FOMC released the minutes from its March 20-21, 2018 monetary policy meeting at 2:00 PM on April 11, 2018. A recovering S&P 500 and the DJIA, both turned negative soon afterwards as investors digested a more hawkish Fed. Given that the Fed is data dependent and backwards looking we expect investors to start anticipating and preparing for four rate hikes going forward, compared to the three currently anticipated. Higher rates are good for Financials, relatively better for growth stocks and technology stocks, are bearish for high-yield bonds, highly indebted companies, utilities and EMs.

In ANTYA’s view, we are headed to a 5% 10-year U.S. Treasury yield by the end of 2019.

The Federal Open Market Committee (“FOMC”) released its minutes of the March 20-21, 2018 meeting on April 11, 2018, and it appears that the capital markets were surprised by the more hawkish tone emanating from the FOMC. We have been of the view that investors are underestimating the resolve of The Federal Reserve Bank (“Fed”) to stay on top of its dual mandate of 2% inflation and full employment for some time now as discussed in our previous notes. FOMC participants lowered their estimate of the long-term rate of natural unemployment from 4.6% to 4.1% in the previous meeting, and now expect even lower in the medium term. FOMC said that:

The unemployment rate was projected to decline further over the next few years and to continue to run below the staff’s estimate of its longer-run natural rate over this period.

Therefore, FOMC’s stance has tilted such that having delivered a mortal blow to unemployment, it wants to ensure success in the sphere of inflation as well. We discussed that earlier in February 2018 Employment Report – Supports 4 Hikes in 2018 and 4 in 2019 – Are Asian Equities Ready?

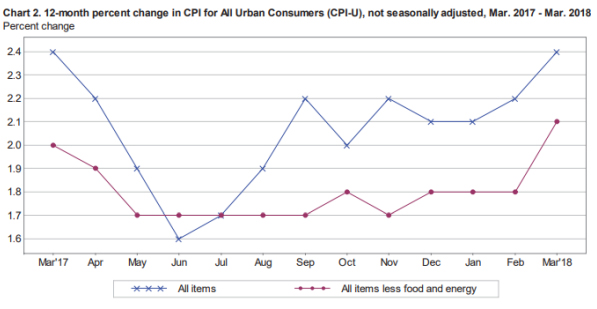

Although the Fed expects its preferred measure of inflation based on PCE price inflation to reach the FOMC’s 2 percent objective in 2019, other measures of inflation have already reached that target and are beginning to breach the 2 percent threshold regularly. Figure 1 from the Bureau of Labour Statistics March 2018 inflation report of April 11.2018, highlights that CPI inflation breached the Fed’s target in March.

Figure 1: Inflation is here: Believe it or Not!

Source: BLS and ANTYA Investments Inc.

We have discussed previously in our reports The Dot Plot Giveth – The Fed Presses On that most indicators suggest that wage inflation should also pick up, given that there is little slack in the labor market and that the only savior we can think of is an ever-improving LFPR. It appears that the doves in FOMC still believe an improving LFPR can keep wages low, as highlighted in the following para from the minutes of the meeting.

The firmness in the overall participation rate— relative to its demographically driven downward trend— and the rising participation rate of prime-age adults were regarded as signs of continued strengthening in labor market conditions. A few participants thought that these favorable developments could continue for a time, whereas others expressed doubts. A few participants warned against inferring too much from comparisons of the current low level of the unemployment rate with historical benchmarks, arguing that the much higher levels of education of today’s workforce—and the lower average unemployment rate of more highly educated workers than less educated workers—suggested that the U.S. economy might be able to sustain lower unemployment rates than was the case in the 1950s or 1960s.

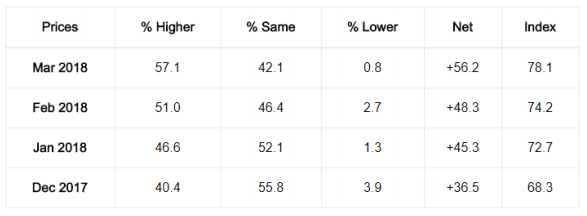

Although an interesting perspective, a growing services sector demands a younger and less skilled labor force than envisaged by the FOMC in its comments. In ANTYA’s view, an improving LFPR can result in the managerial cadre perhaps feeling less loved during wage negotiations, but in the lower rungs of the day-to-day operational economy, the second half of 2018 has some unpleasant wage-related surprises in store. Adding further credence to an uptick in underlying inflation in the March 2018 ISM Manufacturing survey, released by the Institute of Supply Management on April 2, 2018. Figure 2 illustrates the raw material pricing trend as reported by seventeen industries that participated in the survey.

Figure 2: Rising Raw Material Prices Month on Month – A Continuing Trend

Source: Institute of Supply Management and ANTYA Investments Inc.

