Budget 2016 highlighted very clearly that real income of 90% of Canadians has grown at less than 1% for 30 years. Thus fiscal initiatives will assist in mitigating some of the challenges facing a vast majority of Canadians.

“Growing The Middle Class”, that was the refrain of the first Liberal budget. To that end Liberals reaffirmed personal tax changes announced in December 2015. The budget also disclosed additional measures to benefit middle income families with children, and announced some additional grants for university students. That the government is projecting a much higher fiscal deficit approaching $30 billion for 2016/17, comes as a shocker to many, given that the deficit expectation outlined in February 2016 fiscal update was around $18 billion. Nonetheless, Figure 1 highlights stark challenges facing Canada, and provides context to the budget document moniker.

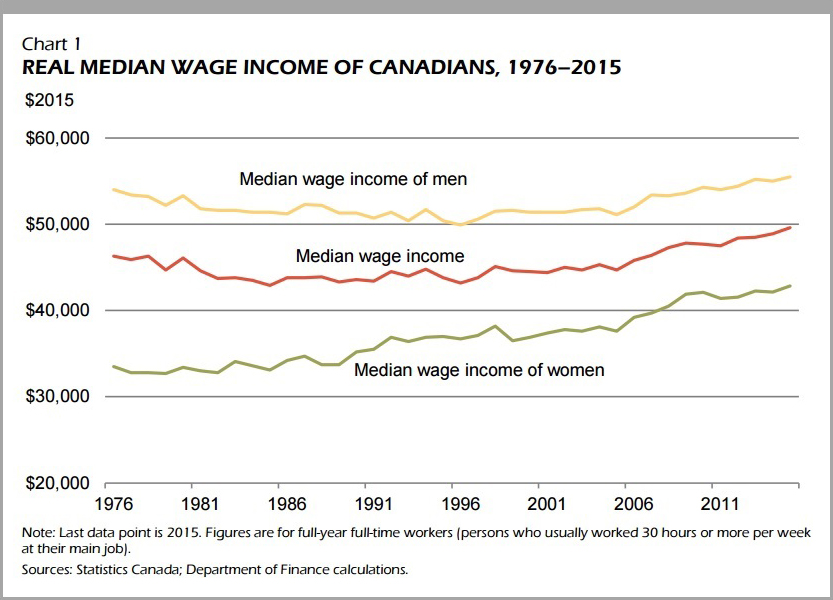

Figure 1 – Why the Crater?

Source: Budget Documents and ANTYA Investments Inc.

Clearly, over a period of thirty years ended 2015, Canadian families have faced a stagnant standard of living, although lower interest rates have led to record home ownership levels and booming auto-sales.

Figure 1 highlights the competitive and technological pressures that have affected vast majority of men working in the commodity-industrial economy, while the rise of the services (technological, health, hospitality & education) has enabled women to narrow the wage differential vis-à-vis the men. The saucer shape of the median wage income curve, which until very recently was levels below those attained 30 years ago, is clearly a concern going forward because slower economic growth could once again cause it to reverse.

