The media, concerned politicians, market commentators and the rest of Canada is anxious about two things at the moment. The first: Canadian real estate – is a hard landing imminent? The second is the sufficiency or a lack thereof, of individual retirement savings. By creating Ontario Retirement Pension Plan (“ORPP”), the province of Ontario is attempting to tackle the retirement savings concern head-on. Based on mandated contributions by employees and employers to establish a corpus, and then creating a bureaucratic structure to support and manage the funds, the province is hoping that pension plan managers will deliver the goods for contributors.

Lost in this backdrop of politicking, debate, and hope is the simple truth that no single individual or organisation can influence the market, and that all market participants irrespective of size and experience are riding the same boat. During my 14 years on Bay Street, I experienced that closely, first as an equity analyst, and then, as head of equity research. The 20% decline in the value of the C$ versus the greenback over the past 18 months, the 70% decline in the price of oil in US$ from close to $100 to approximately $30 or thereabouts within the past 18 months, concomitantly accompanied with the narrative surrounding China changing from extremely bullish to cautious, and then to outright bearish, are some of the macro trends that apparently few foresaw.

Prior to that, bullish forecasts concerning:

- Gold bullion and Gold stocks fell flat (U.S. financial crisis and monetary policy was to lead to unforeseen inflation which did not materialise);

- Natural gas flamed out (apparently there wasn’t enough to feed the oil sands);

- Income trusts evaporated (simply the only income security one could hope to ever own);

- NASDAQ got hacked (the bust took over 15 years to recoup losses);

- The U.S. housing market collapsed (house prices only go up), and the list just goes on.

While these financial events unfolded, bond yields plummeted globally with the Federal Reserve, the Bank of Japan, the European central bank and the People’s Bank of China indulging in various forms of quantitative easing, currency interventions, bond buying and more recently the introduction of negative interest rates, to prop up their respective economies. Whether negative interest rates are working or not, I will leave it to the economists to opine on.

Consider geo politics for a moment, especially given Canada’s stake in the oil business, no expert foresaw or forecast Saudi willingness to stomp out shale oil, or that Barrack Obama’s diplomacy with Iran will work – notwithstanding Benjamin Netanyahu’s very public and overt attempt to express Israeli concerns. The humbling of Pershing Square Capital Management, attributable to its ownership of Valeant Pharmaceuticals Inc. which has close ties to Canada, is another reminder that for active stock pickers the tide can turn overnight, with no recourse.

Point being, that volatility which decimates portfolio performance and tests investor resolve, arises like a hydra-headed monster as if in homage to Murphy’s Law with uncanny regularity.

