Meituan Dianping has built an enviable position in China but is now under attack from all directions. Well funded opponents including Alibaba, Didi, and JD.Com are either fortifying their position or have already bulked up for a debilitating battle. It is unlikely that anyone will take a bow soon and hence IPO investors should take a conservative position while subscribing to shares on offer

Meituan Dianping’s (MEITUAN CH) (“MD” or the “Company”) plans for selling equity to outside investors could not have come at a more inopportune time. Since the filing of the IPO prospectus on June 25, 2018, the war of words between China and the U.S. has seen an escalation with both countries instituting tariffs and threatening to undertake additional measures to defend their respective home markets. In the interim, the U.S. economy showed no signs of slowing down and continues to gain strength while the specter of tariffs appears to have had an impact on China, notably the RMB, with the CNY depreciating approximately 5.2% against the USD. Moreover, it seems that more uncertainty lies ahead. China’s stalwarts including Baidu Inc (ADR) (BIDU US), Tencent Holdings (700 HK), and Alibaba Group Holding (BABA US) have all taken it on the chin, primarily due to trade-related ambiguity.

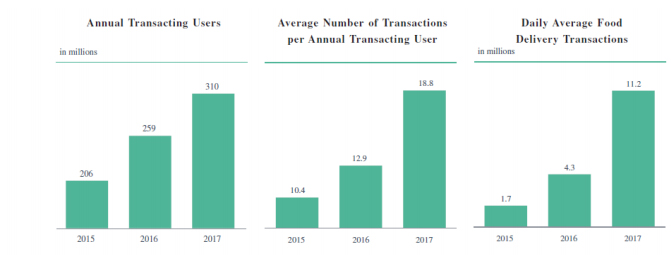

To that, we can now add renewed vigor to China’s food delivery business as billions of dollars of new investment flows into Ele.me – a competitor to MD –, into JD.com’s logistics & delivery business, accompanied by an expansion by DiDi into food delivery. While growth reported by MD in its food delivery segment has been impressive, to say the least, it is accompanied by massive subsidies to entice customers to use the platform in the hope of engendering loyalty and repeat purchasing. As highlighted in Figure 1, on the surface, the Company’s business has shown volume growth accompanied by revenue growth.

Figure 1: MD Gaining Customer Traction

Source: MD Prospectus and ANTYA Investments Inc.

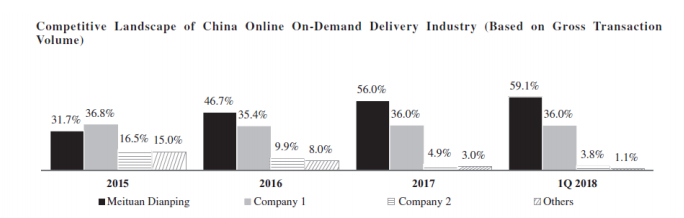

The growth at MD did not stop in 2017, with the Company reporting that on-demand delivery transactions reached over 21 million by the time the prospectus was published in 2018. MD’s growth resulted in significant market share gains in the delivery arena with its market share almost doubling from 31.7% in 2015 to 59.1% in Q1-18, whereas the previous number 3 and number 4 companies were obliterated or consolidated as illustrated in Figure 2.

Figure 2: MD’s Market Share Increases Driven By Incentives

Source: MD Prospectus and ANTYA Investments Inc.

MD managed this feat via massive spending on subsidizing customers and merchants to adopt its platform and try it out. MD believes that;

our massive scale, coupled with network effects, will allow us to acquire more customers and merchants more cost-effectively and benefit from substantial economies of scale.

In our view that is easier said than done, because with gross margins of 8.1%, when you are already at 531,000 delivery riders and providing 11 million meals a daily, any additional scale benefit can only be minimal. MD claimed to be in 2,800 cities and based on its data, delivery riders (“riders”) averaged 21 meals daily, with an average delivery lead time of 30 minutes. That would imply riders are already at full employment, and extra throughput can only come via additional riders, and not necessarily more trips from the same rider unless the number of meals delivered per rider per trip increases significantly.

