Bearish sentiment on Tesla Motors Inc (TSLA US) is rising towards a crescendo. Delayed Model 3 ramp-up has given a new scalpel to bears, who apparently want to go for the jugular and send Tesla careening to the dustbin of history. Tesla, on the other hand, has a few hidden tricks up its sleeve. We explain below.

Following up from our report Tesla Inc. – Prophets of Doom Could Be Blown to Smithereens by Conservative Accounting, this report highlights that Tesla Motors Inc (TSLA US) is changing its accounting policy and adopting a new revenue recognition standard from January 1, 2018. Investors that have followed our work on General Electric Co (GE US), most recently discussed in GE : Marching to A Single Digit Stock Price – Restating the Past for a Brighter Future – Part Four, would recall that we highlighted impending accounting policy changes at GE. We also discussed the probable impact upon retrospective adoption on GE’s financial statements. In our view, most recent Q1-18 quarterly results reported by GE, were better than expectations of some investors due to creative accounting. In general, if accounting issues are of interest to you, then our colleague Nitin Mangal writes some of the best accounting and governance research on India.

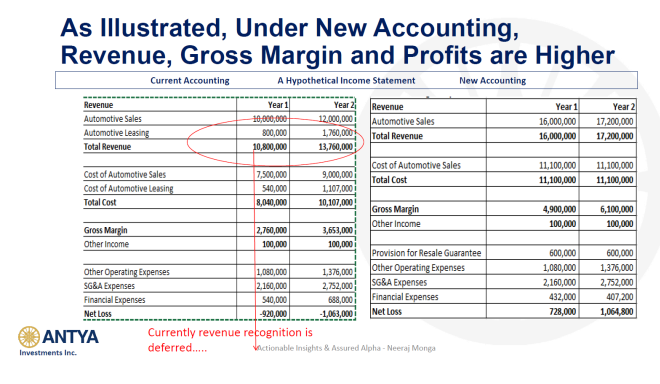

In Tesla’s instance, accounting has been conservative and given the limited operating history of the business, as well as capital constraints, Tesla’s revenue recognition has been cautious. In the absence of Model 3 ramp-up issues, adoption of new accounting policy by Tesla would have had a seismic impact on reported financials. Even now, we believe that forthcoming Tesla disclosures are likely to reset bearish expectations of impending doom while giving the bulls more breathing room.

Of course, a failure to resolve Model 3 production issues will impact the stock negatively, most likely in the first week of June 2018, when the company reports production numbers for the month of May 2018.

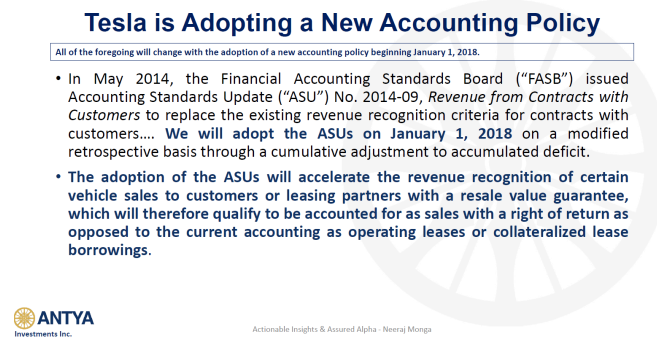

Tesla is Adopting a New Accounting Policy

- In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers to replace the existing revenue recognition criteria for contracts with customers…. We will adopt the ASUs on January 1, 2018 on a modified retrospective basis through a cumulative adjustment to accumulated deficit.

