If corporate governance is shoddy, the closest exit is the safest exit.

On the other hand, good corporate governance is priceless.

Download this Report

“We Do Not Bet on Science, But On Management”

Valeant Pharmaceuticals International Inc. – Annual Report 2011

That Valeant Pharmaceuticals International Inc.’s (“Valeant” or the “Company”) stock price was bound to implode is evident in the quote from the Company’s 2011 annual report. Needless to say that the entire business of drug-discovery is built on advanced scientific knowledge and is subject to peer-review and stress-testing by scientists and statisticians to validate the robustness of any claims. That reassuring process introduces significant failure risk with equally commensurate economic, moral and societal rewards upon success.

Although no scientific process is perfect, a key element of scientific drug discovery is that results cannot be created out of thin year i.e. via financial re-engineering or bravado, but only through cure. For instance SOVALDI from Gilead Inc. (“Gilead”) introduced a cure for Hep C, and in the process has enriched its various stakeholders while making lives of millions better worldwide. Gilead bet on science and stands tall among its peers.

Valeant on the other hand bet on low interest rates, lower tax rates engineered via corporate structure changes, questionable business practices and allegedly aggressive accounting to boost its profile. Cheerful sell-side analysts goaded by their respective investment banks, salivating at the specter of record M&A and debt placement fees, led Wall Street and Bay Street parades from the front.

Portfolio managers afraid of being left behind the benchmark willingly and/or reluctantly jumped on the bandwagon. Top management with prior experience at McKinsey Inc. and Goldman Sachs at the helm, provided succour for those that believed less in their own expertise and more in the aura surrounding alumni from giants of global capitalism.

