Indian banks are dealing with multiple issues, none of which are easily resolvable. However, the recent decline in GOI bond yields has given the banks a temporary reprieve, and in our view, most banks could surprise to the upside when Q4-F18 results are reported. The massive bond hoardes in available for sale portfolios, which impacted some of the banks negatively in Q3-F18, would be marked upwards, realising investment gains on the income statement. The longer term story is less sanguine

The Reserve Bank of India’s (“RBI”) latest release of March 28, 2018, on sectoral deployment of bank credit for the first 11 months of fiscal year 2018, i.e. for April 2017 to February 2018, is at odds with tales of accelerating GDP and a revival in growth emanating from India. (As per the RBI, data on sectoral deployment of bank credit is collected from select 41 scheduled commercial banks, accounting for about 90 percent of the total non-food credit deployed by all scheduled commercial banks).

Although gross non-food bank credit grew 9.8% in 2018, compared to 3.3% in 2017, ANTYA believes the composition of that growth is worrisome. Given the very public humiliation suffered by Indian banks in late 2017 and early 2018 due to various operational and risk-management failures, it does not surprise us that a shrinking capital base at India’s public-sector banks (“PSB”) is a significant drag on nominal credit growth and is resulting in negative real growth of credit.

If the Indian economy is growing nominally at around 12% ( The Investment-Led Recovery Has a Broader Base, and Corporate Earnings Are Gaining Too) ,how can nominal bank credit growth of 3.3% support that proposition, is an important question to ponder! The answer perhaps lies in the rise of a shadow banking system, which isn’t subject to much regulation or oversight yet. While ANTYA is not suggesting that India has a shadow banking problem like that of China’s, India’s non-bank financial companies or NBFCs as they are called, are stepping in and filling a void, and either tend to be lightly regulated or are beyond the purview of regulators.

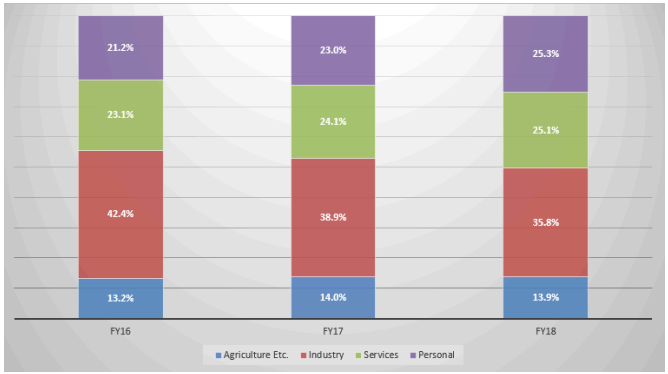

As illustrated in Figure 1, India’s problem is lack of credit growth in its industrial sector.

Source: RBI and ANTYA Investments Inc.

The share of Industrial sector loans in India has shrunk from 42.4% of the total in FY-16 to 35.8% in FY 18, a decline of 6.6%. For an economy that intends to put hundreds of millions of its young to work in higher paying manufacturing jobs – Make in India – and whose leaders highlight India’s demographic dividend at every opportunity, it is indeed a travesty that the biggest employment generator for low-skilled and semi-skilled workforce has no access to credit.

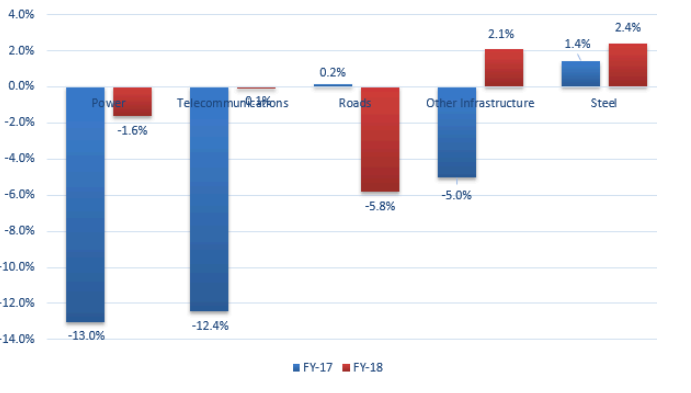

Moreover, Steel, Power, Telecommunications, Roads, and Other infrastructure sectors are all witnessing credit contraction as highlighted in Figure 2.

Source: RBI and ANTYA Investments Inc.

Together the sectors highlighted in Figure 2 comprise approximately 46% of the industrial credit outstanding and form the backbone of a growing economy. With some of India’s biggest loan defaults occurring in these sectors, and many others staring imminently at bankruptcy, in ANTYA’s view industrial credit will both be dormant and in the doldrums for some time. Furthermore Indian

companies have poor financial reporting and high leverage in general. ( India – Grind of Corporate Stress, to Worsen)

Who is Borrowing & Why?

Growth is coming from sectors that should worry the equity market more than it appears to care about it currently. Yes, the service sector credit growth footed to 14.2% YoY, but that included 22.1% growth in credit to NBFCs. Many NBFCs are lending to small and medium enterprises (SME) calling it a hot growth area. Readers of our research would recall that earlier in the year RBI issued a notification to banks to provide relief to SME borrowers challenged by GST implementation (The Reserve Bank of India~Between a Rock and a Hard Place, Higher Yields & Higher NPAs Forthcoming’). That helped the PSBs report lower NPAs than otherwise. Therefore, when we allude to a rise in shadow banking, it is somewhat evident in loans to NBFCs extended by PSBs.

Credit card loans to consumers are growing at a compounded 30.8% since F16, and rose 33.4% YoY, while vehicle loans rose approximately 10%. Thus, higher sales of commercial and personal use vehicles is attributable to more credit available to the consumer and the SME. Could it be that higher loan losses in that segment of the asset base will be the next shoe to drop, for the simple reason that there is no dearth of lending institutions, but credit-worthy borrowers are in short supply. If you don’t believe us, just ask those that are managing the bank NPA books.

Conclusion

Indian banks are dealing with multiple issues, none of which are easily resolvable. However, the recent decline in GOI bond yields has given them a temporary reprieve, and in our view, most banks could surprise to the upside when Q4-F18 results are reported. The massive bond holdings hoarded in available for sale books, which impacted some of them negatively in Q3-F18, would be marked upwards, realising investment gains on the income statement.

Nonetheless, as stated elsewhere in our research, we expect Fed Funds to approach 3.75% in late 2019 implying a 4% yield on the U.S. 1-year bond ( The Dot Plot Giveth — The Fed Presses On). At a minimum, a spread of 4%-5% on Indian sovereign debt over the U.S. Treasuries would suggest Indian yields at 8.5%-9% in late 2019, or the INR will depreciate below 70/USD.

Either way, Indian banks will face an upward pressure on funding costs, the Indian Government will face a rising fiscal deficit driven by higher interest costs, and with the industrial sector in a funk, internal political and social tensions will rise. With recent events foreshadowing increasing political uncertainty as well, ANTYA maintains its view that underweight India, underweight Indian banks, and overweight Indian technology stocks is the best position to take.