GE Will Surprise to the Downside

General Electric Company (“GE” or “company”) had a terrible 2017, with the stock providing a total return of -42.1%, compared to the S&P 500 Index (“S&P”) at 21.8%. Moreover, the company’s streak of dividend growth after the financial crises was interrupted with the dividend for 2018 slashed in half to an annualised rate of $0.48 per share, pushing it back down to 1999 levels. The management of GE is struggling with a conglomerate operating in multiple business segments, that possess neither technology nor market synergy. We expect continued under-performance in 2018 as well. (All amounts in USD)

Multiple issues plague GE beginning with:

GE Capital Blindsides Investors, Regulators and GE – Negative 1

Perhaps GE Capital (100% owned financing subsidiary of GE, “Capital”) is the entity that loosely ties everything together at GE given its ability to “enable orders … through the act of introducing, elevating and influencing customers [paraphrased][1]”. Enabled industrial orders for the first nine months of 2017 at $8.8 billion represented approximately 11% of organic revenues, and 50 bps of YOY organic revenue growth. In Q4-17 Capital booked a $9.5B pre-tax charge, related to its underfunded legacy long-term care business, which has been in a run-off mode since 2006 after Genworth & ERC exits[2].

Capital is now on the hook for a mandated and cumulative cash contribution of $15B to boost regulatory capital at its legacy long-term care business, with $3B due in Q1-18, and $2B annually from 2019-2024. Naturally, dividends to GE stopped, with management outlining “no dividend from GE Capital for the foreseeable future[3]”. Management also acknowledged continuing challenges at Capital by endorsing the need to make the business “smaller and more focussed”, with an intent to “retain targeted capabilities to support industrial business”.

Big Bath Accounting Hides More Than It Discloses – Negative 2

We are not fans of big-bath accounting which tends to obfuscate more than it discloses. A $15B charge related to a book under run-off since 2006, speaks to a culture of complacency at GE. Specifically, in GE Capital’s instance management also booked an additional after-tax $1.8B charge related to its energy portfolio, under the guise of right-sizing it, while driving investor attention towards long-term care. Moreover, management also outlined that Capital will be exiting most of the energy financial services business, $9.9B in assets as of Q4-17 (8.6% of verticals asset base within Capital) and that Capital will also be reducing the size of the industrial finance segment.

GE Capital Leveraged to the Hilt – Debt/Equity Higher Than After the Financial Crises – Negative 3

At the end of 2016, Capital reported book equity of $24.6B, compared to $81.8B in 2012. In 2012, GE Capital reported Debt/Equity of 4.08x compared to 2.79x at the end of 2016. In the aftermath of the financial crises, a majority of large financial institutions realigned their businesses and

reported shrinking books either to escape regulators or to get rid of unviable lines of business. Portfolio rationalisation by GE Capital accomplished via spin-offs and sale of businesses shrunk the company’s earnings as well.

Nonetheless, the fiasco at Capital’s long-term care business resulted in its book equity diving YOY in half to $13.5B at the end of 2017, concurrently increasing Capital’s debt/equity to 7.1x. Management expects an improvement to 4.5x by the end of 2019, perhaps via asset sales. Regulators at the SEC are investigating GE’s accounting practices at its industrial units, and like all market-watchers, are aghast at the $15B long-term care charge. We believe that brings into question control systems at GE as well, and could lead to an investigation of GE’s auditors and its audit practices too.

For the uninitiated, Genworth the long-term care business spun out by GE, trades at a handsome P/B of 0.1x and TTM P/E of 4.5x, for the simple reason that investors neither believe in the stated book equity of the business nor its earnings potential. Uncertainty associated with long tail characteristics of the claims and the rising cost of fulfillment bear the burden of such low multiples.

Capital Valuation Should Take a Hair-Cut – Negative 4

In 2018 and 2019, management expects break-even earnings at Capital, and approximately $500M in 2020. On a current capital base of $13.5B that is an abysmal ROE of 3.7% in 2020. After the financial crises, until Q3-17 (before President Trump was elected) most banks that earned an ROE of less than 8% and reported shrinking books, were valued by the marketplace at less than

0.8x book value and at less than 10x P/E. Therefore, an optimistic multiple of 10x on 2020 earnings of GE Capital, discounted to present at 10%, approximates to $4.1B in present value of those earnings, or about $0.48/ share of GE. That implies a current multiple of 0.30x the book value of $1.56/ share.

