In ANTYA’s view, the worst is behind Tesla Motors Inc (TSLA US). A barrage of criticism in the media failed to dislodge current management at the AGM on June 5, 2018. Furthermore, the update provided by Musk was as per the expectations of long-term shareholders, whereas those looking for additional ammunition to vilify Tesla’s management went home empty-handed. Although Tesla is not out of the woods either operationally or financially, there is enough head-room on both counts for the optimists like us to maintain our bullish view on the stock.

At Tesla Inc.’s shareholder meeting on June 5, 2018, Elon Musk carried the day, when long-term stockholders comprehensively defeated dissident shareholder proposals in favour of maintaining the status quo. That suggests long-term investors continue to hold sway over the company and the distracting media din was just that.

There were only four proposals at the meeting. We provide details on the two that mattered to investors

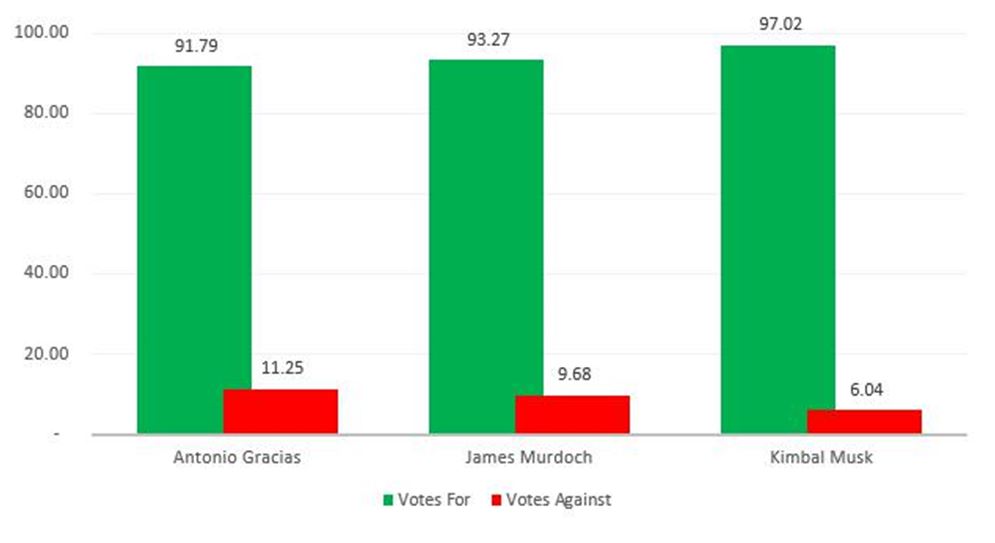

Proposal 1: This proposal brought forward by CTW Investment Group said that James Murdoch, Kimbal Musk and Antonio Gracias should be removed from the board of Tesla Inc. As highlighted in Figure 1, shareholders voted overwhelmingly to re-elect management’s slate, defeating the insurgents.

Figure 1: Management’s Slate Re-elected – Votes in Millions – Abstentions and Non-Votes Excluded

Source: Tesla Inc. 6K Filing & ANTYA

Kimbal Musk is the brother of Elon Musk, who joined Tesla’s board after the SolarCity acquisition. Antonio Gracias is a board member at SpaceX and is also a board member of SolarCity. James Murdoch of Twenty First Century Fox Inc (FOX US) is well-known to investors already. Given the significant number of media stories outlining the need for change at Tesla, the faith reposed in the current board by long-term investors illustrates the need to duck the public relations driven lobbying and media stories and focus on the facts at hand.

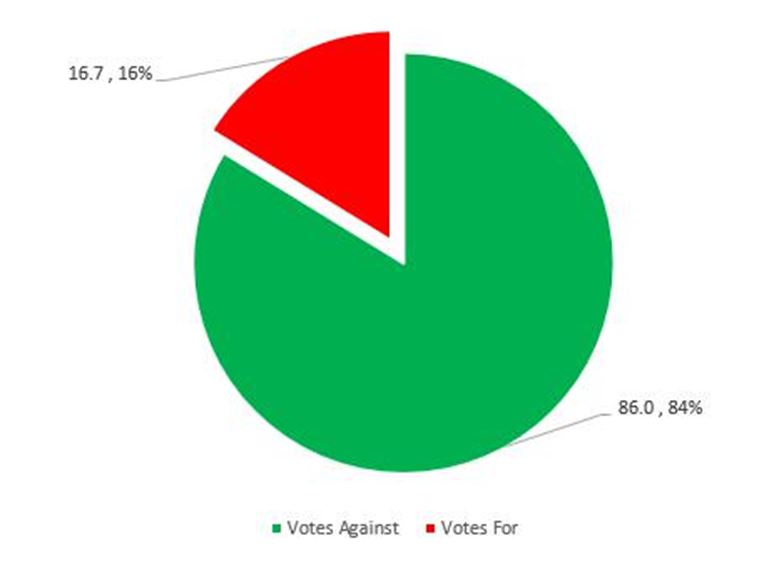

Proposal 3: This was another contentious proposal brought forth by a shareholder seeking to split the CEO and Chairman role, i.e. requiring that Musk give up his role as the chair of the board. Figure 2 highlights that shareholders weren’t pleased with that either given that an overwhelming 84% of the counted votes went against the said proposal allowing Musk to retain both his positions.

