On a down day in the markets, when President Trump’s administration announced the implementation of steel and aluminum tariffs on NAFTA partners and European allies, causing much consternation and confusion, General Motors (“GM”) made a materially important proclamation by partnering with Softbank Corp’s Vision Fund (“Vision”). According to the release and the presentation, Vision is buying into GM’s autonomous vehicle (“AV”) subsidiary called GM Cruise (“Cruise”).

To provide some background, GM bought Cruise for a rumored $1 billion in March 2016 as discussed in the following news story from Reuters GM buys Cruise Automation to speed self-driving car strategy. Subsequently, in September 2017, GM purchased a company called Strobe for its LIDAR technology as discussed in this story from CNBC GM buys Calif. tech-sensor company to help in a self-driving car race with Alphabet, Tesla. For more on LIDAR please see William Keating.

As per the executives on the conference call today, GM has been investing in its self-driving autonomous vehicle unit at the rate of $ one billion per year. When GM bought Cruise in 2016, it had 40 employees and currently employs

about 800. Including the announcement today, GM’s financial commitment to its AV unit is approaching approximately $3 billion (excluding the undisclosed purchase price paid for Strobe).

GM- Vision Partnership

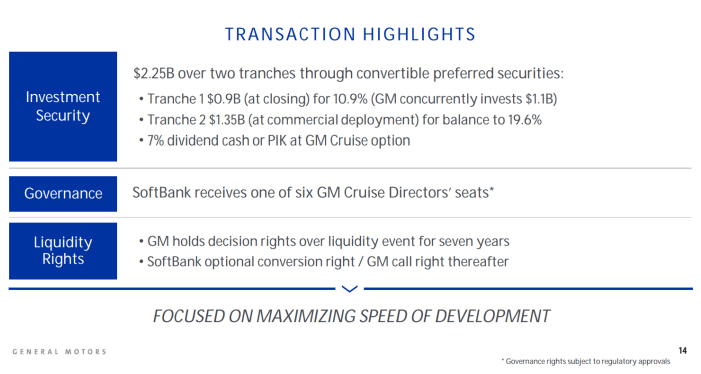

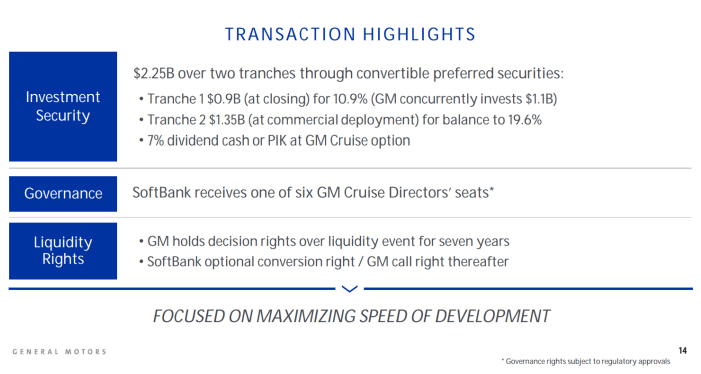

The deal parameters outlined in Figure 1 are sourced from GM’s disclosures today.

Source: GM and ANTYA

In addition to the $2.25 billion investment by Vision, GM will provide a capital injection of $1.1 billion. This transaction thus values the Cruise subsidiary at the low end of the range at $11.5 billion, while based on the valuation of the second tranche of Vision’s investment at the high-end at $15.5 billion. That implies a return approaching 4x for GM within three years of entering the AV space.

Why the Sudden Love for GM, and what does it mean for Tesla Inc.?

In ANTYA’s view, this is a critical question and has significant implications for the AV industry and for the prospects of various players that comprise the automotive value chain going forward. Softbank has been one of the largest investors in Uber Technologies Inc (0084207D US) and is a significant investor in other ride-sharing companies including OLA in India. SoftBank is now Uber’s largest shareholder as the deal closes, details Softbank Corp’s involvement in Uber, and highlights that Rajeev Misra the head of Vision has been appointed to the board of Uber as well.