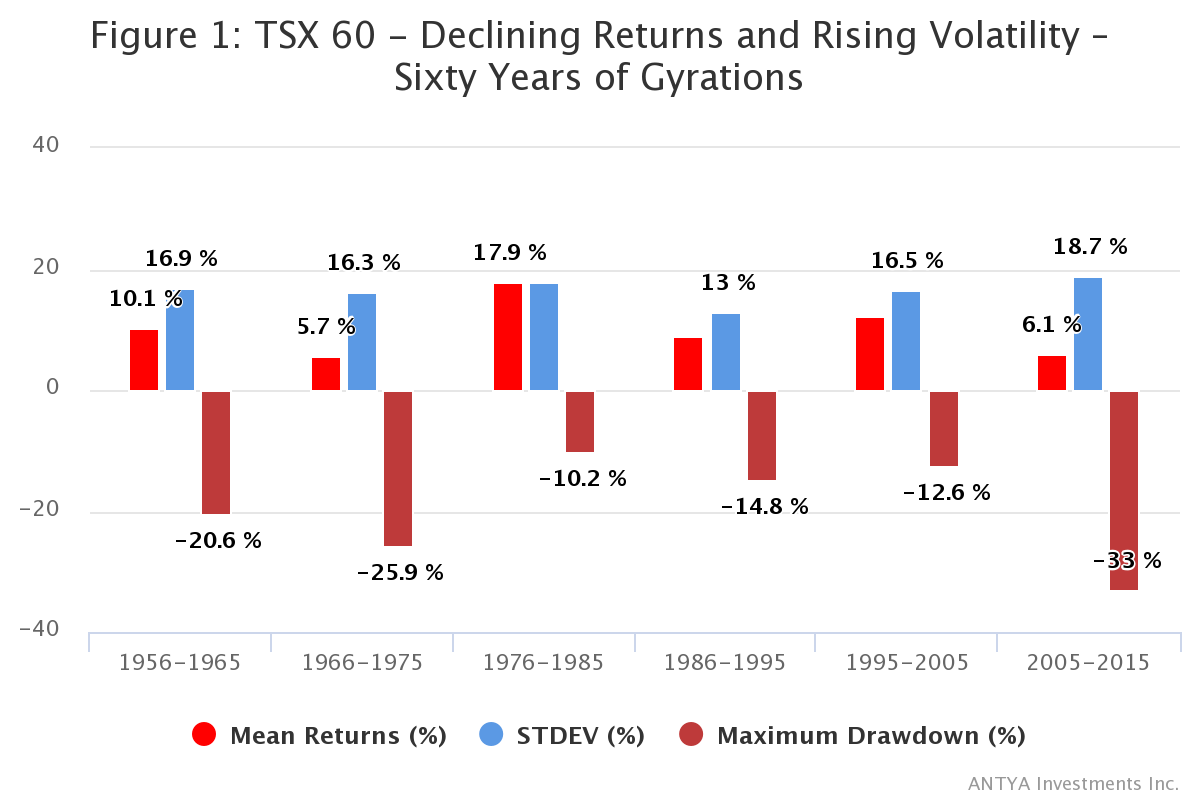

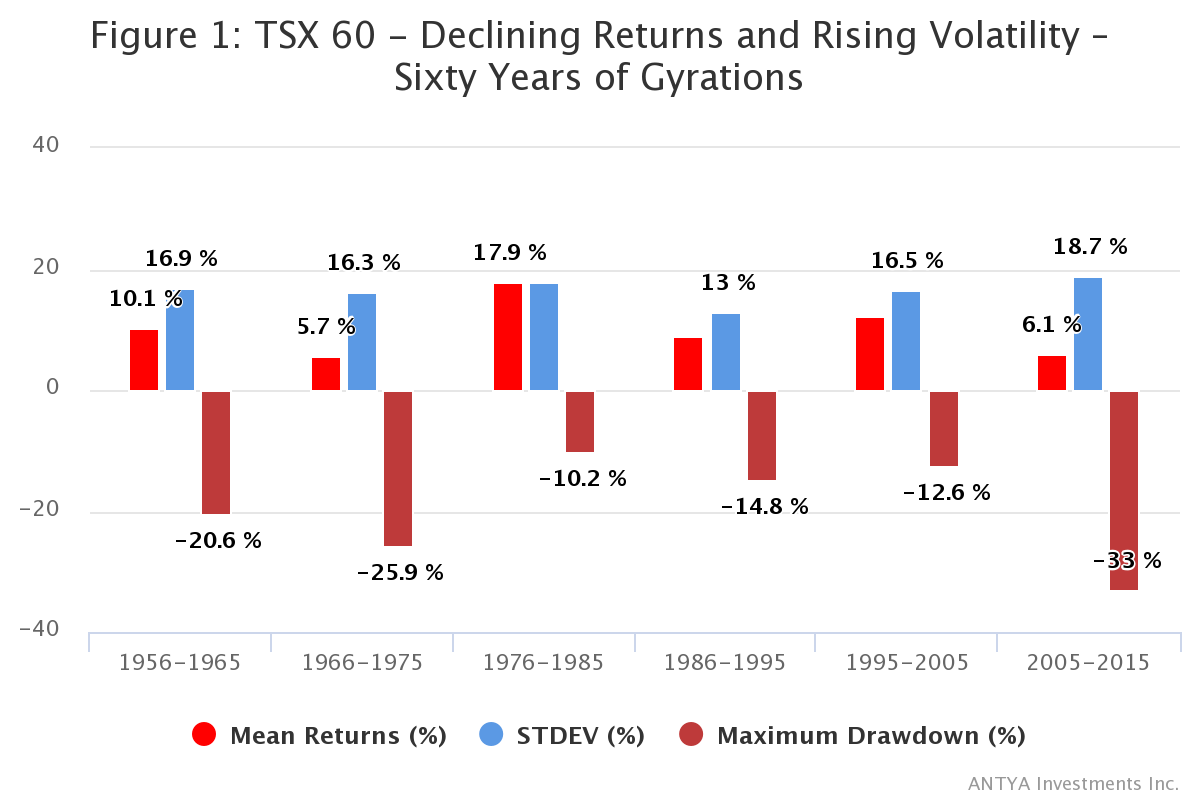

Figure 1 highlights TSX composite performance over 60 years ended December 2015.

Figure 1: Declining Returns and Rising Volatility – Sixty Years of Gyrations

Source: Morningstar and ANTYA Investments Inc.

Clearly the decade ended 2015 has been difficult for investors, and is very similar to the decade ended 1975. Both time-periods show significant drawdowns in portfolio values, approximately similar levels of volatility as determined by standard deviation of annual returns, and mean annualized returns approximating 6%. The stock market is thus doing what it normally does, albeit with one exception.

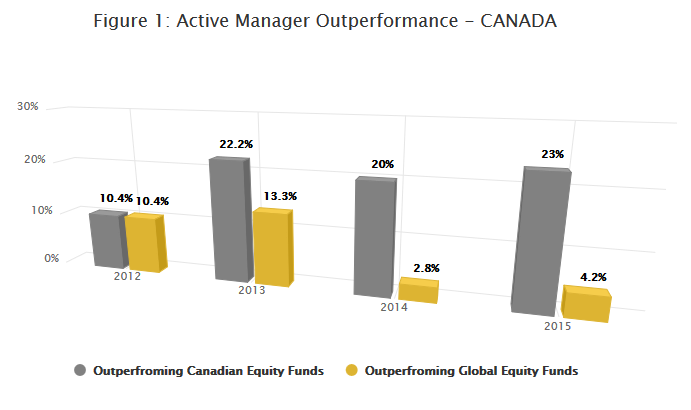

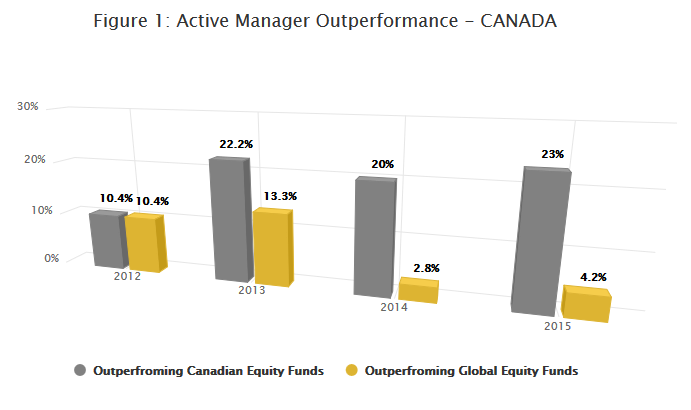

With a proliferation of information related to investing via blogs, TV channels, specialised publications and business sections of newspapers, investors have become more aware of the stock market dance. A positive outcome of this explosion of information is that investors have also become well-aware of the costs of investing. One of the more widely cited studies is published semi-annually by S&P Dow Jones Indices Versus Active Funds (more commonly known as SPIVA), comparing the performance of various active funds and the passive index funds that replicate underlying indices from either S&P or Dow Jones. Figure 2 outlines the performance of active managers in Canada as calculated by SPIVA.

Figure 2: Active Manager Performance Canada

Source: SPIVA Canada and ANTYA Investments Inc. This chart was also used in the first issue of VITARKA in a different context.

As highlighted in Figure 2, for the five-year period ended 2014, only 20% of the actively managed Canadian equity funds (40 in the sample) performed better than their respective benchmarks, whilst a mere 2.8% of the actively managed global equity funds, or 3 out of 106 in the sample, beat the benchmark. While data for the end of 2015 are not available yet, the first half of 2015 wasn’t much better for active management. One should not forget that this performance comes in spite of Canadians paying a significant fee premium to their brethren south of the border for active management, as highlighted in a study by four professors from the U.S. and Europe. We present an interesting finding from the study in Figure 3.

