With each passing day, Tesla’s date with destiny draws closer. Bears have stayed away from the stock, and we can tell because some of the top growth investors do not own it. That means they are bearish because a growth investor bypassing Tesla is equivalent to a coffee aficionado going decaf.

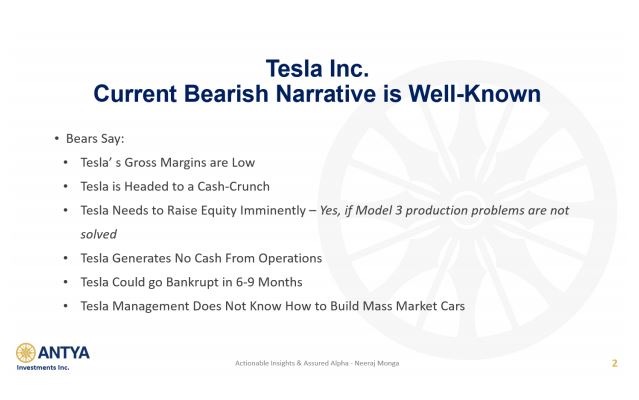

We do not want to name anyone, lest they are annoyed at our name-calling. Bulls have stayed invested, including Fidelity and T. Rowe Price that own $4.72B and $3.06B in stock respectively. Then there are the shorts, which have played every trick in the book including sensational media stories, appearances on TV, and so-called white papers involving comparison to dying companies of yesteryear that don’t add up. The shorts like Jim Chanos, David Einhorn, and many others have come to the party with an “I told you so” attitude, repeating platitudes involving debt, gross margins, missed product launches, self-driving problems, and many more.

By the way, all concerns expressed by shorts are true, and could yet come to pass. However, the shorts are naively assuming that growth investors do not share their concerns, or do not understand any of them. At the end of the day, for one end of the Tesla trade, it is a career-limiting or career-ending decision. We are especially worried about the revolving door involving top tech and accounting executives.

Nonetheless, Tesla’s stock refuses to budge. In our opinion, this cannot be good for the shorts.

Experts on this platform and elsewhere have argued with Tesla’s approach to self-driving technology and how it differs from others in the Industry. We can barely spell software, and therefore, we will not feign any expertise in

A.I. Nonetheless, we did see the SpaceX launch vehicles renter the troposphere safely, come back and make a safe vertical landing on a platform in the ocean. Flight capsules thus became reusable for the next space mission. If that is possible – who knew; at least we did not – and Musk is involved in SpaceX since the beginning, then perhaps there is a method to his madness.

Bringing unmanned space modules safely back to earth does require a particular kind of software expertise that does not exist at current automakers, but is accessible to Tesla’s automotive engineers via SpaceX. That provides Tesla with an edge, or maybe not, but we give Musk the benefit of the doubt. Musk has publicly acknowledged that Tesla’s approach to A.I. and self-driving is different from that of the rest of the industry and that Tesla could be barking up the wrong tree, and hence he may have to eat his “famous” words. We will let our readers chew on that too.

Facebook Inc., Amazon Inc., and Neflix Inc. have once again handed the shorts a resounding defeat after Q1-18 results. So is Tesla about to do the same on May 2, 2018? If Model 3 production were 4,000/ week, instead of less than a 1,000/week it averaged in Q1-18, we would have said YES. Right now we can only bite our nails 🙂 Perhaps these statements give away the composition of our portfolio too!

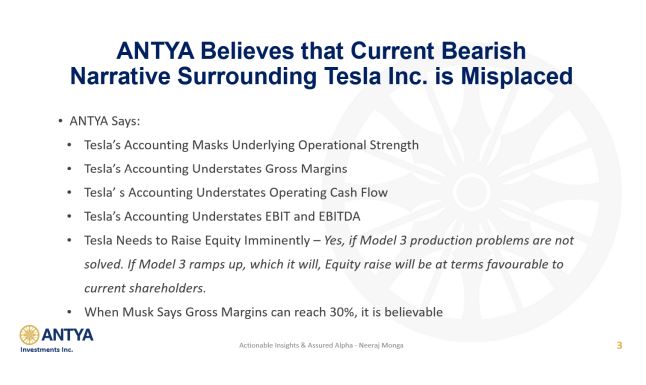

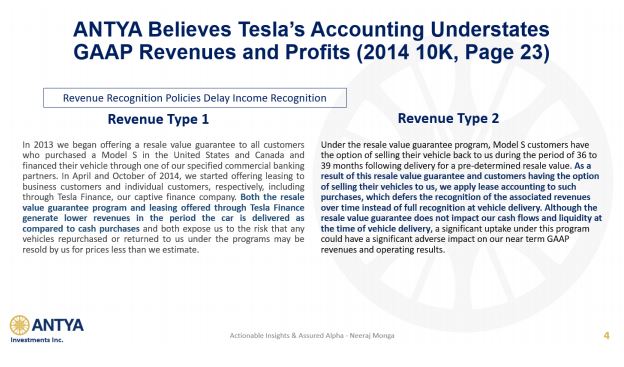

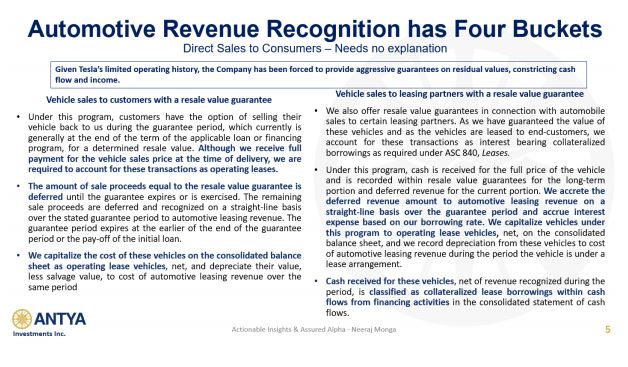

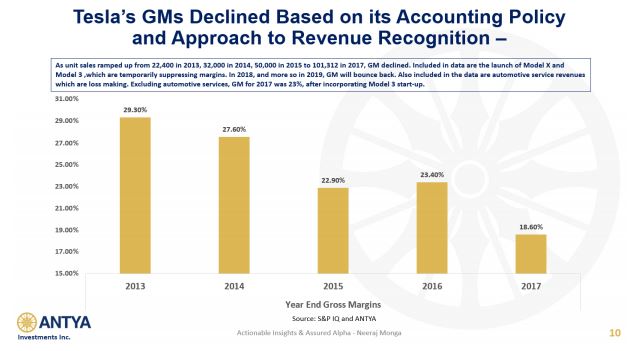

Currently, when it comes to Tesla, we are on the fence albeit leaning towards optimism. We still believe that Tesla stock goes higher after Q1-18 because investors will be surprised at the strength of the operating cash flow, and underlying automotive gross margins, adjusted for Model 3 ramp-up.

How do we know? Follow the details:

What’s next then and do we have more on Tesla?

Yes, we do.

Perhaps those interested can use the premium feature introduced by the platform to find out if it is essential for them given capital exposure to Tesla. Shorts may not get another opportunity to cover, while the longs may not get a chance to add to existing positions. Our job on the other hand is to point out that which is not apparent.

As in StarTrek, we want “To boldly go, where no analyst has gone before” Not to be frivolous, we believe this is a great time to invest in options related to Tesla because the stock will have a wild swing aftermarket on May 2, 2018. The question is in which direction?

As Jim Crammer would say “Bulls make money, bears make money, but the pigs get slaughtered.”

As for the rest who are in it for the intellectual pleasure, or opinions not backed by capital, please stay tuned!