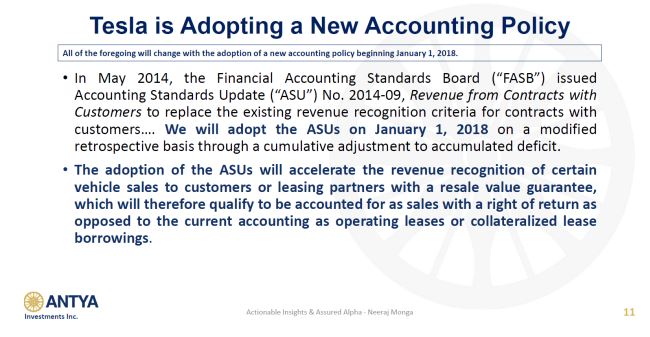

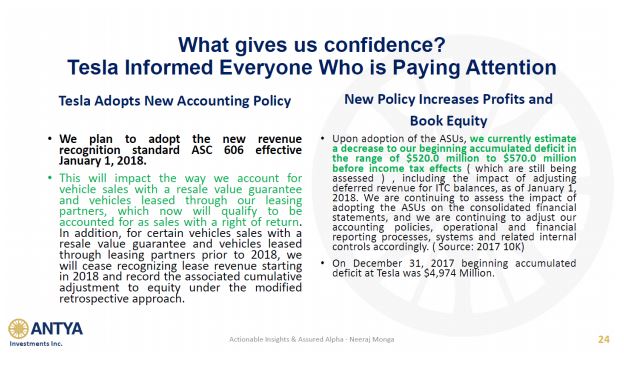

Part 3 of our report on Tesla Motors Inc (TSLA US) highlights our best estimate of re-stated financials under the new accounting policy. We believe Tesla’s book equity could get a boost of $520-$570 million, upon retrospective adoption of the new policy. Given Model 3 production problems, reported accumulated deficit of $4,974 million, may not decline by a similar amount, if there are any impairments associated with its current processes.

This report is a continuation of our earlier reports on Tesla including Tesla Inc. – Prophets of Doom Could Be Blown to Smithereens by Conservative Accounting followed by Tesla Inc. – New Accounting Policy – ANTYA Explains Impact on Financial Statements – Part Two. It is also a counterpoint to Tesla’s Indebtedness & Inefficiencies–A Response to Comments on Our Recent Report and other bearish views on Tesla.

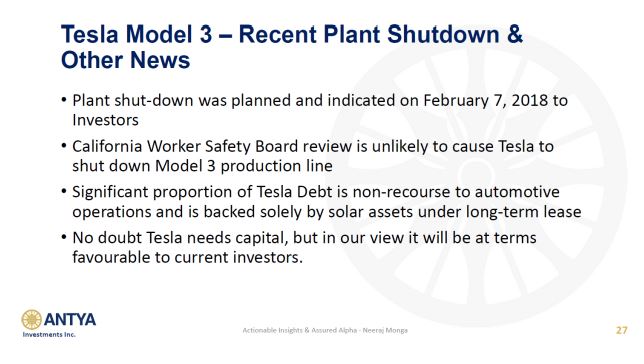

One of the reasons Tesla has been volatile and has under-performed expectations is that Model 3 did not ramp up as planned.

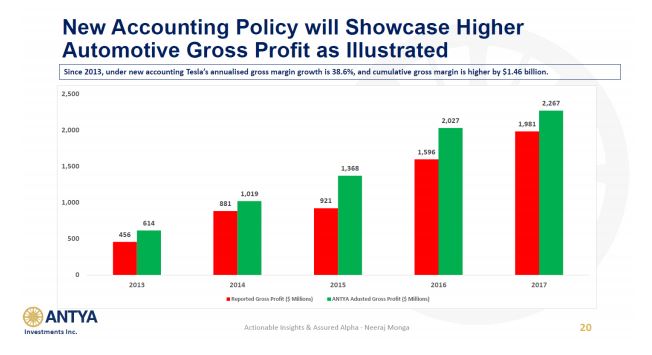

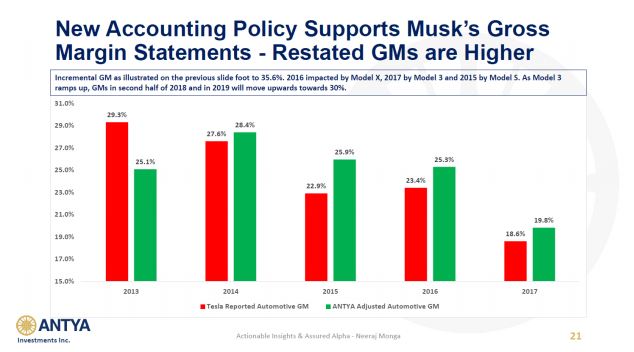

That the business model has underlying strength is evident in 2015 and 2016, when the company was ramping up production processes, adding workers to the shop-floor, investing in tooling lines for Model S, Model X, and Model 3. Even then gross margins continued to march upwards, accompanied by volume growth, implying economies of scale and scope are working through the system.

