The U.S. economy is firing on all cylinders. The Fed is bound to stay the course and, in our belief, will deliver more rate hikes than the market anticipates. EM investors should stay in large capitalisation, export-driven and domestic currency denominated debt-oriented companies with strong balance sheets. There will be more volatility ahead.

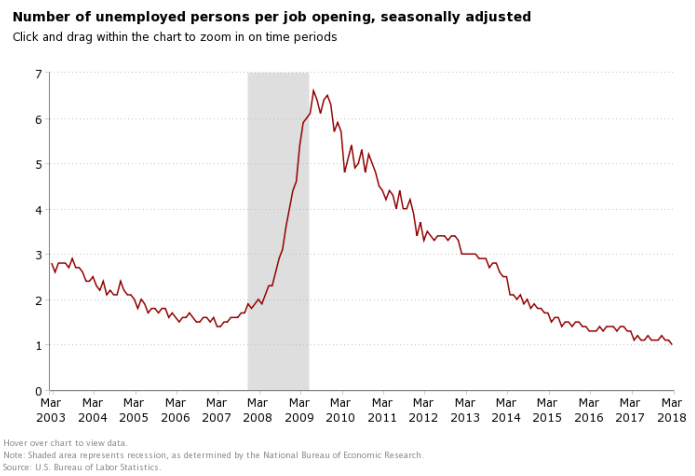

Investors and market watchers continue to exhibit a schizophrenic personality when it comes to parsing the outcomes of U.S. employment data. We have been steadfast in our view since the beginning of 2018 – as discussed in our monthly analysis of U.S. employment data – that investors should prepare for four Fed hikes in the current year and four increases in 2019. The only caveat to our forecast is that the unnecessary trade-related tensions wrought on the global marketplace by the current U.S. administration may derail synchronous global growth causing the Fed to take a more cautious approach. Figure 1 highlights that in the U.S. there is one unemployed person per job opening currently, which is the lowest level in the last twenty years. We have previously discussed the strength of the U.S. labour market in the April Employment Report – Foreshadows a Continued Weakness in Yen and Weaker Emerging Markets.

Figure 1 – How Low can it Go?

Source: BLS & ANTYA

From our perspective, with the unemployment rate hovering at a post-war low of 3.8%, and with the job opening numbers suggesting increasing pressure on employers to find suitable workers, Q3-18 data will show a jump in inflation and labour costs in service and retail sector of the United States. With peak summer driving season upon us, higher energy costs are already filtering through to downstream products and services, and with the labour-related slack in the economy gone, wage intensive retail restaurant and convenience store chains are bound to disappoint investors. We discussed the structural changes underway in U.S. employment data in our previous report April Employment Report – Foreshadows a Continued Weakness in Yen and Weaker Emerging Markets.

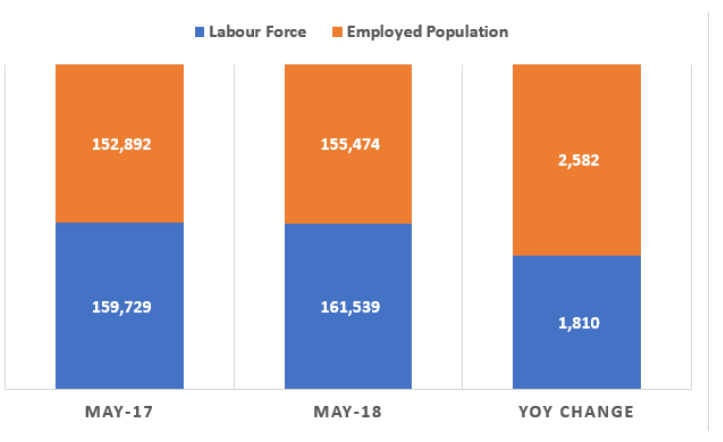

In this edition, we take our analysis a step further and highlight that demographic data shows that the U.S. economy is creating more jobs than the growth in the labour force can handle. Therefore, any reprieve from the Fed will only fructify if global trade tensions result in a slowing U.S. economy, which is unlikely over the next eighteen months.

As illustrated in Figure 2, YoY job growth exceeded labour force growth, resulting in a continued decline in the unemployment rate.

