In ANTYA’s view, TME is another IPO where investors need to pay attention to the valuation because like the online lending boom in China which fizzled out pretty quickly, live-streaming of entertainment content is a me-too business model employed by TME fighting for the same eyeballs and advertising dollars that other more established players such as Momo Inc (MOMO US), YY Inc ADR (YY US), HUYA Inc (HUYA US), Bilibili Inc (BILI US) are also competing for. More importantly, with online gaming revenues in China, both on the PC and on the mobile under an increasing threat of decline for a few years ( For more on that Tencent Holdings: China’s “One Foot, One Punch, One Inch” Initiative Undermines Tencent. ), we believe that all live-streaming players will devote more resources towards entertainment content, thereby pressuring industry margins.

Tencent Music Entertainment (TME US) (“TME” or the “Company”) has unintentionally launched its IPO in times of souring global equity markets, and an escalating trade battle between China and the United States. Nonetheless, long-term investors will bite the bullet in these trying times, and subscribe to the IPO, if they find a medium to longer-term value. Every IPO from China on NASDAQ or the NYSE is sold and marketed as providing unique access to a growing market. Some of it has proved to be true, as in the case of Baidu Inc (ADR) (BIDU US) and Alibaba Group Holding (BABA US), whereas in the case of others such as Qudian Inc (QD US) it has proved to be a damp squib.

Amongst the more recent IPOs from China that listed in Hong Kong, are Xiaomi Corp (1810 HK) and Meituan Dianping (3690 HK). We have been cautious on both as discussed in several insights including Xiaomi Inc. – IPO Priced at the Bottom of Range – 50% Downside Forthcoming and Meituan Dianping– As Good As It Gets?

In ANTYA’s view, TME is another IPO where investors need to pay attention to the valuation because like the online lending boom in China which fizzled out pretty quickly, live-streaming of entertainment content is a me-too business model employed by TME fighting for the same eyeballs and advertising dollars that other more established players such as Momo Inc (MOMO US), YY Inc ADR (YY US), HUYA Inc (HUYA US), Bilibili Inc (BILI US) are also competing for. More importantly, with online gaming revenues in China, both on the PC and on the mobile under an increasing threat of decline for a few years ( For more on that Tencent Holdings: China’s “One Foot, One Punch, One Inch” Initiative Undermines Tencent. ), we believe that all live-streaming players will devote more resources towards entertainment content, thereby pressuring industry margins.

We also believe that as the smallest player, TME will have to bid for talent and content aggressively. The Company’s music streaming business could come under pressure too as competitors vie to build additional revenue streams to diversify business model risks and gain more recurring payment revenue streams. Therefore, as a master licensee for some of the music TME will show revenue growth, but not the type that investors pay a premium for.

The Valuation Yardstick

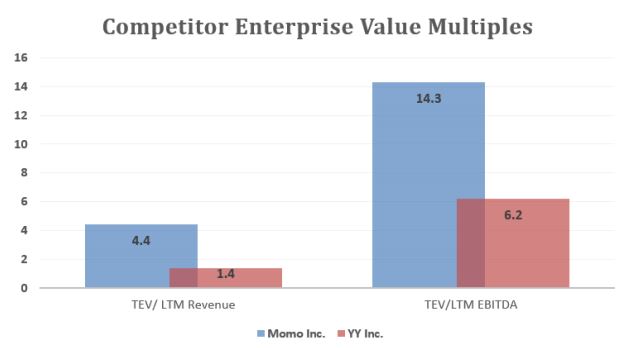

Instead of building a model to forecast what may or may not be, we decided to use a benchmarking approach to estimate the equity value for TME. In Tencent Music Entertainment Group– Competitors Aplenty Imply No Differentiation Except Moniker, we provided an overview of the competitive landscape regarding live streaming companies and also outlined that the two that are closest to TME are MOMO and YY. Figure 1 outlines the valuation conferred upon the two by investors currently.

Figure 1: No Reason to Accord a Higher Value to TME

Source: ANTYA Investments Inc. and Company Disclosures

We excluded HUYA, and Bilibili from the multiples outlined in Figure 1, because although in the live-streaming business, those companies are focussed on social-gaming, whereas MOMO and YY are direct competitors of TME. Consensus revenue and EBITDA growth estimates for both companies are presented in Figure 2.