In our view, it is incumbent upon GE investors to ascribe a hair-cut to Capital’s valuation as well, especially now that it has to de-lever and fund statutorily required capital contributions, will report no earnings for another two or three years and will continue to shrink. If our estimate appears particularly harsh, one should ascribe at most a 0.50x to Capital’s book value. Some of the leading financial institutions of the world that are caught between regulatory requirements and capital allocation decisions, such as the Royal Bank of Scotland and the Deutsche Bank trade at deep discounts to book value, whereas unencumbered compatriots such as CIT group trade at book value.

We should point out that management appears confident that it can reduce leverage at Capital by selling unencumbered assets worth at least $15B.

Power Business Struggling In spite of Synchronous Global Growth – Negative 5

Some of GE’s industrial businesses are facing an equally challenging environment with Power – which is the largest segment contributing 36.3% of 2017 industrial revenues of $99B excluding Oil & Gas – especially

stressed. Power segment orders, revenues, profits and operating margins declined in sync, with management articulating even more difficulties for 2018. GE anticipates a 15% decline in its addressable power market to 30 GW in 2018, with management currently restructuring the power business to support a lower level of demand.

Aviation and Healthcare comprising 47% of industrial segment revenues are growing approximately in line with nominal GDP at 4%-5%, and at this juncture in the economic and demographic cycle appear well-placed. Renewable energy faces challenges from the Trump administration, a rising subsidy burden in Europe, and headwinds in the form of a constrained GE Capital. Lighting, Transportation and other mature segments are unlikely to move the needle for stock investors, and we expect that both are up for divestiture in 2018 or 2019.

Non-GAPP Free Cash Flow and Unfunded Pension – Negative 6

For 2016 (2017 data unavailable), on a GAAP basis GE reported a $19.1B deficit in its pension plan and another $6.5B for its supplementary pension plan[4]. While providing guidance on Non-GAAP 2018 industrial free cash flows from operations of $6-$7B, the company omitted pension contributions in its supplementary disclosures. The intent as always was/is to assist investors in arriving at a “truer” picture of underlying operations.

In ANTYA’s view, reclassifying pension funding contribution as a financing item merely kicks the proverbial can down the road because while it improves optics for a short time under the guise of non-GAAP disclosures, investors ultimately get worried over an unsustainable debt load on a shrinking and challenged business. Management is of the view that instead of $2B in contribution that they could make, the company is making excess contributions of around $4B and hence it should be excluded. In GE’s defense most investors tend to overlook pension funding as a non-operational call on cash flows and hence tend to treat it leniently.

GE is funding the pension plan by $6B in 2018, via debt. While some investors might rejoice at the highlighted $6B-$7B free cash flow number, we highlight cash requirement of at least $10.1B for 2018 in the form of $4.1B for dividends, and $6B for the pension plan contribution. That implies that in the absence of asset sales, GE’s debt is going up again in 2018. Management already expects negative free cash flow in Q1-18.

Rising Rates Will Undermine GE Investors – Negative 7

We believe that GE’s current dividend yield of approximately 3% will break the 4% threshold by the end of 2018, putting downward pressure on GE’s stock price as investors realise that:

- GE Capital and GE’s funding costs will rise meaningfully by 2020. With U.S. 10 year approaching 2.7% and rates rising in tandem across developed capital markets, a 1% increase in rates will have a deleterious impact of approximately $1B in incremental interest expense on GE with gross debt, excluding BHGE, approaching $125B (Asset sales and subsequent portfolio rationalisation could change our estimate).

- Stagnant cash flows, challenged end-product markets, and an urgent need to revitalise the business will require a significant increase in reinvestment rates that current free cash flows are unable to support. Therefore, dividend growth will fail to fructify increasing the yield on the stock.

- As capital market investors scrutinise GE Capital’s predicament and its inability to carry GE forward, any turn-around premium inbuilt into GE’s stock will evaporate, pushing risk-premiums on GE higher.

