The management of Bristol Myers Squibb Co (BMY US) reiterated its optimistic view regarding the acquisition of Celgene Corp (CELG US) on its Q4-18 earnings conference call today. Unlike most acquisitions that succeed based on cost cuts or revenue synergies, Celgene’s distressed valuation allowed BMY to swoop in and buy a leading bio-tech at a bargain price: if the pipeline succeeds. We are betting it will. If not, the robust cash flows from Revlimid make it a low-risk , low-return deal.

Bristol-Myers Squib (“BMS” or the “company”) provided additional commentary on its acquisition of Celgene Corp (“Celgene”) which we discussed in Celgene and Bristol-Myers Squibb – Undervalued and Underappreciated . While the management of BMS maintained its positive stance, investors and analysts that participated in the quarterly conference call appeared skeptical of management’s claim. We are no expert in the science surrounding BMS and Celgene’s products or their respective pipelines, and therefore we are not going to opine on the success or a lack therefor for any of the products going forward.

We provide context to management’s assertions based on new disclosures outlined today and find relief in the fact that the financial strength of the combined entity will be enormous and therefore, downside from current levels for BMS is limited, and by extension, if the deal is successfully consummated, then downside for Celgene is limited too.

In ANTYA’s view, given pipeline related failures at Celgene in 2017 and 2018, the litigation and genericization issue faced by Revlimid, a blockbuster drug from Celgene for treating multiple myeloma with expected sales of US$10.9 billion in 2019, a growth of 11% on 2018 sales of US$9.8 billion, is an important concern for investors. To assuage investors, Celgene reaffirmed its revenue guidance for 2019 and provided a forecast for 2020 on January 07, 2019. More details are available in Celgene Corporation Announces 2019 Financial Guidance and Key Milestones .

BMS Management has also categorically stated its conservative stance in valuing Revlimid, and we quote Charles A. Bancroft who is Executive VP of Global Business Operations & CFO of BMS from today’s call;

Turning to Revlimid on Slide 14. It’s important to know that we performed extensive due diligence on the Revlimid IP situation, both independently and as part of the diligence process with Celgene. We also had the opportunity to review confidentially the Celgene Natco settlement and its impact on various litigation outcomes. With that in mind, we considered 2 bookend scenarios for Revlimid, one in which there is an early at-risk launch and another that is reflective of sell-side consensus representing gradual erosion starting in 2022. We believe both of these scenarios have a very low probability.

In between these bookends are several other litigation outcomes or potential settlements that could play out, and in our view, each are likely to have somewhat comparable implications on the Revlimid revenues in the near term. Our analysis assumes a more conservative approach than sell-side consensus and results in lower sales between 2022 and 2026. Through any of these scenarios, we see the combined company generating significant cash flows that will enable us to de-lever while delivering returns for our shareholders.”