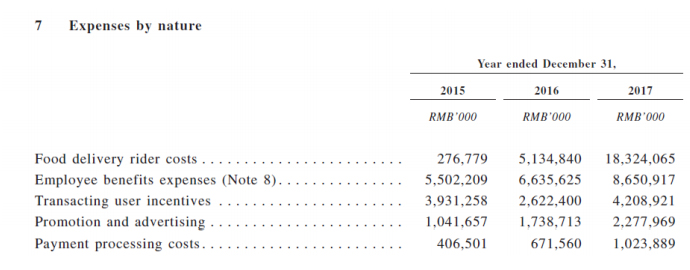

For instance, in 2017 food delivery revenues of 21.03B RMB, attained at the cost of 19.3B RMB. However, that total rider costs were 18.3B RMB or 95% of the total delivery costs. From an accounting standpoint, we want to highlight that “transacting user incentives”, and “promotion and advertising costs” are below the cost of revenue line, embedded within EBITDA. Figure 3 highlights the data.

Figure 3: Type of Expense

Source: MD Prospectus and ANTYA Investments Inc.

As highlighted in Figure 3, 6.4B RMB of expenses, which are primarily food delivery related are allocated below the line under the assumption that these are one-time customer acquisition costs, and hence would be operationally non-recurring going forward. There may be merit to that argument, or it might just be wishful thinking because in our view every merchant would like to maintain multiple service providers, i.e. no merchant wants exclusivity because that would limit the market. It’s just like content in that sense. The more people view, hear or read it, the more valuable that content becomes. Similarly, it would be up to the digital platform to keep the customer engaged.

Combined, the incentives and promotions at MD amounted to 30.4% of revenue. It is anybody’s guess as to how a pull-back in promotions will impact MD’s business. We think increasing incentives from competitors is bound to slow down MD’s revenue growth trajectory in the summer and second half of 2018 and early 2019.

Ele.me Ratcheting Up Significantly

Alibaba recently upped its stake in Ele.me from 43% to 100%, at a rumored valuation of $9.5B. Subsequently, the Company is seeking to raise a significant sum from Softbank to bankroll its intent to regain market share lost to MD illustrated in Figure 2 earlier. It is Ele.me’s stated intent to have more than half of the market share of all food delivery transactions in China over the short-to-medium-term. Ele.me believes that it is in the midst of a “summer battle” against Meituan. Ele.me CEO has been quoted as saying that; “Ele.me is very important for Alibaba’s new retail strategy … Dining and food delivery is also a service that users will frequently use, hence benefitting our payments business.” Details on Softbank’s investment in Ele.me are discussed in Softbank’s Vision Fund To Invest $3B In Alibaba’s Food Delivery App Ele.me.

According to the South China Morning Post, Ele.me has a delivery crew of about three million and operates in 670 cities. Wang Lei, CEO of Ele.me said local service is “a must-win” for Alibaba.

With MD set to lose Market Share What Comes Next – Hotel Segment Sees More Competition

It appears that not only will MD lose market share amidst rising subsidies from competitors and more delivery options, but also faces a threat of slowing growth and increasing expenses in its hotel segment as Bookings.com recently announced a tie-up with Didi with an investment of $500 million to boot. The partnership will allow Didi customers to book hotel properties as well. More details in Didi Chuxing and Booking Holdings Enter into Strategic Partnership.

The following story highlights DiDi’s foray into food delivery in China. DiDi

Foodie Expands to Nanjing, Taizhou and Chengdu in June.

Finally, another well-funded online delivery company appears to enter the market in a significant way through the new Walmart & JD.com investment in Dada-JD Daojia. Details in Walmart and JD.com invest $500 million in a Chinese online delivery company

Therefore, China’s online delivery marketplace is heating up with all the big guns going after market share and no shortage of capital to fund their plans. Investors should be cognizant of the risks and make portfolio decisions regarding the MD IPO accordingly.