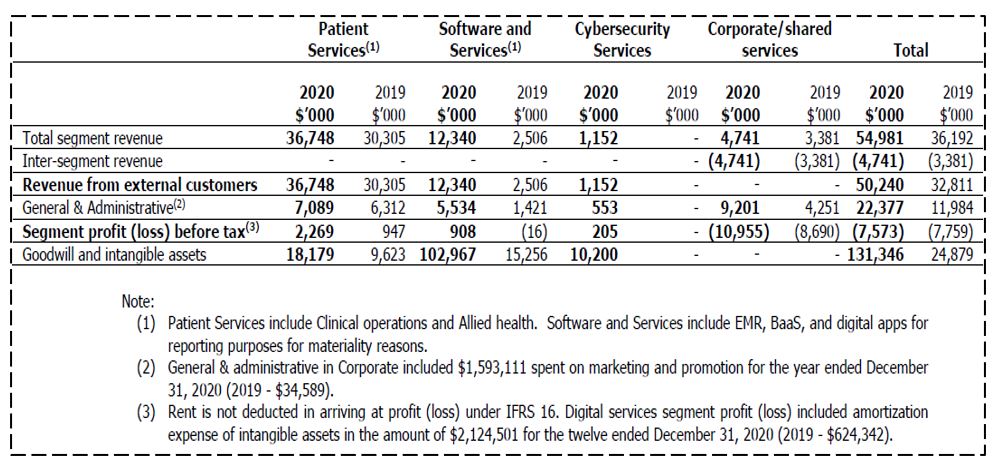

Figure 3: Well’s Business Segments – 2020 Financials

Source: Q4-2020, Financial Statements

In 2020, the Company earned $2.2 M in its clinical services division, $0.90M in digital services and $0.2M in the cybersecurity division before allocating any corporate overhead costs. Given that clinical services are the largest segment with $36.4M in revenue, we discuss that group first. Investors must be aware that:

- Well’s clinical revenues are dependent on the fee-for-service model of Health Canada and various provinces. The point being pricing is fixed by either the provincial or the federal government. In the non-insured segment, the primary customer is the insurance company, and they set the pricing.

- 70% of billings belong to physicians that provide services to patients. That implies Well’s share is 30% of gross clinical revenues[16].

- General & administrative expenses are the Company’s responsibility.

- Finally, missing in Figure 3 is the allocation of rent to clinics. That is misleading because clinics operate from rented locations.

Creative Accounting Plays its Part

On January 01, 2019, the Company adopted a new accounting standard, like many others, IFRS 16 – Leases (“IFRS-16”). Figure 4 outlines the underlying modality of IFRS 16.

Figure 4 – Leases on Balance Sheet – Bypass Income Statement

Source: 2020 Financial Statements, Page 25

The 19 clinics that WELL bought in 2018, others in Quebec and elsewhere later, came with rental locations on which monthly lease payments are due. Under IFRS 16, WELL recognized the present value (“PV”) of those obligations amounting to $12.8M in lease liability on the balance sheet, using a discount rate of 5.9%-6.1%[17]. Once the lease became a balance sheet item, it bypassed EBITDA and inflated cash flow from operations since associated payments pass through the depreciation and interest expense accounts.

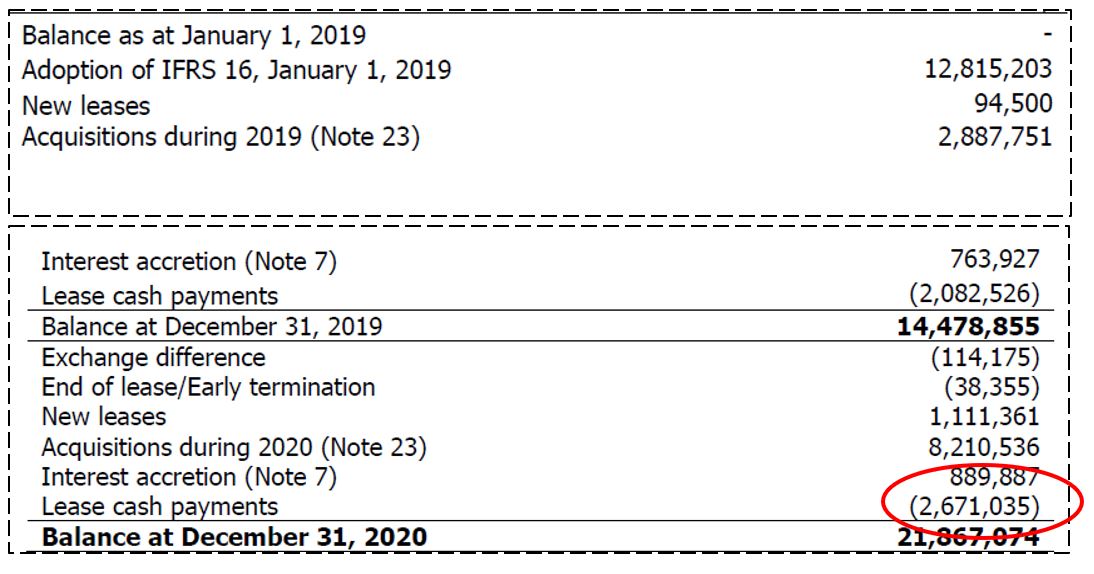

Figure 5 outlines the capitalized lease payments as of year-end 2019 and 2020 to provide context to the discussion so far.

Figure 5: Lease Obligation Related to Clinics and Acquisitions Recognized on the Balance Sheet

Source: ANTYA Investments Inc. & Company Financial Statements 2020

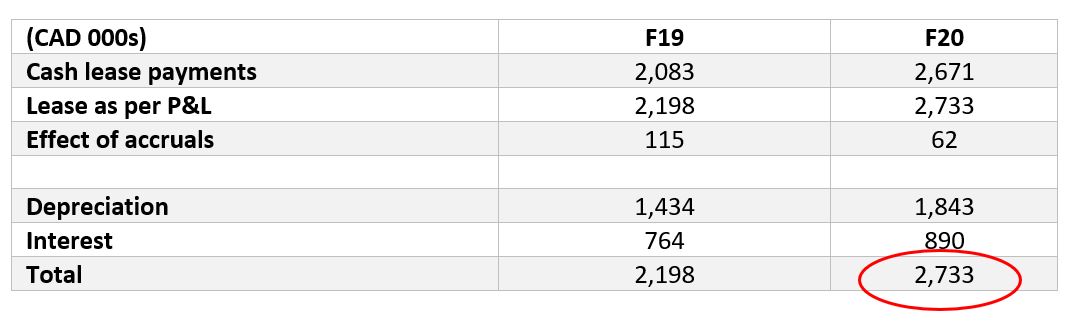

Accordingly, $2.67M of 2020 and $2.1M for 2019 cash rental payment is absent above the 2020 and 2019 EBITDA disclosures. Figure 6 provides a reconciliation of the impact of IFRS 16 on 2019 and 2020 financials.

Figure 6: Reconciling Rent to Lease Expense

As a consequence of adopting IFRS 16:

a. Cash flow from operations is higher by $2.1M in 2019 and $2.6M in 2020

b. EBITDA is also inflated by the same amount

We estimate that the Company incurred a rental expense of at least $1.5M for the public insured clinical services business. The segmented disclosure outlined in Figure 3 excludes the cash 2020 rental cost. Once the rental payment is allocated to the clinical services segment, it is a break-even business at best with nil contribution to corporate cash flows. That should not be a surprise to investors because clinics without a doctor are non-existent. The business has minimal cash surplus after deducting costs associated with the doctors & rent.

According to the CEO’s interview on BNN, Canada’s largest clinical company has about 40 clinics. Therefore, WELL is already half-way or more to that landmark if it is one! The question that investors need to answer is that if the first $30M in clinical revenue – acquired at the cost of $8.5M – is unprofitable or break-even, why would the next clinic or group of clinics be any different. We contend that it will not be, and it cannot be.

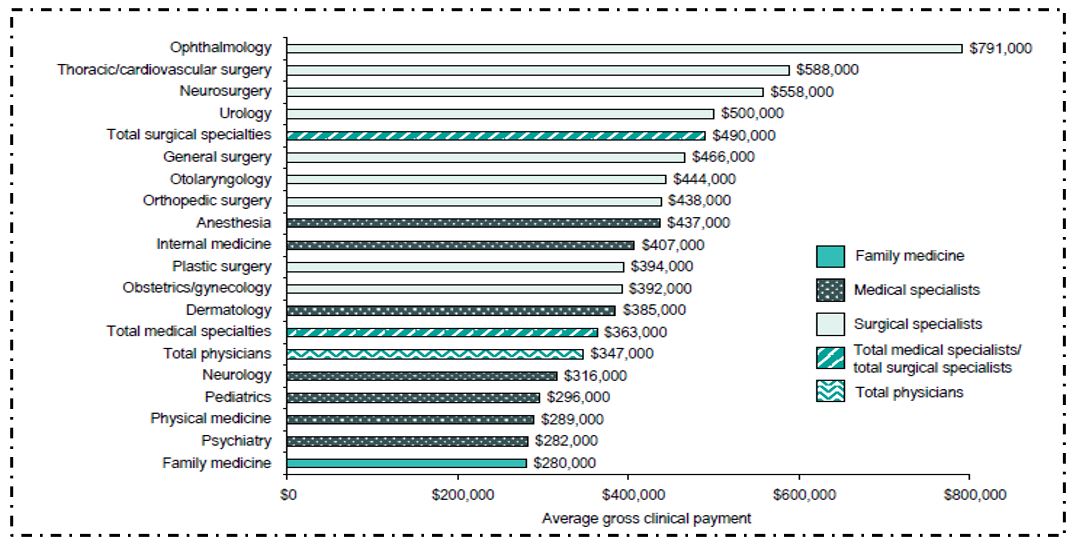

Likewise, with family health services being the only possibility for aggregation, Well will always be in the lowest value-added segment of the entire medical value-chain. Figure 7 highlights the average gross clinical payment by physician specialty in Canada.

Figure 7: Physician Payments Canada, 2018-2019

Source: Physicians in Canada, 2019

With family physicians at the low-end of the revenue spectrum, recent discussions by management surrounding a foray into dermatology are intriguing. Perhaps CoolSculpting and Botox will deliver for shareholders what family physicians cannot. Allergan failed at providing Botox, manicures, and pedicures virtually. Possibly Well will succeed where AbbVie – the new owner of Allergan-cannot!