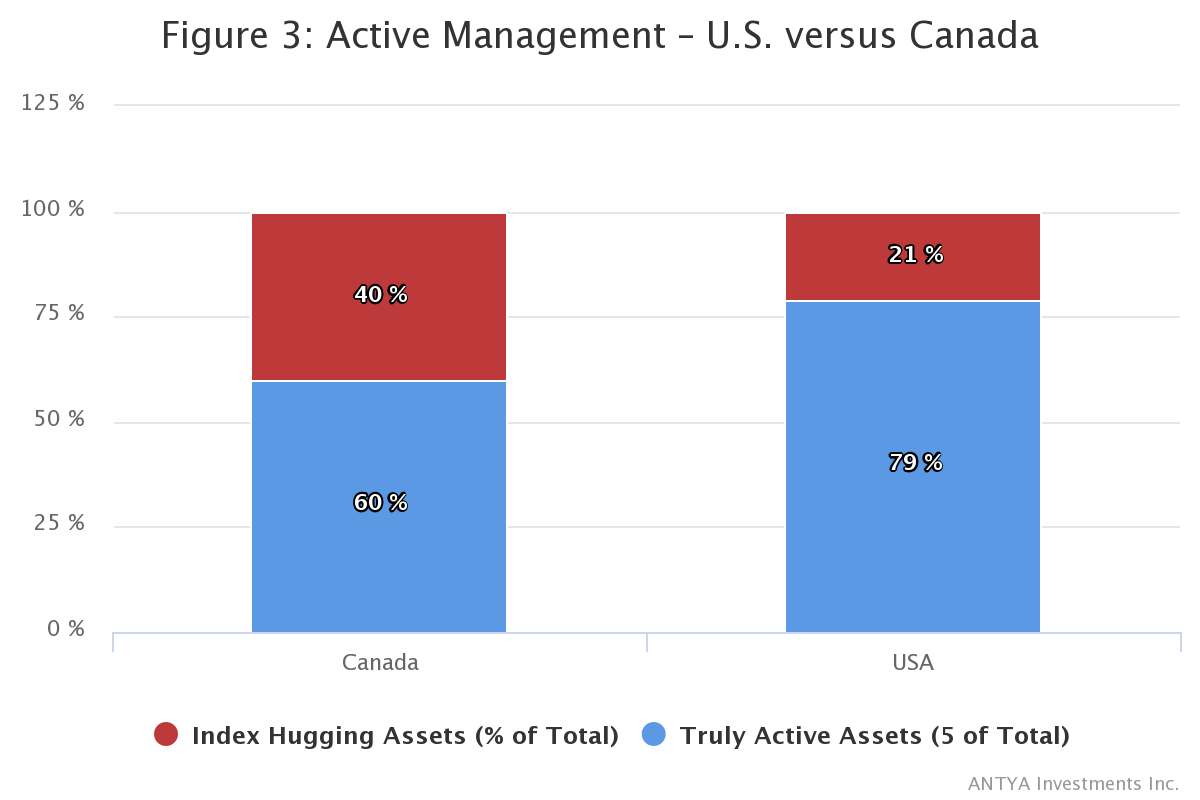

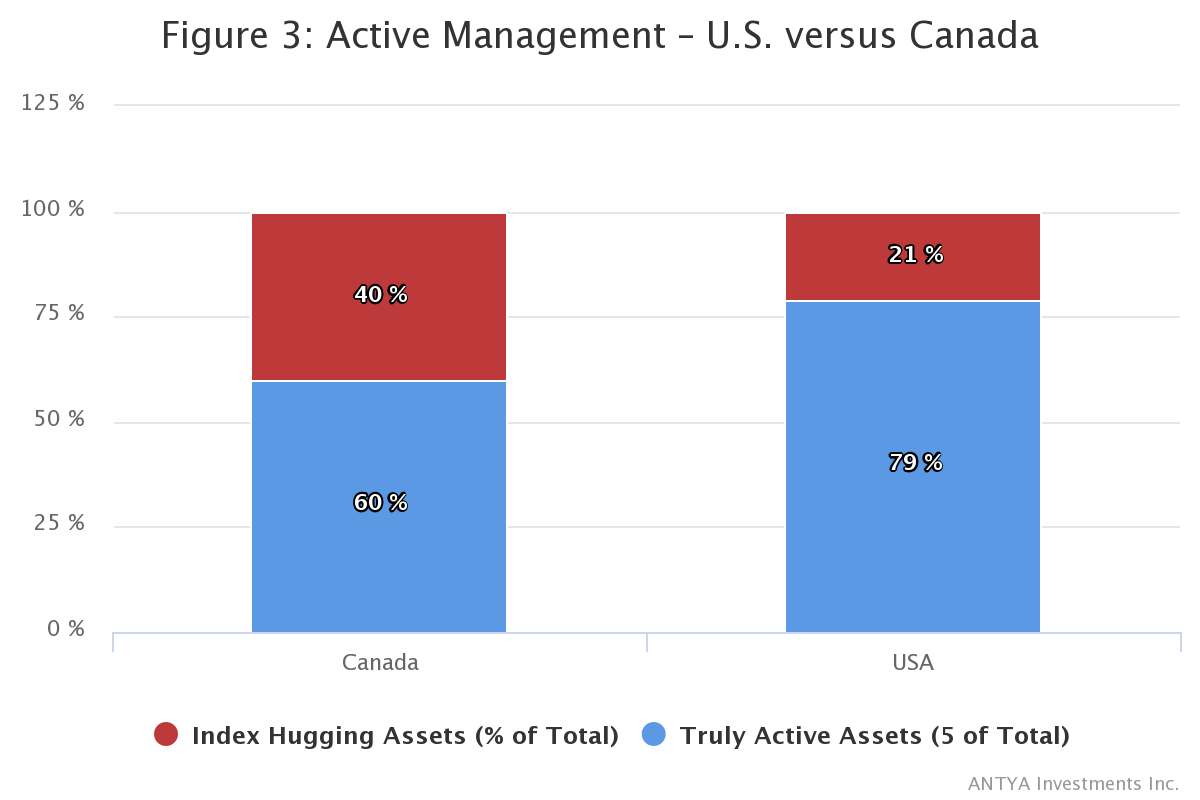

Figure 3: Active Management – U.S. versus Canada

Source: Indexing and Active Fund Management: International Evidence – Martin Cremers – University of Notre Dame, Miguel A. Ferreira – Nova School of Business and Economics, Pedro Matos – Darden School of Business, Laura Starks – University of Texas at Austin

Without getting bogged down in the intricacies of closet indexing (when an active manager’s investments are not significantly different from that of the benchmark index) versus true active management (when investments are different enough either in weightings or actual stocks/bonds), based on the study it is evident that compared to the U.S., twice as many active managers are closet indexers in Canada. While the issue of active fund management costs has been debated and defended vigorously by Investment Funds Institute of Canada (IFIC.ca), citing exclusion of distribution costs from total shareholder cost data in the U.S., Figure 3 is still worrisome, because not only are some active managers charging a significant fee premium, they are simultaneously short charging investors by delivering less than promised.

