Facebook Inc A (FB US) is a bellwether stock for the equity markets. Although the market capitalisation is approaching $475 billion, the Company is still considered a growth stock. In our view, 2019 could be a pivotal year for the Company after a lack lustre 2018, when FB, although volatile, underperformed the NASDAQ. We believe that investors are underestimating revenue growth for 2019 and that FB is likely to surprise to the upside in Q1-19.

Facebook Inc A (FB US) (“FB” or the “Company”) has faced multiple regulatory challenges and intense scrutiny of its platform in 2017 and in 2018. The Company increased its spending on security, hired employees for news and post-verifications, accelerated investments in artificial intelligence to police its platform and significantly increased headcount to fortify its business operations against unwarranted intrusions. All of this has been done to placate concerned citizens and regulators worldwide. In the ensuing melee, FB transitioned from a place where people meet and greet globally, to a place where governments, regulators and law-enforcement agencies keep a watchful eye.

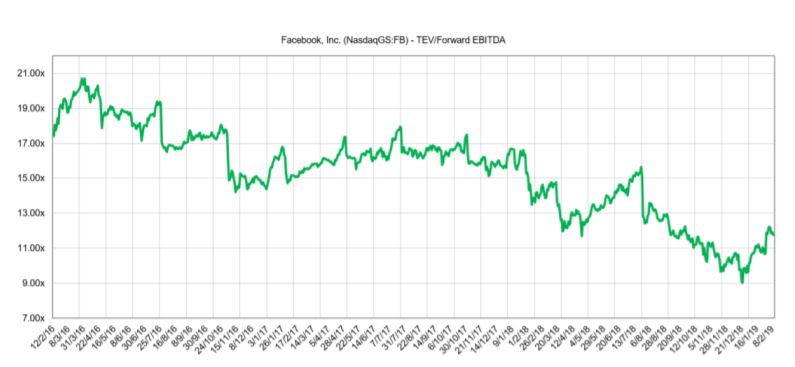

Concomitantly, FB is also maturing as a platform where people connect, although some of its properties such as Instagram and WhatsApp remain primarily unmonetized. Investors nevertheless appear to be skeptical of the Company’s continued growth with the forward EV/EBITDA multiple declining from stratospheric heights to more reasonable levels both on account of a more mature business, and expectations of additional regulatory backlash/oversight. The multiple trajectory is illustrated in Figure 1.

Figure 1: Will FB regain its Mojo?

Source: ANTYA and Capital.IQ

The current forward EV/EBITDA multiple sits at just below 12.0x based on consensus estimates for 2019, compared to an average of 15.3x for trailing three years. Consensus estimates for 2019 are outlined in Figure 2.

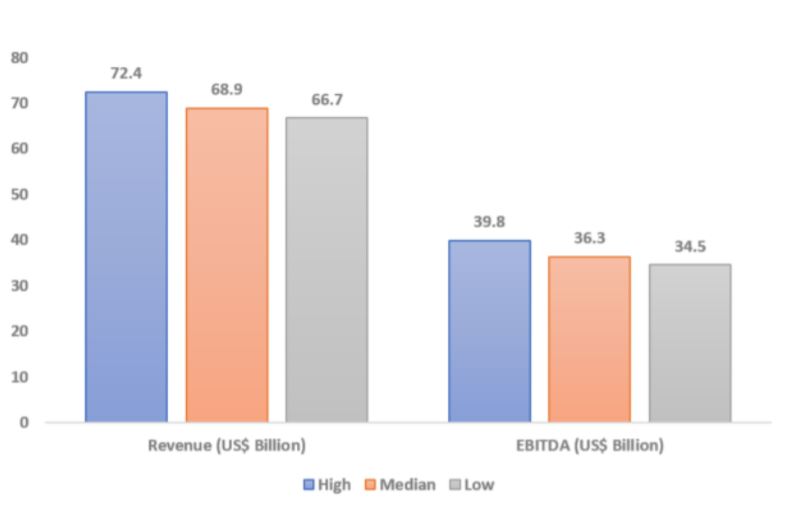

Figure 2: The Forecast Range is Wide – In Billions of US$

Source: ANTYA and Capital.IQ

In ANTYA’s view, the median consensus EBITDA estimates outlined in Figure 2 point to not so exciting 9% YoY EBITDA growth. Moreover, within that number the cost inflation expectations of the Company’s management, as outlined on the Q4-18 conference call on January 30.2019, are fully baked in. We outline the following remarks by Dave M. Wehner, the CFO on the Q4-18 call:

Turning now to the revenue outlook. In Q1, we expect our total revenue growth rate to decelerate by a mid-single-digit percentage on a constant currency basis compared to the Q4 rate. We also expect that our revenue growth rates will continue to decelerate sequentially throughout 2019 on a constant currency basis.

