Tesla Inc. is surrounded by bears, naysayers, bulls, day-traders, convertible arbitrage funds, high-yield seekers, bloggers, 24-hour news channels, sell-side analysts, buy-side analysts, electric vehicle enthusiasts, tree-huggers, journalists etc., all of whom have a different view on the Company’s prospects. We apologise if we missed someone. Then there are some of the most famous investors that are short Tesla, and to use the metaphor, have lost their shirt doing so. Will the shorts breathe easy anytime soon? In our opinion, not likely.

Tesla Inc. (“Tesla” or the “Company”) has been riding a wave of bad news in the last thirty days or so. It began with the involvement of a Tesla Model X SUV in a fatal accident on March 23, 2018. Details on the accident as reported by Bloomberg are here . The Model X crash came close on the heels of an accident involving a self-driving UBER vehicle in the prior week. Jittery investors already on edge due to Model 3 production delays hit the sell button on the news, and the stock price declined precipitously from $315 before the accident, to a low of $250 on April 2, 2018. For more on self driving challenges at Tesla please see Autonomous Driving- The Tesla Delusion .

Production Challenges

During the same week, Bloomberg reported that Elon Musk was sleeping on the Floor of the Tesla factory to solve production related issues. The link to that story is here. Previously in a comment S.C. Capital, another provider of insights on Smartkarma, highlighted that Tesla had to employ extra hands on deck to get to a target of 2,000/week at the end of Q1. We discussed that and much more in our comment Tesla Inc.-Defying Gravity: Tiangong-1or Voyager-1. In our opinion, if additional employees can solve the production problems, then the problem is solvable. Lo and behold, after a not so successful start-up of the Model 3 production line, Musk admitted that he is no A.I. avatar but human after all, by tweeting:

Figure 1: Must Admits That he is Human

In ANTYA’s opinion that proves two things:

1. Musk is human and not an alien, because only humans make mistakes, and admit as much.

2. Excessive automation can and will be, taken care of, and hence the Model 3 production problems are fixable.

Critics pounced once again saying, perhaps rightly so, that prototyping was required, and that Musk is not suited to run a more maturing auto-maker. Noticeably, there is no new information in these stories, except perhaps the right to say, we told you so, beginning with Reuters , followed by many others.

The Economist Wades In; but can it be Right?

Adding fuel to the fire, The Economist played right into the hands of those that are short Tesla stock, by publishing a story on April 13, 2018, with a cheeky take on the “Production Hell” phrase of Musk, rechristened “The next circle of Hell”. The Economist said that the Company faced clear and present danger, and that “Tesla is heading for a cash crunch”. We will not bore (pun intended) you by regurgitating Musk’s response here, but a newspaper devoted to publishing value-added stories printed something that apparently the whole world – except those that are long Tesla – knows, was a bit disappointing. We cancelled our Economist subscription just to get even ? We are peeved that the narrative touted by The Economist is available for free on the Internet, whereas by printing it the Economist expects to get paid top bucks for it!

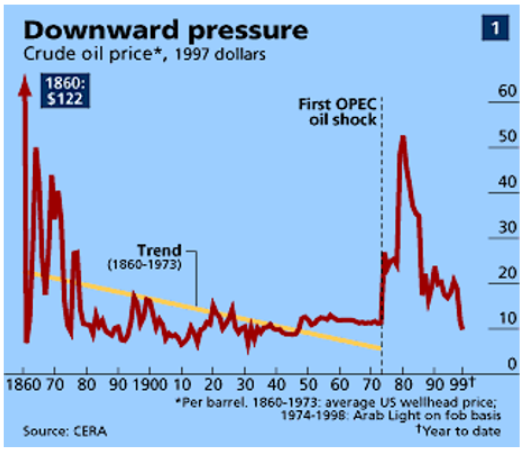

For readers interested in the Economist’s take on Tesla, please click The Economist says . A word of caution, – although we love their contrarian view– is that at the lowest ebb of the crude oil cycle, when it was trading close to $10/barrel in May 99, the esteemed Economist newspaper had a cover story saying “$5 oil”.

To refresh our reader’s memory and to enliven the debate we quote;

“Yet here is a thought: $10 might actually be too optimistic. We may be heading for $5. To see why, consider chart 1 [Figure 2]. Thanks to new technology and productivity gains, you might expect the price of oil, like that of most other commodities, to fall slowly over the years. Judging by the oil market in the pre-OPEC era, a “normal” market price might now be in the $5-10 range. Factor in the current slow growth of the world economy and the normal price drops to the bottom of that range.”

Figure 2 is the chart that the The Economist referenced in 1999.