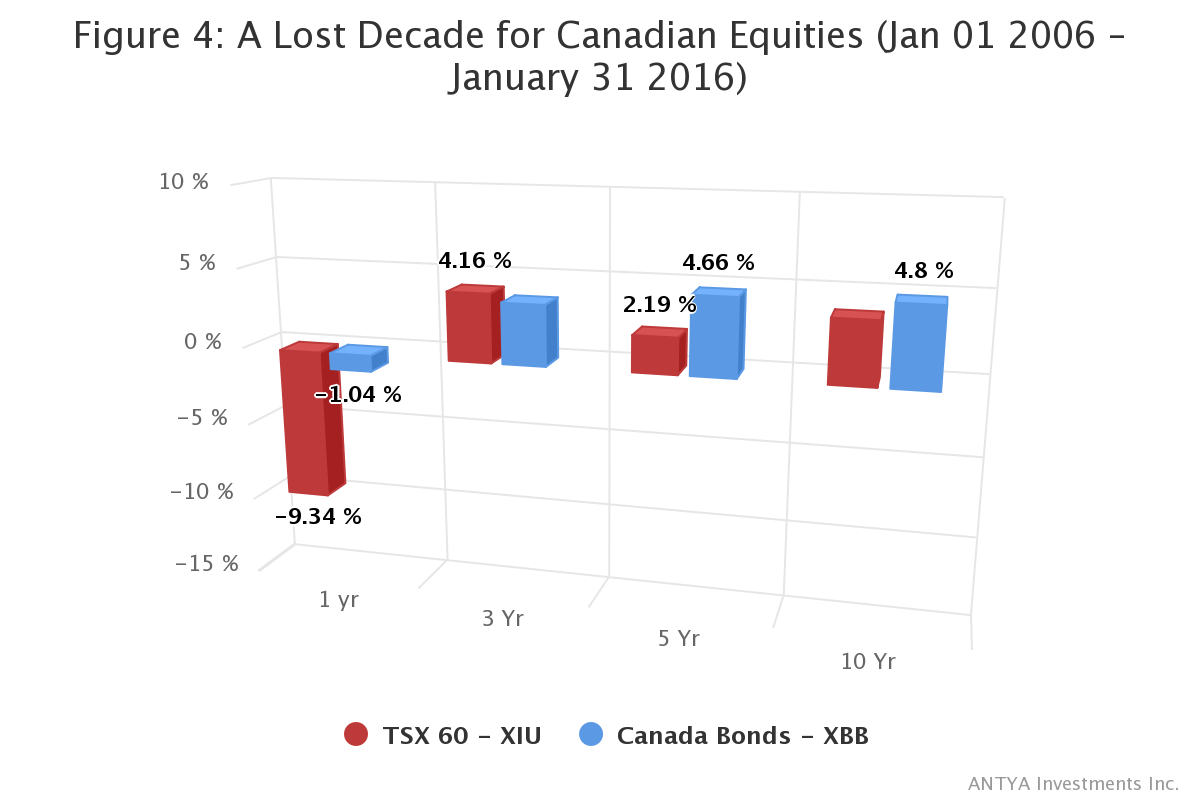

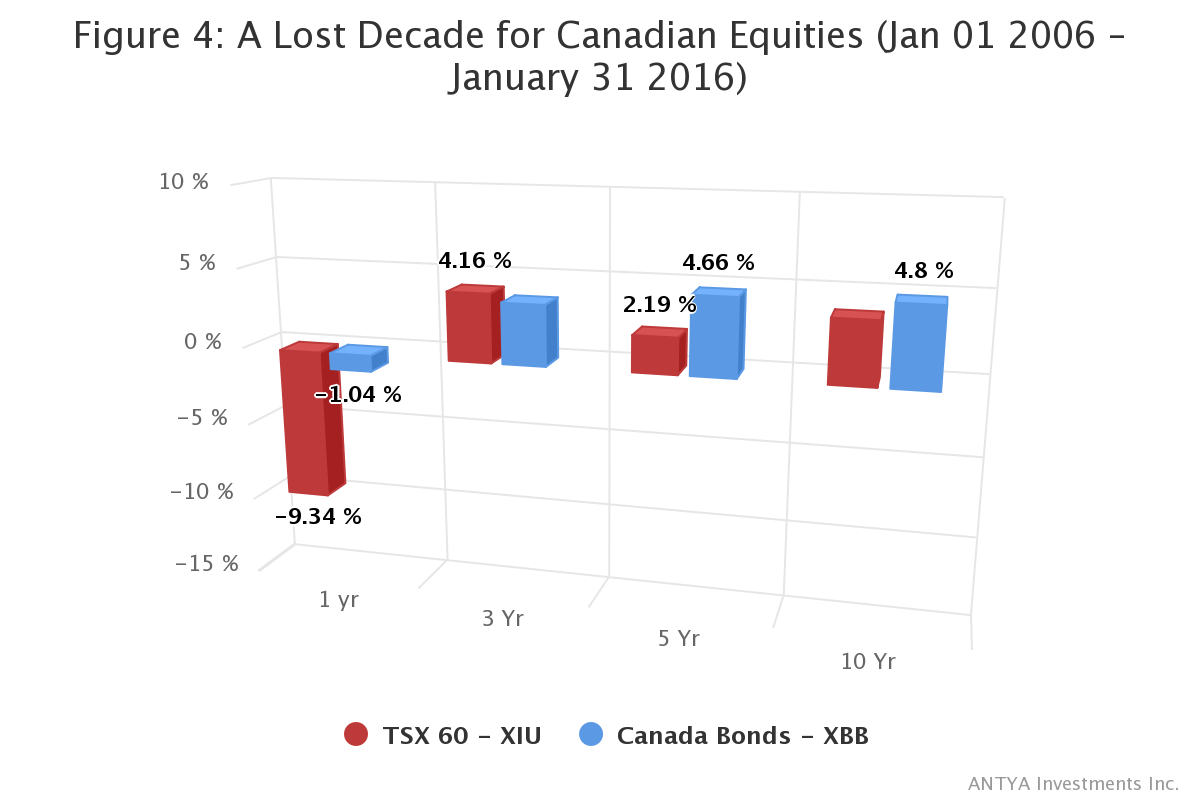

More importantly in ANTYA’s view, the debate surrounding Active vs. Passive equity investing is missing an important ingredient: the performance of Canadian equities compared to Canadian bonds over the last 10 years. Every capital market stake holder has opined extensively on savers stampeding into equities to make up for meagre bond yields, and that central banker monetary policies are inflating the markets. However, data suggest otherwise, with equities underperforming bonds over that time period. As illustrated in Figure 4, Canadian Bonds as represented by BlackRock’s XBB ETF have outperformed Canadian Equities as represented by another BlackRock ETF XIU (TSX 60 total return ETF).

Figure 4: A Lost Decade for Canadian Equities (Jan 01 2006 – January 31 2016)

Source: ANTYA Investments Inc., BlackRock data as of Jan 31, 2016

As illustrated, the equity investor has lagged the bond investor, while suffering 3.8x the volatility and by our estimate endured a 33% peak to trough decline in portfolio value during this time period. More importantly the returns highlighted in figure 4 are net of very low fees of 0.18% annualized for XIU and .33% for XBB. Given that the average equity mutual fund charges a fee of 2% or more, while an average bond fund charges a fee of 1.14% or more, a majority of Canadian investors which own approximately $983 billion in mutual funds representing 31% of their financial assets, would have fared worse than the results outlined in Figure. Clearly at 2% per year, simple math suggests that an equity mutual fund investor pays 20% of initial contributed capital or more if returns are good, to the investment fund manager, while bearing all of the downside risk.

