Tesla Motors (TSLA US) continues to power ahead of the competition in electric vehicles with an 80% market share of all electric vehicles sold in the United States in 2018. With approximately 140,000 Model 3 cars sold in the U.S., Tesla outsold every marquee sedan brand. Model 3 outsold mid-size SUVs including

BMW X3, Acura MDX, Audi Qs, Lexus RX and even the Mercedes C-Class.

To the extent Q4-18 results from Tesla Motors (TSLA US) (“Tesla” or the “Company”) were expected to strengthen the hands of naysayers and bearish investors, the results were disappointing. Others that believe in Musk’s mission of getting rid of fossil fuels and freeing up valuable time from the chore of driving have reasons to cheer. Point being that the tug of war between bearish and bullish investors will continue in 2019, just as it did in 2018.

There was much to like in today’s disclosures, and it appears to us that irrespective of all the negative news surrounding the Company, Tesla is executing on its business plan and will have higher margins and free cash flow, compared to conventional automakers as it moves forward. While bearish investors continue to view Tesla through the lens of a conventional automaker, in ANTYA’s view, Tesla is anything but!

As per the disclosures today:

- The Model 3 production line has attained the capacity to produce 7,000 car per week. Including the Shanghai factory, by the end of 2019, Tesla is targeting a production of 10,000 Model 3’s per week.

- Model 3 gross margins have stabilised around 20%, and Tesla is targeting gross margins of 25% sometime in 2019. On that basis, we surmise that Model S & Model X gross margins are in the neighbourhood of 30%, and therefore in 2020 Tesla gross margins are likely to increase to more than 30%, excluding Model Y ramp.

- Model Y, expected to be launched in 2020, shares 75% of its parts and configuration etc. with the Model 3, and the production line for Model Y will come on stream with significantly lower capital expenditures and in a more streamlined fashion, given the lessons learnt from the excruciatingly painful experience of ramping up Model 3.

- At the midpoint of its guidance, Tesla expects to sell 380,000 cars in 2019. Production of Model S and Model X is expected to flatline while Model 3 should double from around 140,000 cars in 2018 to 280,000 in 2019.

- The Shanghai factory is slated to produce around 3,000 Model 3 cars/week by the end of Q4-19, and including Shanghai, Tesla is targeting a production of 500,000 Model 3 cars on an annual basis sometimes in early 2020. Add Model S, Model X and the launch of Model Y and suddenly Tesla appears to be a behemoth in the making.

- Although Tesla was coy regarding the capital expenditures in Shanghai, it appears Tesla is targeting $500 million excluding land for the Shanghai Gigafactory. That is a much lower number than anticipated by us. Moreover, management appeared confident that it could arrange Renminbi financing at competitive rates in China, and that appears plausible and reasonable. Given the focus on emerging technologies, a slowing Chinese economy and the desire in China to partner with leading-edge companies, we do not doubt Tesla’s ability to raise cheap debt financing in China. That Tencent is a large shareholder should also be helpful if needed.

- Tesla recorded free cash flow of $910 million in the quarter after paying $140 million for the 50-year land lease in Shanghai. December 31, 2018 cash balance of $3.6 billion is comfortable and will be sufficient to pay off the convertible debt due on March 1, 2019. It will be interesting to see how the debt default narrative will play out going forward, given that one of the pet peeves of those that have been short will be knocked down.

- Stock price weakness in Q1-19 is likely to be driven by shifting sales of Model 3 to Europe and China. Tesla expects around 10,000 Model 3 units to be in transit, which would tie up cash resources in working capital, and accordingly the company expects Q1-19 to be marginally profitable and cash flow break-even. Subsequently, Tesla expects to be both profitable and free cash flow positive for the entire year.

- Tesla forecasts total capital expenditures of $2.5 billion for 2019 for the expansion of its Gigafactory, the supercharger network, development of the Semi, Model Y and for investment in its service and retail network.

