As per its news release of April 03, 2018, Tesla Inc. (“Tesla”, “TSLA” or the “Company”) produced 34,494 vehicles, which was a 40% increase from

Q4-17 production of 24,565 cars. More importantly, all eyes and ears were on the production run rate for Model 3. On February 7, 2018, Elon Musk guided the street to a weekly production run-rate of 2,500 vehicles exiting Q1 and 5,000 exiting Q2-18. President Trump’s Twitter storm on global trade and Tesla-specific news stories on the web contributed to a highly volatile quarter for Tesla with both its stock and bonds suffering substantial declines in the quarter.

Nonetheless, Tesla almost delivered the goods with production of Model 3 ramping to 2,000/week, and the Company now forecasting that all three models – Model S, Model X, and Model 3 – are being produced at a rate of 4,000/week. At that rate the company is on track to build and sell approximately 190,000 cars compared to 101,000 in 2017, implying YoY growth of 90%.

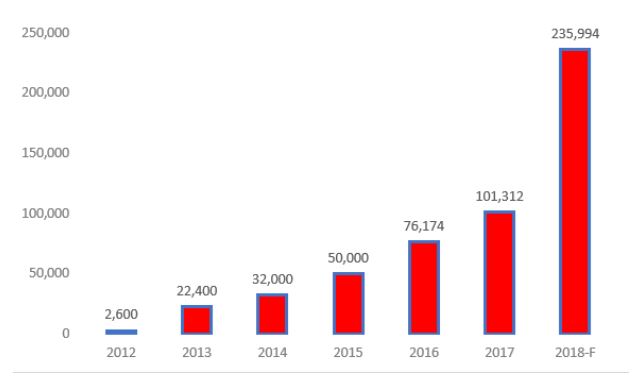

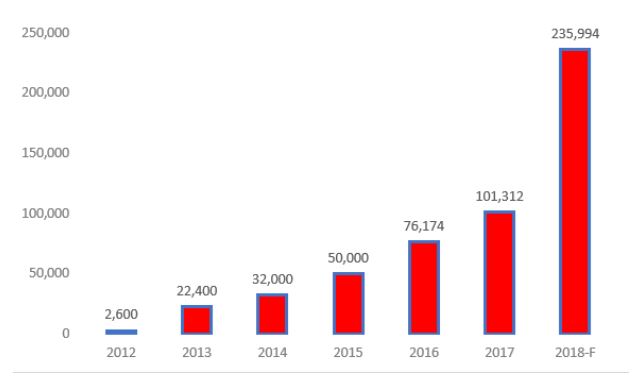

We believe Tesla will exceed this number. Figure 1 illustrates what Tesla has achieved since 2012, and then we can discuss what is coming down the pipe?

Figure 1: Phenomenal Operational Success – Customer Deliveries of all Models

Source: Tesla Inc. and ANTYA Investments Inc.

In our view, the Company has been forthcoming in its disclosures to investors regarding the challenges inherent in scaling up the production process surrounding Model 3. Although the company missed initial guidance as it underestimated the production line challenges at the end of Q4-17, on January 3, 2018, Tesla disclosed that it was approaching a run-rate of 1,000 Model 3’s/week. With the production of 9,766 Model, 3’s the Company undershot by around 20%. However, with production ramped up to 2,000/week, Tesla has once again introduced optimism into its forecast by saying “we expect that Model 3 production rate will climb rapidly through Q2. Tesla continues to target a production run rate of approximately 5,000 units per week in about three months …”.

ANTYA’s 2018, vehicle production forecast incorporates 100,000 models S/X, and 136,000 Model 3’s. That is a run-rate of around 2,600/week for Model 3. Nonetheless, if that run-rate averages any higher, we would have underestimated the production ramp.

What’s holding back Model 3?

Tesla discloses that bottlenecks related to battery manufacturing at its Gigafactory are the primary constraint. That line is built and managed by Panasonic, and hence Musk’s constant acknowledgment and appreciation for the Company’s suppliers and dedication to solving operational issues.