The Uber investment was finalized on January 18, 2018. In our view, the chronological timeline is essential to follow, in order to deduce the conclusion that we arrive at.

Subsequently, there have been difficult developments in the AV market with multiple crashes involving Tesla, discussed ad infinitum in the media, and by interested observers on this platform. However, Uber’s decision to suspend all self-driving tests after the death of a pedestrian as discussed in this BBC report Uber halts self-driving car tests after death is an essential

development for the industry and Softbank.

That was March 19, 2018. Subsequently, on March 27, 2018, Nvidia suspended self-driving car tests as well, outlined in the following story from Reuters Nvidia halts self-driving tests in wake of Uber accident.

Now we quote Michael Ronen, an executive from the Vision fund who was on the call today discussing the GM-Vision partnership.

As investors on this call very well know, the automobile industry is undergoing historic transformation. With three macro trends converging to [crush] the traditional business model. AI and autonomous driving, electrification of displacement of the gas engine and the emergence of ridesharing networks as [an] alternative to ownership. While these are still early days and much is still to come, the path towards GM’s vision, which we share of zero emissions, zero fatalities and zero congestion is clear. It’s not a matter of if but when for it to materialize.

We have been monitoring the AV landscape over the past couple of years and have tremendous admiration for the talent and capabilities of many of the companies are taking on this challenge. While we looked closely as many of these companies and performed extensive technical and financial due diligence over many months, we ultimately chose to invest with GM at Cruise for several reasons.

First, like GM, we believe that a vertical solution where hardware and software are integrated and iterated seamlessly provides a strong competitive advantage.

One could consider the last line in the quote as a throwaway line from a starry-eyed investor, or it could be construed as real-world experience-based learning, driven by gleanings from investments across the technology spectrum by an organization with deep-rooted technical know-how. If you believe in the latter, then the following is self-evident:

- Tesla owns the software stack, the technology platform, and a leading-edge semi AV network globally with approximately 250,000 cars on the road.

- Tesla’s AV network is gathering data and getting better by the day. The most recent over-the-air upgrade to improve the braking distance for Tesla Model 3 is a first in the automotive business. That led Consumer Reports to recommend the car to prospective purchasers as discussed in the following story Automaker responds to Consumer Reports test results and reduces stopping distance by nearly 20 feet. That also calls into questions the concerns expressed by others regarding a lack of

automotive experience at the company discussed most recently in Tesla: Impressions on the Latest List of New Hires – Where Are the Car Guys?

In our view, Tesla is not an automotive company and does not need a plethora of auto executives to run its operations. Ronen also said that;

The Cruise Team is brilliant and agile and its ability to quickly iterate across its technology stack, software and hardware, to drive the business forward is unique.

If ever there was evidence of similar traits required at Tesla, the consumer reports story highlighted in bullet 2 proved it for Tesla as well.

The Autonomous Business Opportunity

Figure 2 highlights another slide from GM’s presentation today that highlighted the mechanics of an independent valuation of Cruise. It is also important to remember that this is a substantial dollar commitment from one of the world’s most sophisticated tech investors, unlike the $10 million committed by Nokia G.P. for an insignificant stake in Xiaomi Corporation as discussed by us previously in Xiaomi Corporation – Value Is in the Eye of the Beholder – $100 Billion or $20 Billion – A Wide Gulf.