The Economist on Oil in May 1999

All we are trying to outline is that historically there have been times when The Economist has proven to be a reliable contrarian indicator, notwithstanding its stellar reputation and credible reporting. We agree with Niels Bohr while paraphrasing him, “that predictions are hard, especially about the future”. We are making one too.

Are Tesla Workers Unsafe?

If all of this preceding wasn’t enough, on April 16, 2018, revealnews.org published a lengthy story outlining that Tesla’s reported worker safety record is not trustworthy because;

“Tesla has failed to report some of its serious injuries on legally mandated reports, making the company’s injury numbers look better than they actually are.”

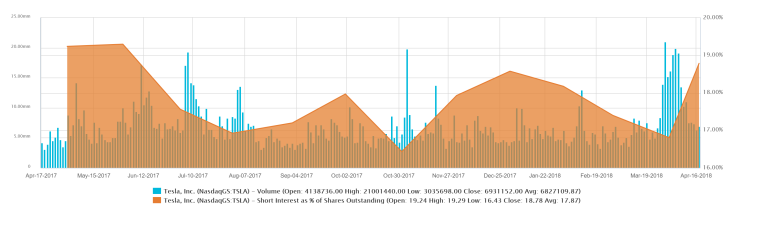

It is not our job to verify any of this, and kudos to the team that uncovered these shenanigans at Tesla. California workers safety board and other federal entities do exist to resolve and deal with such issues, and so we will leave it at that. During this tumultuous time-period, such vilification would have wounded lesser folks mortally, but miraculously not Tesla, although in recent times short interest in the Company has risen as illustrated in Figure 3.

Figure 3: Tesla Short Interest Rising or Not ?

Model 3 Production Line Makeover

If that was not enough after market close on April 16, 2018, Tesla announced a temporary shut-down of the Model 3 production line to fix its shortcomings.

“These periods are used to improve automation and systematically address bottlenecks in order to increase production rates,” said a Tesla spokesperson as quoted in the Reuters news story available here .

Is the Current Shutdown Planned or Not?

We think it is planned. On February 7, 2018, at the Tesla Q4-17 conference call, in response to a query about the fully automated line, Jeffrey B. Straubel, CTO of Tesla said;

“… we do expect the new automated lines to be landing and starting out at the Gigafactory in just the next — well, the landing in sight within this quarter.”

Musk provided additional colour by elaborating thus:

Yes, expect the new automated lines to arrive next month, in March. And then it’s already — it’s been — it’s working in Germany, so that’s going to tracked — going to be disassembled, brought out to the Gigafactory and reassembled and then go into operation at the Gigafactory. It’s not of question whether it works or not. It’s just a question of disassembly, transport and reassembly. So that’s kind of — yes. So we expect to alleviate that constraint. That — with alleviating that constraint, that’s what gets us to the roughly 2,000 to 2,500 unit per week production rate. The next constraint would be material conveyance at our Fremont vehicle plant. And that’s a very sophisticated automated parts conveyance system. We think it’s probably the most sophisticated in the world or at least we’re not aware of one that is more so. And the software for that is quite complex. So that would be the next constraint on production to get to 5,000, is the conveyance system in Fremont. So that also appears to be on track. So we feel like the error bars around the unit volume predictions are getting smaller with each passing week.”

If those automated production lines landed at Tesla sometime in Q1, the Company was bound to shut down the factory for a few days in Q2 to ramp it up.

Thus, a marginal decline of 1% in Tesla’s stock price to $287.69 at the close of trading today, seems to suggest that investors were expecting this shut-down. However, the stock did fall 2.7% on April 16, 2018, after the revealnews.org story. Was there a news leak that the plant was going to shut-down, or was it the worker safety issue, one can never tell because both occurred on the same day. To the extent investors believe in the integrity of the equity market, it appears it was the worker safety story that was unexpected, because the stock price barely budged today. Plant closure was announced after market yesterday.

After Market, the Stock Regains its losses

As we speak, CNBC is reporting that Musk has raised its goal of Model 3 production to 6,000/week by the end of Q2-18, and as we anticipated and

discussed in our report Tesla Inc.-Musk Exudes Confidence in Attaining a Production Rate of 5,000/Week for Model 3 by July… he expects 3,000 – 4,000 Model 3/week in May.

For additional details see Elon Musk raises Tesla Model 3 goal, rips inefficient contractors in internal email.

Lest anyone forget, the news coming out of China on the auto sector is also positive for Tesla, but not necessarily for its brethren, all of whom have joint ventures approaching the age of young adulthood in China.

To those that are worried about cash crunch and capital raise, all we can say is that those concerns only matter if Model 3 production does not ramp up. If it does, the stock is going higher.

Stay Tuned!