With each passing month, we grow more steadfast in our belief that The Fed will show greater resolve than currently anticipated by many investors. The U.S. labour market is exceptionally tight where it matters, i.e. in high-skill and or high-training jobs and is now close to the edge in low-skilled employment as the data highlighted in this insight by us show. In terms of sector and stock positioning ….

An economist from the storied house of Salomon Brothers – a part of Citigroup now – famously created the term Goldilocks economy to suggest an economy that has real economic growth approaching potential growth, accompanied by moderate wage growth and controlled inflation. That allows for an interest rate policy where the real rate of interest is zero, i.e. the spread between inflation and The Fed discount rate is virtually zero. Purists might disagree with our description of the Goldilocks phenomenon but given that we do not have a PhD in Economics, let’s stick to the point at hand. Significant effort has been devoted by multiple leading economists of the world to either defend or challenge the Phillips curve already. Without doubting anyone’s sincerity in their intellectual pursuits, we wish to state that a return of the Philipps curve to its glory days is just around the corner, and so are real rates approaching 50bps-100bps.

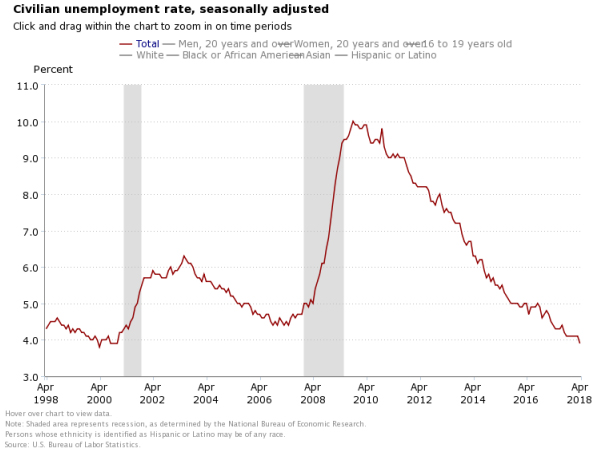

As highlighted in Figure 1 the seasonally adjusted unemployment rate in the United States has reached levels unseen since the Korean War. That is befitting because perhaps we are approaching an end to the war on the Korean peninsula as discussed in Who Is Kim Jong-Un’s Ultimate Role Model? Kim Jong-Il or Xi Jinping?

Figure 1

At 3.9% for April 2018, nonfarm payroll employment in the U.S increased by 164,000. The unemployment rate dipped down after stubbornly sticking to 4.1% for six months. The total number of unemployed fell to a low of 6.3 million as well. Given that the labour force participation rate changed little over previous months, Fed-rate-hike bears would find solace in their expectations, whereas we remain firmly entrenched in the camp that The Fed will be increasingly more hawkish. More importantly, upward revisions to prior months were strong while downward revisions were immaterial.

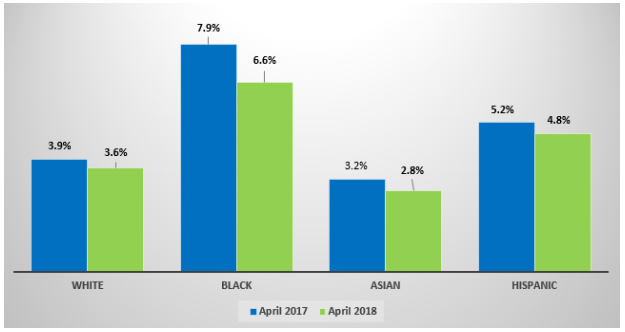

In our view, the narrative will begin to turn more in our favour and there is evidence that it is beginning to turn. We believe the following charts provide additional context to our thinking. By digging deeper into demographic data, it is easier to see that any slack in the labour market is entirely attributable to a specific segment of the population which in the American context also likely has lower skills.

Figure 2: Unemployment Rate by Racial Origins, Source: BLS & ANTYA

Furthermore, a 1.3% decline in the rate of black unemployment provided an additional 262,000 workers over the last year, amounting to a 20% of all extra labour that made it way to the workforce, although Black Americans constitute only 12.4% of the total labour force of 161.5 million. Demographic data provide additional scope for drilling down to attain more granularity as illustrated in Figure 3.

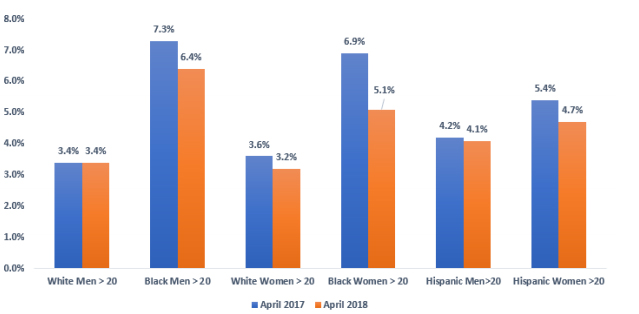

Figure 3: Gender Difference in Unemployment, Source: BLS & ANTYA

There appears to be little possibility of an incremental addition to workforce participation from the white populace, whereas whatever slack might exist is some of the less-trained or less-skilled workforces have disappeared in 2017.

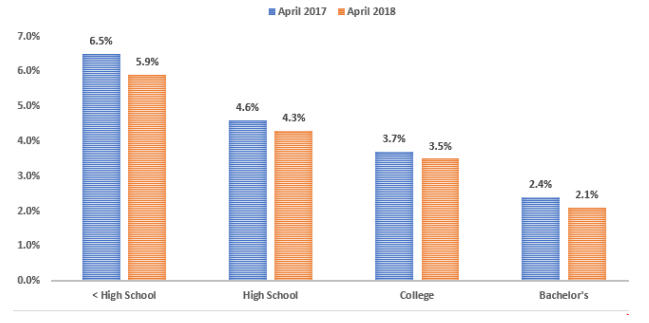

The situation looks even more interesting once combined with unemployment data related to the education level of the workforce as illustrated in Figure 4.

