As outlined in its release today, with the inventory of Model S and Model X stable, and that of Model 3 declining 28% QoQ, accompanied with a 100% increase in deliveries to customers; ANTYA believes that gross margins, cash flow from operations and free cash flow of Tesla Motors (TSLA US) will surprise to the upside when it reports Q3-18. That needs to be weighed against

management’s commentary related to China volumes, impacts of tariffs on raw material costs, and any developments related to the DOJ investigation. Capital expenditure guidance will also be a vital factor in Investor considerations. We maintain our bullish stance.

If one paid attention to the media circus, and to the quick to the gun sell-side equity analysts of Friday, September 28, 2018, then both Tesla Inc . (‘Tesla” or the “Company”) and Musk were staring down a dark alley, out of which no one else but Batman might escape. The securities and exchange commission (“SEC”) apparently morphed into the “Joker” that finally pinned evil “Muskman”, and was about to raze his beloved “Teslacity”. Monday, October 1, 2018, was another day altogether, with Musk and Tesla settling all charges with the SEC. We proposed that outcome when we said, “SEC will get a settlement without Musk leaving Tesla”, in Tesla Inc. – SEC Overreaching to Pin Musk; Unlikely to Succeed. Nonetheless, even we were surprised by the rapid resolution of the entire episode.

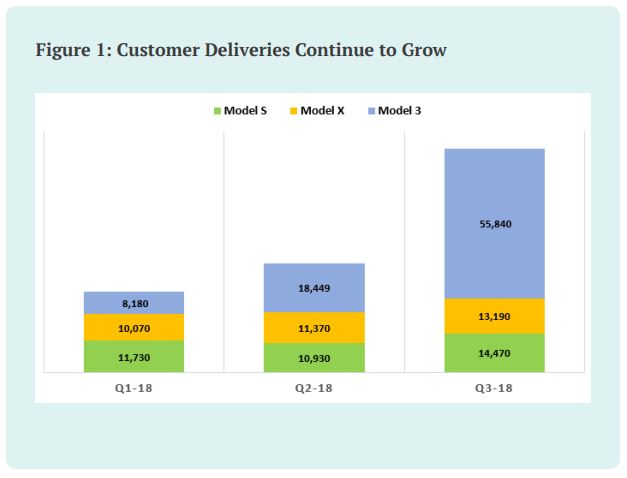

Tuesday, October 2, 2018, brings even better news in the form of production details surrounding Model 3. As highlighted in Figure 1, Tesla has successfully ramped up deliveries of Model 3 while production and shipments of Model S and Model X remain steady.

The fact is that at 83,500 cars in Q3-18, Tesla delivered twenty percent more than the 70,450 automobiles that the company delivered to customers in the first half of the year. Sequential delivery growth was 106% whereas YoY the Company more than tripled its delivery volume. There are a couple of essential deductions to draw from the data outlined in Figure 1. Many observers on the platform and otherwise, believe that the Model S is outdated and that it is running out of steam, and needs a significant upgrade. Those assertions may be correct, but data in Figure 1 do not suggest in any way that the Model S is losing traction in the marketplace. Yes, YoY Model S sales are flat, but it is difficult to draw negative conclusions from that because the Company has been devoting all resources to push Model 3 forward since it is a make or break project for the Company.

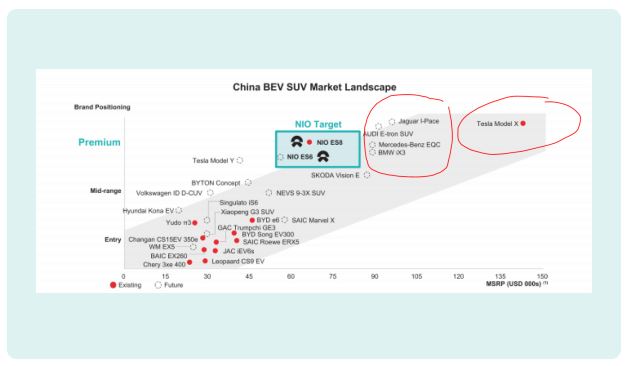

Model X deliveries have also grown marginally with YTD deliveries being 34,630 compared to 33,435 vehicles delivered during the same time in 2017. It will be important for investors to watch both these numbers for 2019 because as highlighted in the prospectus filed by NIO Inc (NIO US) for its IPO, Model X is the premium-priced electric SUV in China. Figure 2 presents Model X’s price position in China.

