We believe that India is entering a stage of maximum risk. Increasing political uncertainty is adding, even more, twists and turns for the traveller on Indian roads. Our recommendation is to remain engaged with India but be very watchful.

With political uncertainty at home and unfavorable macro developments abroad as discussed by us in India: The Indian Rupee — Next Stop INR 70/USD, G-SEC 10-Year Yield — 8% and others in This Time Is Not Different: The Seeds of the Next Crisis Are Being Sown, India’s favoured position in global equity portfolios is threatened. Rising U.S. Treasury yields will cause additional stress on emerging markets assets, and in our opinion, these difficulties are likely to persist through 2019. Adding to this progressively volatile backdrop is rising oil prices, which is pressuring India’s current account deficit, triggering added pressure on INR. Moreover, an economy growing below its potential is causing social tensions.

Finally, the public-sector banks (“PSB”) which form the backbone of the Indian economy are on a Stretcher. A significant proportion of India’s problems, in general, are related to poor governance. However, all of the issues of Indian PSBs are due to a lack of proper internal controls, non-existent internal and up until recently external supervision, unethical management teams and undue pressure from political masters.

The net result is that The Reserve Bank of India (“RBI”) finds itself stepping in to save the banks from hara-kiri via notifications, clarifications and regulatory diktats to rein in incomprehensibly offensive behaviour on the part of both the borrowers and bank management. Recently, RBI issued notices to Dena Bank (DBNK IN) and to Allahabad Bank (ALBK IN) to stop further lending under its Prompt Corrective Action (“PCA”) mandate. We believe Punjab National Bank (PNB IN) could be next in line to get its lending privileges revoked. We are not surprised at these developments, albeit disappointed that it took so long for the regulator to come down hard on erring institutions. We discussed the possibility of RBI stepping in and reining in Indian banks in Hong Kong Monetary Authority—Blindsided by Indian Banks in HK – Could Increase Regulatory Scrutiny.

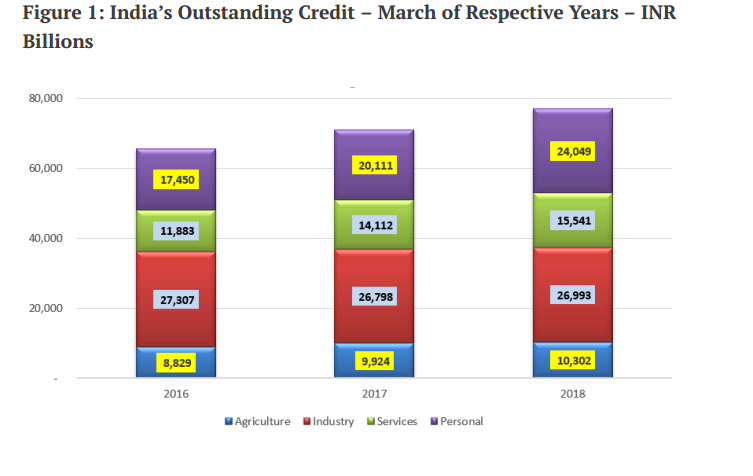

As highlighted in Figure 1 India’s industrial credit has been stagnant for two years and has been shrinking both in real terms and as a percent of total credit outstanding.

In Figure 1, ANTYA has adjusted RBI data by re-classifying credit extended to Non-bank Financial Services (“NBFC’s) companies – included in the “credit to services” segment of its data – to personal credit. In ANTYA’s opinion, Indian NBFC’s are primarily engaged in extending loans against tangible collateral such as real-estate, or the NBFC’s fund consumer durable, jewellery and personal vehicle loans. Therefore, categorising credit extended by banks to NBFC’s as service sector credit does not present an accurate picture of ultimate consumer credit in the economy, although NBFC’s are acting as the conduit.

As illustrated, the share of industrial credit in nominal terms fell from 36% of the total in 2016 to 35% in 2018, whereas personal loans grew from 23% to 31%. Loan growth in the services sector has kept pace with the nominal increase in the Indian economy, whereas the increase in personal loans has exceeded nominal economic growth.

Difficult to Pin India’s Lending Norms

That brings us to the question of credit growth going forward since India’s public-sector banks (“PSB”) are entering a grey-zone between bankruptcy, and RBI’s PCA. In our view, the purpose of PCA is two-fold:

1. Ensure further degradation of banks does not occur.

2. Maintain social order by preventing a run on the banks and deferring

ensuing chaos in India

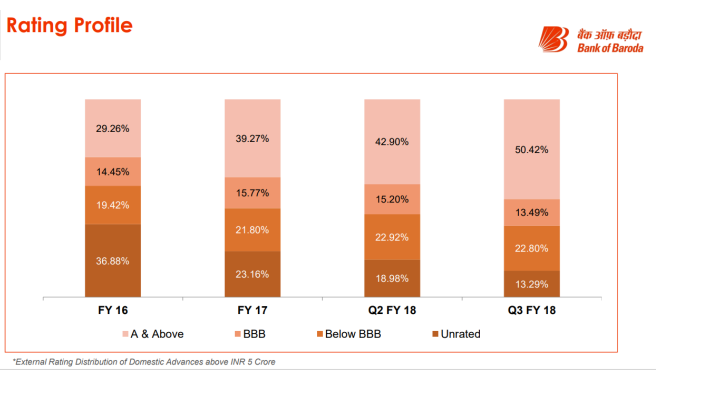

The banks themselves are on a one-way street with no exit. Figure 2 provided by Bank of Baroda (“BOB”) detailing its Q3-FY18 results is instructive and points to poorly managed financial institutions working on nothing more than faith.