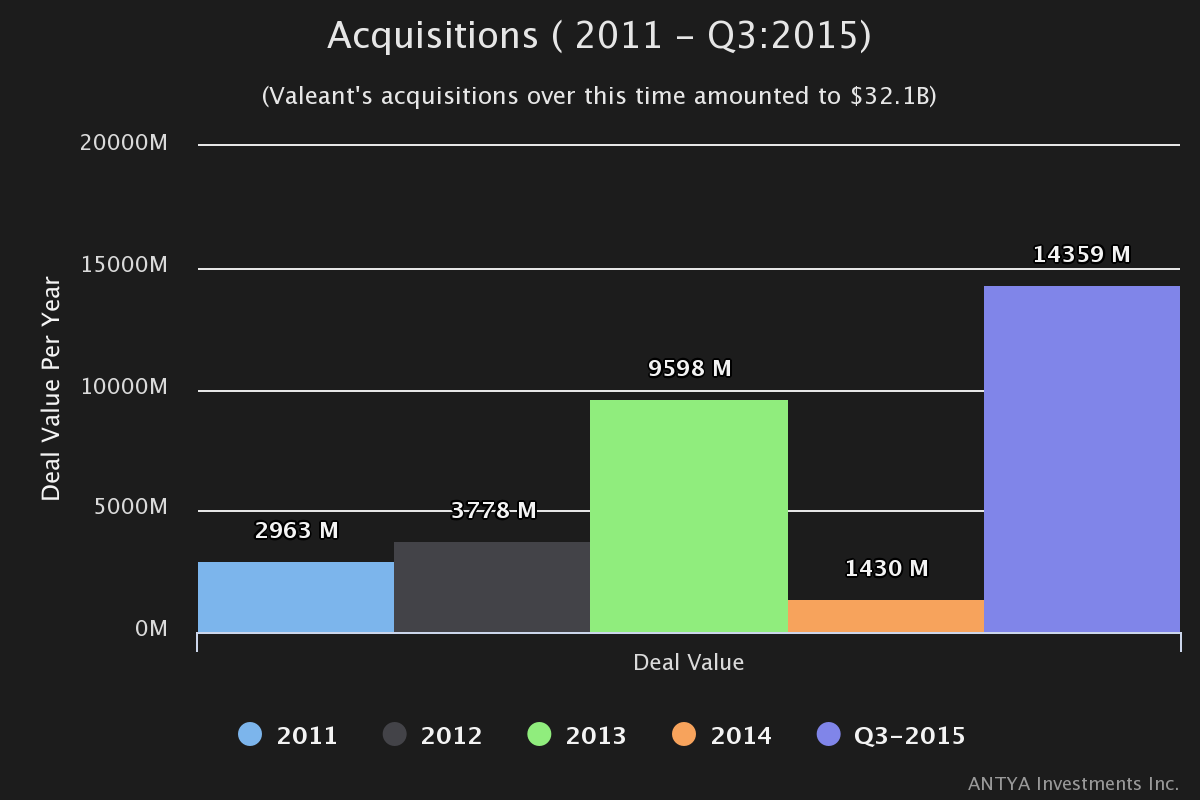

By betting “On Management”, and NOT “On Science”, Valeant’s acquisition trail as outlined in Figure 1, was betting on either brute pricing power or some other force of nature to pay the bills when they come due.

Figure 1: A Debt Enabled Obsession – Thank You Central Banks

Valeant spent a total of $32.1 billion beginning 2011 to deliver on its agenda of betting on management, while highlighting that it was Driving Change1 and that its strategy of betting “On Management” was “Gathering Momentum”.