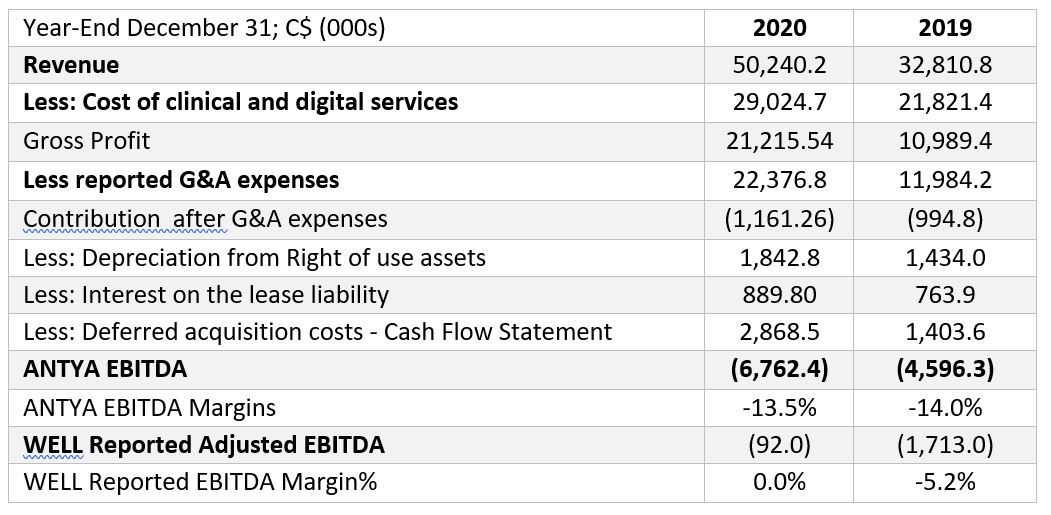

EBITDA Disclosures Understate Losses

We would be remiss if we did not reconcile the EBITDA disclosures to IFRS 16. Figure 8 highlights the adjustments required to get to the accurate EBITDA number compared to the Company’s adjusted EBITDA.

Figure 8: ANTYA Adjusted EBITDA Much Lower Than Well’s Adjusted EBITDA

Source: ANTYA Investments Inc. & Well Disclosures

Although Well’s management wants you to believe that the business is on the right trajectory, as illustrated in Figure 8, after deducting rental expense and deferred acquisition costs, Well’s EBITDA margin for 2020 is negative 13.5%, compared to negative 14% for 2019. On that basis, Well showed no improvement in business operations YoY. In 2020, the Company’s adjusted EBITDA loss of approximately $92,000 implied zero EBITDA margins on $50M in revenues.

If readers have made it thus far, they would agree with our view that the whole clinical and non-clinical services business is at best a micro-enterprise, unfit for public markets.

Are Investors Excited About Digital Services ?

If clinical services cannot bring joy to shareholders, digital health must be the panacea for Well’s ills. Figure 9 provides a context to Well’s digital services revenues.

Figure 9: Well Revenue by Segment

Source: WELL Health MD&A, Q4-2020

Digital services contributed 27% of 2020 revenues. On its Q3-2020 analyst call, Shahbazi forecast annualized revenues of $10M with EBITDA margins of 25%. At the time, the primary business of Well was EMRs. We believe the CEO was referring to IFRS 16 EBITDA margins, which exclude rent, deferred acquisition costs paid out in cash and non-cash stock-based compensation expenses. Therefore, we estimate that the EMR business has been developed through nine acquisitions at an investment approaching approximately $30M, implying a multiple of 3x prospective revenue run rate of $10M, and the EBITDA multiple of 12x ($30M/$2.5M).

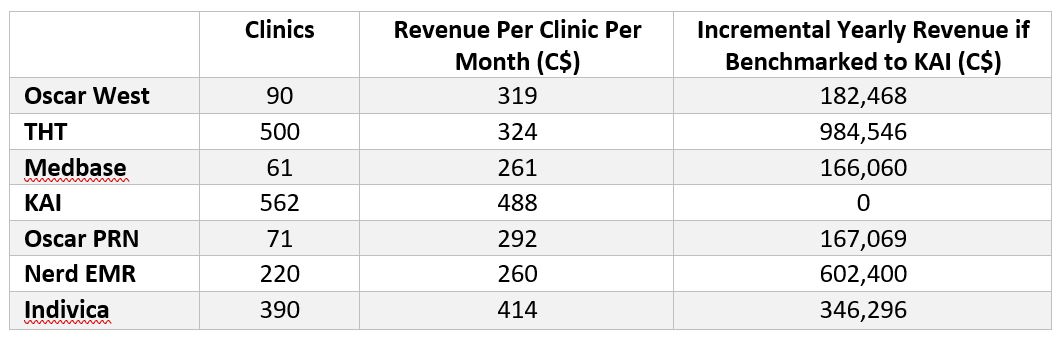

All other segments, including billing, cybersecurity, etc., have been bought in Q4-2020 and Q1-2021. Having established earlier that clinical services are a low-multiple, low-growth, high overhead business, it is evident to us that EMRs are no home run either. As outlined in Figure 10, there is little room to increase EMR revenues.

Figure 10: EMR Revenues, Clinics and Physicians

Source: ANTYA Investments Inc. and Company disclosures

As illustrated in Figure 10, there is a wide discrepancy in EMR revenues that different providers have been charging physicians for their services. KAI’s income of $488/clinic/month is 1.8x that of Nerd EMR’s pricing. If the Company can increase prices across the board in a few years and bring all clinics in line with KAI, it is looking at booking an additional $2.44M in EMR revenues. If management can capture the upside based on physician usage and bring all 10,000 physicians[18] to the same level as KAI, the incremental revenue opportunity is a maximum of $7M.

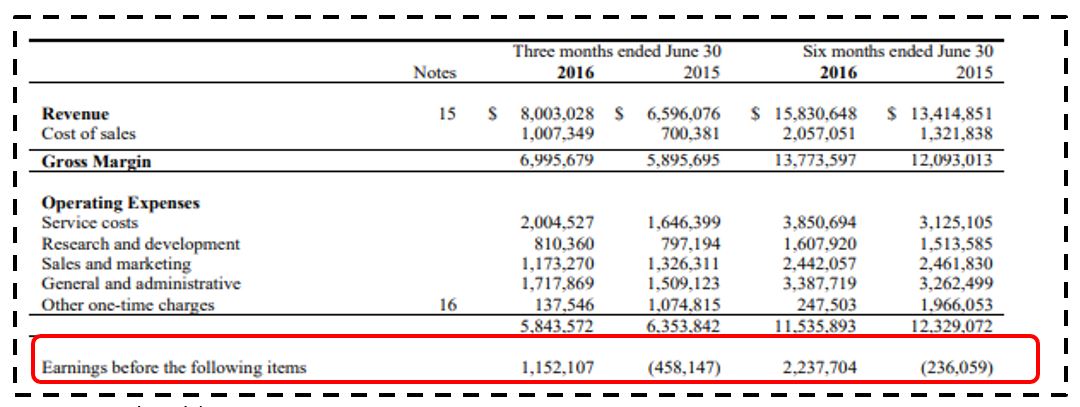

Either way, investors are currently paying more than 100x 2021E EMR revenues. We believe there is a high likelihood that once rent and questionable deferred acquisition costs are allocated to the EMR segment, EBITDA will be zero. Essentially, EMRs are a low margin, mature, low-technology business, and Well has neither proprietary technology nor any edge in providing these. On August 21, 2016, Loblaw Companies acquired QHR Corporation (“QHR”) for $170M, at a premium of 22% to the previous day’s closing price. That price equated to 4x trailing twelve months revenue — figure 11 highlights EBITDA margins at QHR.

Figure 11 – EMRs are a Low Margin Business – QHR Revenue & EBITDA

Source: QHR Financials, June 2016

As illustrated in Figure 11, QHR attained EBITDA margins of 14% for the first half of 2016, after struggling with the business for several years. In QHR’s owns words, it had a 20% share of the Canadian EMR[19] market, which Loblaw valued at $170M. That implies a national fair market value of ($170×5) or $850M. Adjusted for inflation, with barely a 10% share of the Canadian EMR market, Well is currently worth more than the entire Canadian EMR market put together. Therefore, ANTYA believes Well shareholders are staring into a deep, dark Well!

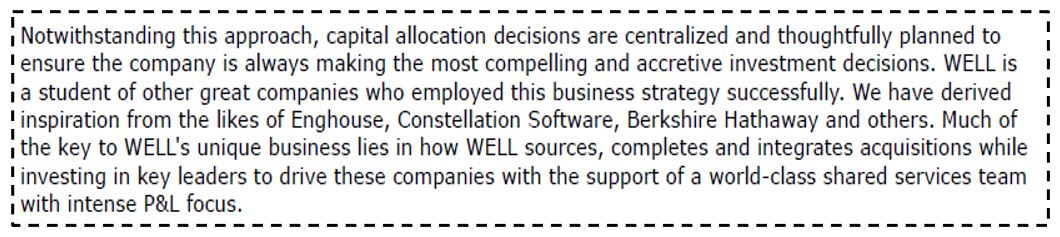

Well is a Capital Allocation Novice

Growth by acquisition stories involves capital allocation decisions regularly. Many an acquisitive executive has touted an ability to stay focused and ensure that deals deliver a respectable ROE to the bottom line. Well is not dissimilar in this aspect. Shahbazi has disclosed his approach to acquisitions on many occasions, including characterizing Well as “an acquisition shop” on BNN. Figure 12 provides additional context to his thinking.

Figure 12: Well is a Student of Other Great Companies

Source: Q2,2020 Earnings Call

It is indeed wonderful to learn from the best and acknowledge their contribution to personal and professional growth. Just as an aside, we find anyone who uses Buffet and investing in the same sentence usually disingenuous because it is like bringing a T-72 tank to a slingshot fight. Typically, a crutch is only necessary if one cannot walk.

Insig – What is it Worth?

