The current melee between China and the United States concerning trade is throwing markets in disarray. We believe that is also presenting exciting and relatively low-risk investments to benefit from the uncertainty in the short-term. One of those plays is ….

President Trump’s views on global trade have roiled the capital markets, and given heartburn to investors, politicians, and corporate executives alike. M&A deals have either been restructured or abandoned, are being challenged in the courts, or have been put on the backburner by interested parties. Broadcom Limited’s proposal to acquire Qualcomm Inc. was one of the most combative takeover battles in recent history, where ultimately CFIUS intervened and declared Qualcomm off-limits, although it was evident that shareholders of Qualcomm were leaning towards Broadcom’s proposal.

Entwined in the Qualcomm Inc (QCOM US) – Broadcom Corp Cl A (BRCM US) story which met an unlikely end is the fate of NXP Semiconductors NV (NXPI US), which Qualcomm is proposing to acquire. The deal announced with much fanfare in October 2016, first met resistance from activist funds that caused Qualcomm to raise its offer from US$110/share to US$127.50/ share in April 2018 discussed here and in Qualcomm: Pinned into an Uncomfortably Tight Corner, Elliott Values NXP at $135 Per Share. Subsequently, on April 19 QCOM informed investors that it was refiling its proposal to acquire NXP with the Ministry of Commerce (“MOFCOM”) in China. Details are available here. As per the release, the closing date of the proposed transaction is now extended to July 25, 2018.

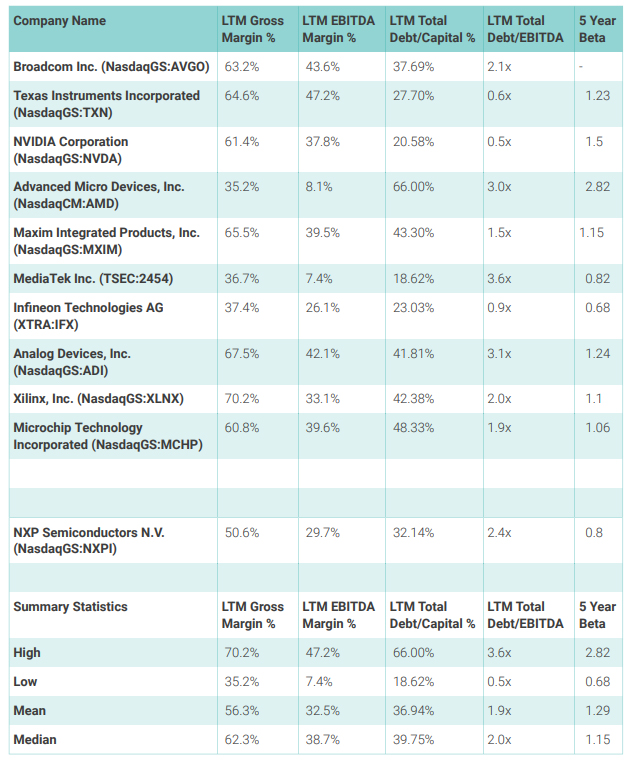

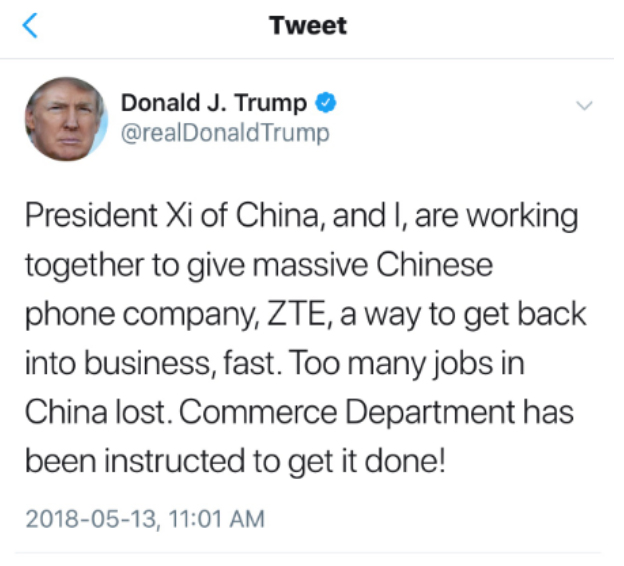

Investors reacted unfavorably to the announcement dumping NXP stock which is currently trading at approximately $99/share or 22% below QCOM’s revised bid. In our view, this uncertainty has created a reasonable risk opportunity for a trading position that could provide 15%-17% upside on a probability adjusted basis. As highlighted in Figure 1, NXP is trading at a favorable valuation compared to its peers in the industry.

