“The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run.”

“The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run.” With those words of wisdom the wizards from the Fed left us to fend for ourselves. Although the Federal Reserve likes to anchor its expectations and forecasts on the basis of U.S. economic data, in my view, negative interest rates in the EU, Japan, Switzerland, Sweden and Denmark are impacting Yellen & Company.

At a time when much of the developed world is trying to inflate its economy by penalising banks, any attempt by The Fed to increase the interest rate differential between the U.S. and the rest of the world, would result in additional strength for the U.S. dollar. The dollar which is already approaching all time highs as illustrated in Figure 1 could derail the U.S. export train. Negative rates and competitive devaluations from Japan, China and EU are already causing significant dislocation in global capital flows. By staying pat, the Fed is tacitly playing the game of beggar thy neighbour, and that I believe is taking the whole globe into uncharted territory.

Figure 1: The U.S. Dollar – Strong and Gaining Strength

Source: ANTYA Investments Inc.

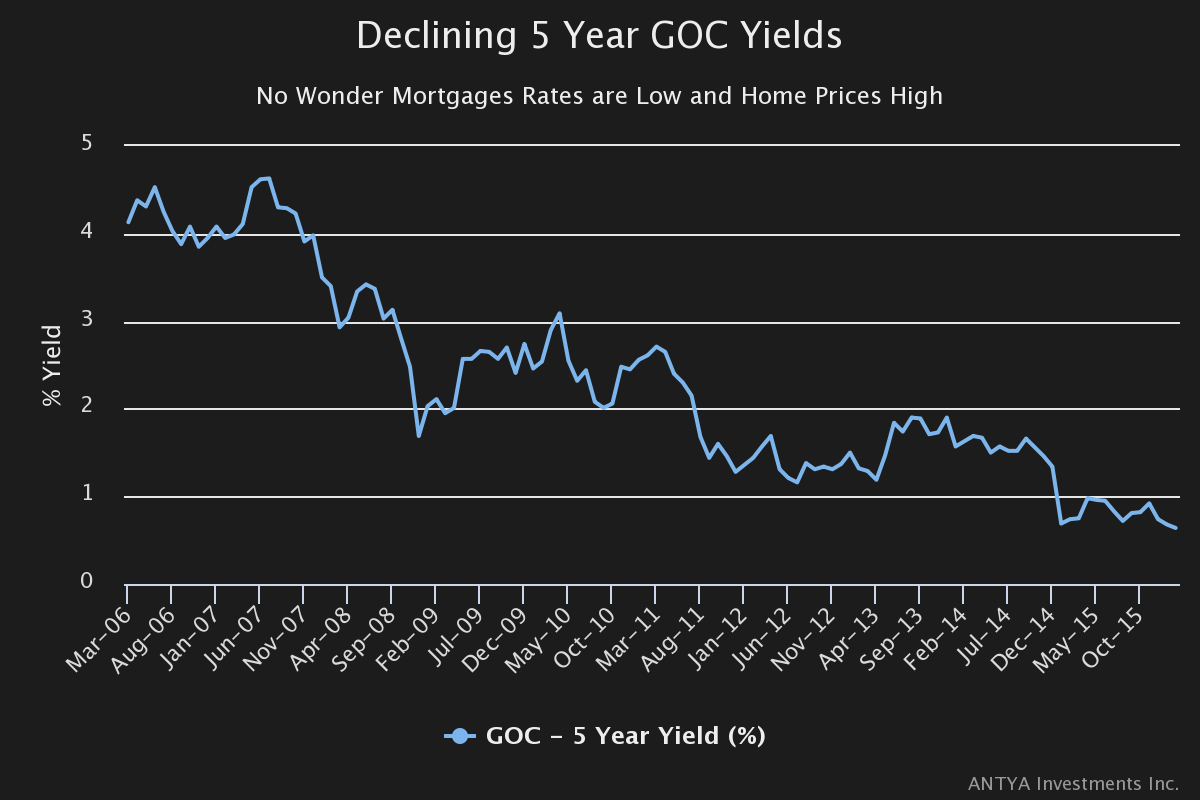

Nonetheless, for those that are retired, and for those that are savers amongst us, this is a less than welcome development. With low yields, come lower returns. Cheap borrowing inflates asset values causing bubble like conditions. All time high real estate prices in much of Canada are clearly due to the lowest mortgage rates in a generation. Perpetual negative equity 8 year car loans are another manifestation of low rates. Nonetheless, the sale of that $1 million house, only earns $19,400 per year invested on a risk free basis in the a 10 year GOC bond.

Therefore, those so called lucky Canadians who may be on the verge of retirement and consider their house as the primary retirement asset – unless excessive risk is taken with the portfolio – will be drawing down accumulated capital from the sale of the house. If there is any doubt Figure 2 should put those to rest.

Figure 2: 5 Year GOC Yields – What Next?

From an asset allocation standpoint, stable free cash flow generating assets are likely to see an increase in valuation multiples in both the U.S. and Canada. With the Fed decelerating, Bank of Canada has some breathing room too, and it gives the weaker Canadian currency extra time to boost the industrial heartland of Ontario and Quebec. With rates flat, declining unemployment in ON, and an influx of job-seekers from other provinces, it appears ON real estate will continue to outperform other Canadian provinces.

That means only one thing: when the tide reverses, and it will, house price stagnation will be long lasting. It will cause labour immobility too. Therefore, for this generation of house buyers, I recommend prudence first, a globally diversified low-cost investment portfolio second, and then if you have cash left over, a house smaller than the one you can afford.