Figure 2: Elon Musk Retains Control – Vote Count in Millions – Abstentions a Non-Votes Excluded

Source: Tesla 6K and ANTYA

Once the results were released, Tesla’s stock shot up and gained approximately 10% after market hours. That suggests near-term uncertainty related to governance, management and Twitter-related jitters are likely behind the company. It should calm Musk’s nerves, and in our view it ought to be back to business as usual.

In ANTYA’s view, the business is exhibiting strength and is in great shape. We highlight, and provide commentary on additional details from the shareholder Q&A.

Translating Musk Speak with ANTYA Follow Through

On Model 3 production Musk believes it is quite likely that;

We will achieve 5,000 cars a week by the end of this month [i.e. by June 30, 2018]” [emphasis added].

ANTYA View : The company is already building cars at the rate of 3,500 per week. Two production lines are running seven days a week, and a third production line is under construction. The plan is to get to 10,000 cars per week in Q1-Q2 2019.

On capital requirements Musk believes that;

… it’s really looking like we are going to have positive GAAP net income next quarter and as well as positive cash flow in Q3 and Q4. And we, as I’ve said before, do not expect to need to raise any incremental debt or equity.

ANTYA View: This is beginning to sound like a broken record with the entire world focussed on Tesla’s low cash-cushion given its capital expenditure and working capital needs while Musk plays the hard to get bride. As illustrated in our accounting pieces, Tesla Inc. – For Whom the

Accounting Bell Tolls, Tesla Inc. – New Accounting Policy – ANTYA Explains Impact on Financial Statements – Part Two and Tesla Inc. – Prophets of Doom Could Be Blown to Smithereens by Conservative Accounting, many investors are overlooking the accounting idiosyncrasies at play in Tesla, and hence overestimate the company’s cash burn and its cash requirements.

Nonetheless, we do believe Tesla needs more capital especially given its expansionary footprint. Therefore, perhaps it is a play on words. Maybe, Musk means not in 2018 or perhaps he implies not for Model 3. Possibly he says not for upcoming debt repayment in 2019. We don’t want to speculate, but if Tesla expands, which it will, a capital raise is inevitable. We believe among the plethora of options that he has, selling equity in the form of convertible debt tied to Tesla’s Shanghai factory and operations is most likely. It will be non-recourse to Tesla Inc.’s operations in the USA. Tencent Holdings Ltd (700 HK) is likely to be a minority partner in that endeavour. Tencent could fund its stake by monetising its Spotify Technology SA (SPOT US) investment, or from the proceeds of its Tencent Music IPO.

Musk Confirms China Factory

“I think we’re close to announcing a combined vehicle and battery pack factory. So future Gigafactories will include vehicle and battery pack and powertrain as a single integrated unit. And we’re close to announcing something in China that I don’t know, Robin, do you want to talk about that? We don’t want to make an announcement exactly. Maybe just talk about like a preamble or something, I don’t know. So Robin is the Head of Worldwide Sales for Tesla.

Thanks, Elon. I didn’t expect to talk about this. So we’re incredibly excited to build first Tesla Gigafactory outside of the U.S., in China, specifically. It’s going to be in Shanghai. And we have been holding discussions with the government, various governments in China, really great discussions, great partners. We really look forward to working with them in the years to come. This is going to be the next generation of Tesla factory. We’re super excited. The stuff that we’re going to be putting there and the cars that we’re going to be building in that factory is going to be incredible. So we’re going to announce something, really, all the details really, really soon

ANTYA View: A China factory is a game changer for Tesla, and for the conventional automotive industry. Tesla is in the enviable and unassailable position of owning its factory 100% in China if it chooses to do so, unlike the other auto majors. Tencent already supported current management in the latest shareholder vote. Perhaps there is a quid pro quo on that.

On Tesla’s market share in the U.S. Musk said;

We just became, in May, the best-selling midsized premium sedan in the United States of any kind”.

ANTYA View: That is believable given that Tesla’s market share is up 36.4% yoy, whereas, Audi ( Volkswagen AG (VOW GR) and Daimler AG (DAI GR) were flat, while Bayerische Motoren Werke AG (BMW GR) rose 3.3%.

Given that for the German automakers the mid-level A4, BMW 3 Series, and Mercedes C class are the workhorses, strength in Tesla’s sales would undermine those premium segments. With all-wheel drive, dual-motor and a more refined and advanced autopilot on the way, pressure on German automakers is bound to increase further in one of the largest and most profitable premium auto markets in the world.