Figure 1: Bench-marking Valuation

Source: Capital IQ

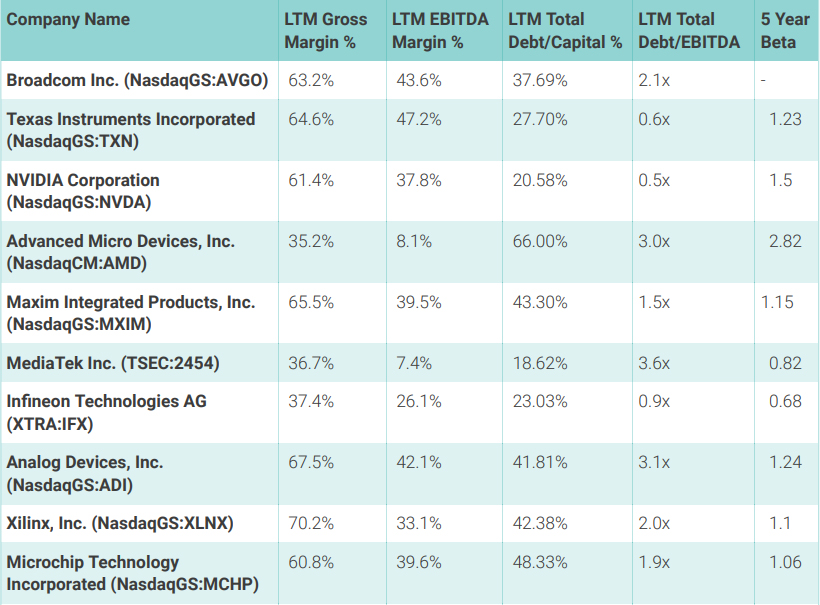

Based on a multiple of revenue as well as on an EV/EBITDA basis, NXP is trading at a discount to the industry group. The mean EV/LTM revenue multiple is 6.1x while the average EV/EBITDA multiple is 20.1x. Not only that, but NXP also has lower volatility than the industry given its beta of 0.8 versus a mean of 1.29 for the comparator set. Details available in Figure 2.

Figure 2: NXP Operational Characteristics

Source: Capital IQ

Although LTM Total Debt/EBITDA of 2.4x is higher than the mean of 1.9x, the consensus forecast for NXP sourced from Capital IQ highlights $2.6B in free cash flow generation for 2019. At that level of free cash flow, NXP is prospectively trading at a 7.6% free cash flow yield, implying that a failure of QCOM’s transaction is priced in, but not a success.

Qualcomm is Appeasing China

Xiaomi Corporation (“Xiaomi”) of China recently filed a prospectus detailing its plans for an IPO. We find it interesting that Xiaomi provided an update on its relationship with Qualcomm as follows:

“We entered into a new multi-product patent license agreement with Qualcomm in April 2018, which replaced the multi-product patent license agreement entered into with Qualcomm in November 2017. Under the new license agreement, Qualcomm licensed to us, outside of mainland China, certain new technologies in addition to those licensed to us under the prior license agreement on a royalty basis. This newly entered license agreement is currently effective and contains customary termination clauses.”

The timing surrounding the licensing agreement is intriguing indeed. What compelled QCOM to renegotiate an arrangement within five months? Given QCOM’s character, as outlined in multiple lawsuits by various device manufacturers, QCOM rarely gives an inch. Therefore, for QCOM to go back and re-sign a new licensing agreement, in the same month that MOFCOM asked QCOM to refile NXP acquisition proposal, points to progress. Furthermore, the strategy appears two-fold;

- Appease regulatory authorities in China and a potentially lucrative buyer of its products

- By providing access to technology outside China, put pressure on Samsung and Apple to settle

Whether it works on Apple Inc. or not, in our view QCOM has prepared a base for dealing with MOFCOM’s concerns and has increased the likelihood that MOFCOM will approve QCOM’s proposal.

China Approves Qualcomm Semiconductor JV while NXP Sell Out

On March 28, 2018, Reuters broke the story that NXP had sold its 40% stake in Suzhou ASEN Semiconductors Co Ltd to Taiwanese venture partner Advanced Semiconductor Engineering Inc 2311.TW for $127 million discussed here.

Subsequently, on May 4, 2018, the WSJ reported that Qualcomm’s chipset JV with state-owned Datang Telecom Technology Company. More details are available here.

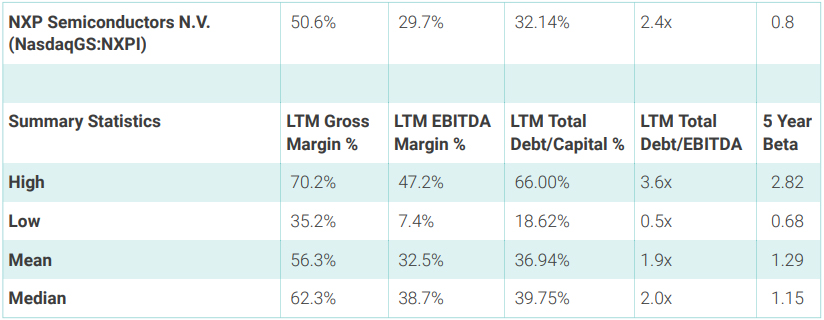

President Trump Assisting ZTE

The latest development that appears favorable for Qualcomm is President Trump’s recent tweet highlighting his discussions with President Xi of China.

Figure 3: President Trump’s Tweet to President Xi

Source: Twitter

The Commerce Department sanctioned ZTE for selling prohibited American technology to Iran. Given that there is no love lost between Iran and the current U.S. administration, violations by ZTE resulted in severe sanctions, crippling its ability to continue in business. After being sanctioned, ZTE has approached the Commerce Department citing weak internal controls (Holy! never a good defense in our opinion) and not corrupt intent on its part. ZTE fired a few senior officials from its compliance group as well.

Nevertheless, the current tone of communication suggests rapprochement between two administrations that do not want to escalate more than necessary. It appears the U.S. administration’s belligerent messaging is having

an impact on China’s thinking, and we conclude that now MOFCOM will have to bite the bait and approve QCOM’s acquisition of NXP. Quid Pro Quo would be President Trump’s idea of “The Art of The Deal”.

Conclusion

Given the various developments we have discussed so far, we assign a 66% probability to QCOM-NXP transaction being approved by MOFCOM and meeting its July 25, 2018 deadline. That scenario involves an upside of 28.7% from current levels implying a probability-adjusted expected return of 18.9%. In the event the deal fails, we do not foresee more than 10% downside implying a probability-adjusted downside of 3.4%. Therefore, a probability-adjusted return of 15.5% is available for buying NXP at current levels.