To conclude, a majority of active managers in Canada are riding the same wave of volatility as the stock market, lag their respective benchmarks whilst charging premium prices and offering plain vanilla services. So what should individual investors and/or savers do?

I believe that all retail investors should find every conceivable way to lower investing costs. The new breed of online wealth managers building quantitatively managed ETF/Index portfolios is a good option that should be explored. With Canadians holding $983 billion in mutual funds a reduction in fees from 2% to 1%, will benefit the savers by $9.8 billion per year, ignoring any compounding effects of returns on accumulated capital. I believe that given institutional investors are paying less than 20bps (1 bps is 1/100 of 1 percent) for managing assets, there is no reason to believe that retail should pay much more.

While higher retail pricing on account of lower scale economies is inevitable, the current difference of 10x or more in fees, is definitely untenable. Furthermore, it is the smaller accounts that bear a disproportionate burden of higher fees, and thus smaller investors will benefit significantly from lower fees. Therefore, Canadian policy makers should encourage competition in the financial services space by allowing the new breed of investment managers, online bankers and other service providers to push the boundaries of what is possible.

In my view, Canadians will be better served via more competition and lower investing costs compared to anything else that the regulators/policy makers could propose. I believe that lower management fees, which enable investors to keep more of their accumulated and contributed capital, are a very important solution to the retirement savings conundrum and/or debate in Canada. In this instance, “A dollar saved is a dollar earned”, is not a cliché.

Costs are certain. I wish I could say the same about returns.

Click on the link below to download this report in PDF

Download this Report