Figure 2: The U.S. Created 1.42 Jobs for Every Addition to The Labour Force (in 000’s)

Source: BLS & ANTYA

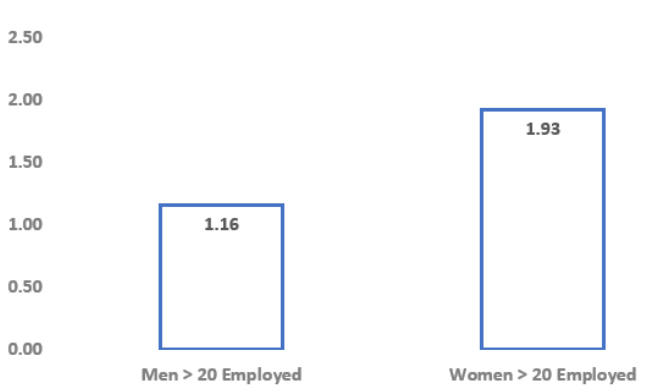

To us, it appears that many on the FOMC and others, continue to weigh future Fed actions based on backwards-looking inflation data, which even the Fed acknowledged has reached its target as discussed in FOMC Minutes May 1-2, 2018 – Much Ado About Nothing. As shown in Figure 3, if the increasing number of jobs created is any indication, the robust and resilient U.S. economy is already above full-employment.

Figure 3 – Women are Joining the WorkForce in Large Numbers – Number of Jobs Filled Per Entrant

Source: BLS & ANTYA

The pressure on the job market, and perhaps better pay and benefits are encouraging more women to join the labour market as well. In May 2018, 1.93 jobs went to women aged 20 years and over, for every single women 20 and over that entered the workforce. Similarly, 1.16 positions per new male entrant to the workforce were created and filled by men age 20 and over.

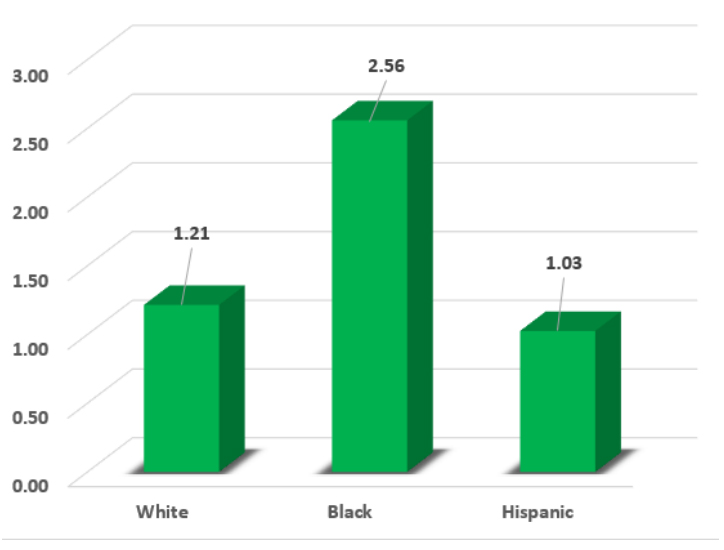

More importantly for investors, other than the macro data foreshadowing inflation, wage growth and GDP growth, is the impact that the tight labour market conditions are likely to have on specific sectors such as transportation, retail, services and the farm sector of the economy. Figure 4 provides clues to hidden earnings-related disappointments that could come from that segment of the market during Q3 and Q4 of 2018.

Figure 4- The Lower-Skilled are Also Tapped Out – Number of Jobs Filled Per Entrant by Ethnicity

Source: BLS & ANTYA

It is important to note that YoY in May 2018, 208,000 black civilians joined the labour force, but overall black employment increased by 532,000 to approximately 19.1 million individuals. Similarly, the Hispanic workforce increased by .975 million but the number of employed Hispanics increased by 1 million. Based on BLS and census data, one can easily deduce that these two populations tend to be lower-skilled as well. Therefore, right conditions are allowing for these populations to enter the job -market and perhaps find employment in professions that were previously difficult to get. Nonetheless, a lack of slack should be worrisome for industries dependents on hourly wage workers.

Therefore, when news such as Walmart Offers to Pay College Tuition Bills for U.S. Employees crosses the wires, investors should take notice, because Walmart has never been a benevolent employer. To quote Wal Mart Stores Inc (WMT US);

Many of our associates don’t have the opportunity to complete a degree…We felt strongly that this is something that would improve their lives and help us run a better business.” [Source: Fortune]

This new initiative from WMT is in addition to an increase in hourly wage implemented for all of its 1.5 million employees in 2017 and earlier this year.

Conclusion

The U.S. economy is firing on all cylinders. The Fed is bound to stay the course and, in our belief, will deliver more rate hikes than the market anticipates. That cannot be good for emerging market bonds, emerging market currencies and the Japanese Yen. (It will remain a safe haven trade). If there was any doubt the carnage in Turkey, Argentina, Venezuela and weakness of Indonesian, Malaysian and Indian currencies is only the beginning. Foreign money is leaving the Indian bond market in droves as discussed in the following news story FPI Outflow Hits 18-Month High At Rs 29,714 Crore In May.

EM investors should stay in large capitalisation, export-oriented and domestic currency denominated debt-oriented companies with strong balance sheets. There will be more volatility ahead. We expressed a similar sentiment in FOMC Minutes – Growth, Financials and Technology Outperform; Gold, Yen, HY and EMs Will Correct. So far our hypothesis seems to work out.