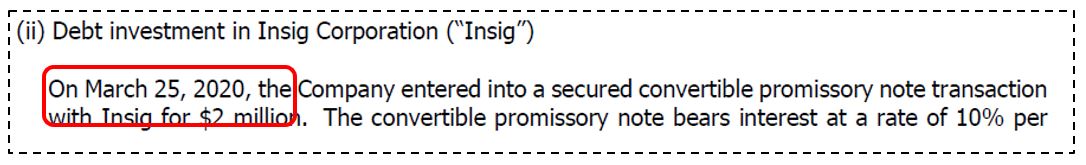

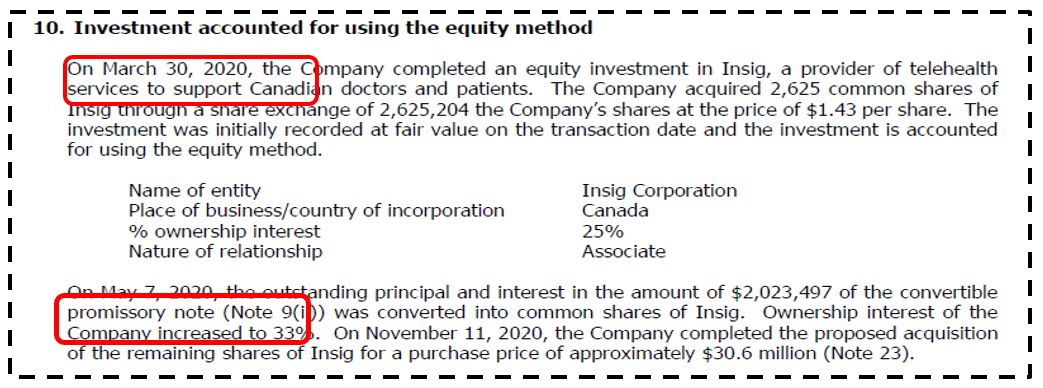

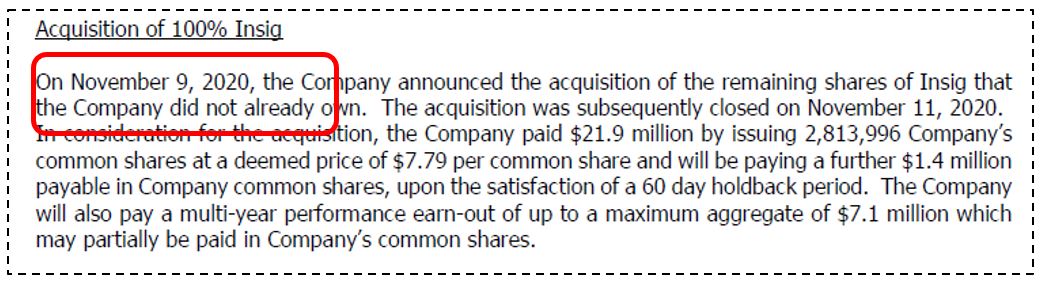

Now is an opportune time to introduce Insig Corporation (“Insig”) to investors, a fascinating puzzle. Please follow the steps for a better understanding.

Figure 13: Step 1

Source: Well Health Technologies Q3, 2020 Financial Statements

Figure 13: Step 2

Source: Well Health Technologies Q3, 2020 Financial Statements

Figure 13: Step 3

Source: Well Health Technologies Q3, 2020 Financial Statements

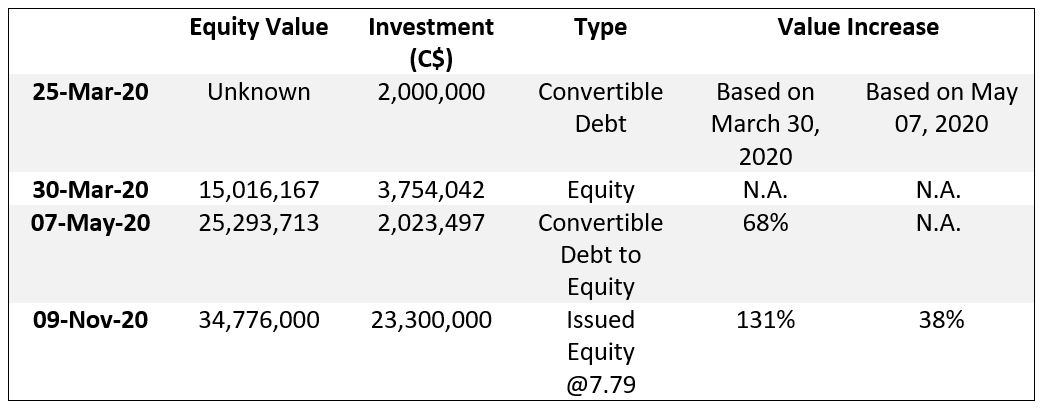

The steps highlight that Insig’s equity valuation rose exponentially within a short span of six months, primarily driven by Well’s funding initiatives. Figure 14 demonstrates the valuation jump.

Figure 14: Insig Valuation Conundrum

Source: ANTYA Investments Inc. and Q3, 2020 Financial Statements

The final equity valuation of Insig in Figure 14 of $34.7M assumes that WELL bought 67% of the equity it did not already own. The Company is also on the hook for $7.1 million of contingent consideration. Between March 30, 2020, and November 09, 2020, Well paid a premium of 131% to gain control of a nascent yet unproven business. In its annual disclosure, the Company has revisited some of its valuation assumptions regarding Insig and now ascribes it a provisional value of $37.5M[21].

The current brouhaha surrounding virtual health reminds us of the weed mania before the smoke cleared, and investors ended up fanning smoldering stalks of weed stocks.

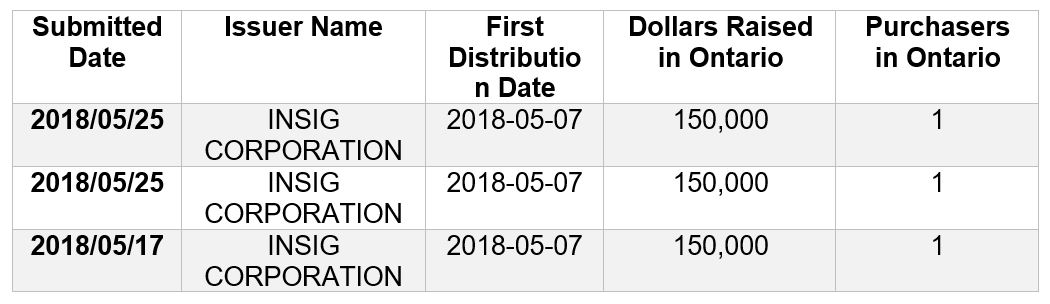

A Nascent Insig is Worth $5M and NOT $50M

Of course, our assertions and beliefs need proof and context, although it is difficult to pin a value on a “proof of concept.” Nevertheless, based on publicly available data from the Ontario Securities Commission, Insig raised a total of $450,000 in equity capital before Well arrived on the scene in late March 2020. Figure 15 presents the information related to capital raising at Insig.

Figure 15: Insig Capital Calls of $150K Each in 2018

Source: Ontario Securities Commission – Exempt Market Data

Data from the OSC are current as of September 2020. The founders, David Del Balso and Matthew Mazzucca, will be joining the Company after the acquisition.

Figure 16: Insig had Nothing Going For it

Source: https://www.stmichaelscollegeschool.com/stories/~board/stories/post/alumni-team-up-online-to-help-flatten-the-curve

The story in Figure 16, from April 23, 2020, highlights that only 150 doctors were using the Insig platform to conduct business at the end of April 2020. In ANTYA’s books, that is called “Proof of Concept.” That was well-after Well invested $2M in a convertible note and $3.5M in a share exchange. The Company valued Insig at $15M on March 30, 2020, and then $25.2M on May 07, 2020; With 150 doctors on the platform.

As far as Well’s virtual care technology’s uniqueness is concerned, it can be done for $15 per month if enough marketing dollars are handy. Interested entrepreneurs should look up the following link and many others like it available readily https://www.continuouscare.io/pricing/.

Nonetheless, via its EMR aggregation, WELL offers the ability to bring everything onto a single platform. That has some value, not the importance ascribed to it in the marketplace today. We believe that the Company paid all plausible future economic value, to the sellers of these acquired businesses pronto.

Insig has no funding to Compete

Well has neither acquired nor created anything unique in its purchase of Insig. Insig requires significant investment in R&D, its technology platform and advertising to gain market share; otherwise, it will fall by the wayside. The Company will have to devote critical resources to manage and grow Insig, which will slow down its growth by acquisition strategy and increase cash burn rates.

Well’s competitors in the space have been funded with cash to build their operations, whereas Well merely managed to pay a high price based on a richly valued stock to gain access to off-the-shelf ideas. Compared to Insig, another virtual care company from Canada called “maple” has raised approximately $100M in cash funding to build its operations in Canada, most recently $75M in September 2020[22].

If one hears Shahbazi’s characterizations of Insig, it suggests that the WELL-Insig combo is hitting the ball out of the park, with faithful in the “Bay” in their paddle boats waiting to catch it[23].

Just as a gentle reminder for investors, we quote the hyperbole in Figure 18, followed by the truth from the Company’s disclosures.

Figure 17 A and 17 B: Insig Flying Off the Shelf or Management off its Handle?

Source: WELL Health Shareholder / Analyst Call September 30. 2020

Source: Well Health Q3, 2020 Call, November 12, 2020

Figure 17-A is either hot air or foreshadows trouble ahead for WELL investors. If after a year of co-development with Insig, which had already partnered with Appletree Medical too, only 150 doctors (Figure 16) were using the platform – out of more than 75,000 physicians in Canada – then the product-market fit does not exist; at least not in its current form.

More importantly, Figure 17-B, with additional granularity on data, is also tenuous because it does not translate into actual revenue or EBITDA. For all the rumpus engulfing virtual care and WELL’s so-called promising lead in the space, WELL booked income of $627K and a loss of $28K for 2020[24] from Insig.

Where is the cash to burn and grow?

Growing tech businesses burn cash. That is proven. The quantum of cash burnt determines revenue growth and the ultimate expected size of the business. Since cash infusion and cash support for Insig is minimal, it is neither generating much revenue nor burning much cash. Insig is at a standstill because all it enables is outlook appointments through a calendar-style app, and it collects preliminary data on forms. The kind that asks you if you have been in touch with anyone who travelled abroad in the last 14 days. That is neither tech nor A.I., just administrative form filling. Not to say that the platform is not evolving through additional product development.

Either way, Insig is losing money on every transaction it arranges, which makes economic sense because once doctors are paid, leftover funds are barely sufficient to cover overhead, technology, marketing, business development and other costs. As Insig scales up, more funding and more cash losses will ensue.