As illustrated, in Q3-FY18, approximately 50% of BOB’s credit exposure is to low-investment grade credit. 23% of total credit outstanding is below investment grade, and another 13% or thereabouts is to unrated borrowers. BOB is one of India’s largest PSBs and is considered by some — not us — to be

one of the better-managed institutions. However, as illustrated, we fail to understand risk management practices at BOB and PSBs in general. There is no reason to believe that the loan book at any of other PSBs is any different.

In what scenario does BOB think it is OK to extend speculative credit amounting to 25% or more of total credit outstanding? After all, it is a bank with a fiduciary obligation to its depositors and not a distressed asset fund. BOB will point out that the trends show that management is working to improve the quality of the loan book, but that is akin to shutting the barn door after the horse has bolted.

The Rot Runs Deep

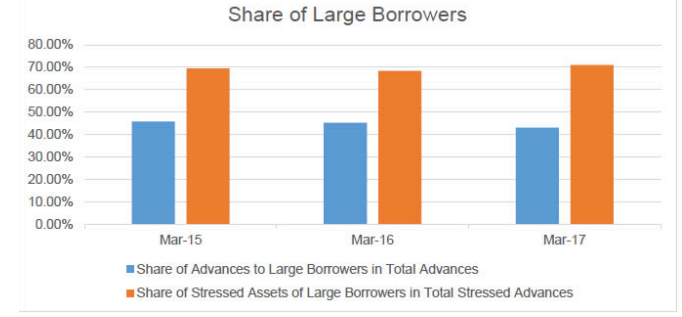

The problem that India’s banks face and which investors seem to be ignoring at their peril is that it is the well-heeled that are defaulting having escaped the clutches of Indian regulators and law-enforcement agencies. In a recent speech N.S. Vishwanathan, the Deputy Governor of RBI, referenced Figure 3.

Figure 3: Who is defaulting?

We find Figure 3 of more than passing interest, and it speaks to the devil residing in India and Indian banks, which a beleaguered RBI is trying to cage.

1. Large borrowers are expected to be sophisticated in their funding needs, while banks are presumed to be diligent in understanding those requirements.

2. Large borrowers profess professional management with appropriateboperational risk-metrics in place, while banks should have an open line of sight into these relationships.

3. The supposition is that large borrowers will behave ethically, while banks are meant to keep a tab on fund usage, utilisation and leakage.

Indian banks and Indian borrowers fail on all counts. Most recently a story on Jaiprakash Associates appeared in the press highlighting issues surrounding propriety, poor lending decisions, and convoluted arguments made by borrowers regarding their conduct. NCLT’ Asks Jaiprakash Associates To Return Jaypee Intra’s Land.

Where to Lend?

Summing up his presentation the deputy governor said and we quote:

“There is another issue from the equity perspective. One must understand that smaller firms and new entrants, which create dynamism and enterprise within sectors of the economy, get unfairly competed out when large borrowers are routinely able to obtain soft landing even upon defaults and

under-performance.”

The bigger question for investors, the Indian economy and Indian banks is that if borrowers show no ethics, lenders exhibit no control or accountability, then how and whom to extend credit to?

The answer lies in extending personal credit. It seems to be the easy way out. However, is it? It appears that the regulator is cognizant of developments underway in India’s consumer sector and it none too happy about it. In the words of the deputy governor:

There appears to be taking hold a herd movement among bankers to grow retail credit and the personal loan segment. This is not a risk-free segment and banks should not see it as the grand panacea for their problem riddled corporate loan book. There are risks here too that should be properly assessed, priced and mitigated.”

We agree.

Some of these issues have been discussed by Daniel Tabbush in HDFC Bank —New Pillar 3 Disclosure Reveals Broad Based Credit Quality Deterioration and by Hemindra Hazari in various posts.

Conclusion

We believe that India is entering a stage of maximum risk. Rising global yields, increasing internal inflation, weakening currency, slowing human exports driven by Trump Administration’s “America First” agenda, and a fetish for consumer credit when job growth is uneven and of low-quality make for an explosive cocktail. Increasing political uncertainty is adding, even more, twists and turns for the traveller on Indian roads.

Our recommendation is to remain engaged with India but be very watchful.