- Finally, Tesla believes that in the first instance, i.e. at 3,000/week, the Shanghai Gigafactory will represent 10% of the China opportunity for Model 3, implying Tesla ultimately expects to sell 1.5 million units per year in China.

To sum up, in 2019;

Tesla will be free cash flow positive after capital expenditures of US$2.5 billion.

Tesla will pay down the convertible debt that has been the “go to point man” of bearish investors.

Tesla will fund the Shanghai Gigafactory through local currency debt.

That means Tesla will not issue equity and dilute current investors.

Could Tesla’s bonds be undervalued relative to the risk?

We have argued previously that bond investors in Tesla appear to be chilling out, compared to the volatility that equity investors appear to be suffering by investing in Tesla. We discussed our view on Tesla bonds in Tesla Inc. – The Debt Default Narrative – Why Are Bond Investors Sanguine?

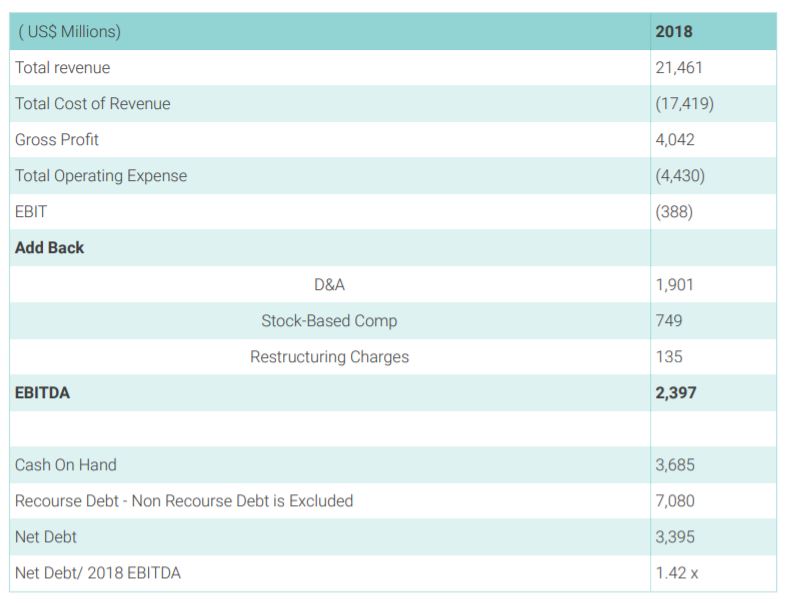

To that end, we highlight Figure 1, which seems to us to suggest that there is an opportunity in both Tesla’s equity and in Tesla’s bonds.

Figure 1: Who says Tesla is Highly Levered?

From our vantage point, once you look beyond the unnecessarily glorified debt-default narrative, Tesla’s net-debt/EBITDA number looks highly respectable. The numbers in Figure 1 are sourced from Tesla’s cash flow, income statement and balance sheet released today. Given that our readers are sophisticated, we wouldn’t venture to explain the process of arriving at the net-debt / 2018 EBITDA multiple of 1.42 x

We estimate that with revenues expected to rise by at least 45% in 2019, and operating expenses by only 10%, 2019 EBITDA is likely to double from 2018 levels approaching US$ 4.7 billion or more.

In our experience, based on that metric, Tesla possesses an investment grade balance sheet, although no rating agency would agree with our view. Rating agencies by their very nature have a retrospective view, whereas equity investors need to be prospective.

To conclude, slowly but surely, Tesla is gaining industrial strength with world leading and world-beating technology. None of its avowed competitors come even close in performance, price or their ability to deliver high volume production of BEV’s. By the time real competition arrives in the 2020-2021 timeframe, Tesla with its Semi, Model Y, Model X, Model S, Model 3 and The Roadster would be so far ahead of the competition that they would be just a blurt in its rearview mirror. We maintain our bullish view.

As usual, we ignore bearish viewpoints -— at our peril — because, beyond negative free cash flows, low margins and high debt, we have not heard anything innovative or critically interesting yet. We remain open to hearing data-driven and fact-based bearish outlines, other than those based on a DCF.