Although the stock price of Home Capital Group rebounded yesterday, it is a dead cat bounce. HCG is headed to penny stock status.

Home Capital Group (“HCG”, HCG.TO) has been in the news recently for all the wrong reasons. Although stories surrounding the unreasonable and elevated valuation attributed to real estate in Canada- especially in Vancouver and the Greater Toronto Area- abound, it is the flurry of stock market activity surrounding HCG that puts a spotlight on the untenable situation. The Federal Government, the provincial governments of British Columbia and Ontario, The Bank of Canada, and various journalists, bank economists, analysts (including ANTYA Investments Inc.) have all;

1. counseled Canadians through public discourse

2. cajoled banks and financial institutions through policy directives to rein in lending, and

3. coerced speculators through punitive tax measures to abandon the market.

None of that worked until now, when the chicken seems to be coming home to roost.

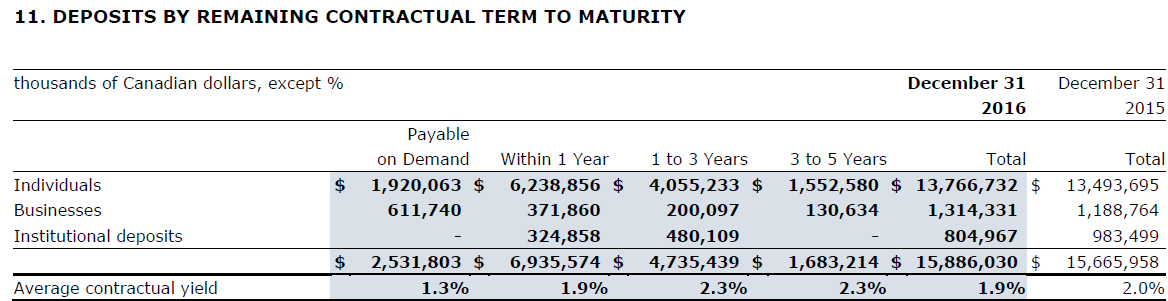

In our view, either Home Capital will go BUST, or will be liquidated under the supervision of OSFI, at a value much lower than $7.00 or thereabouts, that it is trading at currently. Given that HCG faces a liquidity crunch based on an asset-liability mismatch in its books i.e. mortgages are longer term assets, while the GICs and fixed deposits will come due sooner as outlined in the table below, HCG needs to find capital to pay its depositors. Clearly, it cannot force mortgage owners to fast track mortgage payments.

Source: HCG Q4-16 Filing

As of December 31, 2016, HCG had $2.5 billion of deposits payable on demand, and another $6.9 billion payable within one year. Of that the High Interest Savings Account (“HISA”) accounted for $2.01 billion, which fell to “approximately $1.4 billion as at April 24” and is expected to be $521 million on Friday April 28 after settlement of Thursday ‘s transactions. While on demand depositors are fleeing, a run on the GICs is also a very real possibility, notwithstanding CIDC guarantees. GICs are currently being redeemed at the rate of $10 million per day.

That liquidity challenges are severe is demonstrated by the onerous terms of emergency funding secured by HCG including fixed fees of $100 million, commitment fees of 2.5% annualised on undrawn amounts and interest rate of 10% on drawn amounts. Furthermore, with credit ratings downgraded to speculative status by DBRS already, it is unlikely that ongoing funding costs attained through the broker channel will remain low, and that deposit brokers would be willing to direct client funds to HCG at all going forward.

Most importantly, we firmly believe that the real estate market has peaked and that a decline in transactions and a gradual decline in price is emerging. How do we know that? We base that on the following remarks of Stephen Smith, the CEO of First National Financial (“FN”), Canada’s largest mortgage servicer. We quote from the Q1-2017 conference call of April 26,

“Entering 2017 we expect to see a decline in single family originations with some offsetting growth in total renewals and in commercial originations. … actually, results for the quarter mirror these expectations. In single family originations amounted to $1.9 billion, 3% lower than a year ago, … volumes were down 12% in Western Canada … origination activity was down 6% in Quebec … offset by 9% growth in Ontario and Maritimes … however we expect lower single family originations this year across Canada and heightened competition across Canada for mortgage markets that have been affected by government intervention”.

“Our basic thesis for 2017 is that recent changes to the mortgage rules will shrink the overall size of the single-family market and create greater competition for the business that remains. … first quarter represented a period of transition for the new rules. … rules will definitely favour lenders who can most efficiently fund conventional mortgages. … our seasonal volumes could be down significantly in 2017 … overall we expect 2017 to be a challenging year for originations.”

The proof of the pudding is in the eating, and single family originations have also declined at HCG. Single family mortgages constituted 53.2% of the total outstanding mortgages for 2016. Therefore, HCG is looking to sell itself and deal with regulatory challenges at a time when the best days of the Canadian mortgage market are behind it.

In our view, speculating that HCG will fetch a higher price than what it is trading at currently, belies the changed fundamentals of the marketplace, and the unsettled state of affairs at HCG alleged by the OSC. ANTYA Investments Inc. retains it conservative stance, even though the stock price is trading at a steep discount to its book value.

We believe that although the underlying mortgage portfolio is holding up well, HCG is likely to be sold for pennies, and not the dollars it is trading at currently, if at all.