NIO Inc (NIO US) is coming to the market amidst rumours of PIF, the sovereign wealth fund of Saudi Arabia, investing up to US$1 billion in Lucid Motors, an electric vehicle start-up in California. As per media reports, PIF has also taken a 5% stake in Tesla Motors (TSLA US) and could be considering a privatisation transaction with Musk and other shareholders of Tesla. A private Tesla would benefit NIO immensely because it will be a pure play investment on China’s burgeoning electric-vehicle market.

On August 19, 2018, Reuters broke an exclusive story suggesting that PIF, the Saudi Arabian sovereign wealth fund, was in talks to invest in an electric vehicle start-up called Lucid Motors Inc. (“Lucid”) based in California. The story highlights that PIF and Lucid Motors have drawn up a term-sheet under which PIF would invest more than $1 billion and obtain majority ownership. The first tranche would be for $500 million, and subsequently subject to Lucid Motors meeting production milestones, the rest of the funds would become available. More details on the rumoured deal are available in Exclusive: Saudi PIF in talks to invest in aspiring Tesla rival Lucid – sources.

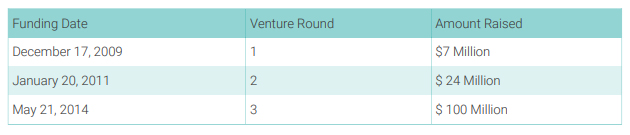

Lucid Motors has an interesting history in the sense that the company started out in batteries for electric vehicles and other systems, and only in 2014 did it branch out into automobile development. According to data from Crunchbase, Lucid has completed three funding rounds so far, raising a total of US$131 million since 2009. The largest round was in 2014 when Lucid raised $100 million from a group of investors. Figure 1 outlines the various rounds of funding raised.

Figure 1: Funding at Lucid Motors

Source: Crunchbase & ANTYA Investments Inc.

As per Lucid’s Form D SEC filing dated May 19, 2014, it was looking to raise approximately $200 million in 2014 but managed only $100 million, before paying commission approaching $5 million. Therefore, prior to the current frenzy surrounding Tesla Motors and electric vehicles, the going was tough for those with aspirations of creating a new mode of transportation.

Saudi Vision 2030 – Where does it come in?

We are not big on any vision document. Top-down ideals foisted upon an unsuspecting bureaucracy and operational management tend to fizzle out. However, in a monarchy where decisions by diktat are the norm, especially if the name of the King is directly involved, it becomes important for decision-makers and allocators of capital to pay special attention to “Vision”. First, we quote from the Saudi 2030 Vision document and discuss ramifications subsequently.

A RENEWABLE ENERGY MARKET

Even though we have an impressive natural potential for solar and wind power, and our local energy consumption will increase three-fold by 2030, we still lack a competitive renewable energy sector at present. To build up the sector, we have set ourselves an initial target of generating 9.5 gigawatts of renewable energy. We will also seek to localize a significant portion of the renewable energy value chain in the Saudi economy, including research and development, and manufacturing, among other stages. From inputs such as silica and petrochemicals, to the extensive expertise of our leading Saudi companies in the production of different forms of energy, we have all the raw ingredients for success. We will put this into practice with the forthcoming launch of the King Salman Renewable Energy Initiative. We will review the legal and regulatory framework that allows the private sector to buy and invest in the renewable energy sector. To localize the industry and produce the necessary skill-sets, we will also encourage public-private partnerships. Finally, we will guarantee the competitiveness of renewable energy through the gradual liberalization of the fuels market.”

Saudi Vision 2030 document was finalized and adopted by the cabinet on April 25, 2016. Since then the kingdom of Saudi Arabia has announced multiple initiatives in renewable energy without much success. Tying the timing of the release to Musk’s statement that;

Going back almost two years, the Saudi Arabian sovereign wealth fund has approached me multiple times about taking Tesla private. They first met with me at the beginning of 2017 to express this interest because of the important need to diversify away from oil. They then held several additional meetings with me over the next year to reiterate this interest and to try to move forward with a going private transaction. Obviously, the Saudi sovereign fund has more than enough capital needed to execute on such a transaction.

Recently, after the Saudi fund bought almost 5% of Tesla stock through the public markets, they reached out to ask for another meeting. That meeting took place on July 31st. During the meeting, the Managing Director of the fund expressed regret that I had not moved forward previously on a going private transaction with them, and he strongly expressed his support for funding a going private transaction for Tesla at this time. I understood from him that no other decision makers were needed and that they were eager to proceed.

I left the July 31st meeting with no question that a deal with the Saudi sovereign fund could be closed, and that it was just a matter of getting the process moving. This is why I referred to “funding secured” in the August 7th announcement.”

In light of Saudi Vision 2030 and its goals, Musk’s statements regarding multiple discussions with PIF are credible.

It would not surprise investors that given the competitive environment in “Sheikhland”, the bigger and more outrageous the deal, the better it is for public relations and national pride. For doubters the following story reported widely in media provides some context Get off my boat! Saudi

Prince kicks Russian oligarch off $400 million yacht after buying it on the spot.

