Punjab National Bank (“PNB”) gained international notoriety earlier in February 2018, when much to the chagrin of the Government of India (“GOI”) which is its largest shareholder at 57%, and the Reserve Bank of India (“RBI”) which is its primary supervisor, PNB alleged fraud approximating $1.8B committed by a group of individuals in connivance with bank officials (we will refer to it as “allegations”, or “event/s” since the truth will come out in due course). Apparently, the event went unnoticed for more than six years, and breached the entire operational risk infrastructure of PNB – disclosed as part of its Basel III filings – consisting of “three lines of defense” viz:

- The first line of defense represented by various HO Divisions which are Control Units, Business Units, or Support Units

- The second line of defense represented by the Operational Risk Management Department; and

- The third line of defense represented by the Inspection & Audit Division which is [apparently] a challenge function to the first two lines of defense.

If the event had been contained domestically, it would cause us less consternation. However, the tentacles of these allegations head offshore in multiple jurisdictions. We lower our lens on Hong Kong, and one of the parties affected by these events, Allahabad Bank (ALBK IN) (“bank”). We would be remiss if we omitted the rather interesting fact that the Hong Kong (“HK”) branch is the only foreign branch of the bank, whilst it has 3245 branches in India.

In a filing with the National Stock Exchange on February 16, 2018, the bank said it had advanced $366.87 million through its overseas branch in Hong Kong. Similarly, on February 17, 2018, Uco Bank (UCO IN) in its filing said that it had “extended credit of USD 411.82 million” to a “….few of the

Corporate Clients associated with the incident of recent fraud … in Punjab National Bank”. State Bank Of India (SBIN IN) had an exposure of $212 million to the same event, although it’s not clear if it was through its Hong Kong operations or elsewhere.

How will Hong Kong Monetary Authority Respond?

Hong Kong Monetary Authority (“HKMA”) is the supervisor of banking in HK. It would not surprise us that after these events, HKMA is looking closely at all Indian banks operating in HK. Capital adequacy is always a key concern for any banking regulator, and given the large sums exposed to this event risk arising from India, HKMA would like to ensure that deposits are safe and that in the case of a liquidity crunch all depositor obligations can be met without disruption or panic. ANTYA also believes that as HKMA digs deeper, it will be extremely concerned by a lack of prudence, oversight, and banking etiquette exhibited by subsidiaries of authorized institutions (“AI”) from India doing banking in HK. In this regard, HKMA would not be alone, given recent developments in South Africa related to Bank of Baroda discussed here ( Zuma Sacked, PNB Hacked, and Bank of Baroda South Africa Axed).

Allahabad Bank – Description of its international presence

The Bank is having one overseas branch with a dealing room in Hong Kong. The business of Hong Kong has increased from `12,519 crores [$1.9B] as on 31st Mar’16 to `14,130.68 crores [$2.17B] as on 31st Mar’17. The business of the branch increased by 12.87% on a Y-o-Y basis. The total deposit as on 31stMar’17 stood at `2535.54 crores [$390M], whereas advances stood at `11595.14 crores [$1.78B].

The global investment portfolio of the Bank as of 31.03.2017 stands at` 55711.96 crores [$8.57B], which includes a domestic investment of ` 55433.36 crores [$8.52B] and Overseas investment by our Hong Kong Branch to the tune of HKD 333.85 Mio [M], i.e., ` 278.60 crores [$42.7M] (converted @ 1HKD = ` 8.3450).

Source: 2017 Annual Report

The 2017 annual report of the bank runs into 314 pages, out of which two short paragraphs are devoted to the bank’s overseas presence in HK. However, in ANTYA’s view, there is enough in those two paragraphs to cause heartburn to HKMA in particular, and to investors in Indian banks in general. In our opinion, these disclosures reveal a complete abdication of prudent banking practices by the management team of the bank in HK.

The bank said the following for F17:

- Total deposits of $390M.