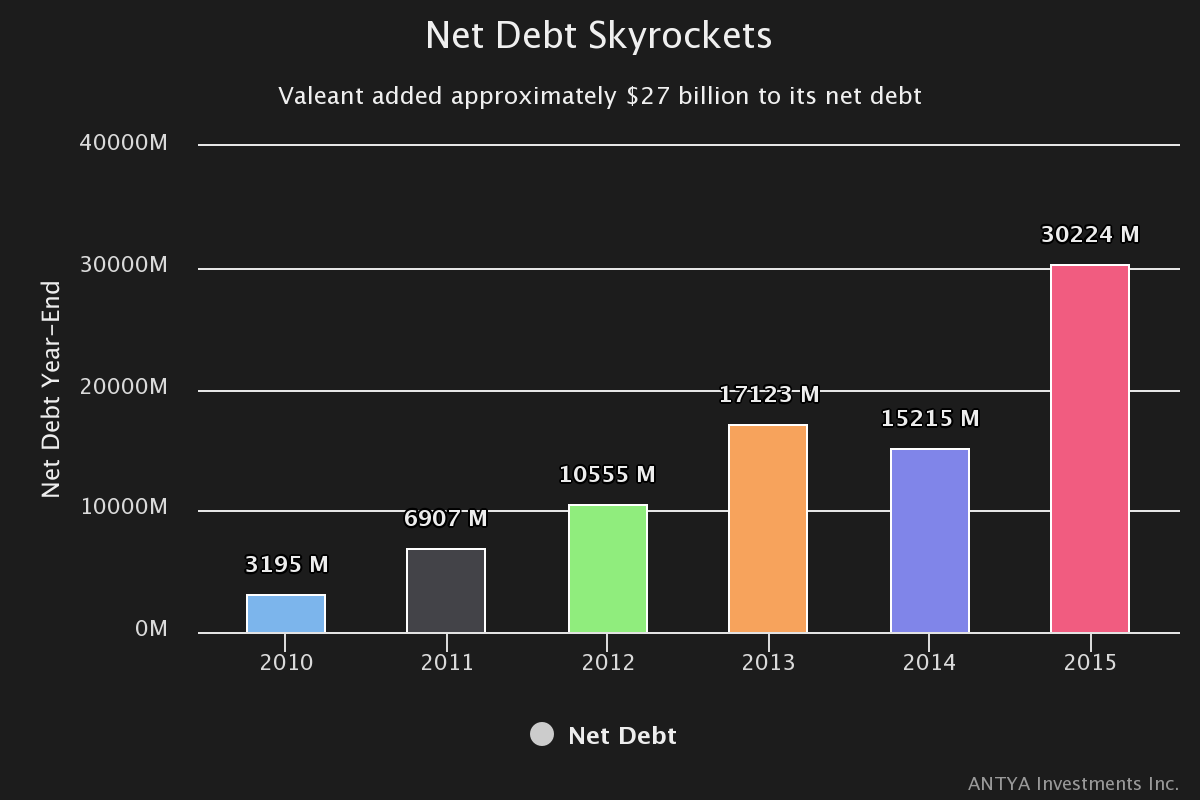

Figure 2: The Problem Starts Now – Debt Has To Be Repaid

A benign macro environment of credit, blinded further by clichéd pronouncements from self-dealing intellectuals calling the company a “Platform of value creation2” whipped the equity and credit markets into a frenzy that has resulted in a precarious situation for all involved. Valeant is seeking an extension from its lenders with respect to the filling of its financial statements, so as not to breach debt covenants.

On the one hand the company bravely proclaims that it maintains a cash cushion, has enough liquidity and its businesses continue to perform well, on the other its CEO has been let go, the CFO is being asked to resign from the board, and there is a cease trade order directed at the top management of the Company.

has been let go, the CFO is being asked to resign from the board, and there is a cease trade order directed at the top management of the Company.

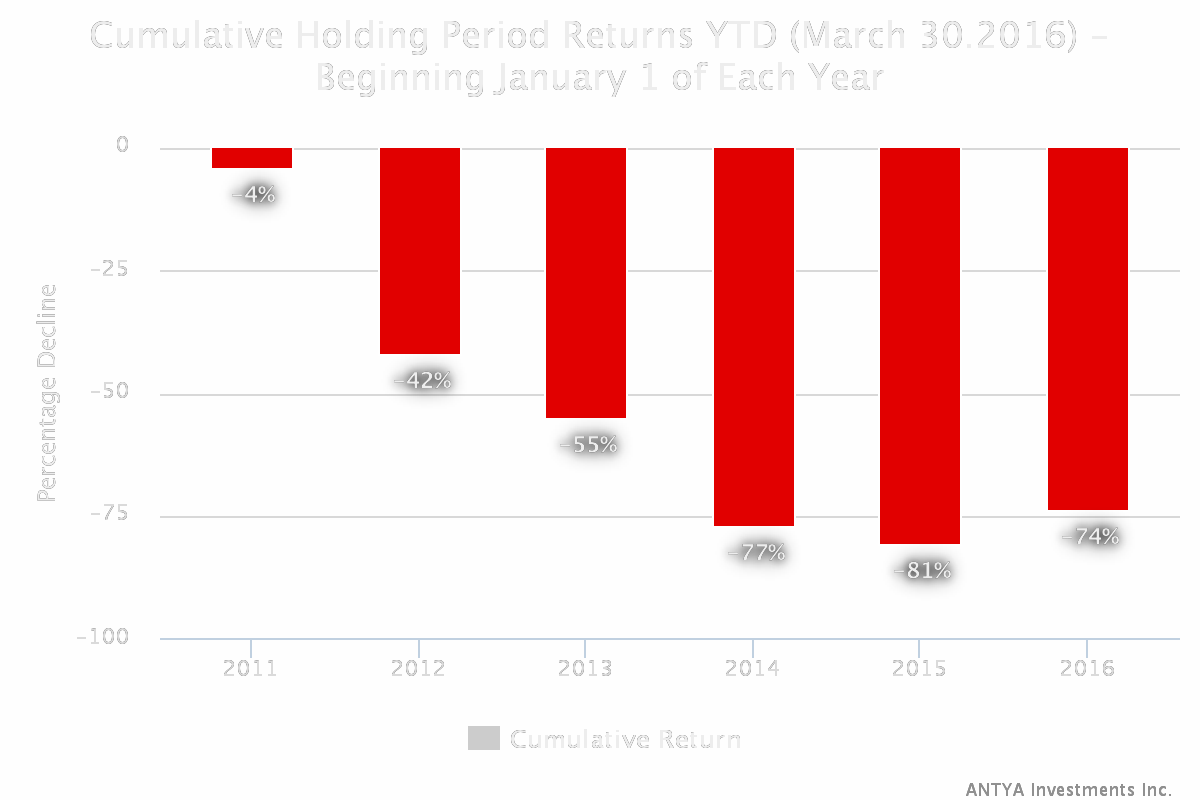

Figure 3: Are you Valiant Enough to Wade In?