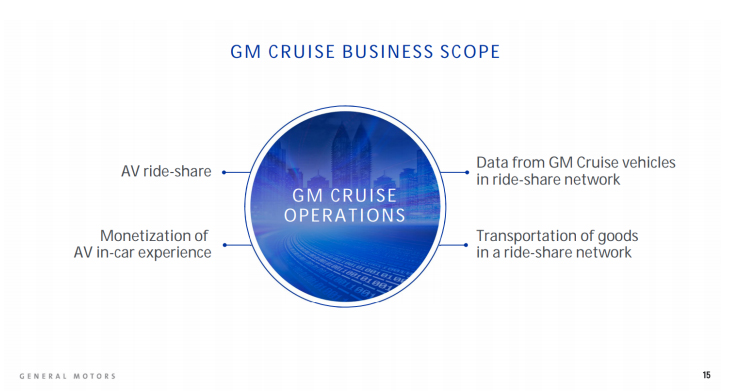

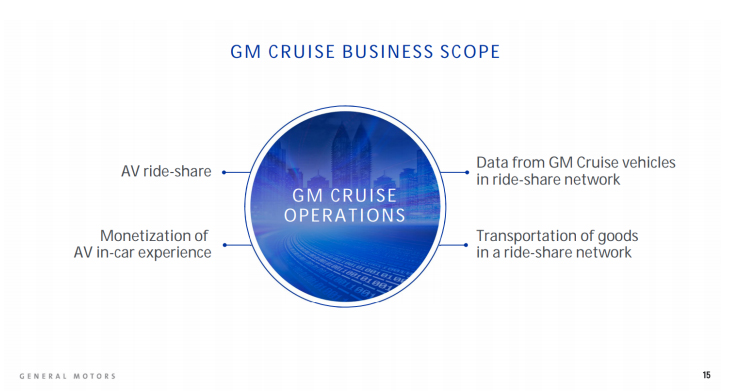

Figure 2: What are the Various Revenue Streams?

Source: GM and ANTYA

The four distinct revenue streams involving ride-sharing, data capture, and analytics, monetization of the in-car experience, and transportation of goods in a ride-share network are all large opportunities, and should not be dismissed. Targeted, geo-tagged advertising, the sharing economy with its food -delivery, and package -delivery apps are all already a part of our daily existence. More importantly, the existing Tesla supercharger and AV

network already share all this information with the head office, allowing Tesla to enable its diagnostic and repair mode whenever needed. Again that is already ahead of Cruise and its ilk.

What does Cruise Currently have in the form of assets?

In our view and as explained by GM management, 800 employees, a visionary business plan, an AV module under development, and an experience building cars, and now, the support of Vision.

A much bigger and far advanced AV unit is already embedded within Tesla.

Moreover, Tesla has all that and no baggage related to a business model under siege, no pension-related obligations. On top of that, customers love its cars. Last evening we saw the first Tesla Model 3 in our neighborhood. We rolled the windows down and asked the owner how he felt? Ecstatic was his answer. Another owner with a Tesla S expressed similar sentiments and added that he sold his SUV to buy Model X, and he vowed he was never going back.

Although our examples are anecdotal in character, the increasingly long waitlist of prospective customers and great referrals from current owners suggest a car company on the verge of greatness – unless Musk derails it in a Twitter war of words – with a new business paradigm.