Clearly, some of the price premium on Tesla has to do with import and customs duties, which in Q3-18 increased significantly to the detriment of the Company. To quote from Tesla’s release today;

“Demand for Model S and X remains high. In Q3, we were able to significantly increase Model S and X deliveries notwithstanding the headwinds we have been facing from the ongoing trade tensions between the US and China. Those trade tensions have resulted in an import tariff rate of 40% on Tesla vehicles versus 15% for other imported cars in China. |n addition, Tesla continues to lack access to cash incentives available to locally produced electric vehicles in China that are typically around 15% of MSRP or more. Taking ocean transport costs and import tariffs into account, Tesla is now operating at a 55% to 60% cost disadvantage compared to the exact same car locally produced in China. This makes for a challenging competitive environment, given that China is by far the largest market for electric vehicles. To address this issue, we are accelerating construction of our Shanghai factory, which we expect to be a capital efficient and rapid buildout, using many lessons learned from the Model 3 ramp in North America.”

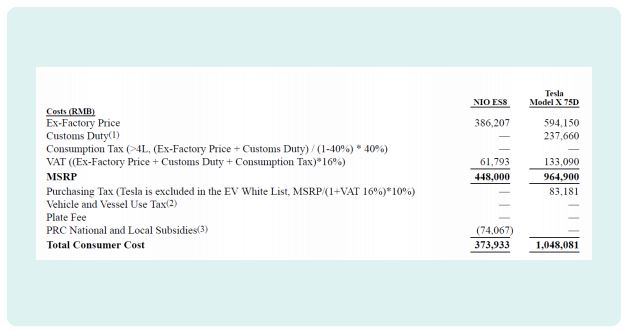

This is indeed as much a concern for Tesla as it is an opportunity. Going back to NIO Inc.’s disclosures, the numbers as disclosed by NIO and referenced by Tesla do add up. Figure 3 highlights the price differential between a domestic and foreign producer in China.

While the ex-factory price as highlighted in Figure 3 is a function of technological edge and a better product offered by Tesla, the rest of the difference amounting to RMB 392,138 is equivalent to the price to the consumer of NIO ES8, the vehicle that NIO has launched in China. Hence, Tesla’s intent to accelerate its China strategy today. We agree with it, and we also believe that Naysayers about China will be proven wrong.

Nevertheless, it remains unclear if a diversion of Tesla’s products away from China to other parts of the world will create a gross margin compression at the Company, and for that, we will have to await details on the Q3-18 conference call to be held sometimes in November 2018.

Cash Flow Will Surprise to the Upside

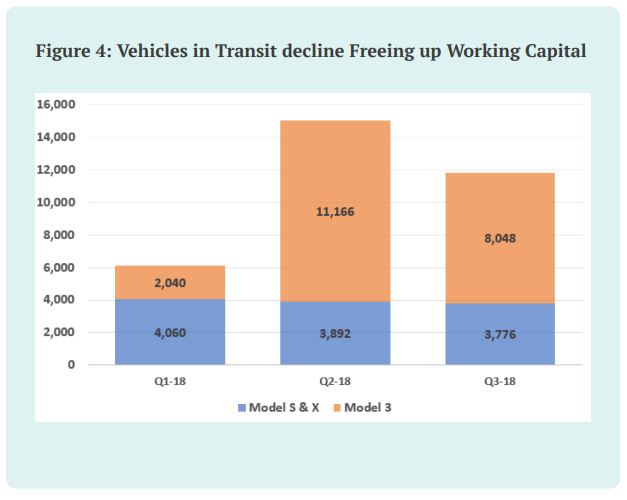

Another interesting piece of data forming the release today is highlighted in Figure 4.

Between Q1-18 and Q2-18 the numbers of vehicles in Transit increased 2.46 x to 15,068 from 6,100 in the prior quarter. That caused inventory to balloon on Tesla’s balance sheet, with management outlining an investment of $579 million in finished goods inventory as of Q2-18.

With the inventory of Model S and Model X stable, and that of Model 3 declining 28%, accompanied by a 100% increase in deliveries to customers QoQ, Tesla’s gross margins, cash flow from operations and free cash flow will surprise the upside. That needs to be weighed against management’s commentary related to China volumes, impacts of tariffs on raw materials, and any developments related to the DOJ investigation. Capital expenditure guidance will also be a vital factor in Investor considerations.

Currently, the stock is back at $300, and in our opinion will bounce around at these levels till additional clarity emerges in early November 2018. We maintain our bullish stance.