Duopolies are generally good for profits in an industry. However, a central aspect of a duopolistic framework is market equilibrium. If China is headed to a duopoly in the food delivery and lifestyle services sector, then Meituan Dianping (3690 HK) will have to cede ground to Alibaba Group Holding (BABA US), before the two can regain pricing power to maximise the opportunity. With MD twice the size of BABA, and BABA signalling its intent to gain its fair share of half the serviceable market, investors in MD are advised to be optimistic but cautious. In ANTYA’s view, going forward, MD will willingly give up ground to BABA to conserve cash and grow responsibly. The days of growth at all cost are over, and therefore MD’s valuation will correct.

Meituan Dianping (3690 HK) (“MD” or the “Company”) defied the expectations of many on the platform, including us by pricing its IPO above our estimated range and then delivered a strong performance on day one of trading. As discussed in our report Meituan Dianping – Peak Value Is Estimated @ US$ 7.50/Share, the pricing at HK$69/share was a premium of 17% to our theoretical peak expected valuation. Moreover, a gain of approximately 5.3% on the first day of trade, establishes a 23% premium to what we believe is a reasonable equity value estimate of the company; at least in short order.

Longer-Term we are Perplexed by CEO’s Comments

Bloomberg managed to talk to the CEO of MD, Wang Xing, for a few minutes after the stock made its much-anticipated debut on the Hong Kong Stock Exchange. For those interested in hearing the CEO’s opinion the video is available at the following link: Meituan Dianping CEO Says Food Delivery ‘Close’ to Break Even. The CEO was categorical in outlining and emphasizing for viewers and investors alike, that the Company is focused on “Food First”, and that everything else including developing a platform for lifestyle services comes after. That is interesting indeed, given that the Company is already a leading online travel and hotel booking destination.

Nonetheless, the CEO asserted the Company’s intent is to go deeper into food and that enabling MD’s consumers to have the best experience involves both timely delivery and high-quality food at the same time. Since a primary component of good food is higher quality primary ingredients that are used during the preparation of various dishes, it appears that MD is looking to create and invest in a platform that involves supplying restaurants with wholesale products (cash and carry a version of Walmart) accompanied by the logistics network, the warehousing, and the whole back-end infrastructure that accompanies such a massive effort. This sudden shift in tone is inexplicable!

The CEO also suggested that the in-house dining business has attained break-even levels of revenue and costs and that despite increasing competition from ele.me, which we discussed in Meituan Dianping – Market Domination & Share Gains to What End? , MD gained a 2% market share in the most recent quarter. Therefore, management remains confident in its ability to fend off increasing competition. While the trajectory of growth

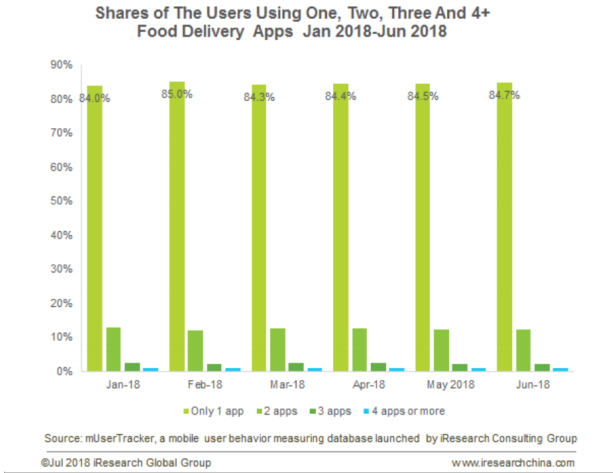

cited by Alibaba and MD is impressive, 3rd party data appears to suggest that the rivalry between ele.me and MD will intensify. Figure 1 highlights our view.

Figure 1: Consumers are loyal users of Apps

Source: ANTYA Investments Inc.

Evidently, users of food delivery apps appear to be highly brand loyal and comfortable in their habits. Therefore, the Company’s strategy to use incentives and discounts to lure usage could be a masterstroke in establishing its dominance in the marketplace. However, Investors are aware

that with $15.5 billion in free cash flow from its core operations, Alibaba Group Holding (BABA US) has vociferously announced its intentions to go after the food delivery business and considers it a “must-win” as we discussed in Meituan Dianping – Market Domination & Share Gains to What End?