Model 3 volume production has been less than we initially anticipated due to production bottlenecks, with the battery module assembly line at Gigafactory 1 being the primary production constraint to date, although future bottlenecks in other areas of vehicle manufacturing may surface. We have redirected our best engineering talent to Gigafactory 1 to fine-tune the automated processes and related robotic programming not only to address the challenges we have experienced but also to continue evaluating our overall manufacturing process for efficiencies.

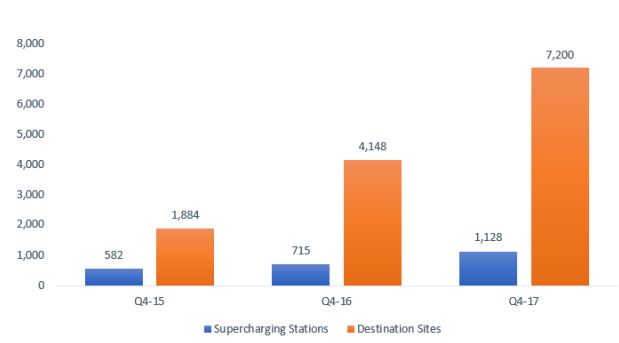

Yes, There are Other Challengers, But Where are the Superchargers?

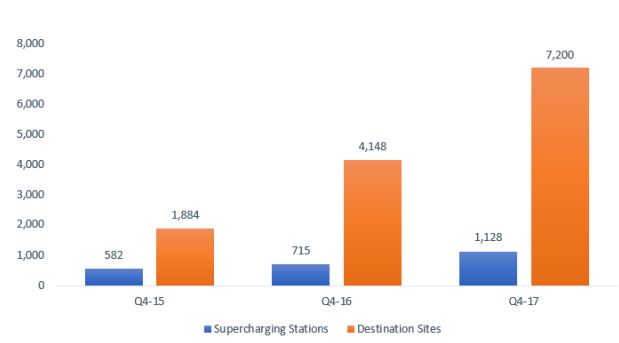

An often-overlooked fact when considering the emergence of competition in the EV space is the lack of charging infrastructure for Tesla’s competitors. Strategically, that is erroneous because then buyers of those cars are limited to the confines of their charging catchment area, whereas at least in North America Tesla owners drive coast to coast and across the border into Canada knowing that the car can be charged. The wall pack from the energy division could be used as a super-charger at home if not currently soon enough, and then Tesla would have solved the speed of charging, and where to charge the problem concurrently. Figure 2 presents data on supercharging stations.

Figure 2: Stress-Free Driving

Source: Tesla Inc. and ANTYA Investments Inc.

As defined by Tesla, “The Tesla Supercharger is an industrial-grade, high-speed charger designed to recharge a Tesla vehicle significantly more quickly than other charging options. To satisfy growing demand, Supercharger stations typically have between six and twenty Superchargers and are strategically placed along well-traveled routes to allow Tesla vehicle owners the ability to enjoy long-distance travel with convenient, minimal stops. Additionally, we are also building Superchargers in an increasing number of city centers to enable urban use. Use of the Supercharger network is either free or requires a small fee.”

In ANTYA’s opinion, the supercharger is grabbing significant strategic and locational advantages and increases the cost of entry for every subsequent manufacturer that enters the space. The first question a prospective EV customer asks is; where do I re-charge when on the road?

We hear that the answer from Tesla’s competitors is a raised eyebrow!

In our view, the absence of superchargers implies higher-end vehicles such as those being planned by Mercedes-Benz, Audi or BMW could find an audience amongst the well-heeled as a 2nd or 3rd car, but in the mass market, competitors could be left holding the proverbial bag.

Conclusion

Tesla will be a volatile stock subject to the onslaught from multiple sources, including those that are short the stock. One of the biggest names in the business, David Einhorn has underperformed the S&P 500 and has been famously short Tesla and Amazon Inc. amongst others. His gripe is that the market and investors have lost touch with reality and that the valuation doesn’t justify the price. John Maynard Keynes said, “The market can stay irrational for longer than you can stay solvent.”

Those short Tesla better remember Keynes, because if at the end of Q2-18, Tesla hits a Model 3 ramp of 5,000/week, the bonds will become investment grade, the stock will approach $400, and Musk will send another roadster to space. If the Model 3 ramp to 3,000/week some volatility will ensue while at 4,000/week the market will cheer.

Stay tuned for more on Tesla.