Circle Medical – Going Around in Circles

Could it be that investors are ascribing a significant growth multiple to its U.S. asset viz. Circle Medical Technologies Inc. (“Circle”), in a frantic scramble to get in on the ground floor of the enormous U.S. healthcare opportunity?

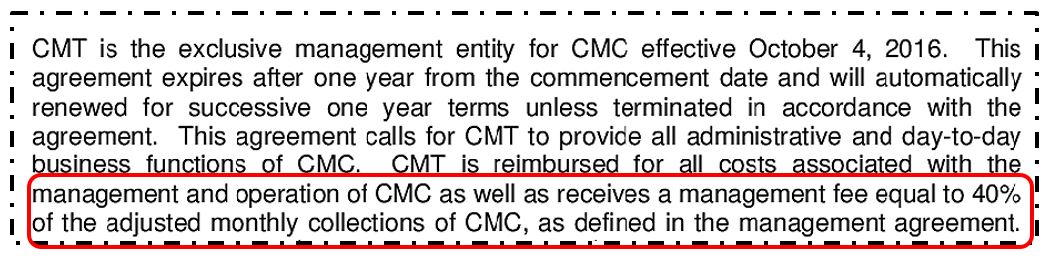

Circle is a collection of low-margin clinics that drive traffic to its mobile app. It is different from WELL’s Canadian clinics in that physicians in Canada are regulated based on the Fee for Service model and WELL takes a 30% cut. In the U.S., Circle employs the physicians full time and charges its clinical operations 40% of revenue to run the technology. We describe the business model in Figures 18 A & 18 B.

Figure 18 A & B: Circle Business Model

Source: https://blog.circlemedical.com/y-combinator-backed-circle-medical-raises-3-5m-edd6776bec54

Source: Circle Medical Technologies Annual Report 2017

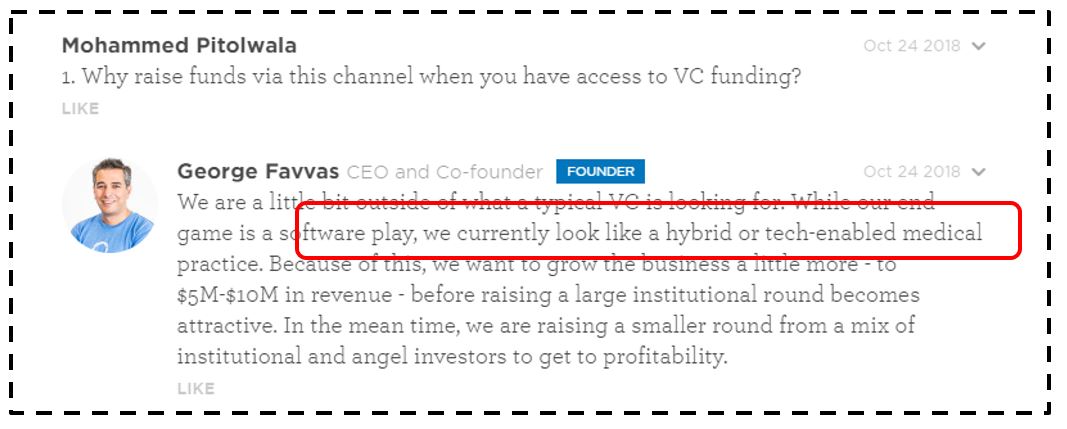

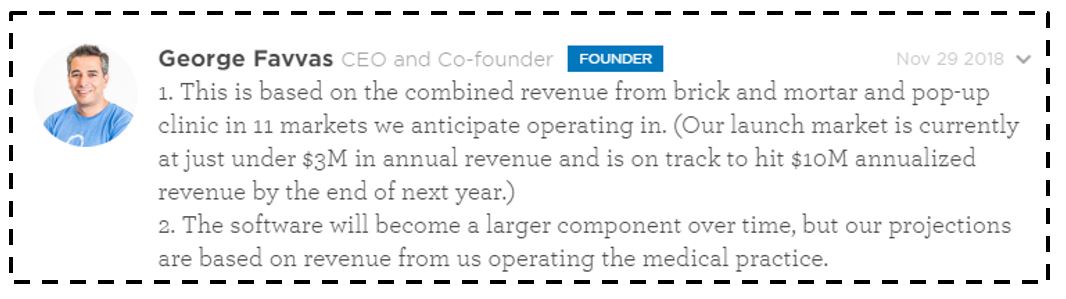

George Favvas, the co-founder of Circle, has publicly acknowledged that his company is “ a tech-enabled business model” and not a technology business, and hence venture funding is scarce. Isn’t that interesting? In the land of the plenty where tech unicorns fall from the sky, VCs are unwilling to support Circle. Better to hear it straight from the founder rather than ANTYA rephrasing the message.

Figure 19: Why Raise Funds From We Funder?

Source: https://wefunder.com/circlemedical/ask

In ANTYA’s view, every business is a “tech-enabled” business. In VC parlance, that means there is neither proprietary technology nor uniqueness to Circle’s business model.

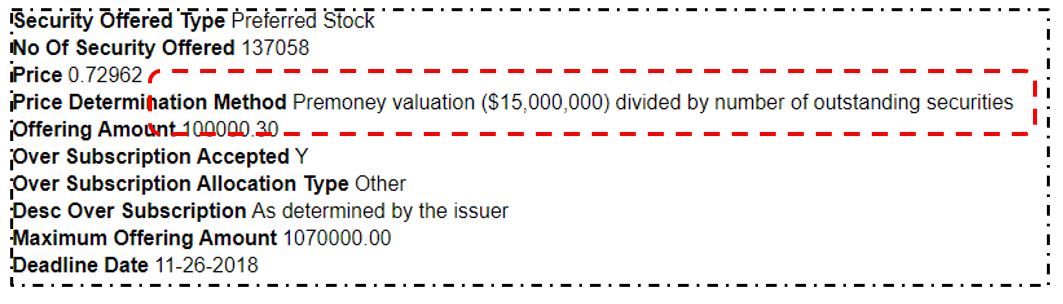

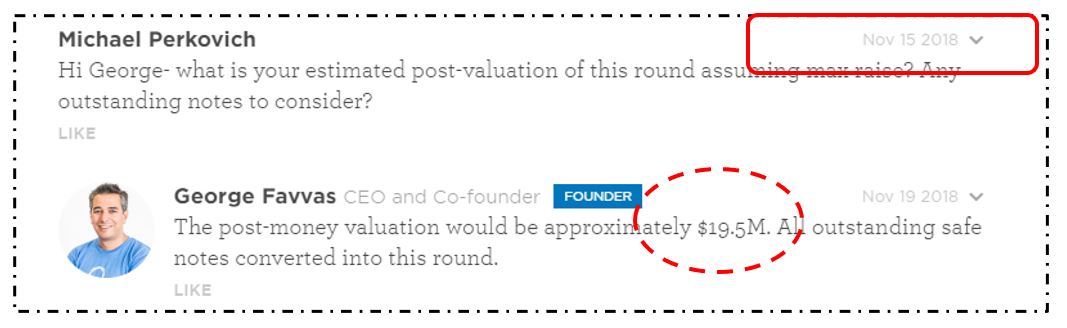

Based on Circle’s public filings, we surmise that Circle found it hard to raise additional funds for expansion after the initial funding rounds. Initial investors who provided funding of U$5.4M in convertible debt were looking for ways to salvage the funds. Hence, wefunder.com provided an outlet to raise equity capital in $100-$500 tranches. A US$200K investment accompanied the wefunder.com campaign from Well[25]for justifying the US$15M pre-money and US19.5M post-money valuation of Circle[26].

Figure 20: Circle Medical Pre-Money Valuation

Source: https://sec.report/Document/0001670254-18-000464/

Figure 21: Circle Medical Post-Money Valuation

Source: https://wefunder.com/circlemedical/ask

Despite the technology at its disposal and an intent to revolutionize healthcare delivery in San Francisco, Circle raised US$520,000 from 526 investors, or an average of US$990 per investor[27]. If ever, there was any doubt to investors’ sophistication from wefunder.com, the following question from one of the participants who subscribed to Circle Medical’s offering should enlighten Well’s current investors.

Source: https://wefunder.com/circlemedical/ask

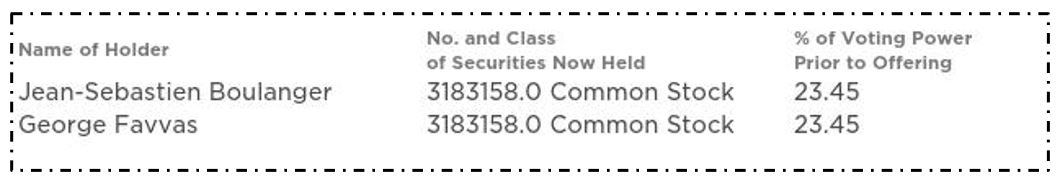

To this eclectic mix of knowledge, Well provided US$200K, thereby justifying the US$19.5M valuation of Circle. If it is a game, it has been well played by all involved. At this juncture, the founders of Circle owned 46.9% of the combined company, as illustrated in the Figure 22.

Figure 22: Founder Ownership of Circle Medical

Source: https://sec.report/Document/0001670254-18-000464/

On September 01, 2020, Well announced its intention to acquire a majority stake in Circle, sending its stock skywards as if floodgates to billions in free cash flow were imminent. Insiders of Circle and seed investors appear to be contrarian in this instance because of the U$14.5M control investment, that provides 58% ownership of Circle on a fully diluted basis to Well, only US$5M goes into the treasury and the rest to selling shareholders in the form of a stock swap. Early investors have moved on favoring liquidity and greener pastures, leaving Well shareholders holding the proverbial bag.

As far as revenue growth touted by WELL’s management is concerned, increasing the clinic footprint and adding physicians to the roster was always a part of the plan at Circle. The schedule automatically comes with minimal EBITDA and margins. As early as November 2018, the co-founder of Circle was anticipating $10M in annual revenue by the end of 2019, which they were on track to achieve a year behind schedule in 2020.

Figure 23: Business Plan of Circle Medical

Source: https://wefunder.com/circlemedical/ask

At this juncture, it is important to remind investors that Teladoc, AMWL, and ONEM have proprietary systems, technologies and significant scale in operations. Circle has two clinics, compared to everyone else in the game, and it is both years in time and decades in technology behind the others. Alphabet invested cash US$100M in AMWL, and it has US1B to build its business. ONEM has US$682M cash on its books to build out its business. Circle has US$5M in its treasury to compete. Not to forget ten other players that are competing in the same segment and we have not named.

