GE will be reporting its Q1-2018 results on April 25, 2018. In our view, GE’s challenges are significant and underappreciated by investors. We believe that the list while long, is best summarised as ….

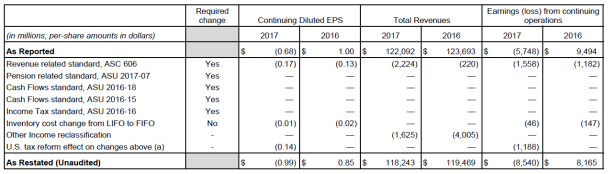

We have been bearish on GE’s prospects since initiating coverage of the stock on Smartkarma and maintain our view that GE’s ultimate destination is a single-digit stock price in the latter half of 2018. Our report of February 13, 2018, on General Electric (“GE” or the “Company”) General Electric – A Single Digit Stock Price – Part 2 discussed GE’s upcoming accounting policy changes, and their impact on the Company’s reported financials going forward. On April 13, 2018, GE filed its form 8K with the Securities and Exchange Commission (“SEC”) in the United States and disclosed restated prior year financial results, incorporating lower revenues, lower earnings, and a significant decline of $7.5 billion to its 2017 book equity. Figure 1 sourced from the 8K filing outlines some of the changes.

Figure 1: GE – Restating the Past for a Better Future

Source: GE 8K SEC Filing and ANTYA Investments Inc.

GE is also under intense scrutiny by the SEC, which has initiated an investigation into the Company’s accounting practices, alarmed by the $15B write-offs associated with its long-term care liabilities announced in January 2018. In ANTYA’s opinion, accounting changes undertaken by GE serve to boost it’s bottom-line going forward, by re-writing history. From our vantage point, the most interesting thing to highlight up-front – before discussing other more conceptual changes – is the change associated with GE’s inventory policy from LIFO (Last-in first-out) to FIFO (First-in-first-out). It is especially intriguing given that this change only affects the U.S., as disclosed by GE in its 10K and we quote;

Cost for a portion of GE U.S. inventories is determined on a last-in, first-out (LIFO) basis. Cost of other GE inventories is determined on a first-in, first-out (FIFO) basis. LIFO was used for approximately 32% and 34% of GE inventories in 2017 and 2016, respectively.

Equally pertinent is the fact that the U.S. economy is at full employment, the Fed’s preferred metric of inflation is imminently approaching 2%, and the

prices reported by PMI rose for the 25th consecutive month as discussed in FOMC Minutes – Growth, Financials, and Technology Outperforms; Gold, Yen, HY and EMs will Correct. Given our view on the underlying strength in the U.S. economy, discussed in February 2018 Employment Report – Supports 4 Hikes in 2018 and 4 in 2019 – Are Asian Equities Ready? and

in The Dot Plot Giveth – The Fed Presses On, we believe GE is once again trying to boost its earnings via a deliberate change in its accounting policy.

We believe the a/c policy change associated with GE’s inventory is an opportunistic change designed to deliver traction in gross margin improvement promised by management to investors under the “cost-out” moniker. We expect that by moving from LIFO to FIFO, the Company’s gross margin should gain, due to a deferral of higher and/or rising current period raw material costs to later periods. While using LIFO earlier, GE benefitted from the deflationary U.S. business environment which began during the financial crisis.

By implementing the inventory accounting change as illustrated in Figure 1 and booking a charge to its earnings in 2017 and 2016, in one swoop GE has lowered the cost of its U.S. inventory on its books. GE justified its decision by saying that;

We believe the FIFO method is a preferable measure for our inventories as it is expected to better reflect the current value of inventory reported in the consolidated statement of financial position, improve the matching of costs of goods sold with related revenue, and provide for greater consistency and uniformity across our operations with respect to the method of inventory valuation….The retrospective application of the change resulted in a decrease to our January 1, 2016 retained earnings of $105 million and an increase to our loss from continuing operations by $124 million and a decrease to our earnings from continuing operations by $147 million for the years ended December 31, 2017 and December 31, 2016, respectively.”

Acute observers of financial statements will note that management is “of the view now” that the newly adopted accounting policy better matches costs to “related revenue”.

