Readers that have followed our published view on GE previously ( General Electric (GE US )- 25% Downside and Perhaps a Single Digit Stock Price in Its Future?) will recall that we were and still are sceptical of capital’s prospects for 2018 and beyond. Therefore, this recent update from the CFO doesn’t surprise us. However, it does give pause to those investors that have been bullish on GE’s prospects assuming a quick turnaround in its fortunes. We, on the other hand, believe the that the challenges facing GE are significant, although not insurmountable. However, in the time that GE’s management puts a credible turnaround plan in place, executes on it and delivers results that investors can hang their hat on, the markets would have moved much higher, while GE’s stock will lag, causing portfolios exposed to GE to under-perform.

What else did we learn today?

Compared to the update provided by the company in November 2017, the CFO updated investors with the following additional pieces of information which we discuss below.

GE: The power business is a little worse than expected. There is significant inventory accumulated in the power business.

ANTYA view: That cannot be good because it is the company’s largest segment. It confirms our view, outlined previously, that cost reductions will be accompanied with price reductions with little net benefit to realised industrial operating margins.

GE: Renewable Energy is about the same with some pricing pressure emerging.

ANTYA view: As envisioned by us we expect cost control to be competed away in price.

GE: Aviation and Healthcare are OK.

ANTYA view: These are GE’s strongest segments driving higher margin service revenues. There are rumblings that both could be spun out as independent companies.

GE: Transportation and Mining are Ok.

ANTYA view: These are much smaller segments that will not have a meaningful impact on GE’s valuation. If transportation doesn’t recover or perform up to projections, then some of the goodwill associated with the Alstom acquisition could be impaired.

GE: GE Capital is expected to be worse.

ANTYA view: This is an albatross around GE which will continue to weigh on GE’s prospects for years.

GE: Baker Hughes GE is performing as expected, with some improvement in near-term oilfield services segment, whereas the longer cycle CapEx related elements are expected to improve in second half of 2018.

ANTYA view: BHGE is a cyclical business which is unlikely to bring stability to GE’s industrial ambitions and will introduce higher volatility in GE’s earnings thereby becoming a drag on the company’s P/E multiple.

GE: Management remains confident in litigation reserves related to the representation and warranties associated with mortgages etc. which it inherited from the financial crisis.

ANTYA view: Management is closest to the situation, and hence we take their word for it.

GE: On the new Department of Justice investigation, related to similar matters from the time of the financial crisis, it is too early to tell what track the investigation might lead to, and hence nothing is certain on that front.

ANTYA view: We have no way of estimating any penalties that might be levied by DOJ.

GE: A face to face meeting with the SEC regarding the accounting

investigation is expected to take place in March 2018.

ANTYA view: The market is expecting a restatement already. With SEC meeting in March, perhaps GE wants to provide additional details it is 2017 10K. Our view on GE’s accounting and the impact of upcoming changes can be found here ( General Electric – A Single Digit Stock Price – Part 2).

GE: The long-term insurance liability has been provided for in the January 2018 disclosures related to capital. Independent actuaries, auditors, accountants and consultants were involved to ensure that no stone was left unturned. A rising interest rate environment can be helpful to GE Capital in this specific instance, but right now nothing else is required to be done. We are confident in our provisions.

ANTYA view: We agree with management on this. It makes sense that the new CEO and CFO want to clean house, and so we believe they would have done exactly that.

GE: Every 25 bps increase in interest rates, helps reduce the pension plan deficit by $2.2B. However, we are still contributing $6B this year and will contribute additional amounts as required. So far there is no change in plan.

ANTYA view: Given that regulations that inform Employment Retirement Income Security Act (ERISA), which governs pension contributions for pension plans, are based on backwards-looking interest rates and not prospective rates, we don’t expect GE to catch a breather in the near term.

GE is Undergoing Massive Transformation – At least That’s What the CFO is Notifying

The CFO also portrayed a picture of a company undergoing existential soul searching, which we are a little perplexed with. Apparently, management of GE is focussed on:

- Resetting the power business.

- Run the business for cash and costs, i.e. maximising cash flow and optimising costs.

- Ensuring deep operational rigour is in place to maintain leadership in product segments.

- Review the portfolio which is perhaps an allusion to the $20B or so of divestitures being contemplated by management and highlighted by the CEO.