Finally, the day Well announced the Circle deal, the stock went up approximately US$238M, compared to Circle’s fair value of about US$25M. Something does not add up. One of those fair values is incorrect. We surmise that Well shareholders will bear the brunt of the fall and not selling shareholders of Circle.

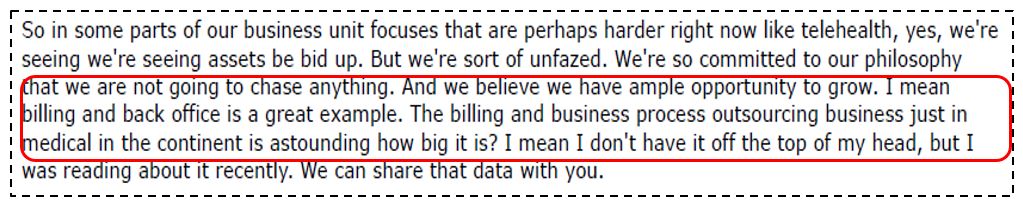

Well Expands into Cybersecurity, Billing & Back-Office

We are perplexed at another development, which investors appear to have overlooked. Well bought a company called Source 44 (Source”), which provides cybersecurity products and services to “protect healthcare clinics and their data across Canada.” Source 44 delivered a ten percent EBITDA margin on $20M of trailing twelve-month (“TTM”) revenues ended October 31, 2020. The Company paid 7.87x TTM EBITDA of $2M to acquire Source. The sellers were happy to part their holding at that price.

That was a fair price given that in August 2019, Broadcom Inc. acquired Symantec Enterprise Security business for US$10.7B in cash at an implied EV/EBITDA multiple of 8.2x[28]. The consumer business of Symantec now trades under the name NortonLifeLock Inc. (“Norton”). Norton trades at a prospective EV/2021E EBITDA of 10.8x[29]. Therefore, Source is not accretive to investors in any way. Large scale global enterprise security technology with all the benefits of scale and R&D trades for around 10x EV/EBITDA. Why should WELL security operation be any different? If anything, WELL merely bought a reseller with high labour content, and hence the low 10% EBITDA margins. Source should trade at a discount to everyone else.

Muddled strategic thinking, a marketplace that is rewarding revenue growth, a lame-duck board of directors awarding significant stock-based compensation with no metrics available to investors to assess are all fueling insanity at WELL. Management needs to keep investors engaged with its acquisition treadmill, and that is what it is doing. Perhaps the intent is to sell unnecessary security services to the 2,000 clinics using EMRs.

Management proclaims and preaches discipline, but we see no evidence of it. WELL, is buying anything and everything available for sale. But Why? It is bound to end in abject failure for investors.

Figure 24: We Will Grow; Come What may

Source: Q3, 2020 Conference Call

After cybersecurity, billing is next, and the Company spent $18M acquiring DoctorCare (“Care”) on November 01, 2020. Care has revenue of $3.5M and an EBITDA margin (under IFRS 16, we presume) of 20%, implying $1M in EBITDA. Although the purchase price includes $7M of so-called performance earnouts, so far, all deferred performance earnouts have been paid out. That implies an 18x EV/EBITDA multiple on a billing company. The press release says Care is Canada’s biggest billing company for doctors[30]. Canada’s fee for service clinical payments in 2018-2019 amounted to $28.2B. At $3.5M, doctor care is the largest already. It would be nice for WELL to educate investors on the opportunity in this space.

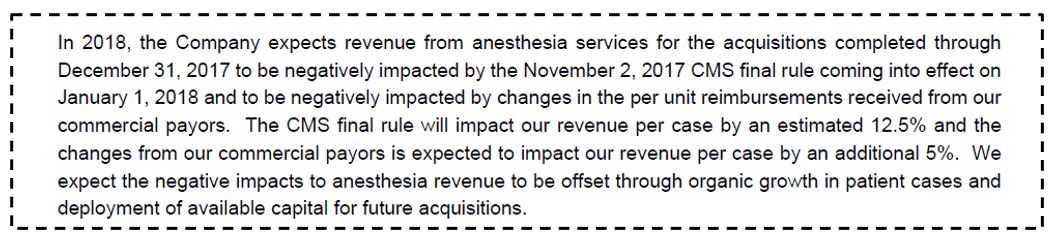

Are you disruptors? I say we are not

Figure 25: We are not Disruptors. We are Organizers.

Source: Shareholder / Analyst Call, September 30, 2020

We would love to know what Well is organizing! Investors are assuming Well provides exposure to a high-growth virtual healthcare company at the forefront of digitizing healthcare. Management is saying that it wants to be a back-office to doctors. Business process outsourcing or technology enablers are a dime a dozen in the global marketplace, and the valuation multiples of all those businesses approach 10x EV/EBITDA. That has been true in the past, is correct at present, and will not change.

Investors are ascribing a phenomenal EV/EBITDA multiple under the pretext that Well is the future The Company is proving to everyone that it wants to live in the past. Case in point: CRH Medical Corporation

The Acquisition of CRH Medical Corporation (“CRH”)

As reviewed and discussed by us, all of Well’s acquisitions are suboptimal businesses that management has presented as winners to a warm reception by enthusiastic investors. Emboldened by investor gullibility, WELL is spending $473M to buy one of the worst possible businesses it could, thereby confirming our doubts regarding management’s strategic and business judgement. We believe this deal puts Shahbazi in the league of one of the worst allocators of capital anywhere in the world and that investors backing him, including Shing[31], may have committed in haste but will repent at leisure.

Let us analyze the revenues associated with a “best-in-class device,” acquired as a part of CRH, touted on the conference call, and we quote, “They have a patented FDA-approved med-tech device known as the O’Regan System,……. And it’s really a best-in-class device[32]”. The much-ballyhooed best-in-class device’s revenue trend has been flat for seven years, beginning 2014 as illustrated in Figure 27.

Figure 26: O’Regan System Revenue over the Years – (Millions of U.S. Dollars)

We are comforted to see that pain is under control and not growing in the U.S., though management targets a $100M opportunity. If revenues have flatlined since 2014, how or why they will move upwards now is a riddle for Santa’s elves. I know we digress!Source: ANTYA and Capital IQ

What about the Anesthesia Segment?

Perhaps, the opportunity that WELL uncovered is in the anesthesia segment of CRH. The skeptic in us can only highlight facts that appear contrary to the accepted or the telegraphed narrative, and therefore we find no saving grace in anesthesia either.

The anesthesia business of CRH provides service to hospitals and Ambulatory Surgery Centers in the U.S. The business began with the acquisition of Gastroenterology Anesthesia Associates, LLC (“GAA”) in 2014, for US$58.6M and additional consideration of US$14.65M payable over 4.5 years.

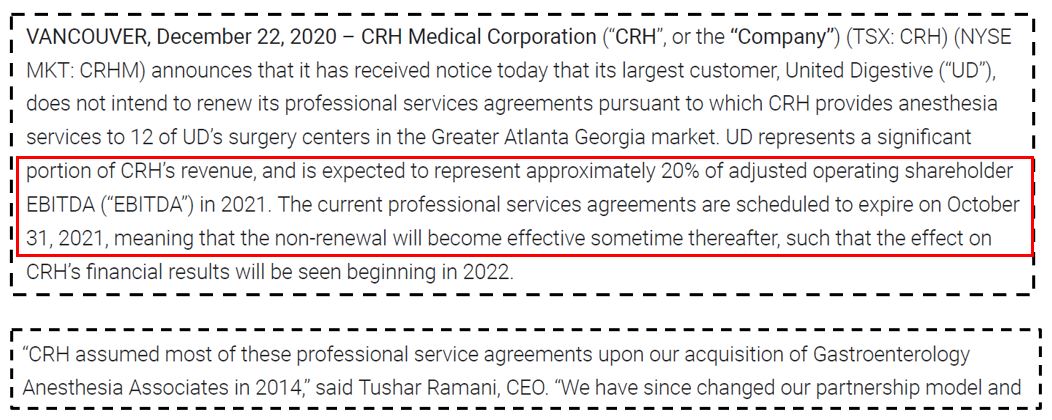

The medical industry’s standard procedure is to buy the selling practice assets in an exclusive professional services agreement. The GAA purchase came with a term of 6 Years and 11 months of a contracted professional agreement, beginning December 01, 2014. The expectation at the time was that the agreement would be renewed when the time comes. That time has come, and the deal initially failed to renew as per the press release dated December 22, 2020.

Figure 27: CRH Fails to Renew its Biggest Contract: Press Release – December 22, 2020

Renews at a Lower Rate Later

Source: CRH Medical Corporation

CRH booked an impairment charge of US$27.1M concerning its GAA professional services agreement for the year 2020[33]. On February 23, 2021, CRH announced a rejigged arrangement with United Digestive that will allow CRH to maintain “a material” portion of the EBITDA[34].

CRH running hard and will run harder to stay still

Like Well, CRH owns some of its clinics 100%, and others only 51%. Since 51% ownership gives CRH control over the asset, it can fully consolidate the results of those partially owned clinics both at the revenue and the EBITDA level. To drive home the point, CRH reports an adjusted EBITDA number, which is then further adjusted lower by deducting the share that belongs to the minority to arrive at a number that belongs to CRH shareholders called the “operating shareholder EBITDA.”

Therefore, we advise that investors shrug off the top-line EBITDA because it is the adjusted EBITDA number after deducting the share of the minority that is relevant. That trend is hardly inspiring for CRH, irrespective of Shahbazi’s assertion that “we expect that CRH will continue to grow pursuant to its extensible and very successful capital allocation program[35]. “

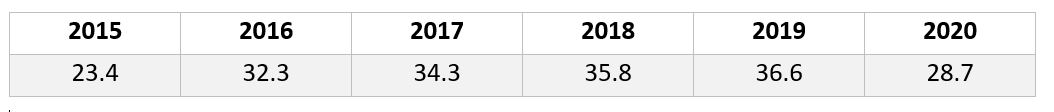

Figure 28 highlights the adjusted EBITDA attributable to shareholders of CRH, as reported.

Figure 28: Anesthesia Shareholder Adjusted EBITDA – (In Millions of U.S. Dollars)

Source: ANTYA and CRH Annual Reports

A management team that ostensibly “can allocate capital successfully” but cannot grow shareholder EBITDA while acquiring medical practices at the rate of 6-7 per year is described as successful by capital allocators at Well! Something is remiss. We cannot figure out what it is and why? Figure 29 brings all the numbers together.