With Valeant making daily headlines for a number of years, it is but natural to evaluate it as an investment for a portfolio. Incidentally, Figure 3 highlights that unless you have been one of those day traders sitting in front of a terminal with your fingers on the pulse of the market and/or Valeant, it has been a loser in your portfolio. For instance if you bought Valeant on January 01, 2014 and held on to it, as an investor your loss is 74% YTD (March 30, 2016). Similarly, if you had bought at the beginning of 2016 on January 1, after the stock had already lost 29% in 2015, you would still be down 74% in 2016, because the stock price has crashed to approximately $27 from $101 at the beginning of the year.

Our Perspective

- Debt enabled acquisition stories never end well. If a management team bets only on acquisitions to grow its business, it will have an unhappy ending. An example of another debt enabled Canadian acquisition story that went awry and ultimately ended in bankruptcy in Canada is Yellow Pages Income Fund. Yellow Pages depended on price increases and acquisitions to mask fundamental weakness in its business. Valeant is similar.

- Anyone promising to revolutionise a business model is most likely a snake-oil salesman. An example of that from Canada is Timminco Ltd., which claimed to have found the holy grail of solar-grade silicon. The stock went from $0.35 to $35.00 and back to zero. Valeant similarly claims to have discovered that gutting R&D and milking drugs by raising prices, is the NEW way of running a pharmaceutical company. A single tweet from Hillary Clinton destroyed the so called credibility of the NEW model.

- If accounting is aggressive or questionable, the closest exit is the safest exit. Nortel Networks, Enron, WorldCom were all found to have aggressive accounting. Similar allegations exist against Valeant as well. There are innumerable other examples of aggressive accounting that don’t need to be repeated here.

Valeant is unique in that it exhibits the holy troika of, a debt driven acquisition binge, the promise of a revolutionary business model which belies the realities of the industry it participates in, and accounting practices that are allegedly aggressive. With approximately $2.2 billion of free cash flow on $30 billion of debt, in a business that has already cut R&D to the bone, has lost pricing power due to regulatory scrutiny and political backlash, is subject to vagaries of generic competition, and has an SEC investigation under way, Valeant could be at a tipping point in its evolution.

Good Governance Matters

ANTYA Investments Inc. considers high-quality corporate governance to be the primary indicator of a stock’s long-term return. In our view, assessing good corporate governance is as much an art as it is science. Nonetheless, the primary characteristics of a Company that is governed well and could find home as an investment in your portfolio are:

- A high quality balance sheet

- A forthright management discussion and analysis section

- Accounting policies that are consistent and comparable across time

- A proven business model

- A valuation that suggests upside in our view

ANTYA’s clients entrust us with their savings under the assumption that the portfolio will deliver when clients need access to funds, and that we will manage risk-adjusted returns keeping in view client needs. Investing That Empowers You is undeliverable if we overlook the five key principles outlined above. Thus our investment philosophy, which has been honed over 15 years of fundamental research surrounding corporate governance, accounting and valuation is the primary driver of client portfolio returns.

ANTYA’s screening process never considered Valeant to be a worthy investment, and irrespective of its fan following it failed to impress us. We missed the thrill of the ride on its way up. However, we take comfort in the knowledge that we aren’t in Mr. Ackman’s camp either. Today some consider Valeant to be a value play. I believe their valour is misplaced and things are likely to get worse with many reputations tarnished for good.

ANTYA clients can be rest assured that wherever the next Valeant is, it is not in their portfolio. More importantly, if something else has caught your fancy, based either on a self-conceived theory of a company’s business prospects or due to someone else’s recommendation, do engage us. Perhaps we will learn something new collectively.

[1] Annual Report 2011

[2] Pershing Square Capital, 2015 Sohn Conference

Click on the link below to download this report in PDF