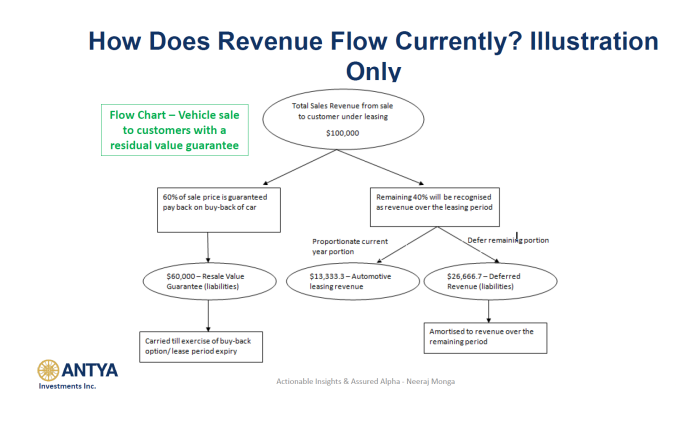

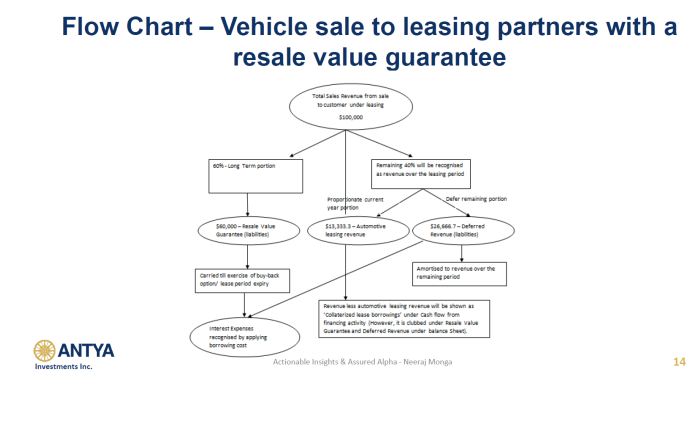

- The adoption of the ASUs will accelerate the revenue recognition of certain vehicle sales to customers or leasing partners with a resale value guarantee, which will therefore qualify to be accounted for as sales with a right of return as opposed to the current accounting as operating leases or collateralized lease borrowings.

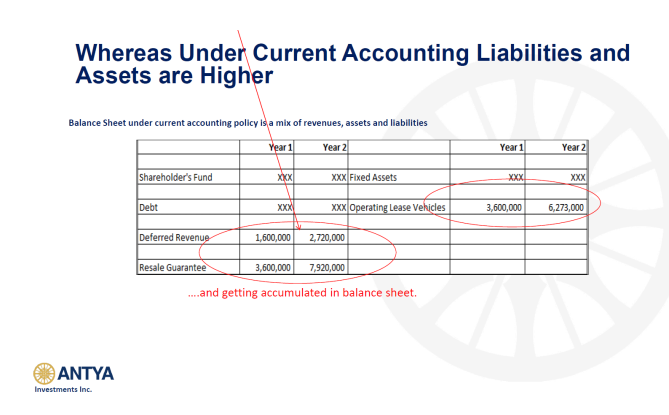

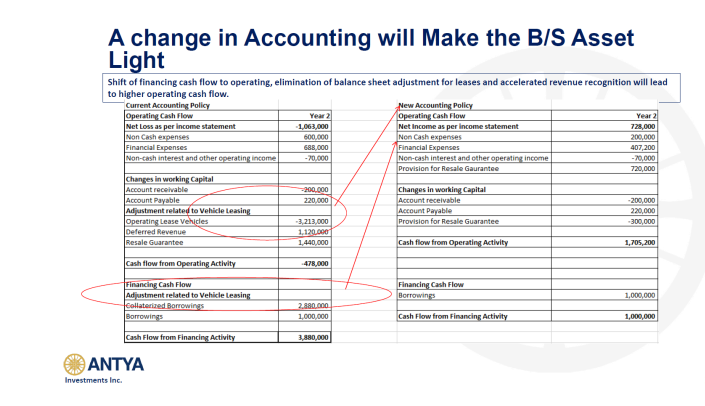

The most important aspect of newly adopted accounting policy is that Tesla’s balance sheet will become asset light, with lower liabilities associated with deferred revenue and residual value guarantees, lower assets related to operating lease vehicles. Cash flows from operations will get a boost as well, allaying bearish perceptions while providing fuel to bullish fires.

SC Capital has provided some additional colour on questions raised by us concerning one of their bearish reports in Tesla’s Indebtedness & Inefficiencies- -A Response to Comments on Our Recent Report. Respectfully, we remain unconvinced by their argument. However, we agree that their concerns are legitimate.

Our colleague Henry Kwon has also provided thoughtful comments on Part 1 of our report on Tesla’s accounting Tesla Inc. – Prophets of Doom Could Be Blown to Smithereens by Conservative Accounting.

We will follow up with Part 3 on May 2, 2018, with our best estimate of Tesla’s restated financials. Stay tuned!