Figure 29: We Acquire to Stay put – CRH Cash Flow Allocation

Source: ANTYA and Capital IQ

From 2015 to 2020, CRH expended US$156.9M on acquiring anesthesia providers. However, a growing shareholder EBITDA has been elusive, as demonstrated in Figure 29. Pricing pressure from payors, Medicare and Medicaid is the culprit.

All Acquisition Capital at CRH is Maintenance Capital

If adjusted shareholder EBITDA is stagnant despite capital spent on acquiring practices, that also implies that free cash flow is not what everyone might assume it is. A moribund EBITDA profile over five years exemplifies that all capital spent on acquisitions is maintenance capital only. Replacing approximately 5%-10% of CRH’s annualized shareholder EBITDA loss from the repriced UD contract (Figure 28) beginning Q4-2021 requires upwards of US$10M in cash to steady the ship again. It is but inevitable that some of the other agreements will not be renewed either.

Once cash paid out to minority shareholders is excluded, CRH generated cumulative cash of US$123.4M from 2015 to 2020 while spending US$156.9M to acquire anesthesia practices. The repricing of a single contract already undoes some of that work. Therefore, under WELL, CRH will have to run harder to stay still.

We conclude that at CRH:

- EBITDA is NOT EBITDA

- Free Cash Flow is NOT Free Cash Flow

- CRH cannot grow organically due to regulatory and pricing pressures.

We believe that WELL has seriously underestimated the resolve of the U.S. healthcare system to control costs and that it will be fighting a perpetual uphill battle to make much headway with CRH. To the nonbelievers, we cite additional evidence in the following quotes from management and some recent developments.

Regulatory Pressure to Lower Healthcare Costs in the U.S. is Perpetual

Figure 30: CRH Management not in Control of Outcomes at the Regulatory Level

Source: MD&A 2017

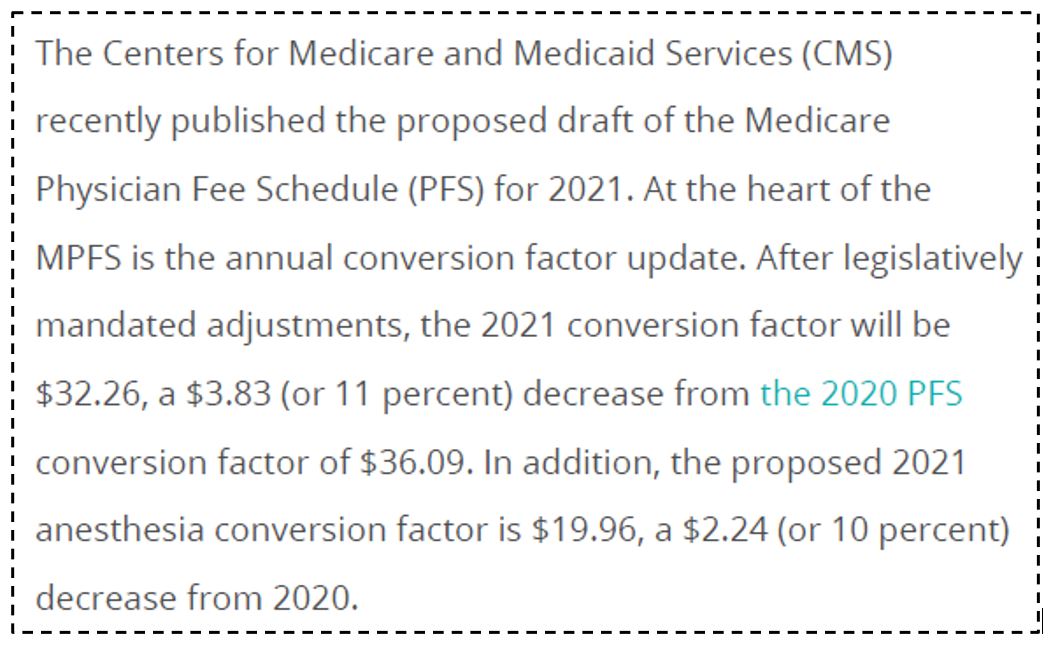

In 2018 regulatory changes lowered CRH’s ability to maintain pricing, and its entire revenue base was repriced lower. That is not a one-off incident either. Once again, in 2020, The Center for Medicare and Medicaid Services (“CMS”) proposed a lower fee for anesthetic procedures as highlighted in the following note from a medical billing provider.

Figure 31: Proposed Physician Fee Schedule for 2021 – Implementation Delayed

Source: CIPROMS Medical Billing (https://us5.campaignarchive.com/?u=eb0059b0d8226feadfa98a9df&id=0ef10ce1e8 )

Nonetheless, the 10% reduction did not materialize for 2021 because of intense lobbying and the COVID-19 pandemic jeopardizing many frontline physicians and support staff’s safety. The new price reduction is 3% for 2021. The 10% price reduction will be implemented in 2024. Therefore, beginning three years from today, CRH will need to replace 15%-20% of its organic EBITDA from 2020 levels.

To recap, an estimated 5%-10% of EBITDA loss from the repriced UD contract discussed in Figure 28, 10% via the price reduction currently delayed by the CMS to 2024, and a 3% price cut implemented by CMS in 2021.

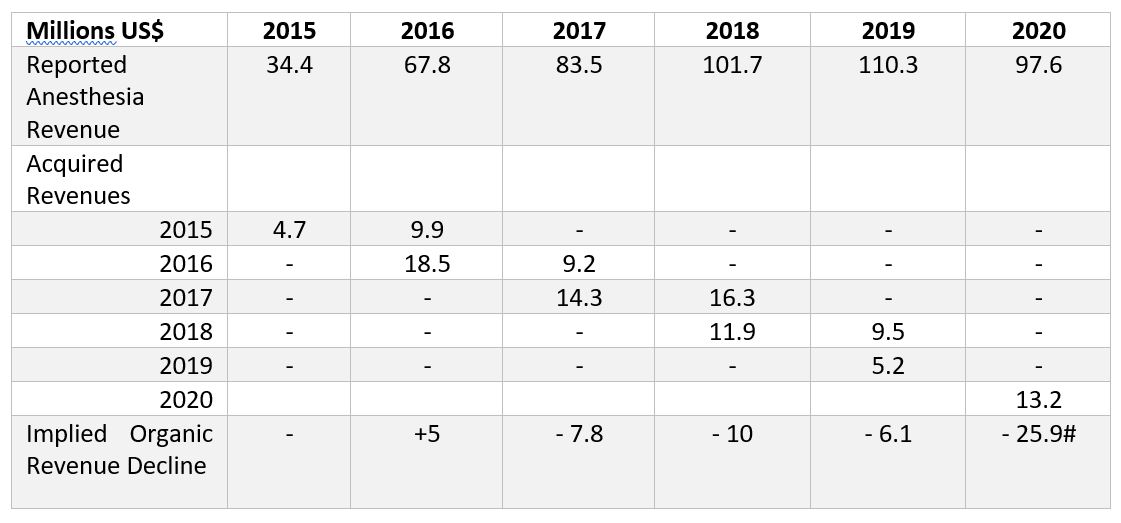

Figure 32 highlights the tug of war between acquired revenues, negative organic growth, and CMS dictated price reductions at CRH.

Figure 32: Declining Anesthesia Revenues Masked by Acquisitions

Source: ANTYA and Annual Reports # Includes COVID-19 related decline of US$21M

For 2016, CRH reported anesthetic revenue of US$67.8M, comprising revenue contribution of $9.9M from acquisitions in 2015 and $18.5M from investments in 2016. Net of that, revenue grew US$5M YoY. Subsequently, in each of 2017, 2018 and 2019, revenues net of acquisitions declined as outlined. Thus, five years of data provide substance to our viewpoint that all acquisition-related expenditures at CRH are maintenance capital expenditures and that CRH has no TRUE discretionary free cash flow.

For 2020, CRH reported an unfavourable revenue variance of $21.1M due to COVID-19. Correcting for the adverse effects for COVID-19 and then deducting the US$13.2M contribution from acquisitions in 2019 & 2020, we estimate that CRH organic revenues declined US$4.5M. Cumulatively, CRH has suffered an organic revenue decline of US$ 44.8M beginning 2016, including COVID-19 effects. Excluding COVID-19, the situation is no better, with an estimated organic revenue decline of US$23.7 M.

We conclude that WELL not only overpaid for CRH but that it made a strategic blunder that should compel its board of directors to hire a new CEO and claw back all stock-based compensation doled out over the years. In Canada’s capital allocation history, this must be the worst decision ever, unless one counts the Maple Nuclear Reactor fiasco engendered by MDS Inc. in the late 1990s and early 2000s.

Valuation of Well

Investors need to make a bold decision. Should they stick around for an estimated 80% decline in WELL’s share price, which can come any day?

The Company has four distinct business segments.