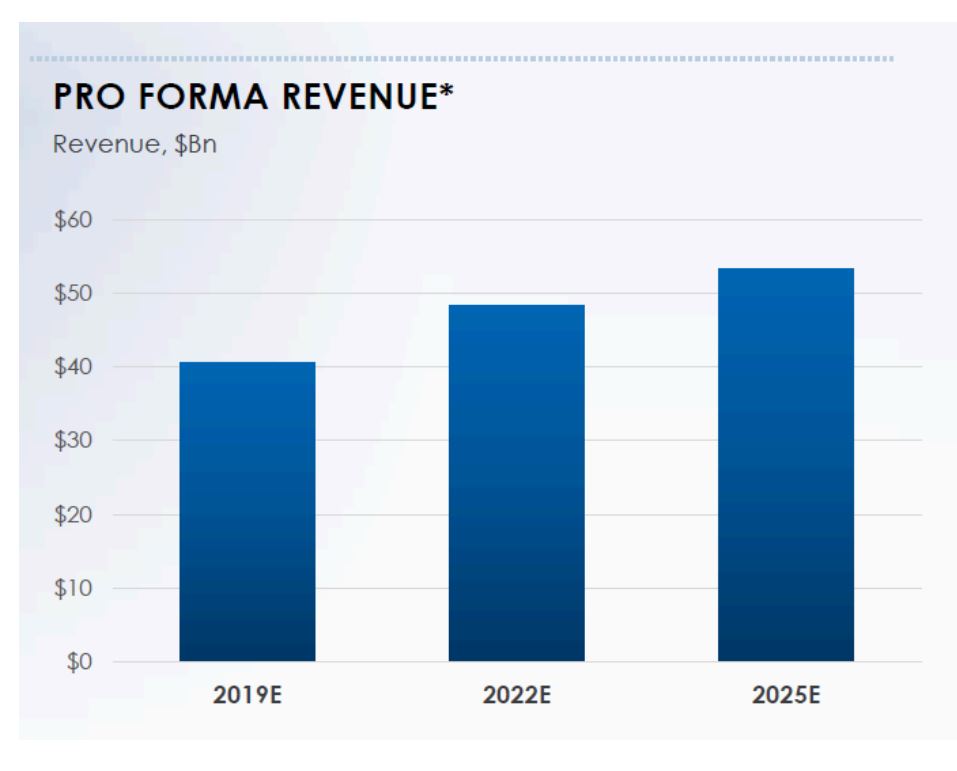

While it is appropriate to tout conservatism, how do outside investors assess that? Given that both companies are still independent consensus estimate from Capital IQ can help parse the data. Figure 1 provides the estimated pro-forma revenue of the combined entity as disclosed by BMS today.

Figure 1: Estimated BMS and Celgene Combined Revenue

Source: ANTYA Investments Inc. and Bristol-Myers Squib

For 2022, BMS management is projecting revenues approaching US$49.5 billion for the combined company, compared to consensus standalone estimates of US$22.9 billion and US$ 28.8 billion for Celgene and BMS respectively. That adds up to US$51.1 billion for the combined company. Therefore, when BMS asserts that it has been conservative in its assessment of Revlimid, especially beginning 2022, it appears to show up in the pro-forma numbers disclosed today, compared to whatever the consensus forecasts add up to on Capital IQ. More importantly in our view, it does seem that the sell-side analysts are overly bearish, given that Celgene outlined sales of US$ 20 billion and an EPS estimate of US$12.50 for 2020, whereas consensus 2020 revenue estimates for Celgene are still hovering around US$19.1 billion.

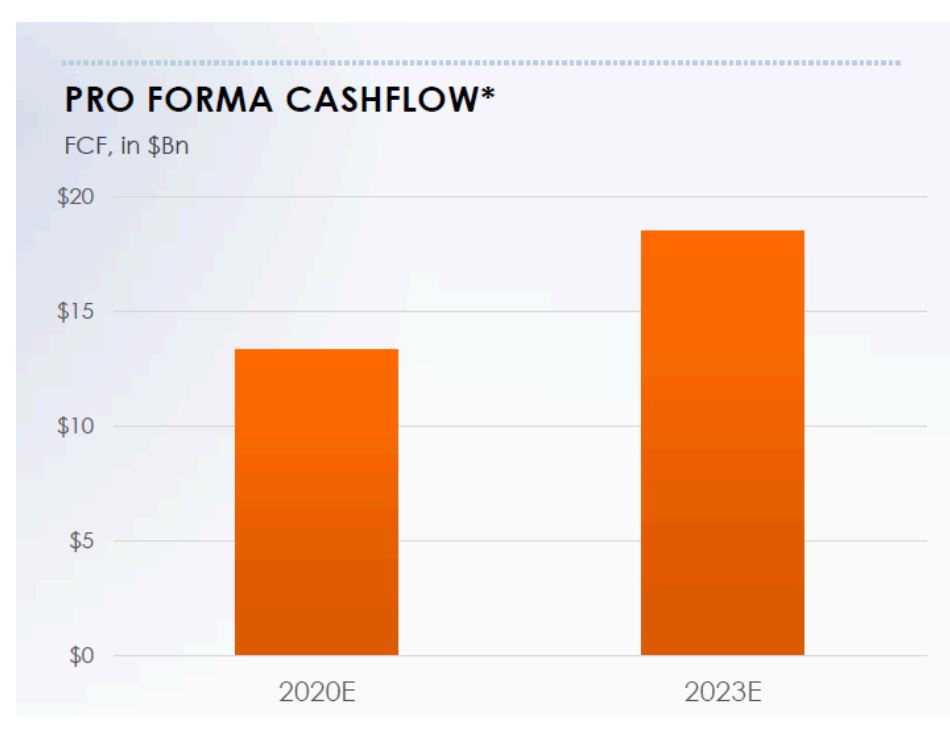

From our perspective, before the optionality associated with the combined pipeline, and the new product launches come into play, given the approximate debt of $42 billion post-closure, free cash flows that enable deleveraging are of utmost importance. As illustrated in Figure 2, free cash flows after dividends are robust and will ensure a de-levering of the balance sheet.

