Bond markets are generally better at sniffing out distress than equity markets. Many narrators are worried that on March 01, 2019, Tesla Motors (TSLA US) will default on its US$920 million in bonds. Currently, the bond market does not exhibit any such anxiety. What gives?

Recently in the following insight, Tesla’s Q3 Results Could Mark Its Peak and the Beginning of the End our colleagues at SC Capital expressed apprehension at Tesla Inc.’s (“Tesla” or the “Company”) ability to repay its debts coming due on March 01,2019. The authors say that;

FCF [ Free Cash Flow] should be positive but not significant enough to repay upcoming debt”.

Many others including well-known bears on the stock have also hung on to the narrative that the Company will default on its obligations sending the stock into a tailspin, and bulls like ANTYA Investments Inc. into retreat. Others on the platform, notably Vicki Bryan, have opined on the investibility of Tesla’s bonds on multiple occasions with generally a bearish tenor to their thesis and recommendations with the most recent being Musk and Weird Q3 Developments Are Driving Investors to Telsa’s Rivals .

Once again, as discussed in Tesla Inc. – Long Tesla & Short Global Automakers where we highlighted the disconnect between free cash flow and revenue at German automakers, we are intrigued by the gulf between the bond market, that has real capital on the line, and bearish equity investors or analysts that are pre-supposing a default on Tesla’s bonds. Reconciling that position with the following story from The Wall Street Journal today that Uber Borrows $2 Billion in Debut Bond Sale is mighty difficult.

Although additional details on Uber Technologies Inc. (“Uber”) are in the story, suffice it to say that Uber borrowed:

… $500 million of five-year notes that priced with a 7.5% coupon and $1.5 billion of eight-year notes that were sold with an 8% coupon. Both interest rates were in line with initial guidance.”

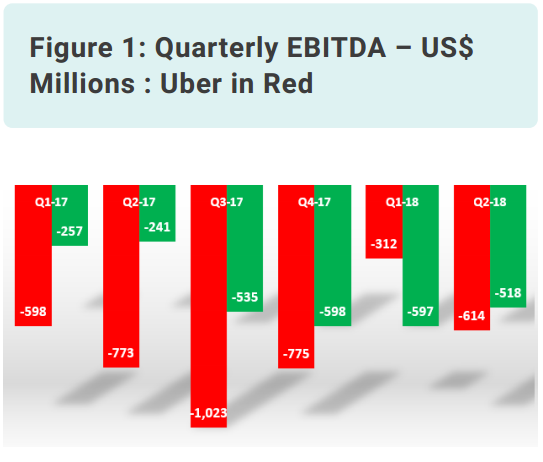

Although Uber is a global phenomenon, adding additional service to its platform including food delivery, temporary office workers (details available in Uber is testing a new ‘on-demand labor’ service, sort of like a temp agency) freight hauling etc., the financials are in no better shape than those of Tesla. The following EBITDA chart shown in Figure 1, provides investors with a comparative view of Uber and Tesla.

As illustrated, on a cumulative basis, beginning Q1-17, Uber’s negative EBITDA foots to US$4,095 million, whereas Tesla’s negative EBITDA totals much less in comparison. For those that are keeping score, the Company reported a negative US$2,746 million in EBITDA. Uber has a better cash and investment position than that of Tesla, but it is a private company.

Nonetheless, bond investors were not deterred by Uber’s disclosures, and readily subscribed to US$ 2 billion of 8%, eight year notes. Uber is backed by Softbank, which has supported the co-sharing start-up WeWork as well. WeWork too raised US$500 million in an offering of unsecured seven year notes in April at a yield of 7.875%.

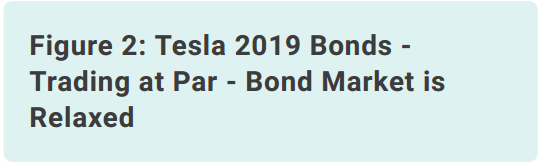

If the proof of the pudding is in the eating, then the bond market is on a chill pill concerning Tesla’s upcoming debt repayment or refinancing as the case might be. How can we be so sure? For that, we asked the bond market to provide us with a quote to trade the said bonds – about to go in default – and get the results. Figure 2 highlights the quote in some detail to avoid any ambiguity.

Early in the year and during the summer, perhaps driven by the “funding secured” tweet, Tesla’s bonds were trading at a premium as evident in the chart. Right now the Company’s 2019 bonds are trading at par. Given that bond markets are very good at sniffing out trouble ahead of equity market investors, with a mere sliver of a yield of 0.5%, investors holding US$ 900 million of bonds appear happy and content in the safety of their principle and the meager returns on offer.

Could that change? Yes, anything is possible!

But will it? In our opinion, NO.

More importantly, if bonds due in about four months are trading at par, then default is the last thing that any of those institutional investors are worried about.

To conclude, Tesla will not default on its debts. It can always be refinanced. Equity investors should take the cue and buy the stock now