- Clinics

- Virtual Healthcare

- Cybersecurity and the Rest

- CRH Medical Systems

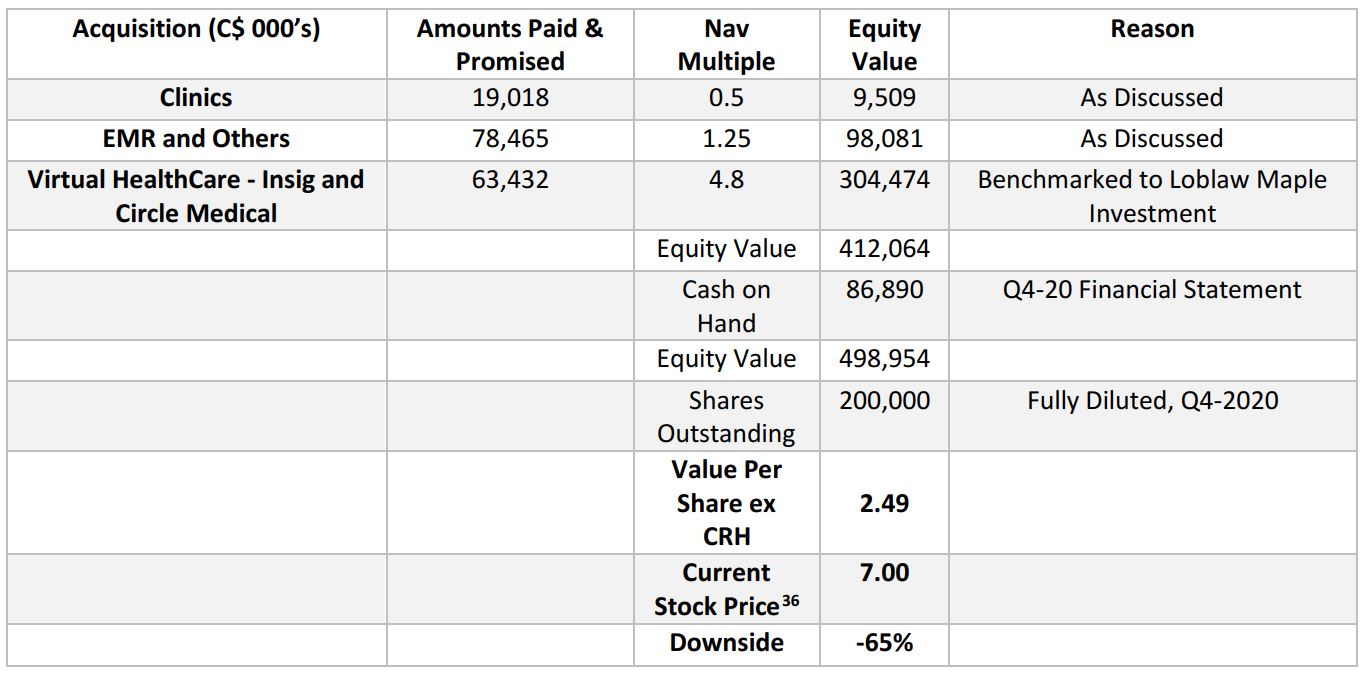

On a sum of the parts basis, Well’s equity value is a total of all four. We first focus on 1,2 and 3 and then present our view on the 4th. To assist investors, we frame the solution by taking a cue from Canada’s resource sector by focusing on a NAV multiple.

Figure 33: Optimistic estimate of Well’s equity value per share excluding CRH

Source: ANTYA Investments Inc.

Clinics are a low-margin, low-growth business that the Company acquired to learn about the healthcare business to succeed at its Virtual care offering. Moreover, without doctors, there can be no virtual care either. We assign a 0.5x NAV multiple to the clinical operations. For discussion purposes, we define NAV as the capital invested in creating the business segment. We also know that all the acquired businesses/clinics have been fair-valued within the previous twelve months, and hence the NAV multiple is fair. Even at a 1x NAV multiple, the clinics do not provide much of a value-added for shareholders.

The EMR business, the security business, the apps business and the billing business provide WELL with the option of cross-selling services, improving margins through better pricing, and other synergies that might come through. Moreover, access to 2,000 EMR clinics allows pharmacy and virtual care to grow as Well. Therefore, we give that segment a multiple of 1.25x the capital invested in creating the segment or NAV. These have also been fair-valued within the previous 9-12 months.

Virtual healthcare has a very recent benchmark, with Loblaw investing $75M through Shoppers Drug Mart in a company called maple. (www.getmaple.ca). maple has raised funding of approximately $100M since its inception. According to The Globe and Mail, it is valued at $300M, or a 3x multiple on invested capital[37]. maple has access to Shoppers Drug Mart throughout Canada, and hence it is in an excellent position to compete against other virtual healthcare providers such as Well that do not have a footprint. However, instead of valuing Well as a multiple of invested capital, we value Well’s virtual healthcare operation at the same overall equity value as maple ($304M). That is optimistic because maple is ahead in the game with its product offering. So, we ascribed a multiple of 4.8x to Well’s invested capital. That forms the basis of our optimistic valuation.

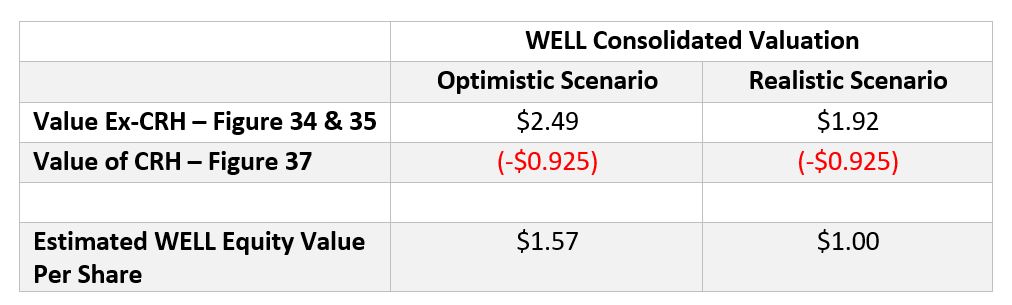

Finally, we add cash on hand and on that basis, our equity value per share of Well ex-CRH is $2.49 per share.

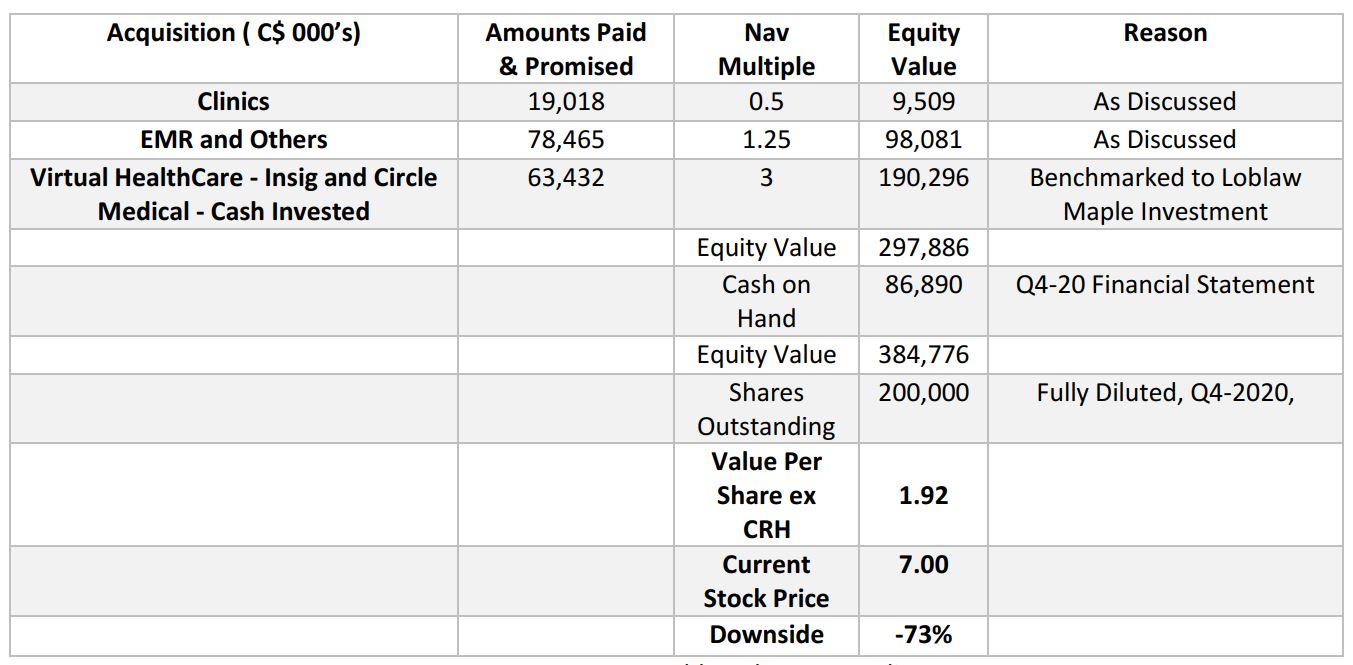

Figure 34 outlines a more realistic assessment of the Company’s equity value per share.

Figure 34: Realistic Equity Value Per Share – Excluding CRH

Source: ANTYA Investments Inc. Some amounts may not add up due to rounding.

If we ascribe a more realistic 3x invested capital valuation – benchmarked to Loblaw investment in maple to the virtual care segment, while leaving the rest as is – Well’s equity value per share ex-CRH declines to $1.94 per share.

That is a realistic assessment given that collectively INSIG and Circle Medical are on track to deliver an estimated $19.2M in 2021 revenue. A segment valuation of $190M implies a revenue multiple of 10.0 x prospectively. For comparison, TDOC on the NASDAQ is at 15.2x, and ONEM is 10.9 x 2021 revenue.

The Value Destructive Aspects of CRH

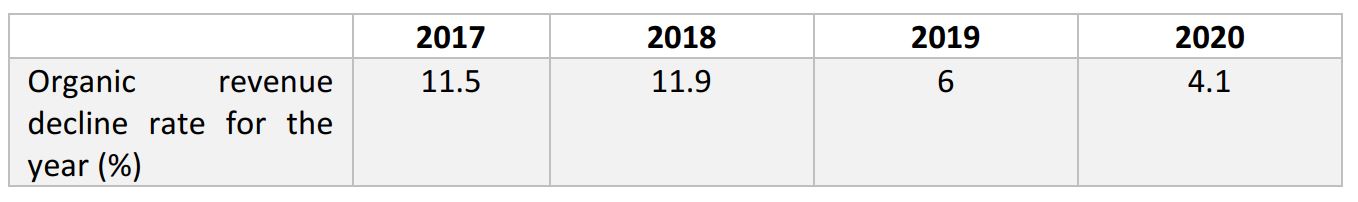

We have already discussed that acquisitions of anesthetic practices merely stabilize cash flow and that adjusted EBITDA applicable to CRH shareholders has been stagnant for five years. Our estimated revenue decline rates, based on Figure 33, are presented in Figure 36.

Figure 35: Underlying Revenue Decline Rate Significant (In % each year)

We know that another 5%-10%% of revenue will disappear in October 2021 and that there is a 3% reduction in reimbursement prices from CMS for 2021 to boot. Therefore, the five-year average revenue decline rate, including 2021, would be approximately 8.3%. Figure 36 walks through of our thinking on CRH.

