The dual mandate of the Federal Open Market Committee (“FOMC”) is to use monetary policy tools at its disposal to stabilise consumer price inflation (“CPI”) towards its 2% target and to maximise employment in doing so. Since the financial crisis of 2008, the global economy – of which the United States is the most prominent constituent – was operating below capacity. The resulting output gap contributed to a global deflationary spiral. To the relief of policymakers worldwide, in the United States that the output gap has disappeared, and the U.S. economy is now growing at a rate which is above potential. Furthermore, while monetary policy had already done its job of re-establishing the economy on a firmer footing, the Trump administration is attempting to galvanise it further with a fiscal plan. In our opinion, that is bound to cause overheating, forcing the FOMC to step on the gas.

Data Dependence Suggests Tighter Policy Ahead

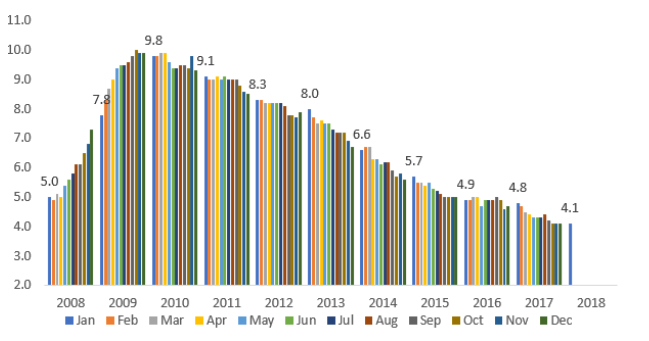

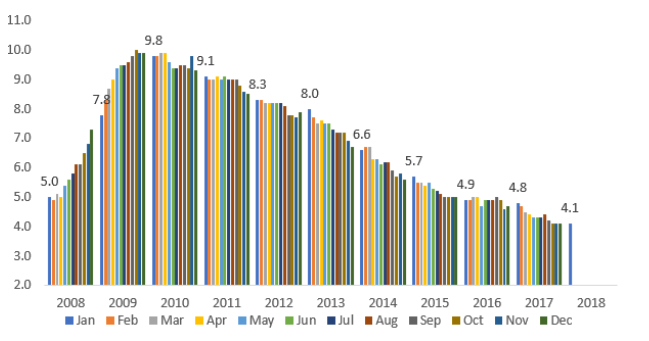

Every central banker loves to use the term “data dependent”. Monetary policy attempts to set in motion events for tomorrow, via the decision making today, based on facts that transpired yesterday. Therefore, in our opinion, it should not surprise investors that volatility has risen rapidly in global financial markets, given that U.S. unemployment has reached historical lows as illustrated in Figure 1.

Figure 1: Monthly Unemployment Rate in the U.S. Data for each year in January.

Source: ANTYA Investments Inc. and Bureau of Labour Statistics

At 4.1% for January 2018, the U.S. unemployment rate (“UR”) is lower than the 5% of January 2008, which was a low prior to the great recession. Therefore, over the last decade, the U.S. economy has recovered the entire job losses incurred in the interim, and then some. 4.1% is 0.5% lower than the FOMC’s expectation of the longer-run normal rate of unemployment (“NRU”) of 4.6%. FOMC’s earlier target for NRU was 4.8%. Given the backwards-looking characteristics of the central banking process, it was only at January 30, 2018, meeting that the median expectation of FOMC was updated to 4.6%, after considering 25 consecutive data points for 2016, 2017 and 2018 that all came below 5%.

In FOMC’s own words,

In setting monetary policy, the Committee seeks to mitigate deviations of inflation from its longer-run goal and deviations of employment from the Committee’s assessments of its maximum level. These objectives are generally complementary. However, under circumstances in which the Committee judges that the objectives are not complementary, it follows a balanced approach in promoting them, taking into account the magnitude of the deviations and the potentially different time horizons over which employment and inflation are projected to return to levels judged consistent with its mandate.”

Since January 2016, when the UR fell below 5.0% for the first time, the UR has averaged 4.59%. The current rate of 4.1% is one full standard deviation lower than FOMC’s NRU forecast based on past 25 months of data. In our view that “magnitude of deviation” is large enough for FOMC to telegraph to the market that a more hawkish attitude is emerging within the FOMC.

Labour Force Participation Rate has Recovered

One of the central arguments of sceptical and bearish commentators on the declining UR has been a low labour force participation rate (“LFPR”). That myth was recently busted by the Monetary Policy Report (“MPR”) of February 23, 2018, submitted to the Congress which said that, “The fact that

the LFPR for prime-age men remains below its pre-recession levels might suggest that slack remains along this dimension; however, the lower level of the LFPR for prime-age men primarily seems to reflect the continuation of a decades-long secular decline rather than a cyclical shortfall in their LFPR.”