Gross margins as highlighted by us are inclusive of the loss-making services segment, which is still scaling up. Moreover, tooling costs and labor costs are fully allocated to the cost of sales and manufacturing lines, whereas it is no secret that automotive volumes are still catching up to capital investments. Therefore, when Musk says that at a fully ramped-up Model 3, Tesla will get to 30% or more in GM, he is not shooting for the stars, but estimating attainable targets.

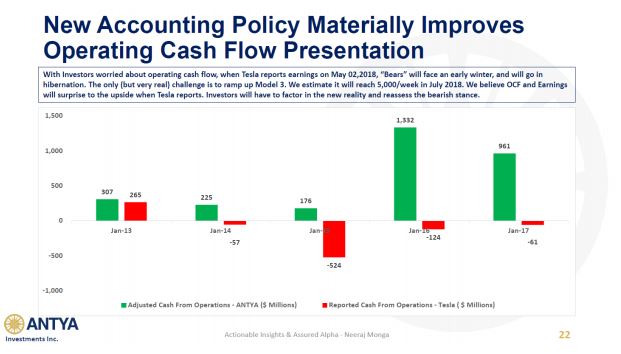

This brings us to the biggest peeve of the bears. Their refrain is that Tesla is burning cash like there is no tomorrow. There is a crass cartoon on Bloomberg’s site with musk throwing wads of cash into a flame thrower. Please check it out.

In our view, this is where the Bears are WRONG and do not know what they are talking about, except regurgitating 3rd party opinions. Cash flows from operations as restated by ANTYA and illustrated in the slide below, have never been negative at Tesla. Yes, there is cash burn after capital expenditures, but all growing businesses have cash-burn. That is not news to investors, especially to growth investors. Amazon.com Inc (AMZN US) with its cult status and an insurmountable valuation is barely cash flow positive in the company’s own words discussed by Rickin Thakrar in one of the insights.

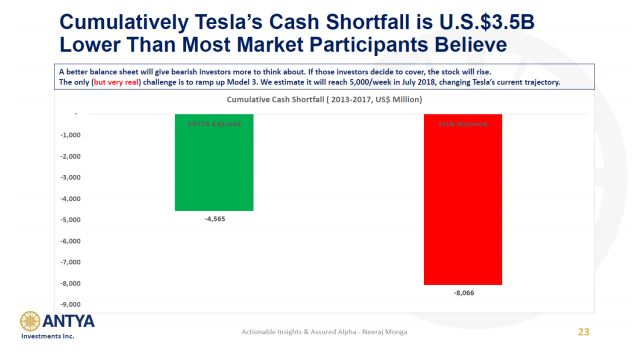

Bears say Tesla burned through $8 billion dollars of cash since 2013. We say Tesla burned through $4.5 billion of cash.

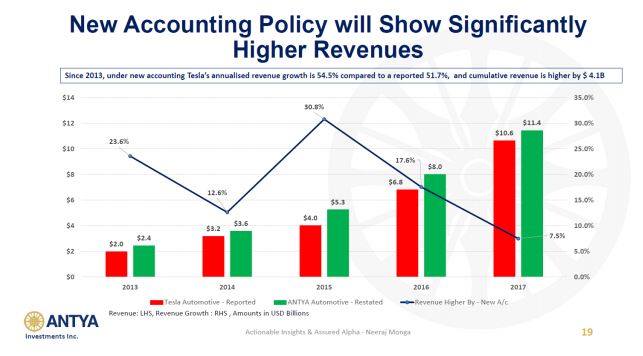

Bears say Tesla is loss-making. We say once again that Tesla is profitable in some years, otherwise, the beginning accumulated deficit cannot decline upon restatement, unless there is some funky accounting that we do not understand as shown in the slide below.

As far as an update on Model 3 is concerned, we should get that during the conference call.

Conclusion

In our twenty years on Bay Street and Wall Street, we have seen enough bull and bear battles to not be perturbed. In our view, in the investment business, all analysts and fund managers including yours truly, are correct at only a point in time, and only for a certain time period. Then we move on to the next big-big, win-lose situation.

Nothing Lasts Forever.

Tesla Bulls and Bears won’t last either, because, either we are all going to Mars in a roadster, or becoming road-kill due to the coming avalanche of EVs from China. There is no other future.

Unless you are a space traveler and then it either belongs to Blue Origin or to SpaceX.

The point being, there is no escaping Musk.

Take your pick 🙂