Nonetheless, we agree wholeheartedly with all skeptics who are shaking their heads that Musk could be so naïve as to believe a “Managing Director” of PIF, without ever asking for a meeting with the head of PIF, who happens to be MBS. It is anybody’s guess if MBS fancies taking Tesla private with a significant ownership stake for the PIF, or he fancies an investment in Lucid? Our bet is on MBS being interested in Tesla (It is a trophy asset after all), although with all the current noise and Musk’s brash personality, MBS may not find the power equation to his liking. So to all those writing off PIF, Tesla, and Musk’s assertion, we say that there is a 50:50 chance Musk gets it done, although earlier we thought it was 70%.

MBS, Musk, and Masa are the 3Ms that can solve the Tesla conundrum, and in ANTYA’s view, only two M’s can stay for a deal to close. Masa cannot give up on the $45 billion that MBS has

committed to the Vision Fund. MBS needs Tesla to highlight the success of the King Salman renewable energy initiative. Musk needs MBS to come good on his “secured funding” tweet.

As for the so-called “Managing Director” he may well have the authority to invest in Lucid, but taking Tesla private is a matter that requires MBS’s attention and Masa’s an approval/counsel.

The same “Managing Director” could also be eligible for a significant bonus if the 5% stake in Tesla is rolled over into an SPV at $420/share, and then resold in an IPO in 5-7 years. So one cannot under-estimate the motivations of all parties involved here.

What about Nio Inc. Then?

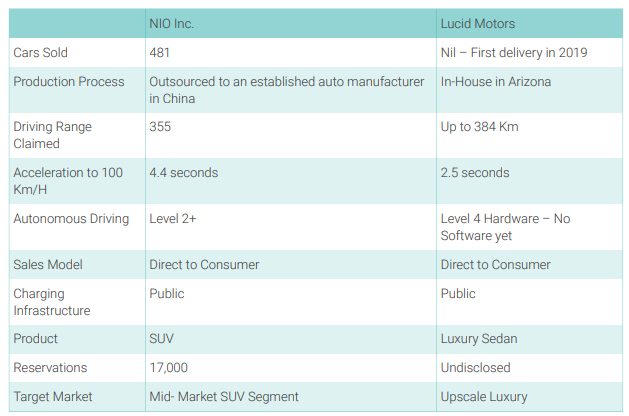

Lucid is a year or two behind NIO, when it comes to its cars, expected production schedule, and execution of its business plan. Figure 2 provides some comparative context between NIO and Lucid.

Figure 2: Comparing Two Upstarts

Source: ANTYA Investments Inc.

Lucid plans to spend approximately $240 million on its site in Arizona, where it estimates it can build 6,000-8,000 cars in 2019 with that kind of capital expenditure. Since the proposed sale price is around US$60,000 per car, if Lucid can deliver on its plan, it would be a masterstroke because that would imply sales of US$480 million, implying a 2x turn on plant investment. One can, therefore, deduce that either Lucid is overpromising, or that the economics of electric vehicle manufacturing are starkly different from those of conventional automakers. Subsequently, Lucid intends to spend another US$460 million, and with that, it expects to reach production of 130,000 units. That translates into a 10x asset turn on fixed capital

investment in plant and equipment. If these numbers are true and attainable, then NIO, Tesla, and other upcoming all-electric auto manufacturers will be highly profitable in due course.

Valuation of NIO Compared to Tesla and Lucid

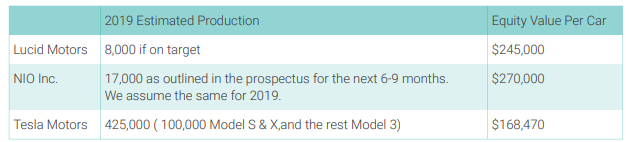

If as reported in media, PIF pays US$1 billion for a majority stake (we assume 51%), then Lucid is valued at US$1.96 billion. In the most recent funding round, NIO equity was valued at US$4.6 billion. At the proposed $420/share privatization price, Tesla’s equity is worth $71.4 billion. Figure 3 highlights an approximate value per car produced for each of the pure-play electric vehicle companies.

Figure 3: Tesla’s Valuation is at a discount. NIO valued Richly

Source: ANTYA Investments Inc.

There are a few caveats to the approximations in Figure 3. Lucid is a development stage enterprise with no history, a few prototypes in production, and a significant business plan to execute. NIO is much further ahead, but light years behind Tesla. If one were to apply NIO’s per car valuation metric to Tesla, Tesla would be easily worth more than $500/share.

Conclusion

On a per car basis, ignoring timing-oriented production differences between NIO and Lucid, it appears both companies are valued equally. It appears to us that NIO may have served as a benchmark for valuing PIF’s proposed investment in Lucid. The proposed Lucid investment could also be a ploy to drive a hard bargain with Musk and Tesla.

Tesla, on the other hand, is a bargain, given its proven business model, a well-established technological edge, a recognized visionary leader, and no shortage of capital to fund its operations.

While aware of the risks, we are also cognizant of the opportunity ahead for NIO. NIO remains an investment for Braveheart while Tesla is for the warrior in you.