On the supercarger network Musk said;

Tesla is approaching 10,000 superchargers worldwide, with the goal of going almost anywhere on earth using a Tesla supercharger station. A fully integrated supercharger station with a solar roof, solar battery storage, and Tesla charging stations called, “Supercharger Generation 3” is on its way by the end of the year.

ANTYA View: Undoubtedly this will be a competitive advantage for Tesla, and others are playing hard to catch up with the cost of entry rising exponentially with each passing day. Network economics will continue to favour Tesla.

On battery production Musk said;

Next quarter, at the Gigafactory we expect to make more battery capacity than all other EVs combined worldwide, including China.

ANTYA View: Tesla’s achievements are no mean feat and foreshadow better technology, faster learning, a lock on raw materials and production equipment, and an improving price/kWh outlook, as well as longer driving distance, for Tesla cars. Tesla has also engineered cobalt [almost] out of its battery pack, improving the cost structure and reducing its environmental footprint.

On new products Musk said;

And we’ve got some exciting products in the works. The Model Y is really going to be something super special. We are aiming to unveil the Model Y approximately March next year, and then go into production about maybe around 2 years from now. Maybe a little less than 2 years but basically first half of 2020 for production Model Y. Something similar for Semi and Roadster. So these products are shaping up. I think Semi and Roadster are actually going to be even better than what was unveiled. We figured out ways to improve the range and overall functionality of the Semi. In particular, the Roadster, we — what I unveiled with the Roadster was the base model performance. That’s — it’s going to have a SpaceX option package. It’s crazy.

ANTYA View: We are not worried about new product launches because as discussed, the entire technology is accessible via the screen, while the battery pack gets better with each passing day. The Model S of 2018 is different from and superior to Model S of 2012, although they look similar from outside. In our view, new models are more than the upgraded grill in the front, and that is well-taken care of at Tesla.

On battery cost and technology Musk said;

I mean, we think at the cell level, probably, we can do better than $100 per kilowatt hour maybe later this year. Depending upon what — on commodity prices. If commodity prices are roughly where they are today, they will probably do better than $100 kilowatt hour at the cell level. And then with further improvements to the cell chemistry, the production process and more vertical integration on the cell side, for example, integrating the production of cathode and anode materials at the Gigafactory and improved design of the module and pack, we think long term we can get below $100 kilowatt hour at the pack level, which is a key figure of merit for a car. But long term, meaning, definitely less than 2 years. That’s Tesla long term.

ANTYA View: If Tesla is iterating products on a two-year cycle, with software being a crucial part of it, supported by leading-edge battery technology, then Tesla is not an auto manufacturer, although it is in the transportation business. So if one were to look at Microsoft Corp (MSFT US),

Alphabet Inc Cl C (GOOG US), Apple Inc (AAPL US) or Facebook Inc A (FB US) as platform companies, then Tesla is moving in a similar direction with a market cap that is less than 1/15th of most of these players.

On autopilot making significant progress Musk said;

We’ve been pursuing 2 paths: one really complicated path that I think isn’t working that great; and then a simple path that I think will work pretty well. I mean, I was able to drive last night, go from highway on-ramp to highway off-ramp using the simplified version of the control system, and I think with some further effort, we can get that out in the next couple of months. Yes.

ANTYA View:

We are not autopilot experts. We will leave the readers or the users of the car to make sense of these statements.

Autonomous – LIDAR or NOT!

Well, I think LIDAR will be seen as — what LIDAR tends to drive companies to do is to go to a local maximum in terms of autopilot capability or autonomous driving capability. And LIDAR ends up being like somewhat of a crutch. It’s helpful to get almost there, but if you rely on it, you will never get – actually get there is my opinion. So you have to make vision work extremely well in order to achieve true self driving. Once you’ve made vision work extremely well, LIDAR is really unnecessary. It’s not really adding anything. We do have sophisticated sonar, like ultrasonic sensors around the vehicle for near field. And we do have a forward radar system, which is useful for detecting objects even in fog, sort of snow, rain, like low visibility conditions where you can’t see what’s going on. And that’s also a case where LIDAR is ineffective because LIDAR is an active photon generator in the physical spectrum. This doesn’t make sense to me because you have a massive amount of incoming photons in the visible spectrum normally. So if you’re going to do active photon generation, the 400 to 700 nanometers is the wrong wavelength – or on that order is wrong wavelength. You only want to be aiming for something that’s around 4-millimeterwavelength because that is occlusion penetrating.

ANTYA View: Recently we discussed the JV announcement of Softbank and General Motors in our report GM & Vision Fund JV Highlights Tesla Inc. Is Significantly Undervalued; Stock Is Headed Higher. GM and most other auto manufacturers have hitched their wagon to LIDAR. More on LIDAR is available in William Keating’s work. Softbank’s investment may be a vote for that technology but may not mean much for the outcome.

Android, iOS, Windows, Linux all exist and serve different customer segments. Again, we are not experts, and hence we maintain faith.