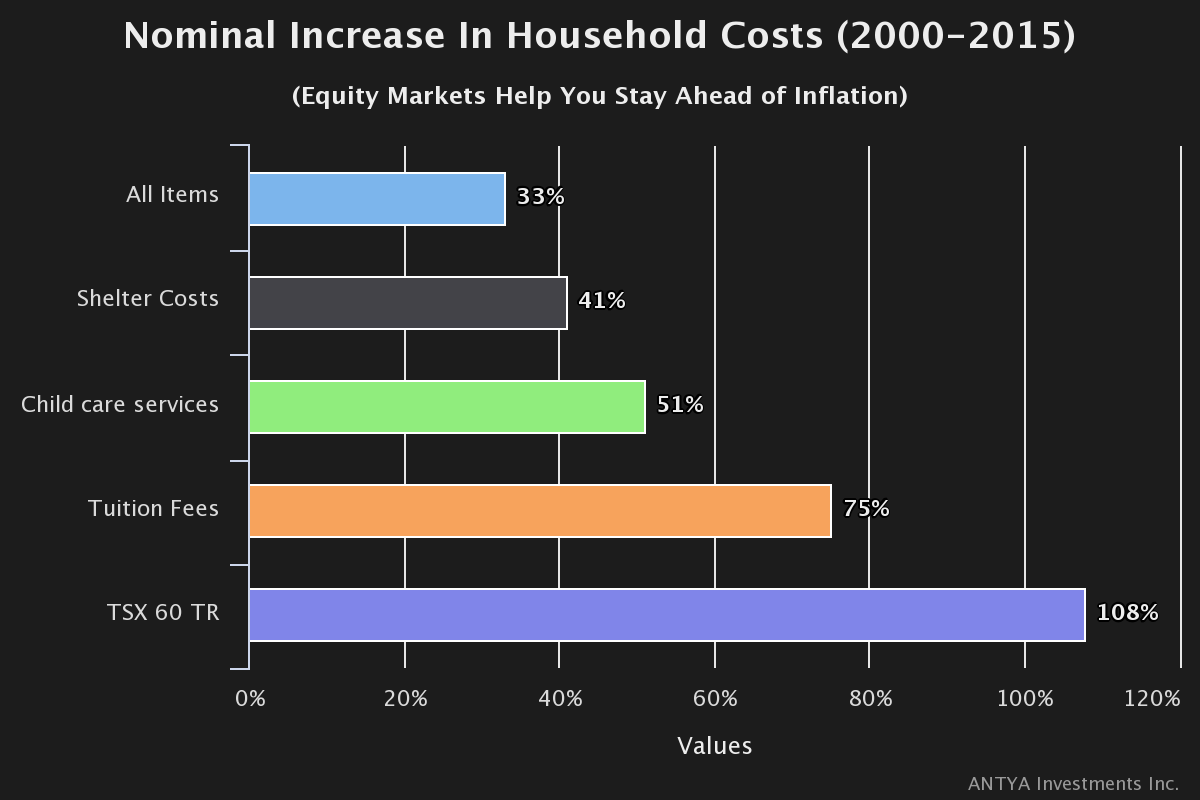

Moreover, at a time when central bankers have focused our attention on inflation being low, Figure 2 highlights the real impact consumers are facing in their day to day lives based on trends outlined in Budget 2016.

Figure 2: Significant Increase in Most Costs In Spite of Low Inflation

Source: Budget 2016 and ANTYA Investments Inc.

It is clear that shelter costs (weighted average of rent, mortgage, property taxes, water, fuel and electricity costs) have been kept in check in large parts to low interest rates, which have also resulted in record debt levels. But more importantly, if savers have stayed away from equity markets, even in a low inflation environment key aspects of household expenditures have sky-rocketed. That must have been an important consideration for the Liberal think-tank, and they have tried to mitigate some of it with decisions that fiscally the most sound G7 country i.e. Canada, can make.