Figure 4: Unemployment by Education Levels Source: BLS & ANTYA

Figure 3 and Figure 4 combine to indicate at least directionally that those still unemployed are individuals that do not have high school education and are either Black or Hispanic Americans.

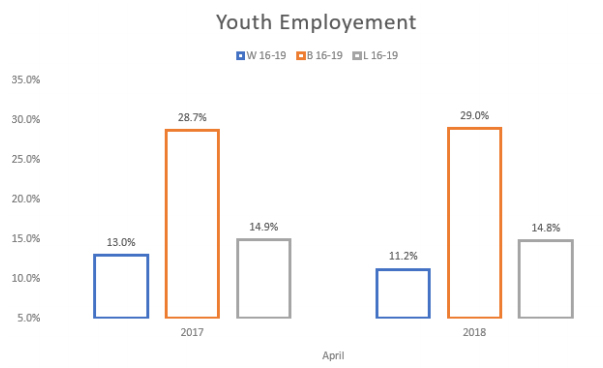

Figure 5: Youth Unemployment, Source: BLS & ANTYA

Our job is not to make a political statement but to draw some actionable and meaningful conclusions from the data. Finally, looking at youth unemployment, white youth have had more success in finding gainful employment than Black or Hispanic. There is already significant demand for labour that is not being met currently within the United States forcing employers to increase overtime for existing workers.

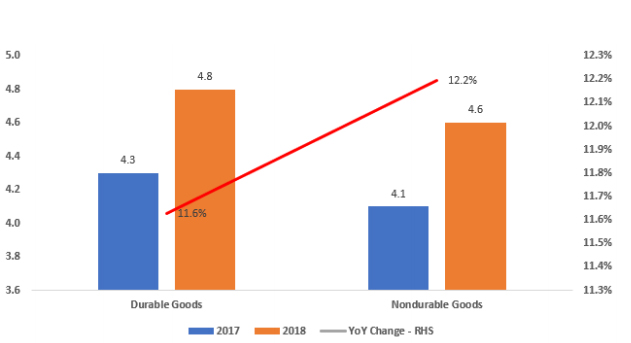

Figure 6: Overtime Work Hours, Source: BLS & ANTYA

Overtime hours have increased significantly for both durable goods and non-durable goods industries and in the month of April grew approximately 12% YoY for both. If an average work-week is 40 hours, workers are already on the job for an extra half-day per week. Worker wages are also rising as illustrated in Figure 7.

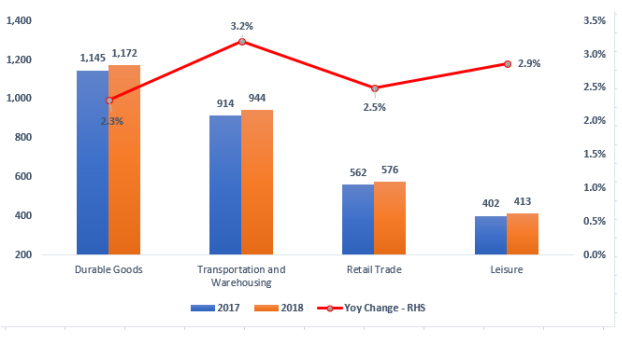

Figure 7: Weekly Wages, Source: BLS & ANTYA

Wages in the durable goods sector are growing at 2.3% annualised compared to transportation which rose 3.2% and leisure and hospitality which increased by 2.9%. We highlight these sectors specifically because with few workers available these sectors are beginning to feel the crunch and are adopting aggressive tactics to gain workers. The retail trade could be especially hard-hit in the peak selling season come September when footfall increases and there aren’t enough workers to man check-out counters or restock shopping shelves.

Transportation companies are facing difficulties recruiting drivers and are offering $15,000 signing bonuses to eligible drivers. Please see here. The tight labour market is forcing BNSF and Union Pacific railroads to offer up to $25,000 in bonuses to employees. Check here. Washington post discussed the dilemma of too many jobs and not enough workers at this link.

Conclusion

We have highlighted the dilemma faced by The Fed in our earlier work February 2018 Employment Report – Supports 4 Hikes in 2018 and 4 in 2019

- Are Asian Equities Ready and FOMC Minutes – Growth, Financials and Technology Outperforms; Gold, Yen, HY and EMs Will Correct.

With each passing month, we grow more steadfast in our belief that The Fed will show greater resolve than currently anticipated by many investors. The U.S. labour market is exceptionally tight where it matters, i.e. in high-skill and or high-training jobs and is now close to the edge in low-skilled employment as the data highlighted in this insight by us shows.

We believe quick-service restaurants, hotel and motel chains and retail stores are especially vulnerable in the second half of the year as peak driving season arrives and then as peak shopping and travel season follows through. President Trump is not making it any easier via his tough on free-trade, tough on undocumented immigrants, and tough on imports policies.

We advise caution in U.S. consumer stocks especially in transportation, leisure and the retail trade, even more so given rising oil prices. We see continued strength in the U.S. dollar, weakness in EM currencies which will be followed by weakness in EM stocks. We see a lower Yen even from current levels, and a lower Yuan. We believe the Euro makes a comeback in the second half of the year, and so does the British Pound.