Tencent Music Entertainment (TME US) was created via a reverse merger whereby Tencent Holdings (700 HK) combined its music apps with those of China Music Corporation to create an online music behemoth. While subscription-based online music is still in its infancy in China, live video streaming appears to be a part of the mainstream. The question that investors need to answer is that given that TME is not really a music subscription service, what multiple should be paid for a fast growing Chinese media company?

Tencent Music Entertainment (TME US) (“TME” or the “Company”) has been positioned as the Spotify Technology Sa (SPOT US) of China. We have already discussed our reservations regarding that moniker in Tencent Music Entertainment Group – Much Ado Nah Music About Nothing! and so have others including Tencent Music Entertainment IPO: The Bear Case. This insight is about certain idiosyncrasies as observed by us regarding the acquisition of China Music Corporation (“CMC”) and disclosures surrounding paying subscribers.

Reverse Merger with China Music Corporation in 2016

On July 12, 2016, Tencent acquired CMC, a major online music entertainment platform in China, through a series of transactions pursuant to which Tencent obtained a controlling interest in CMC and CMC’s operations were merged with Tencent’s QQ Music and WeSing businesses.

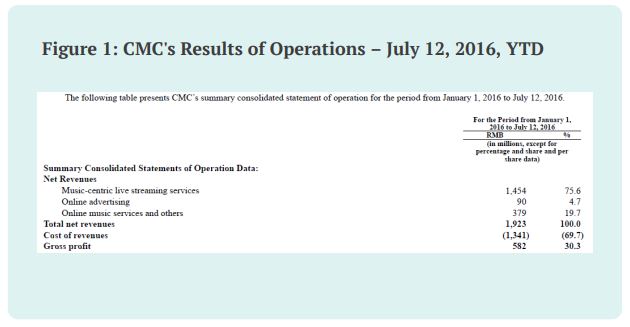

For the period from January 1, 2016 to July 12, 2016, CMC’s total revenues and net loss was RMB1,923 million (US$288 million) and RMB152 million (US$23 million), respectively.

Figure 1 highlights CMC’s results as reported in the prospectus by TME.

Source: ANTYA Investments Inc. and TME Prospectus

As illustrated, CMC has a half-year revenue run-rate approaching RMB2.0 billion, with the live streaming business contributing more than 75% of revenue, while online music subscription services contributed 20%, and the rest accounted for by advertising.

As per the prospectus issued by TME;

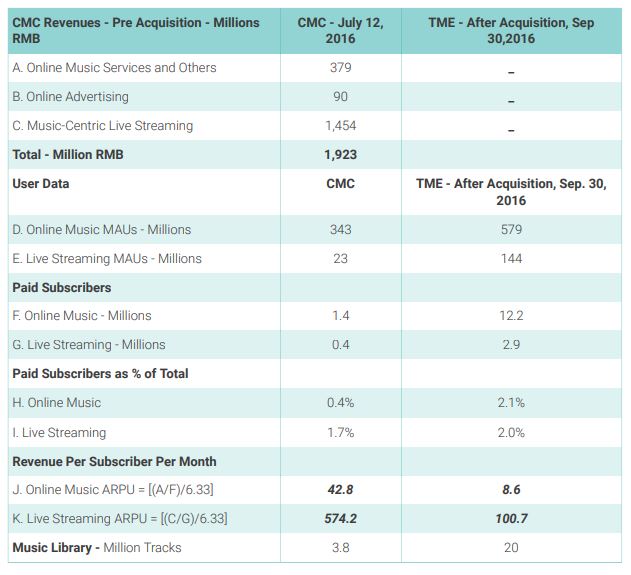

Prior to the acquisition, CMC operated a leading online music entertainment platform with a large user base and content library. For the three months ended June 30, 2016, mobile MAUs of CMC’s online music services and live streaming services were approximately 343 million and 23 million, respectively, and the number of CMC’s paying users for its online music services and live streaming services were approximately 1.4 million and 0.4 million, respectively. As of March 31, 2016, CMC’s content library included approximately 3.8 million tracks. Therefore, we believe that CMC has contributed materially to our business.

In ANTYA’s view, if that disclosure is correct, i.e. not erroneous concerning an inadvertent mistake creeping in while disclosing “paying users”, then Figure 2 highlights ARPU-related questions that are bound to arise in investors’ mind.

Figure 2: User Metrics – CMC and TME – ARPU Data Require Scrubbing

Source: ANTYA Investments Inc. and TME Prospectus

Reconciling the ARPU Differential

Based on Figure 2 we surmise that either paid subscriber data or MAUs data, or both, at TME, needs to be reconfigured, or that subscribers that TME had before the CMC acquisition and those that it is acquiring since are not keen on increasing spending on TME’s live streaming shows and for online music subscriptions.

Based on the following default assumptions that:

- TME’s subscriber data are correct

- The composition of TME’s subscriber base did not change materially between July 12, 2016, when the CMC acquisition closed, and September 30, 2016, when TME reported subscriber numbers on a consolidated post-acquisition basis; we estimate the following.

- Pre-acquisition video streaming subscribers at TME generated approximately RMB25.5 in ARPU compared to those acquired from CMC who was 20 x as valuable.

- Pre-acquisition music streaming subscribers at TME generated an ARPU of RMB4.1 or thereabouts compared to RMB42.8 at CMC, meaning CMC subscribers were 10 x as valuable.

- [ CMC subs approached Spotify ARPU levels, meaning CMC enjoyed a first-mover advantage that captured higher-value subscribers willing and ready to pay for streaming music services early on, with price-sensitive laggards joining the platform later]

After the CMC acquisition, music streaming ARPU has been level, and barring Q2-18, live streaming ARPU has been flat too. Therefore, TME’s avowed pedigree has been of little help in securing higher-paying subscribers for the platform. We discussed TME’s ARPU challenges in Tencent Music Entertainment Group – Much Ado Nah Music About Nothing!

It also re-emphasizes the oft-repeated experienced in the tech-world that leadership in one category does not automatically translate into leadership in another.

As an aside, for those that are keeping score, according to the prospectus, goodwill foots to RMB16.2 billion for the most recently ended quarter. We estimate that RMB15.7 billion that is attributable to the reverse merger with CMC.