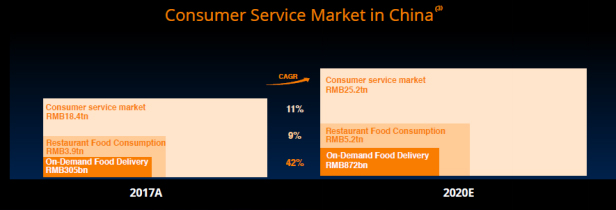

Bullish investors will point to strong growth in China’s food delivery market to justify the Company’s stratospheric valuation. BABA did provide fuel to this bullish fire when it outlined the details highlighted in its investor day presentation which have been reproduced in Figure 2.

Figure 2: Everyone is riding the same bandwagon

Source: ANTYA Investments Inc. and Alibaba Investor Presentation

With the food delivery business expected to grow at an estimated CAGR of 42% to 2020, resulting in an overall addressable market of RMB 872 billion from RMB 302 billion in 2017, it appears that there is enough room for everyone to make merry. The valuation accorded MD would suggest that investors are willing to accept that narrative at face value too. However, Figure 3 outlines the competitive dynamics as they appear to be unfolding between MD and ele.me.

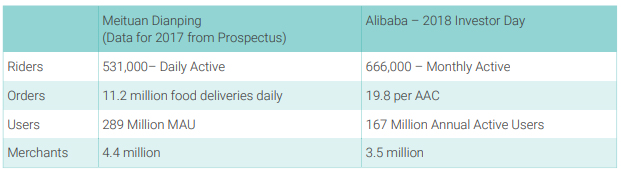

Figure 3: Comparing Meituan Dianping to Alibaba

Source: ANTYA Investments Inc., MD and Alibaba

Both companies have disclosed data in a way that it is impossible to make a like to like comparison, but we hone in on the merchant data and the rider data. BABA is looking to serve 701 cities, whereas MD has a presence in 2800 cities. Therefore, BABA will be targeting fewer areas to make a dent in MD’s

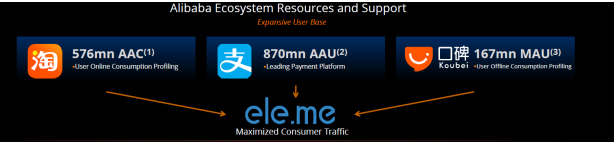

business. Going back to figure 1, it will be necessary for BABA to rachet up the incentives, directly and indirectly, to wean customers away from the Company’s platform. As shown in Figure 4, BABA does have the heft and the wherewithal to plough through MD’s customer base in multiple ways.

Figure 4: Alibaba’s Ecosystem will Support ele.me

Source: ANTYA Investments Inc. and Alibaba

The numbers appear to be large wherever you look. What is important is that, with BABA’s reach, MD will have to gracefully give up share and lower its incentive spending because it needs to live to fight another day. With the IPO behind it, MD appears to be already curtailing its ride-hailing investments and will further reduce its consumer incentives. Investors will therefore soon come to realize that some or all of the super-charged growth was courtesy payments to either consumers or merchants. If there are any doubts then perhaps the words of a student, Wu Lingli will provide some context.

Generally it’s all about price,” said Wu, who jumps between Meituan and rivals Ele.me, Didi, Taobao and others when shopping online. “If the product is the same then I’m definitely just looking at price; I’ll go wherever is cheaper.

More details are available in As its trading debut looms, China’s Meituan locked in battle of super-apps.

If that sounds familiar as a consumer, it is because the hottest stock for the last few years in retail in Canada has been Dollarama Inc (DOL CN). For the uninitiated, that is a dollar store, in a G-7 country with one of the highest per capita incomes in the world. Lesson learned; consumers everywhere love a deal.

Did investors get a deal buying MD stock at the current valuation? That is a question worth a few billion dollars for investors.