What should investors make of any of this is the key question. It appears based on this description that prior to 2017, and the new CEO coming in, GE was not managed to any of these fundamental principles that define how a business should be run? Why would that be?

Aha, because perhaps GE Capital was the saviour. Now that capital is on life support, apparently air is being sucked out of the company’s lungs too. It seems it was cheap liquidity accessed via capital that kept the industrial segments of GE afloat. Now that capital can’t provide the cushion, all bets are off the table, or are they on the table!

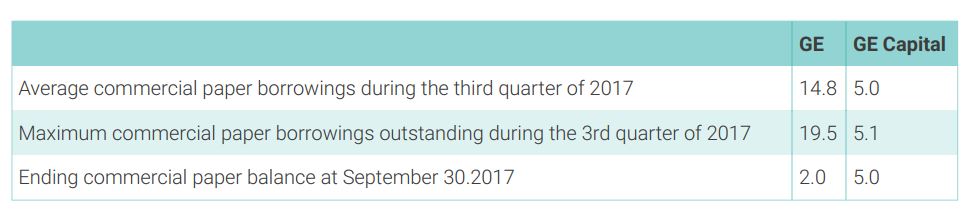

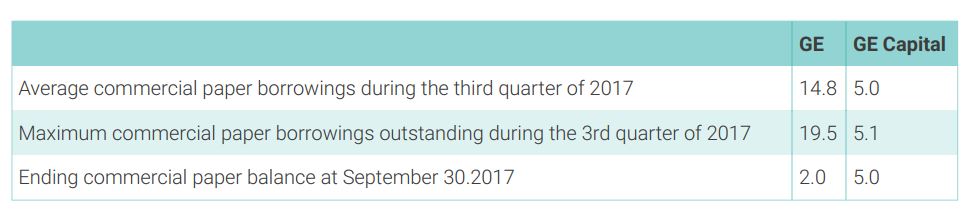

To corroborate our point, we highlight the following table from GE’s 3Q17 results. During the 3rd quarter of 2017, GE utilised approximately $15B of commercial paper for its liquidity management needs, although at the end of the quarter, i.e. on the reporting date of the balance sheet, the company had only $2B of commercial paper outstanding.

Figure 1: GE Commercial Paper Outstanding

Source: ANTYA and 2017 3Q Form 10Q

These are big numbers even for a big company like GE, which intends to end 2018 with cash at GE industrial of $15B. What’s even more important, is that all this liquidity was available at much lower rates in Q3-17, compared to where rates for similarly rated issuers are today, and after today’s minutes of FOMC, these are going up even more. For the naysayer, we highlight data in Figure 2.

As illustrated in Figure 2, rates are up more than 50% from September 2017. That implies big users of commercial paper like GE are bound to feel the pinch when it comes to EPS because liquidity is no longer cheap. Hence our steadfast view that troubles at GE Capital are likely to affect the company far more seriously than currently anticipated by market participant. For instance, if GE were to use an average of $15B in commercial paper throughout 2018, based on current rates it would increase the company’s year-on-year interest expense significantly. An annualised increase of 1% would increase interest expense by $150M.

In our view that is the most important question that the CFO could have answered today. However, the answer doesn’t provide confidence to us that GE’s stock is headed in the right direction; at least not yet. For 2018 and 2019 the CFO was of the view that GE needs to improve its working capital cycle to free up cash in the business – i.e. get rid of inventory in the power business – and work on operational improvements. The CFO said that GE turns its inventory 4 times currently, and that there is room for improvement.

We do sympathise with the dilemma facing management, because if the biggest business segment, i.e. power is under duress, and if so-called “cost-out” is going to be competed away to win business, then the only options are to sweat the assets first, and then worry about growing the cash flow via reinvestment later.

Conclusion

To conclude, GE has clearly telegraphed to investors that it is facing challenges on multiple fronts. The company is making some headway in dealing with a few of its issues, while it continues to work on the rest. Investors, on the other hand, do not have the luxury of waiting for this

turnaround. With limited capital and multiple opportunities, it is our view that there are many mega-cap stocks in the Dow, S&P 500 and STOXX 50, that are a better bet than GE.

At this juncture, GE is neither a value play nor a turn around story. It is a meandering ship looking for the right port of call.