- Investments of $42.7M; and

- Loans outstanding of $1.78B.

On the balance sheet loans of $1.78B is backed by $42.7M in investments and $390M in deposits. To provide context to the investment number disclosed by the bank, HKMA expects an authorized institution to have a minimum capital of at least HK$300M or $38.3M. The loan to deposit ratio (“LDR”) in North America ranges between 60%-90%. HSBC Holdings Plc (HSBA LN) which has a significant presence in HK, reported LDR approaching 70% for 2017. That compares to 456% for Allahabad Bank in HK. So what gives?

Could it be that Allahabad Bank is undercapitalized in HK, and is offside HKMA rules?

Rules are meant to be broken. So, goes the expression. ANTYA is not suggesting that the bank violated any laws in HK. We highlight that regulatory guidelines involve principles that need to be applied, and then there is the spirit behind the regulations which maintains the sanctity of operations. It appears Indian bankers stay onside rules but pay little heed to “ the spirit” comprising regulations.

In ANTYA’s opinion, prudence in banking calls for adherence to both.

Part 4.5 of chapter 4 of the HKMA’s Guide to Authorisation for banking in HK says that “In the case of an institution incorporated outside Hong Kong, the primary responsibility for supervising capital adequacy rests with the home supervisor. In arriving at his own assessment of the financial strength of an overseas institution, the MA will take the views of the home supervisor into account but may also wish to make his own independent assessment, taking into account for example whether the institution in question is state-owned”.

“The MA will generally require an overseas bank which wishes to set up a branch or a subsidiary in Hong Kong to maintain capital levels consistent with the latest applicable capital standards issued by the Basel Committee. The MA will generally accept calculations of the capital requirements which are based on the methodology of the home supervisor provided that this is consistent with the various national discretions allowed under the Basel Committee’s capital standards. However, the MA also reserves the right to require capital requirements to be recalculated on the basis of the methodology used in Hong Kong to check that they are not over-stated”.

Under these guidelines, authorized institutions in HK, that are not locally incorporated such as the bank, have significant leeway in managing their operations. It seems that Allahabad Bank in HK has escaped HKMA scrutiny because of the cover provided by its parent, which is also a state-owned institution in India.

No On-Site Supervision Either

Beyond capital adequacy, HKMA also conducts on-site examinations of authorized institutions to assess asset quality and adequacy of internal controls. The frequency of inspection varies from institution to institution.

Para 3.28 of The Legal and Supervisory Framework of HKMA says that

“Normally, the minimum frequency of on-site examinations will be once every year for major locally incorporated institutions and once every 4 to 5 years for overseas incorporated institutions”.

Once again, the bank business practices appear to have escaped scrutiny by HKMA.

Extraordinarily Large Single Credit Exposure

Moving beyond capital adequacy and on-site supervision, we believe HKMA is bound to take strong exception to the bank’s performance when it comes to adhering to guidelines related to CR-G-8, large Exposures, and Risk Concentrations. It is a comprehensive document that sets out minimum standards and requirements that authorized institutions are expected to follow.

Para 1.1.5, on the first page of the policy manual, says that “For the purpose of this module, any exposure to a counterparty or a group of related counterparties which is greater than or equal to 10% of an AI’s capital base is regarded as a large exposure.”

The bank’s exposure of $366.8M to a single credit was equal to 94% of its deposit base in HK, and almost 10x it’s capital.

Nevertheless, all rules have some exceptions, and in this instance, “Under §81(6) of the Banking Ordinance, the financial exposure of an AI is exempted from the application of §81(1) if such exposure falls within the following categories:

- exposure to an overseas incorporated bank which is not an AI where it is, in the opinion of the MA, adequately supervised by the relevant banking supervisory authority;

Thus, Allahabad Bank and other Indian banks operating as authorized institutions in HK, are covered as far as rules are concerned because the counterparty to these events was an AI: prudence be damned.