Turning now to the expense outlook. On a full year basis, we continue to expect 2019 total expenses will grow approximately 40% to 50% compared to 2018. Our 2019 capital expenditure outlook is unchanged at $18 billion to $20 billion, driven primarily by our continued large investment in building data centers.

Lastly, we expect that our 2019 tax rate will be a few percentage points higher than our 2018 rate”.

The CFO outlined expectation of revenue deceleration for the fourth quarter as well on the Company’s October 30, 2018, Q3-18 conference call, but revenue for Q4-18 came in much stronger than management anticipated, resulting in a significant bump in the stock price. However, we are concerned more with the expense growth and less with revenue forecasts, because the cost inflation numbers as outlined by management line up seamlessly with consensus estimates. That suggests to us that there isn’t much information value in consensus EBITDA numbers, and hence investors looking for an edge need to look beyond the consensus.

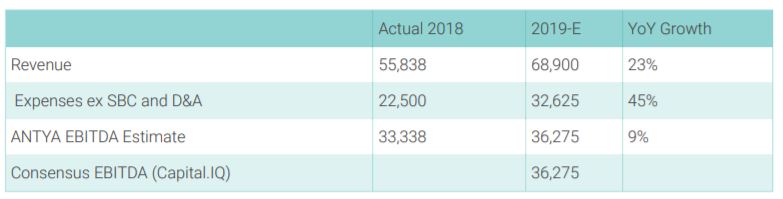

Figure 3 outlines our view based on management’s forecast.

Figure 3: Forecast EBITDA and Consensus – In Millions of US$

Source: ANTYA, FB and Capital.IQ

The revenue forecast for 2019 and 2020 in Figure 3 is based on consensus estimates outlining revenue growth of 23% for 2019 and 21% for 2020. The CFO of the Company outlined a mid-single digit revenue deceleration for Q1-19 and expects the revenue deceleration trend to continue for the remainder of the year. For 2018, FB delivered revenue growth of approximately 37%, and hence a deceleration to 23%, would imply a decline of 14% YoY for the full year. While that may seem much, with a majority of monetisation growth coming from lower value products and from outside N America some slowdown is inevitable.

More importantly, in 2019 management expects total expenses to increase 40%-50% from 2018 levels. We assume a midpoint of 45% YoY increase in costs, for our purposes. There are three categories of expenses;

- SG&A, COGS etc.

- D&A, and;

- Stock Based Compensation or SBC.

We allocate anticipated expense increase of 45% to the three cost categories on an equal basis for our purposes. Since costs under categories “b” and “c” are non-cash, we limit our discussion to expenses above the EBITDA line.

ANTYA estimates that at the midpoint of management’s forecast, costs would rise to US$32.62 billion from US$22.5 billion in 2018. In 2018, FB also reported US$4.3 billion in D&A, and approximately US$4.1 billion in SBC, which we exclude from our current estimates. On that basis, ANTYA estimates that FB will report EBITDA of US$36.2 billion for 2019, compared to the low-end consensus estimate of US$ 34.5 billion, or the median estimate of US$ 36.3 billion. Thus, without much ado, a simple back of the envelope calculation taking management’s numbers at face value, results in our estimate lining up with that of the consensus.

The implication being that investors interested in FB stock, will have to dig deeper into the revenue trajectory if they are looking to have an edge, because expected cost inflation has been disclosed, is certain, and is already baked into estimates. Thus, it is the variability in the top-line that will determine the trajectory of the stock, especially given that revenues flow thorough at a rate of 90%.

Figure 4 highlights the Company’s revenue trajectory for the last two years.

Source: ANTYA and Facebook

For Q1-18 FB delivered revenue growth of 48.9%. Management has suggested revenue deceleration of mid-single digits for Q1-19. In a worst-case scenario, where “mid-single digit” equates to 8%, for Q1-19, FB should deliver revenues of US$16.38 billion, compared to current consensus revenue estimate of US$ 14.9 billion. Consensus estimates are suggesting YoY revenue growth of 25.2%, which is approximately half of that attained in Q1-18, and far off from management’s estimate.

Therefore, we conclude that to the extent there is significant uncertainty in investors’ mind regarding the Company’s revenue trajectory for 2019, it could be wild ride for FB investors this year. Q1-19 revenue growth appears to be underestimated because even the highest revenue estimate of US$15.2 billion on Capital IQ implies 27.7% YoY revenue growth, whereas management’s guidance is much stronger.

It is likely that many forecasts are baking in a slowing global economy, but interestingly FB is neither exposed to trade currents nor to China’s economy. The Company’s biggest market i.e. North America is exceptionally strong, and FB is ramping up investment to monetise the rest of the world. Therefore, it appears that the Company will once again surprise to the upside when it reports Q1-19 results.