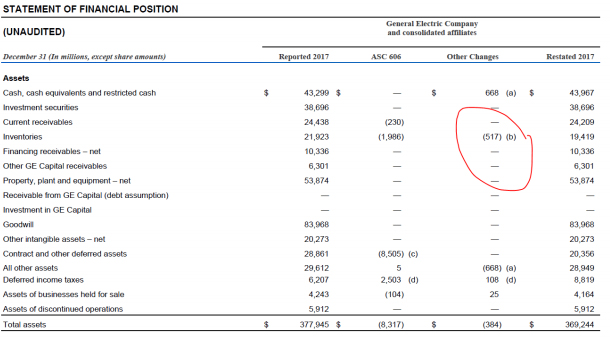

GE’s accounting policy change increased its cost of sales by $175 million in 2017 and $199 million in 2016, while simultaneously resetting the cost base of its entire inventory lower by $517 million as per the restated filing. See attached Figure 2.

Figure 2: LIFO to FIFO Lowers Inventories on Books

Source: GE 8K and ANTYA Investments Inc.

Going forward, this should provide a boost to already meager margins especially in the power segment, which we highlight later in the report.

Adoption of ASC 606 Reins in Management Discretion

In ANTYA ‘s view, the adoption of this accounting policy takes away a judgment-based cookie jar that previous GE managements appear to have used to boost net income and accelerate revenue recognition. Under the prior standard, based on managerial assumptions, GE was able to revalue its contract assets, and any margin changes associated with those contracts were

applied to the entire length of the contract (i.e. long-term service or equipment replacement agreements in power, aviation, and other segments) . To quote GE from its 2016 10K:

There was limited guidance for accounting for contract modifications under prior U.S. GAAP. As a result, our previous method of accounting for contract modifications was developed with the objective of accounting for the nature of the contract modifications. Generally, contract modifications were accounted for as cumulative effect adjustments, which reflected an update to the contract margin for the impact of the modification (i.e., changes to estimates of future contract billings and costs); however, modifications that substantially changed the economics of the arrangement were effectively accounted for as a new contract.

The application of that policy worked to the benefit of managerial bonuses, whereas shareholders were left to deal with vagaries associated with operational uncertainties. Nonetheless, as per 2016 GE 10K:

… Revisions may affect a product services agreement’s total estimated profitability resulting in an adjustment of earnings; such adjustments increased earnings by $2.2 billion, $1.4 billion and $1.0 billion in 2016, 2015 and 2014, respectively.

These adjustments reported by GE for 2016, 2015, and prior years were all booked to GE’s industrial segment. For 2016, GE’s industrial segment operating profit declined 4% YoY to $16.7B, from $17.4B in 2015. If we take away the $2.2B increase in earnings attributable to assumption changes, the 4% decline would translate into a much bigger and more worrisome number. We are unable to illustrate the adjusted calculation here because the reported earnings impact of the accounting change is on a consolidated after-tax basis, whereas industrial segment organic profit growth is reported on a pre-tax basis.

However, in 2018, according to GE, the adoption of the new accounting standard and policy resulted in a write-down described thus;

… our previously reported retained earnings as of January 1, 2016 decreased by $4,243 million and our previously reported revenues and earnings (loss) from continuing operations decreased by $2,224 million and $2,668 million (or $1,558 million before impact of U.S. tax reform), respectively, for the year ended December 31, 2017 and by $220 million and $1,182 million, respectively, for the year ended December 31, 2016. The effect on our statement of financial position was principally comprised of changes to our contract assets, inventories, deferred taxes, deferred income and progress collections balances resulting in an $8,317 million decrease to previously reported total assets as of December 31, 2017.

The assumption based gain of 2016 became a write-off in 2018. For the optimists in the room, GE believes that:

While these contract asset balances have been reduced due to the accounting changes, the economics and cash impact of these contracts remain unchanged.”

To the layman, that says yes, we booked fictional gains on contract assets in the past, and yes, we are writing-off those fictional gains, which negatively affects our book equity. Don’t be worried though, because we will re-book the same income going forward once again! This time correctly; based on economic and cash flow reality.

Trust us! No wait, trust the new accounting standard.

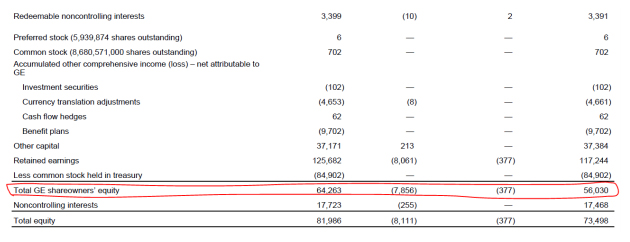

A Massive Hit to Book Equity is Disconcerting

Given various write-downs, divestitures, and spin-offs, GE’s book equity continues to decline at an alarming rate. The adoption of the new accounting standard resulted in a 13% decline in consolidated book equity to $56.03B or by $0.95 per share to $6.45 per share from $7.40 previously as illustrated in Figure 3 from the 8K filing.