Tesla Valuation

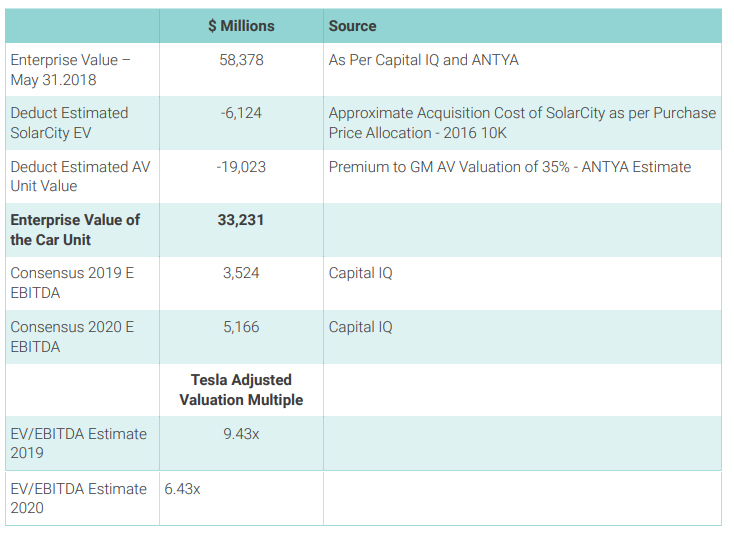

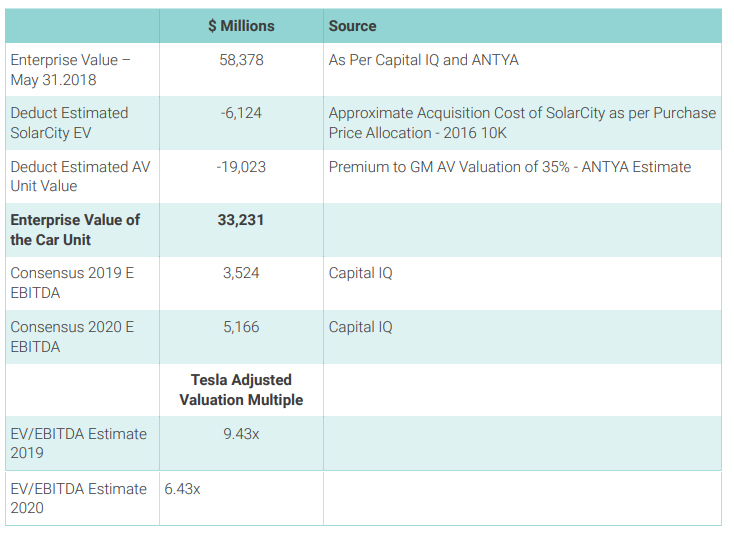

The most crucial element of today’s GM announcement is the ability to isolate the Tesla AV program and opportunity from its car business. In Figure 3 we highlight our view of Tesla’s valuation based on developments today.

Figure 3: Tesla’s Car Business is Undervalued

Source: ANTYA and Capital IQ

As highlighted, we value Tesla’s AV driving unit at $19 billion approximately. SolarCity valuation is available from purchase price allocation outlined in 2016 10K. Deducting the two from Tesla’s current enterprise value in the marketplace, we arrive at the enterprise value of the automotive operations only. Our estimate is approximately $33 billion or thereabouts, or 9.43x 2019 consensus EBITDA, and 6.43x 2020 consensus EBITDA.

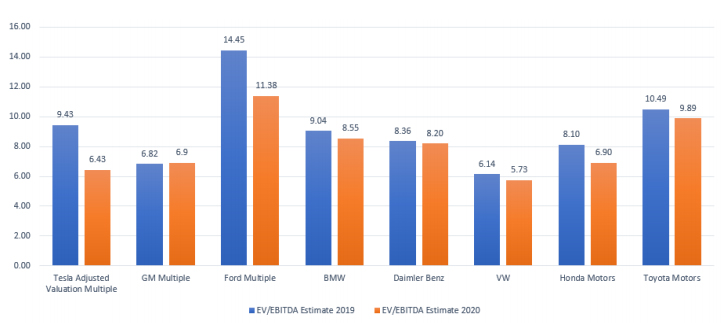

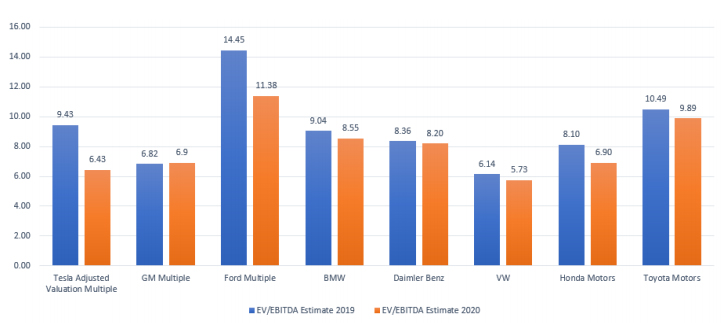

How does that compare to other automotive manufacturers? Figure 4 provides the answer.

We Conclude Tesla is Undervalued Compared to its Peers

Figure 4: Tesla is Undervalued Compared to Its Peers

Source: ANTYA and Capital IQ

ANTYA believes that investors will find it hard to argue that Tesla should trade at a discount to all other automotive manufacturers.

We conclude Tesla is undervalued, and that as soon as Model 3 production problems are behind it, the stock will skyrocket upwards. Good Luck to the bears.