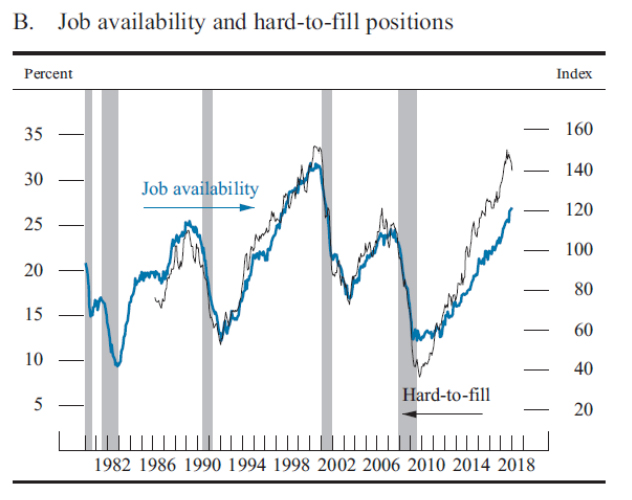

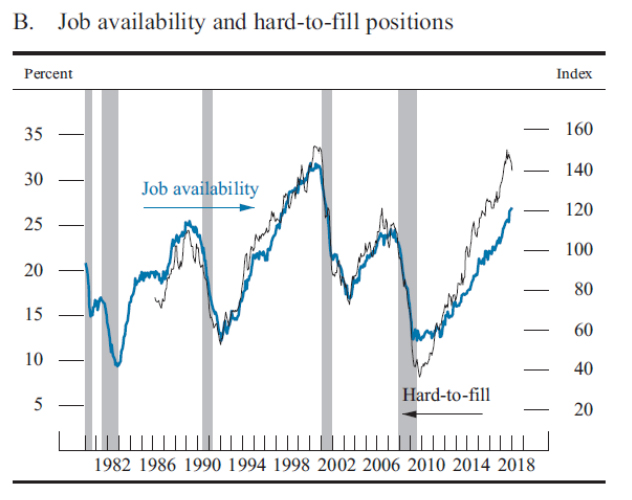

Small Businesses not Finding Enough Employees

Another set of data that we want to highlight is illustrated in Figure 2. This chart sourced from the MPR shows the share of small businesses with at least one job opening that they view as hard to fill. The hard to fill trend visible in black is now close to its record levels seen in the late 1990s, consistent with the notion that as the labour market tightens, businesses find it increasingly difficult to hire additional workers.

Figure 2: Small Businesses Scrambling for Labour in the U.S.

Source: ANTYA Investments Inc. and The Federal Reserve

Purchasing Managers Cite Labour Shortages

The Purchasing Manager Index (“PMI”) of the Institute of Supply Management (“ISM”) corroborates data from the MPR and demonstrates two clear trends, a growing economy that is accelerating, and pressure on labour.

As shown in Figure 3, the February PMI® indicates growth for the 106th consecutive month in the overall economy and the 18th straight month of growth in the manufacturing sector.

Figure 3: PMI Index Foreshadows Accelerating Momentum in the U.S.

Source: ANTYA Investments Inc. and ISM Data

What we find fascinating from February data is the comment from ISM which says that “The past relationship between the PMI® and the overall economy indicates that the average PMI® for February (60.8 per cent) corresponds to a 5.4 per cent increase in the real gross domestic product (GDP) on an annualized basis.” If that is true within a 90% confidence interval, then the FOMC is already behind the curve.

We also take the liberty of juxtaposing ISM’s optimistic yet data-dependent forecast, with the FOMC’s data-dependent view that, “Real GDP was projected to increase at a somewhat faster pace than potential output through 2020; … The unemployment rate was projected to decline further over the next few years and to continue to run well below the staff’s estimate of its longer-run natural rate over this period.” The federal reserve also noted that involuntary measures of employment had returned to pre-recession levels.

To sum up, in the words expressed by purchasing managers to ISM:

“Employment is one of our biggest challenges. No labour available.”

We Continue to Believe That Rates Will Rise Faster Than the Market Anticipates

ANTYA thus concludes that wage inflation is just around the corner, which will seep into much higher PCE inflation numbers that FOMC is targeting. Furthermore, just as the FOMC updated its NRU forecast with a lag in January 2018, the minutes of the meeting also show that a number of participants had marked up their economic growth forecast for the economy in the near-term relative to those made for the December 2017 meeting, while continuing to state that the actual path for federal funds rate would depend on incoming data.

It is thus apparent that FOMC is updating and recalibrating its stance both on inflation, and on economic growth. FOMC is also aware that policy transmission works with a lag in the economy, and hence it would not want to be caught flat-footed. Moreover, the last thing that a Fed led by a non-academic at the helm wants is the stigma of a policy error that causes inflation to become entrenched. Therefore, we expect the Fed to be hawkish.

Conclusion

ANTYA expects that the FOMC will raise its interest rates 4 times in 2018 and maintain that trajectory for 2019 as well. Yes, we are calling for a 3.5% federal funds rate by the end of 2019, and assuming spreads stay constant a 4% yield on one-year U.S. Treasury is in the offing. Our forecast implies a stronger dollar, weaker Asian currencies, and much weaker equity markets in Asia ex-Japan including India as discussed here. (2018 India – Tread With Caution).

We reiterate from our report, The Dot Plot Giveth ( https://antya.ca/ research/the-dot-plot-giveth), that investors should be overweight financials and overweight growth stocks.

sfdsfdsf