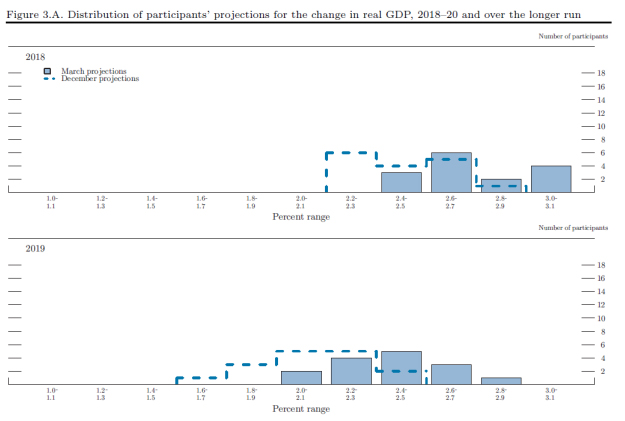

A higher proportion of survey participants with each passing month have reported higher input costs. The ISM Price Index of 78.1 increased by 3.9 percent on the previous month and registered the 25th straight month of increasing raw material prices. Given that FOMC is both data-dependent and backward-looking several new observations have come up in the current release. Compared with the Summary of Economic Projections (SEP) from December, a substantial majority of participants marked up their projections for real GDP growth as illustrated in Figure 3.

Figure 3: FOMC’s Real GDP Growth Expectations Heading Higher

Source: FOMC and ANTYA Investments Inc.

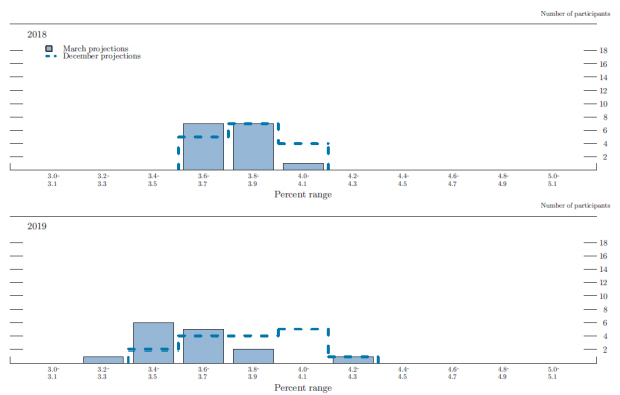

As illustrated, FOMC members are moving towards the right, i.e. higher growth, more so in 2019 than in 2018, accompanied simultaneously with lowered unemployment projections as highlighted in Figure 4.

Figure 4. Unemployment Rate Forecasts Move Lower

Source: FOMC and ANTYA Investments Inc.

In our view, this chart highlights the increasing risk that the Fed could be forced to move four times in 2018, and four times in 2019. Unprecedented low levels of unemployment accompanied by rising fiscal deficits and a strong global economy – barring a trade-war-related derailment which we are not forecasting in this document – could change the risk characteristics to the upside. Currently, the Fed believes that the risk is balanced. We do NOT!

Moreover, ANTYA is not alone in its expectation of an unanticipated shock to the system. The following from Jamie Dimon in his annual letter to shareholders released on April 5, 2018, provides context to our views.

It would be a reasonable expectation that with normal growth and inflation approaching 2%, the 10-year bond could or should be trading at around 4%. And the short end should be trading at around 2½% (these would be fairly normal historical experiences). And this is still a little lower than the Fed is forecasting under these conditions.

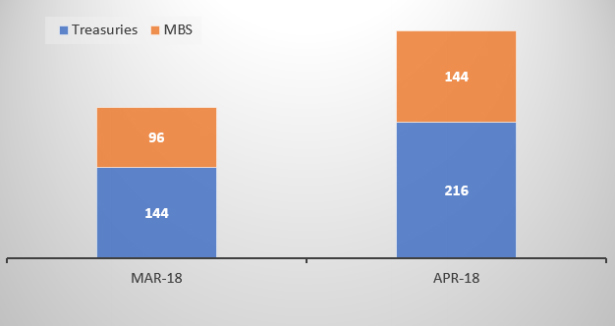

Beyond full employment and inflation, a normalization of the quantitative easing process will also contribute to a rise in rates. The Fed has already increased the pace of reduction of its holdings of both Treasuries and mortgage-backed securities (“MBS”) beginning April 2018. Figure 5 highlights the trend.

Figure 5: Fed’s Balance Sheet shrinking at a 50% Faster – Annualised

Source: FOMC and ANTYA Investments Inc.

Needless to say that the current withdrawal rate from the quantitative easing of $360B is contributing to rising yields. Jamie Dimon also said, and we quote;

It is also a reasonable explanation (and one that many economists believe) that today’s rates of the 10-year bond trading below 3% are due to the large purchases of U.S. debt by the Federal Reserve (and others). However, by the end of this year, the Fed has indicated it might reduce its holding of Treasuries by up to $150 billion a quarter. And finally, the U.S. government will need to sell more than $250 billion a quarter to fund its deficit.

Thus, it appears to us that a perfect storm is brewing.

- Lower support from Fed will push up Yields at the long-end of the curve.

- Higher inflation expectations will push up yields at the shorter end of the curve.

Conclusion

Therefore, the yield curve will shift upwards and steepen across all maturities sometime over the next 6-12 months.

We recommend that investors position portfolios away from high-yield, away from the value, and away from utilities and fixed income type securities such as preferred shares. We are overweight financials, overweight technology, and overweight growth. ANTYA also believes US$ will stay strong, Japanese Yen will weaken given Kuroda’s latest statements, while Euro will strengthen in the second half of 2018. Gold remains a haven trade and hence will bounce between $1,300 and $1,400, and if political tensions ease will break below $1,300. EM Debt and currencies will have to overcome a wall of worry and tightening liquidity conditions.