- Although management has telegraphed a challenging Q1-18, investors could still be surprised and head for the exits, especially if progress on divestitures is slow and appears not meaningful.

- A smaller board comprising current board members is unlikely to steer the organisation any better, and with a $15B hole in the run-off operations, it has already been found to be sleeping at the wheel.

- The SEC investigation into GE’s accounting w.r.t to the insurance reserve increase, and GE’s revenue recognition and control of long-term service agreements, could result in GE restating past results and perhaps a lowered prospective guidance. We are also very interested in understanding the accounting behind service contracts and have approached GE investor relations with some questions.

- Investors can invest in pure play companies to bet on healthcare, power, transportation, finance, lighting and GE’s other business. Therefore, GE provides no compelling reason for investors to own the stock unless it can grow its dividend faster than the overall market & other industrial stocks. It has already failed to prove its resilience on both counts, i.e. it has cut its dividend twice in 10 years and will be unable to grow it meaningfully going forward till after 2020.

- In a low-tax environment, buy-backs and dividends for S&P 500 are likely to increase across the board. Lagging its counterparts will push its valuation lower with the passage of time.

- GE could be kicked out of the Dow Jones Industrial Average causing dislocation in client portfolios. ETFs replicating the Dow, will sell GE en masse.

- With Siemens AG reporting declining revenues, declining orders, lower operating margins and lower profits in both its wind power and power divisions, the lesson for GE investors is that the hoped-for turnaround is fundamentally challenging with no readily available solution to its problems.

Currently Priced for Perfection – We estimate 25% or More Downside from Current Levels – Negative 8