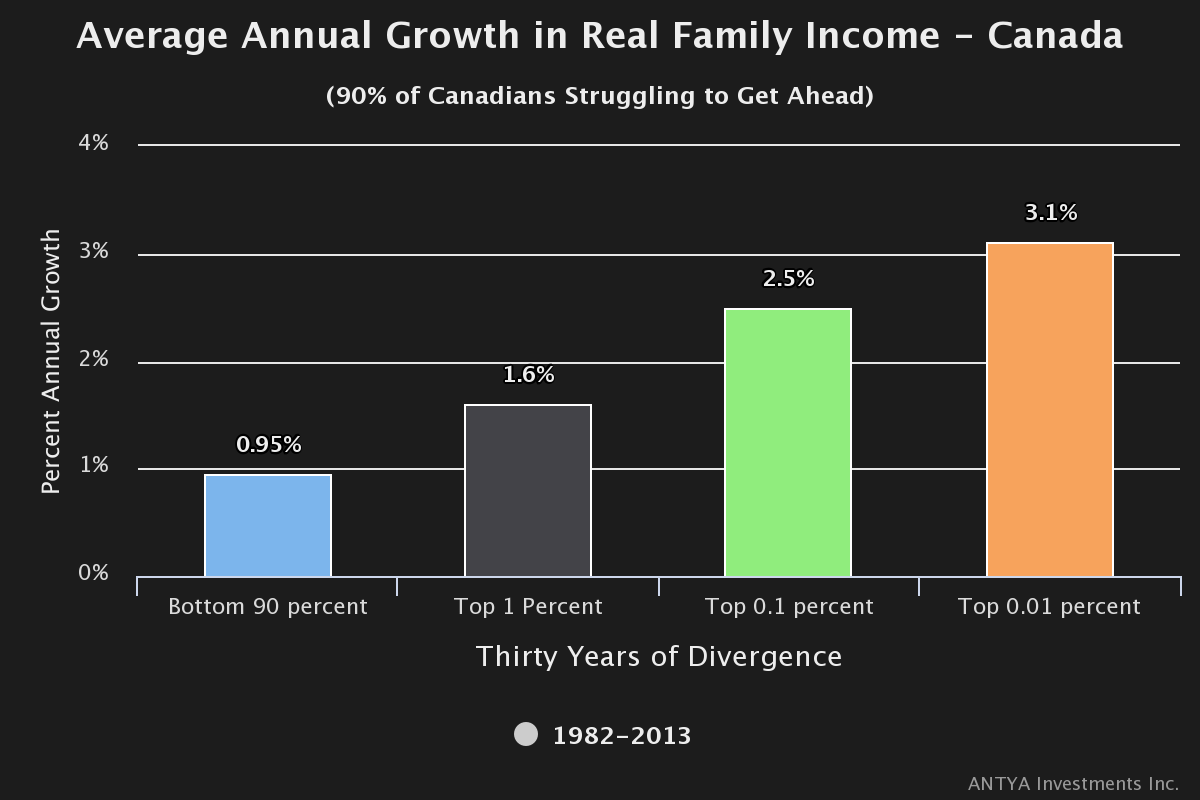

Another important nugget of information that came from the Budget is that the real income growth of 90% of Canadians is 60% less than that of the top .1% of Canadians. Figure 3 presents information from the Budget.

Figure 3: The Top is Doing Great

Source: Budget 2016 and ANTYA Investments Inc.

In his landmark book, the world famous (some would say reviled) French economist Thomas Piketty, author of “Capital in the Twenty-First Century”, discussed the contribution of investment returns on surplus capital, and how that phenomenon contributes to rising inequality in the society. Figure 3 highlights some of that for Canada as well. With booming equity markets in the U.S. and Canada, the surplus capital at the disposal of high-income families has assisted them in growing their real incomes and standard of living while many face adversity (This column is not by a leftist and does not hold a grudge against anyone because most people in top 1% are self-made entrepreneurs).

Policy prescription and/or guidance was absent from Budget 2016 on promoting innovation & entrepreneurial ambitions, as well as, narrowing the real income growth gap for 90% of Canadians.

Canada has the fiscal room to undertake some bold initiatives. While investing in infrastructure is great and would assist in improving productivity, in my view, the Federal Government of Canada needs to create $1 billion fund with a mandate to fund 2,000 entrepreneurs in non-commodity, non-housing sectors, each given up to a maximum of $500,000 forgivable loan matched $ for $ by an equivalent amount of equity. The loan can be forgiven based on either a job creation goal, or 1$ for every $3 in export of goods and/or services. If this initiative succeeds then a bigger one can be launched. Most entrepreneurs in Canada feel stifled due to lack of risk capital.

No doubt, my idea needs to be refined, but I would urge the government to consider such a plan for the next budget.

As for those looking to invest and save either in RRSP, TSFA or RESP accounts, or otherwise, given the ability of even very low inflation to affect the standard of living as illustrated in Figure 2, I would advise pay attention to investment management costs, diversify away from real-estate, downsize now if you can, and invest in equities as a hedge against inflation.