However, HKMA also provides very clear guidance regarding “Prudent principles for controlling risk concentrations” going so far as to say that, “When considering the extension of large credit facilities (in particular those exceeding 10% of an AI’s capital base), AIs should exercise extra care in ensuring that prudent credit granting criteria are met. They should have a thorough understanding of the borrower’s background, financial strength and repayment sources, nature of business and funding needs, as well as management capabilities. The credit decision should be supported by an in-depth credit assessment of the borrower’s debt-servicing capacity based on sufficient and reliable information (see CR-G-2 “Credit Approval, Review and Records” for further guidance).”

ANTYA believes that HKMA will review Allahabad Bank and other Indian banks operating in HK for the following significant operational shortcomings:

- Exercising poor judgment and inadequate controls

- Being off-side prudent lending in HK

- Failing to undertake adequate due diligence on borrowers

- Exposed 10x of its capital base (estimated for Allahabad Bank HK) to a single credit

- Failing to follow-up with PNB to authenticate or verify significantly large corporate guarantees extended to flimsy diamond merchants

- Assuming tacit regulatory approval of activities under various regulatory guidelines since counterparties were authorised institutions

By making use of exceptions granted under the banking regulation by HKMA, some Indian banks in HK appear to have boosted their bottom-line temporarily. While focussed on exceptions to the rules, the Indian banks overlooked regulation 1.1.3 which says that “Failure to adhere to the standards and requirements in this module may indicate that an AI does not have adequate systems to control its risk concentrations and carry out its business in a prudent manner. This may call into question whether the AI continues to satisfy the above-mentioned minimum authorization criteria under the Seventh Schedule to the Banking Ordinance.

Part 1.1.4 goes on to say that “Non-compliance with this module may also constitute a ground for the MA to impose a higher minimum capital adequacy ratio on the AI under §101 of the Banking Ordinance to lessen any additional risk from the concentration”.

Yes, Indian banks followed rules in HK but failed to live up to other equally important parts of the regulatory framework of HKMA. It is indeed possible that HKMA could order Allahabad Bank and a few others to wind up operations in HK or it could impose penalties and require that off-shore AI’s inject capital in HK.