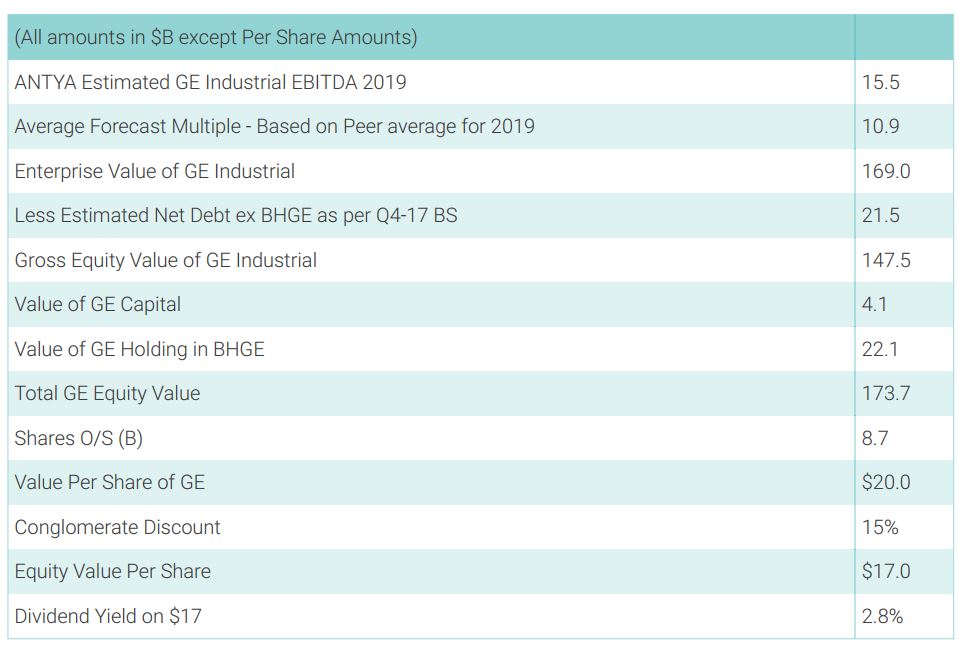

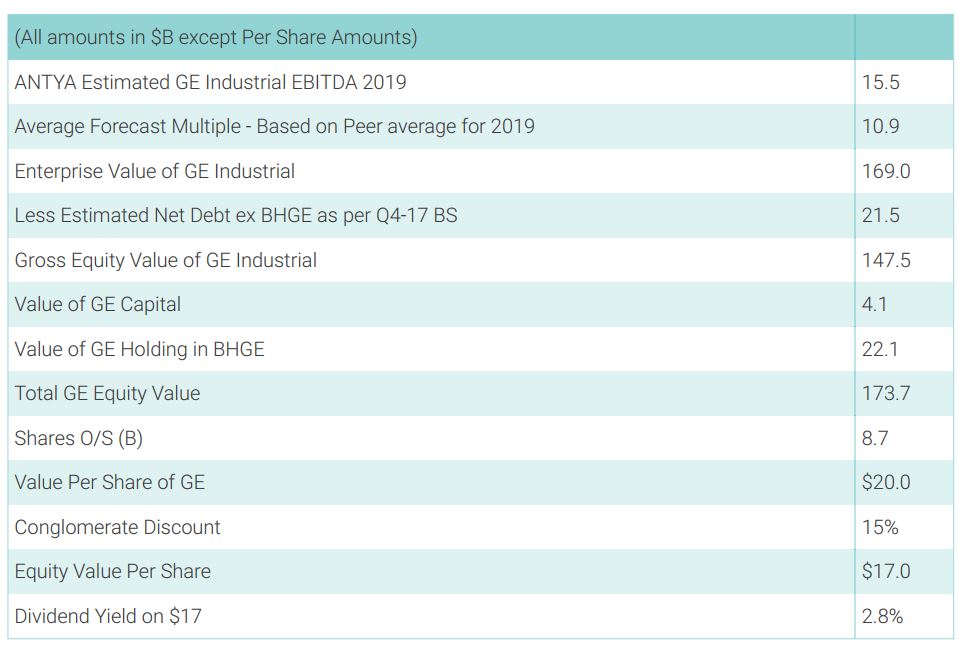

In our view, a 4% dividend yield on a slumbering giant that expects to grow 2-4% organically, with hiccups along the way appears about right. That equates to an EV/EBITDA multiple of 8.3 x 2019 estimated EBITDA, compared to a current multiple of 10.9x.

We estimate that currently GE is valued by investors at industry EV/EBITDA multiple for the industrial segment. Our estimate is based on an average of Bloomberg sourced data for comparative group comprising Honeywell International Inc. (HON US), Lockheed Martin Corp (LMT US), ABB Ltd (ABBN VX), Siemens AG (SIE GR), Vestas Wind Systems A/S (VWS DC), Bombardier Inc. (B CN) , Schneider Electric Infrastructure Ltd. (SCHN IN), Safran SA (SAF FP) and United Technologies Corp (UTX US).

Source: ANTYA and Company Disclosures.

Our $15.5B EBITDA estimate for 2019 is based on parsing 2017 financials, and excludes BHGE. For 2017 we estimate that GE Industrial reported approximately $16.2B in EBITDA excluding BHGE. We do not expect EBITDA to grow in 2018 and 2019, given multiple headwinds in approximately 50% of GE’s revenue base. Prospective accounting policy changes are also likely to reduce EBITDA going forward. We expect any gains in costs to be competed away in an over-supplied market for industrial infrastructure.

Higher rates will also compress EV/EBITDA multiples going forward. Current valuations do not reflect that eventuality. That compressed multiples could easily result in a single digit stock price for GE in the second half of 2018, should not be underestimated.

While a simplistic application of forward looking industry multiples encompassing various valuation yardsticks suggests at worst a fully valued stock price, we believe the issues raised by us describe a heightened state of flux within the enterprise, and a rapidly evolving external environment over which GE has little control. Given Capital’s predicament, and the challenges facing the power and the renewable energy segment, investors need to rethink their reasons for owning GE at this juncture. At prices approaching 4.5%-5% dividend yield, GE would be a good addition to large cap value portfolios.

Right now GE is a drifting ship and will be a drag on portfolio alpha everywhere. Eight negatives do not a positive make.

Caveat Emptor

An activist investor could get involved giving a temporary boost to the stock price, although it is unclear given current valuation & business challenges what could be done in short order?

We are pessimistic nonetheless. A better risk-return trade-off is available elsewhere in S&P500 and/or in the Dow.

If past is prologue then GE’s accounting has set it up for more downside going forward. Stay tuned.

[1] 10 Q – Q3.17

[2] Q4-17 presentation

[3] Slide 5, GE Insurance Update, January 16, 2018

[4] Page 124, 2016 10K