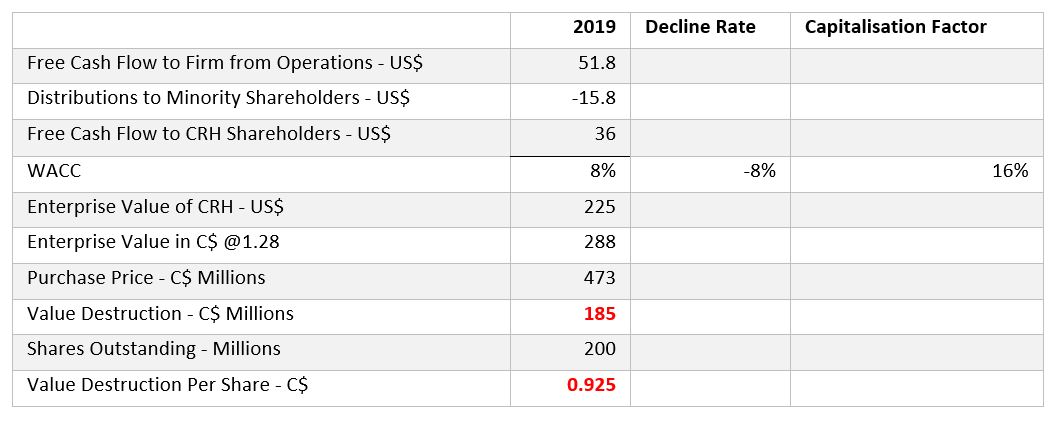

Figure 36: Calculating Value Destruction at CRH – We use 2019 data because COVID-19 negatively impacted 2020

Source: ANTYA Investments Inc.

As shown, based on a free cash flow to the firm of US$36M, we estimate that the enterprise value (“EV”) of CRH at a 16% capitalization factor (8% WACC, -8% for G) is US$225M. At the exact exchange rate used by Well ($1.28), the EV is $228M. WELL bought CRH for $473M. On that basis, we estimate that there is value destruction of $185M or $0.925/share of WELL.

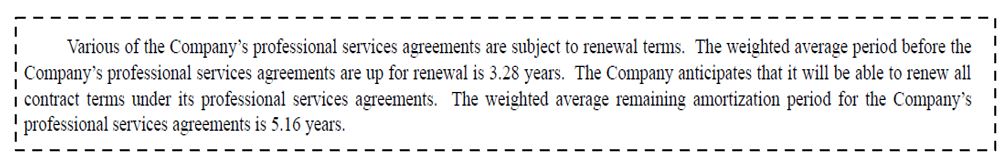

Is the 16% capitalization factor too harsh in a zero-interest rate world? For an answer to that, we turn to CRH disclosures that somehow tie into our back-of-the-envelope work-out.

Figure 37: Weighted Contract Length at CRH- 3.28 Years

Source: 2019 10K

It is interesting indeed that while CRH acknowledges that its contracts are about to expire on average in 3.28 years, it amortizes the purchase price over an extended period of 5.16 years. That should raise eyebrows. Inconsistent accounting requires a better and more detailed explanation from the management. Management expects contract renewals and hence it uses an extended amortization period. That did not work out so well in the case of the United Digestive, CRH’s most significant contract. As discussed previously, CRH booked an impairment charge of US$27M on it in 2020.

Nonetheless, even at 5.16 years, the implied discount rate including renewals is (1/5.16) or 19.3%. That is higher than our estimated discount rate of 16%. Hence, we are not concerned that our numbers are unduly aggressive, especially knowing that with US$156M spent on acquisitions, CRH delivered zilch EBITDA growth.

Time to Recap

The rising tide of telehealth stocks has lifted Well Health Technologies Inc. upwards. In the current frenzy, given the paucity of dependable Canadian growth stories, investors have missed multiple red flags at the Company, including but not limited to:

- Accounting policies that are inconsistent with the economic reality of the business

- Cash flow from operations and adjusted EBITDA as reported are unreliable

- Deferred acquisition costs, accrued as part of the acquisition and paid out later in labour-intensive businesses, appear to be compensation expenses under the guise of acquisition accounting. Greater scrutiny by CPAB (Canadian Public Accountability Board) could compel the Company to restate financial statements.

- A haphazard business acquisitions strategy creating a conglomerate of small businesses will result in a discounted valuation

- Accumulation of low ROIC, labour-intensive operations is a recipe for underperformance

- A company that is shaping up as a back-office for physicians implies it should be valued as an outsourcing operation such as CGI Inc. (11.1x EV/E-EBITDA 2021); not the current valuation multiple

- A top-line regulated and dependent on 2%-3% per annum organic billing growth is the best that Well can attain. Well uses a range of 2%-8% revenue growth and a discount rate of 12% or more for its impairment tests. The market should use a similar discount rate too.

- Multiple well-financed vendors in the virtual health segment all vying for the same patients and doctors with a similar product offering, i.e., pharmacy, prescriptions, family health, email communication, video calls, are a recipe for low returns

- For the uninitiated, oncallhealth.com, www.getmaple.ca, https://zoom.us/healthcare should give pause to think. Sir Li Ka-Shing is the 2nd largest owner of Zoom. Shahbazi should note that.

- A management team that is paid significant compensation in the form of RSUs, PSUs and options and whose interest is the stock price; not necessarily the underlying economics of businesses strewn together.

WELL Increasingly UNWELL – Enough Already

We believe Well’s days as a stock market darling basking in the glow of Virtual healthcare are numbered. We remind investors of Patient Home Monitoring (“PHM”), a one-time beloved of growth by acquisition investors that touted it endlessly – including its top management – on BNN in 2015-2016. Some of the same money manages now back Well. PHM’s promoters walked into the sunset, while investors ultimately needed some real-time mental health monitoring at home. Figure 38 is our final tribute to Well.

Figure 38: Equity Value Per Share of Well Much Lower

Source: ANTYA Investments Inc.

Well is NOT the next Constellation Software of Canada. In our estimate, Well is worth between $1.00/share and $1.57/share. We advise extreme caution and are sellers.

At this juncture, we are reminded of the lyrics to the song, “Don’t throw the past away; you might need it some rainy day.”[38]

If Jim Crammer- the host of Mad Money on CNBC- read our report, he would scream, “ SELL, SELL, SELL.”

This report ignores investments made after Q1-2021 for our analysis. Those have all been fair valued upon acquisition and hence provide zero value-added to current investors. We disregard the multiple arbitrage game that Well is playing, which many sell-side analysts are cheering.

Download this Report

[1] https://www.theglobeandmail.com/report-on-business/telus-to-buy-emergis-for-763-million/article20406373/

[2] Bloomberg Data

[3] Well Health AIF, May 6, 2020

[4] Q4, 2020 MD&A

[5] Proforma EV and revenue data from management presentation of February 10, 2021. 2021 EBITDA based on management and ANTYA estimate. (C$7M at WELL, US$36.6 X1.28 at CRH = C$46.8M, C$53.8M)

[6] Pre-rent and pre-deferred acquisition costs of around $4M

[7] WELL has not reported its FY2020 results yet. Therefore, all YTD 2020 references imply the first nine months of 2020.

[8] At $7.50/share stock price.

[9] Frank Sinatra

[10] https://www.wsj.com/articles/SB940529915922186655

[11] Non-Brokered Private Placement, Page 20 2018 MD&A and various other MD&As. Prior to the CRH transaction.

[12] https://www.crunchbase.com/organization/horizons-ventures/recent_investments

[13] https://www.reuters.com/article/us-ckh-holdings-chairman-idUSKCN1GS11L

[14] https://www.horizonsventures.com/team/

[15] https://www.sec.gov/Archives/edgar/data/1633917/000000000018026450/filename1.pdf

[16] AIF 2018, Page 12

[17][17] Financial statements 2019, Page 24

[18] Q3,20-20 MD&A

[19]Today, QHR supports 7,700 health care providers, representing about 20% of EMR technology use nationwide

[20] March 23, 2021

[21] Note 23, Page 41, Annual Financial Statements 2020

[22] https://www.bnnbloomberg.ca/loblaw-investing-75m-for-minority-stake-in-telemedicine-firm-maple-1.1494134

[23] For those disconnected from Baseball but interested in sports this is helpful This day in sports history: Barry Bonds hits first HR into San Francisco Bay – Sports Illustrated

[24] Note 23, Page 42, Annual Financial Statements 2020

[25] https://www.prnewswire.com/news-releases/Well-health-announces-strategic-investment-in-circle-medical-806455059.html

[26] Management ascribed a provisional valuation of C$25.9M to Circle as outlined in Note 23, of 2020 Financial Statements.

[27] https://wefunder.com/circlemedical/updates

[28] https://investors.broadcom.com/news-releases/news-release-details/broadcom-acquire-symantec-enterprise-security-business-107

[29] February 16, 2021

[30] https://www.Well.company/for-investors/news-releases/Well-health-acquires-doctorcare—the-market-leader-for-billing-as-a-service-for-canadian-doctors

[31] https://www.Well.company/for-investors/news-releases/Well-health-announces-major-expansion-into-us-market-with-proposed-acquisition-of-crh-medical-and-concurrent-c2955m-equity-offering-led-by-mr-li-ka-shing-at-a-25-premium-to-market-

[32] CRH Medical Conference Call, February 08, 2021

[33] CRH Medical Corporation, Financial Statements, 2020

[34] https://investors.crhsystem.com/crh-signs-new-agreement-with-united-digestive/

[35] CRH Medical Corporation M7A Call – Feb 08, 2021

[36] March 26, 2021

[37] https://www.theglobeandmail.com/business/article-loblaw-makes-75-million-investment-in-telemedicine-provider-maple/

[38] Peter Allen & Carole Sager- A&M Records 1974

Legal Disclaimer Please Read

ANTYA Investments Inc. is the copyright owner of this publication. Transmittal and redistribution is not permitted under any circumstance except when prior written permission by ANTYA is granted. This material contains the opinions of the author but not necessarily those of ANTYA and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. ANTYA provides services only to residents of Alberta, British Columbia and Ontario. This is not an offer to any person in any jurisdiction where unlawful or unauthorized. | ANTYA Investments Inc. Suite 1800, 2 St. Clair West, Toronto, ON M4V 1L5 is regulated by the Ontario Securities Commission. Investors should be aware that there is no guarantee that the principal amount of the investment will be preserved, or that a certain return will be realized; the investment could suffer a loss. All profits and losses incur to the investor. The amounts, maximum amounts and calculation methodologies of each type of fee and expense and their total amounts will vary depending on the investment strategy, the status of investment performance, period of management and outstanding balance of assets. Everyone should seek suitable investment advice before making any investment decisions based on any research available on the Internet. Clients may have long or short positions in the stocks discussed. ANTYA is not privy to any client trades, intent or positions. ANTYA does not take short positions directly or indirectly in any stock featured in our research.