High Interdependence Requires Higher Operational Risk Weights

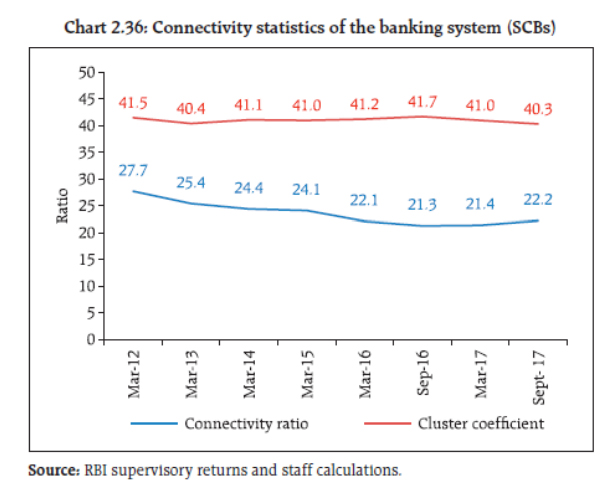

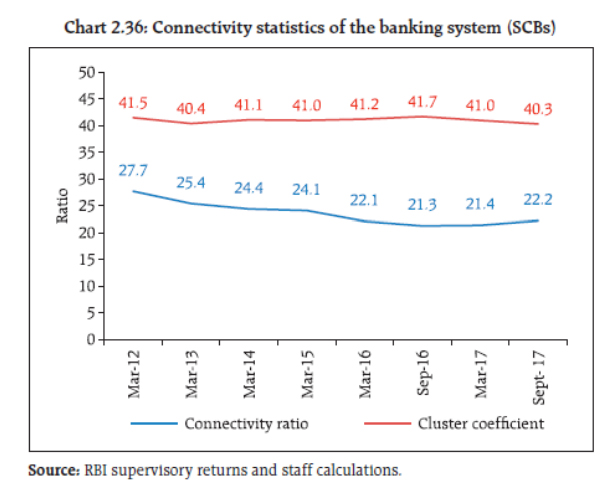

According to RBI’s financial stability reports 2017, scheduled commercial banks are the dominant players in the Indian financial system, accounting for nearly 47% of the bilateral exposure. The degree of interconnectedness in the banking system, measured by the connectivity ratio, has decreased very gradually since 2012. The clustering coefficient which depicts domestic interdependence, however, remained consistent during the period from March 2012 to September 2017 indicating that clustering/ grouping within the banking network has not changed much over time.

The interdependence of Indian Banks

Allahabad Bank, UCO Bank, and Axis Bank may walk away without a hit to their respective P&Ls, but in front of HKMA, we believe their credibility is dented. Since a similar type of event risk exists for banks from other countries under the watch of HKMA as well, we suspect that HKMA will tighten the screws on all authorized institutions, particularly Indian banks operating in its territory. To the extent these off-balance sheet transactions in India, allowed HK or Singapore based offices of Indian public and private sector banks to skirt local capital adequacy or liquidity requirements in off-shore jurisdictions, heightened scrutiny and increased operational risk weights under Basel III should be applied to Indian banks especially given the connectedness implied by RBI’s analysis.

PNB and RBI – Difficult Decisions Ahead

As far as PNB is concerned, its financial statements will undergo multiple changes now that these allegations have surfaced. Since it is PNB’s position that the bank was not aware of these loan drawdowns based on its Letter of Undertakings, the bank capital adequacy ratios as disclosed in the past were overstated, because appropriate risk-weights on an additional $1.8B of loans went unassigned. Going forward, the bank could make a provision for the

entire $1.8B that it claims to be missing in Q4-F18, and then book any recoveries from assets that have been seized by the enforcement directorate and the income tax authorities to income in F19 and beyond. That makes past financial statements unreliable and future financial statements speculative.

Furthermore, unless PNB is recapitalized in short order, it will have to shed assets to bring its RWA in line with its existing capital. Given the highly leveraged corporate sector in India, it is unlikely that PNB can off-load assets and hence RBI will have to allow PNB to rebuild its capital by putting brakes on asset growth. In an already stressed NPA environment, this wasn’t something the Indian economy was banking on.

In the case of PNB, an earnings slowdown due to dilutive financing, higher operational risk weights requiring higher capital and hence lower ROEs, and a more moderate asset growth profile are all in-store. Therefore, ANTYA recommends that investors find alternative investments to earn a better return.

Conclusion – It’s Not Over Yet

HKMA is the second international banking regulator after the South African Reserve Bank to oversee and experience impudent banking practices of state-run Indian banks. In our view, investors need to rethink the book value and dividend yield multiples for Indian financials irrespective of the pedigree, i.e. whether it is a public-sector or a private institution.

We expect a more difficult time for Indian banks in 2018 and 2019 given (2018 India – Tread With Caution):

- RBI’s supervisory stick impacting NPAs which will bring loan portfolios in line with Basel III

- Higher global yields will pressure domestic investment portfolios comprising GOI securities of banks

- Weaker local currency and higher oil prices which will contribute to rising inflationary pressures; and

- Improving fundamentals of global banks compared to emerging market banks will result in a reallocation of portfolio weights to the developed world (The Reserve Bank of India–Between a Rock and a Hard Place, Higher Yields & Higher NPAs Forthcoming?).

Indian banks that are already short on capital could soon be winding up operations abroad in multiple jurisdictions as banking supervisors of various countries call for either beefing up on-shore capital or reduce risk-weighted assets. Expect more scrutiny, higher capital requirements, and lower ROEs sector-wide.