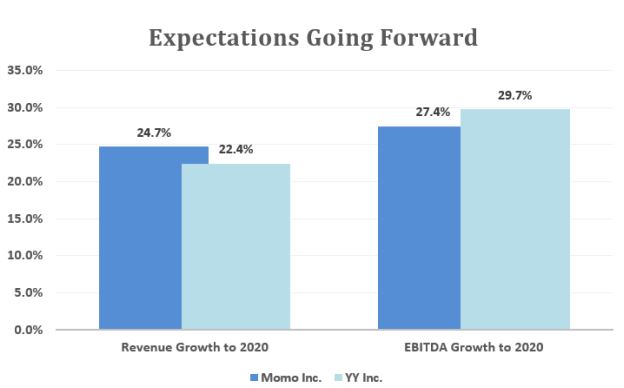

Figure 2: Both Momo and YY are Growing Strongly

Source: ANTYA Investments Inc. and Company Disclosures

Revenue and EBITDA growth expectations sourced from Capital IQ (estimate of 22 analysts) are robust for both MOMO and YY, with both companies expected to grow revenue and EBITDA in excess of an annualized rate of 22%. We have estimated the growth data based on forecast 2018 year-end numbers, which could change. For the first half of 2018, TME’s revenue increased exponentially (more than 90%), and perhaps it can maintain the

same rate for the remainder of 2018. However, given stagnant ARPU at both its music-subscription and live-entertainment businesses, unless penetration changes materially in 2019, TME’s revenue growth will fall in line with that of its compatriots.

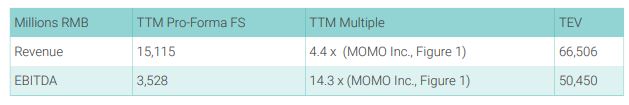

Pro-Forma Financials of TME

Figure 3 illustrates the proforma financials of TME sourced from the prospectus.

Source: ANTYA Investments Inc. and TME Prospectus

On a TTM basis, TME achieved a gross margin of 39% and an EBITDA margin of 23%. The Company’s Pro-forma EBITDA margin as calculated by us could differ marginally from the actual numbers due to our inability to accurately uncover D&A for the second half of 2017. We allocated 50% of annual D&A for 2017, to the second half. On that basis, Figure 4 presents our estimate of the enterprise value of TME.

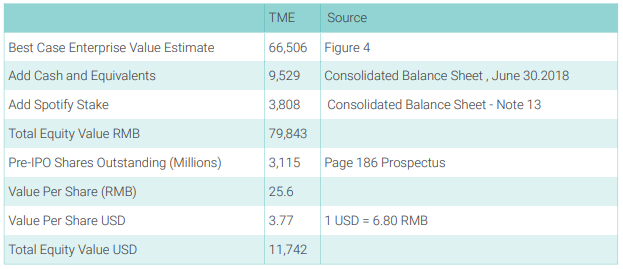

Best Case Valuation Estimate

Figure 4: Best Case Enterprise Value Estimate of TME

Since our intent is to provide a best-case estimate of equity value, we focus on the higher number, i.e. RMB66.5 billion, and use that in Figure 5 to arrive at a best-case equity value for the Company’s shares.

Source: ANTYA Investments Inc.

Our calculations based on the benchmarking to relevant competitors suggest that TME’s equity is worth RMB 25.6 or USD 3.77 per share.

That compares to a value of US$2.96 per share paid by Warner Music Group (“WMG”) and Sony Music Entertainment (“SME”) on October 1, 2018. We outline below in quotes, the disclosure from page F-102 of the prospectus.

On October 1, 2018, the Company entered into certain share subscription agreements with each of WMG China LLC (“Warner”), an affiliate of Warner Music Group, and Sony Music Entertainment (“Sony”) pursuant to which the Company agreed to issue to these two strategic investors, subject to the satisfaction of certain customary conditions, a total of 68,131,015 ordinary shares for an aggregate cash consideration of approximately US$200 million.

Shares sold to WMG and SME are subject to a lock-up period of three years, and hence are offered at a liquidity discount, considering that the “fair value of the Company’s shares was set at US$4.0363 per share in March 2018 to sell shares to outside investors.”

ANTYA’s current fair value of the Company is lower than its last funding round. Since then RMB is down approximately 10% as well.