Figure 2 – Estimated Combined Free Cash Flow

Source: ANTYA and Bristol-Myers Squib

The pro-forma cash flows disclosed by BMS are after accounting for expected dividend increases, although management was coy on the call and wouldn’t reveal the quantum or timing of prospective dividend increases. Nonetheless, Assuming US16 billion is the midpoint, in four years from

2020-2023, BMS will generate approximately US$64 billion in free cash flow. That provides enough head room to undertake the promised US$ 5 billion in share buy-backs, pay down all the US$ 42 billion in debt, pay for the increased dividend and have a cash cushion.

From a risk-reward standpoint, assuming the US$ 2 billion in revenue shortfall for 2022 between standalone consensus and BMS disclosures is attributable to Revlimid, then we estimate that approximately US$ 40 billion of pre-tax free cash flow will be courtesy Revlimid from 2020-2023.

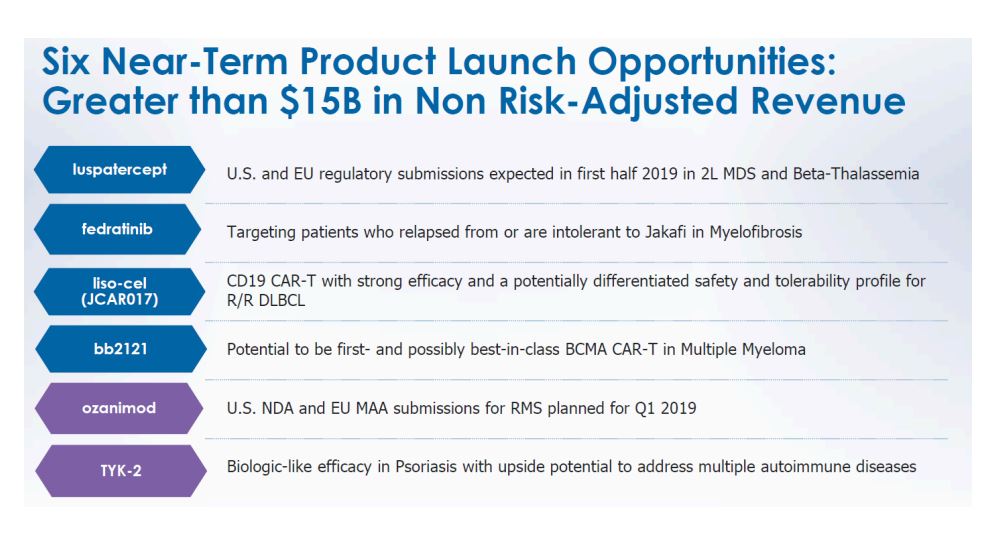

Beyond Revlimid, BMS is highly confident of launching six additional products in the next 12-24 months as shown in Figure 3.

Figure 3. Six Near -Term Products to Boost Revenue

Source: BMS and ANTYA Investments Inc.

This is where science, the FDA, the quality of the submission to the FDA, the efficacy of the drugs being developed etc. comes in to play and therefore the track record of the drug company matters a lot. Investors were relentless in punishing Celgene for its failure and have been equally unforgiving of Abbvie. Could the same fate befall BMS post-closure if one of the six assets that management is hanging its hat on fails to arrive? Most likely! Given that revenue estimates from these products are non-risk adjusted, any failure could have a disproportionate impact on both management’s credibility, and pro-forma revenue, profitability and free cash flow forecasts.

However, we like what we see, and we encourage long-term investors to establish positions. We believe the combined company will have pricing power given that it will have multiple blockbuster products in similar lines of therapy and its ability to create various therapeutic combinations from within its portfolio of immunology, oncology and hematology provide it with numerous degrees of freedoms to develop new treatments.

To conclude:

- Management said in early January that they were conservative in valuing Revlimid. Today’s disclosures suggest that is correct.

- Pro-forma financials suggest that de-levering and dividend increases can and will happen simultaneously.

- There is a potential of US$ 15 billion in un-risked revenue from six new products.

- BMS maintains a leading pipeline in Phase 1 and Phase 2 candidates.

In ANTYA’s opinion, BMS and Celgene provide a compelling value proposition for medium to long-term investors, accompanied with limited downside risk.