Figure 3: GE’s Book Equity Takes a Blow

Source: GE 8K Form and ANTYA Investments Inc.

To those investors that are valuing GE on a multiple of book value, two noteworthy issues to assess are:

- A continuous decline in book value year after year with no end in sight. We still do not believe that the worst is behind GE.

- A rising debt/book equity with each restructuring and restatement resulting in a risk to GE’s investment-grade credit rating.

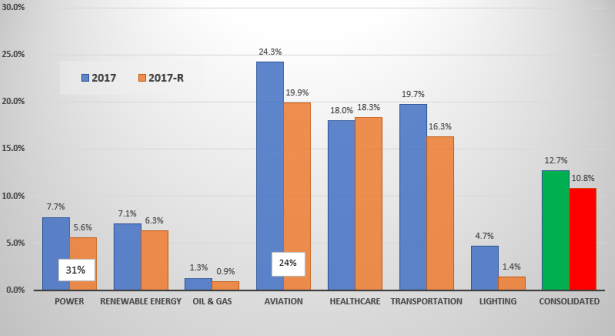

Newly Disclosed Segment Profit Margins Are Meaningfully Lower

The restatement of results further outlines the challenges facing GE’s biggest segments i.e. power and aviation. The two segments account for 55% of GE’s revenues and on a restated basis 60% of industrial profits.

Figure 4: GE’s Restated Margins are Lower Across the Board

Source: GE 8K Filing and ANTYA Investments Inc.

Restated profit margins at Power declined to 5.6% from 7.7% earlier, whereas those in aviation declined to 19.9% from 24.3% previously. Not only are these profits lower, but the new accounting policy also makes it, unacceptable to recognize margins based on assumption changes. Hence the new LEAP engines which are expected to be the driving force behind the growth in the aviation segment, are unlikely to have a material positive impact on GE’s financials in the near term. As GE said in its 8K;

The new revenue standard will result in a significant change from our previous long-term contract accounting model. While we will continue to recognize revenue at delivery, each engine is now accounted for as a separate performance obligation, reflecting the contractually stated price and manufacturing cost of each engine. The most significant effect of this change is on our new engine launches, where the cost of earlier production units is higher than the cost of later production units driven by expected cost improvements over the life of the engine program, which will generally result in lower earnings or increased losses on our early program engine deliveries to our airframer customers. The effect of this change reduced the related contract asset balance of $1,755 million as of December 31, 2017.

Clearly, under new accounting, actual, i.e. achieved learning-curve based cost improvements will flow through to the bottom-line, whereas any forecast based expectations get trashed. Outsiders now have a simpler tool to assess if management can deliver on its promises of structural cost take-outs as discussed and promised by the new management team at various investor events and analyst calls because any reported improvement in gross margins will be factual.

Conclusion

GE will be reporting its Q1-2018 results on April 25, 2018. In our view, GE’s challenges are significant and underappreciated by investors. We believe that the list while long, is best summarised as:

- GE’s tangible book equity is negative. While GE reports $54B of book equity, the Company has $80B of goodwill and $20B of intangible assets on its books.

- GE Capital has $13.5B of book equity, zero net income, a debt load of $95.2B, a liability of $3.5B towards funding insurance liabilities in 2018, and an additional insurance funding requirement of $11.5B by 2024. GE Capital is evaluating its portfolio and expects to sell $15B of assets. However, volatility in markets and a rising rate environment is not favorable towards valuations in general.

- GE is raising an additional $ 6B in debt in 2018 to fund its pension plan which is underfunded by $24B as of 2017. GE would be required to fund additional amounts going forward.

- GE makes extensive use of commercial paper to fund its liquidity requirements. Give that 90-day A1 rated commercial paper is yielding 2.22%, compared to 1.01% at the same time in 2017, the increase in GE’s short-term borrowing costs in 2018-2019, is likely to bite more than the Company’s cost-saving program can take-out from its operational costs.

- If GE is unable to sell assets successfully, it may cut its dividend once again to conserve cash. Currently, GE’s dividend obligation is $4.1B, interest obligation for 2018 is $3.7B, capital expenditures are expected to be around $3.5B. Restated operating income of 2017 is $12.1B. Also, unless GE’s operations are shrinking additional working capital investments will be required. We also anticipate a decline in operating income at power and aviation and an increase in overall debt funding costs at the Company.

In our view, GE is in a bind. A single-digit stock price is on its way. Investors who own the stock should be watchful.